black_shogun/iStock via Getty Images

Thesis

Energy Transfer LP (NYSE:ET) delivered another robust quarter in Q2, following its announcement to increase distribution by 50% in late July. Despite the robust results, the post-earnings market reaction was rather tepid. We believe the sharp rally from its July bottom has captured much of its near-term upside, as the market had anticipated a robust card heading into its earnings.

We cautioned investors in our previous article to observe the price action for a bear trap (indicating the market denied further selling downside decisively) before adding exposure. We are pleased to highlight that we observed a bear trap in its July lows, which indicates a potential buy point if ET pulls back closer to its July bottom.

We have also tweaked our valuation model to account for the changes in its distribution, revised consensus estimates, and its July bear trap. Accordingly, we believe ET’s fair value lies close to its near-term support of $9.15 (adjusted for dividends) to justify a market-perform hurdle rate.

However, given the recent sharp run-up, we encourage investors to wait patiently for a pullback before adding more positions.

As such, we reiterate our Hold rating on ET for now.

ET’s Solid Q2. But, Watch Out For Natural Gas Pricing

Energy Transfer delivered a robust Q2, as it reported adjusted EBITDA of $3.23B, up 23.4% YoY. However, its adjusted EBITDA margin fell to 12.4%, down from Q1’s 16.3%.

Notwithstanding, ET’s distributable cash flow (DCF) increased to $1.88B, up 35.2%, including excess cash flow after distribution of $1.17B. The company also raised its FY22 adjusted EBITDA guidance to between $12.6 to $12.8B, suggesting improved profitability prospects, undergirding the increase in its distribution.

Furthermore, the revised consensus estimates (very bullish) of $12.87B in FY22 adjusted EBITDA suggests that the company could be sandbagging expectations. Therefore, we believe it bodes well for the company in H2. In addition, Co-CEO Tom Long remains confident in the forward prospects of Energy Transfer’s operating model. He articulated (edited):

No expected headwinds on the adjusted EBITDA run rate. We remain conservative on the price deck, and that is the primary driver. In other words, when you look at the first half of the year and the prices that we were able to realize in the first 2 quarters. We continue to look at the second half of the year, and we remain conservative on the price deck. I wouldn’t give you any other headwinds that we see. (Energy Transfer FQ2’22 earnings call)

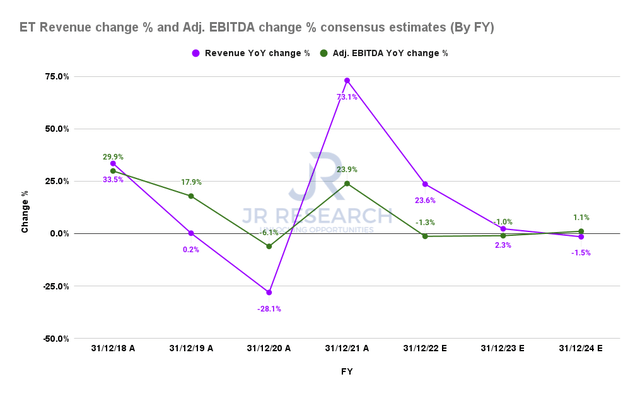

Energy Transfer revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Notwithstanding, the revised consensus estimates suggest that ET’s adjusted EBITDA growth could peak in FY22 before falling markedly through FY24. While we don’t expect it to impact its future distributions (given its robust margins), we urge investors to be cautious of overpaying for ET, given falling growth potential.

Notably, we believe the Street’s caution is justified as natural gas prices appear to be peaking. We also discussed our concern in a recent EQT Corporation (EQT) article. Investors need to be wary of the backwardation in natural gas prices, as August 2026’s contracts are priced at $4.18. ET also cautioned in its filings (edited):

A decrease in the price of natural gas or NGLs could have an adverse effect on our revenues and the results of operations. A backwardated market is associated with lower demand for storage capacity. A prolonged backwardated market or other adverse market conditions could have an adverse impact on our storage revenues. (ET 10-Q)

Is ET Stock A Buy, Sell, Or Hold?

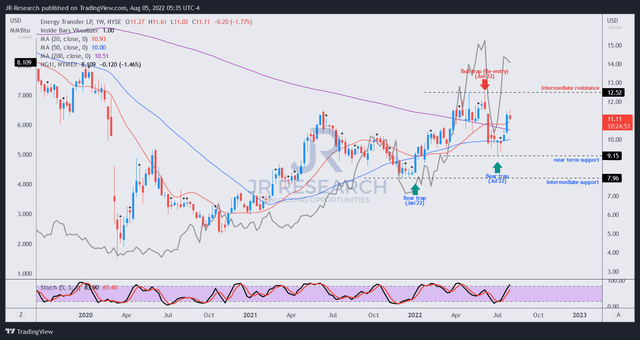

ET price chart (weekly) (TradingView)

As seen above, ET formed a bear trap in July, underpinning its recent sharp recovery. However, we remain cautious in adding at the current levels. Our revised valuation parameters suggest adding closer to its near-term support of $9.15 is appropriate, considering that it’s closer to our fair value estimates.

We believe the selling pressure in natural gas could also force a selloff in ET, allowing an opportunity to add more exposure if it pulls back meaningfully.

Therefore, we reiterate our Hold rating for now and urge investors to wait for a pullback before adding more positions.

Be the first to comment