GCShutter

Summary

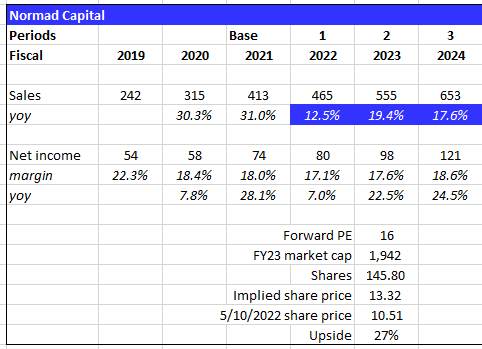

I recommend a buy rating on TDCX (NYSE:TDCX). It provides a solution to a problem that a growing number of companies are facing, and TDCX should be able to continue growing its profits by penetrating into existing clients and winning new logos. I believe TDCX should have no issues hitting consensus figures over the next few years, and assuming the market values TDCX using the current multiple (16x forward earnings), it should generate ~27% upside.

Company overview

TDCX is a provider of digital customer experience solutions, including omnichannel customer experience [CX] solutions, sales and digital marketing services, and content monitoring and moderation services. TDCX also offers customized digital customer experience solutions that can be used to handle sometimes complicated customer interactions.

TDCX’s service offerings are divided into three categories: (1) omnichannel CX solutions, (2) sales and digital marketing services, and (3) content monitoring and moderation services. TDCX’s primary goal is to assist clients in managing customer relationships by providing digital customer experience solutions such as after-sales service and customer support across ten industry verticals such as travel and hospitality, digital advertising and media, and FMCG. The sales and digital marketing services offerings assist clients in marketing their products and services, and the content monitoring and moderation services offerings assist clients in creating a safe and secure online environment for social media platforms by providing content monitoring and moderation services with a human touch. (TDCX F-1)

Attractive market with secular tailwinds

Outsourcing refers to the practice of contracting with an outside organization to handle normally in-house functions such as information technology [IT] and business operations. This frees up resources, so the company can focus on what it does best: running the business. The three main types of outsourcing are ITO (IT outsourcing), KPO (Knowledge Process Outsourcing), and BSS (Business Support Services) is the final group, which includes TDCX. BSS involves outsourcing the operations and responsibilities of specific business functions (or processes), such as payroll, customer service, accounting, and data recording, to a third-party service provider.

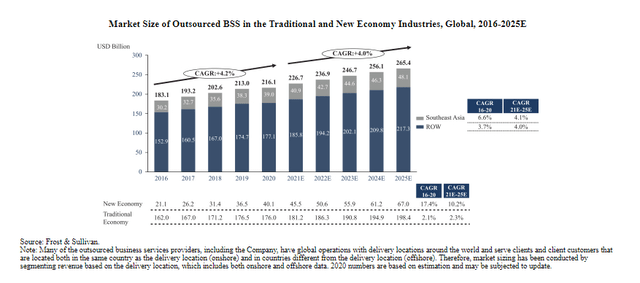

Companies are turning to outsourcing in record numbers to help them succeed in today’s cutthroat market. Even businesses that have traditionally kept most of their operations in-house are beginning to see the advantages of outsourcing. The internal management of legacy systems is becoming increasingly difficult for businesses, so they are looking to outsourcing service providers as partners to help them modernize their operations. As a result of these factors, the BSS outsourcing market expanded at a CAGR of 4.2% between 2016 and 2021, and future expansion is predicted to be even faster, at a CAGR of 4.9%.

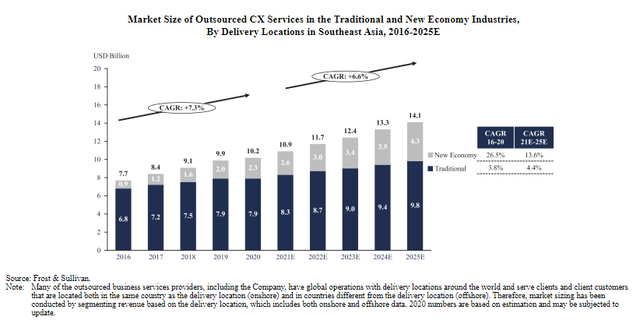

I believe companies are increasing the breadth of business functions they outsource, especially as they embark on digital transformation initiatives, given that it is much faster, lower burden on CAPEX upfront, and easier to deploy. Among the many initiatives, I expect CX to be one of the key growth drivers within the BSS market. Since present consumers expect a unified service across all touchpoints, companies can no longer treat customer service as a series of independent tasks. The primary requirement for CX-centered innovations within digital transformation initiatives will be the development of a differentiated CX via channel integration and contextual responses. Businesses like TDCX are revolutionizing business operations by making possible cutting-edge technologies like automation and analytics. Companies that want to outsource their CX operations will focus on players like TDCX that can help them create a unique customer experience through channel integration and contextual responses, like using a chatbot or conversational AI and using analytics for prediction and AI.

Rise of internet and new economy supports industry growth

BSS and CX industries have seen growth over the past three to five years on a global and regional scale due to the proliferation of the internet and the connected New Economy (defined below). New consumer habits made possible by ubiquitous Internet and mobile access have propelled the New Economy sector to new heights. People use their mobile devices for a wide variety of purposes, including but not limited to communicating, having fun, and gaining knowledge. They do more and more of their shopping, trip organizing, and meal ordering online. As urbanization spreads around the world, I expect more people will be able to participate in the New Economy as a result of rising internet adoption.

Industries that combine rapid growth with technological advancement are what the “New Economy” refers to. The New Economy tech giants include Amazon (AMZN), Apple (AAPL), Google (GOOGL) (GOOG), Facebook (META), Tencent (OTCPK:TCEHY), Microsoft (MSFT), and Tesla (TSLA). To quickly scale up operations as they focus on entering new markets (i.e., companies do not need to waste time on time-wasting things like hiring call center employees, finding an office to fit all these people, etc.) and evolving to provide new products and services, I believe New Economy industries like digital advertising and e-commerce will increase their partnerships with BSS companies.

Moreover, the New Economy’s BSS outsourcing market is shifting from low-complexity work to high-value strategic services. Content management and moderation, ad campaign management, and other back-office support services are just a few examples of the growing trend of outsourcing these tasks to third-party providers because they offer superior service at much lower prices. Outsourcing is becoming increasingly popular as a means of expansion for New Economy businesses because service providers are better equipped to deliver specialized services at lower prices. New Economy companies can gain a competitive edge through outsourcing because it allows them to maintain flexibility and scale at a fraction of the cost of building in-house resources and capabilities. Indeed, the demand for outsourced CX services in the New Economy is predicted to increase by a factor of three over the next few years.

Omnichannel and international footprint advantages

BSS providers that are omnichannel and have a global presence have an advantage over their competitors. To improve their interactions with their customers, TDCX provides integrated omnichannel and multimodal solutions. Such channels include voice and email, as well as messaging and social media, chatbots powered by artificial intelligence, and in-app interactions. At the heart of this is TDCX’s ability to integrate third-party technology and platforms with in-house development to address the unique needs of our clients’ operations. TDCX has ten different locations in Asia, Europe, and Latin America. This gives it access to a wide range of skilled workers and lets us communicate in English as well as important Asian languages like Mandarin, Thai, Korean, Malay (from Malaysia and Indonesia), Vietnamese, and Japanese.

Valuation

At the current stock price of $10.51 and 145.8 million shares, the market cap is ~$1.5 billion. I believe the current market price is undervaluing TDCX’s true value and is an alright entry point for investors that are looking to buy the stock. Based on my model, I believe TDCX will make $650 million in sales and $121 million in net income in FY23. This will be driven by high-teens sales growth and increasing net margin expansion to 19%, giving it a market cap of $1.8 billion and a stock price of $13.32 in FY23, representing 27% upside.

Assumptions:

- Sales: growth expectations to follow consensus, slowing from the high 30% to mid-to high-teens moving forward. I believe a part of the slowdown is likely due to current macroeconomic development, but long-term growth should still be fairly healthy given the secular tailwinds that I expect TDCX to enjoy.

- Net income: net margin expectations are in line with consensus, which should see an incremental step up over the next few years as the business scales off its fixed cost base and recovers to pre-covid levels.

- Valuation: TDCX used to trade around 20x forward earnings before interest rates started to hike, but has now traded down to 16x. I am assuming no change in multiples over the next few years with the assumption of no change in the interest rate environment.

Normad Capital

Risk

Competition

The global outsourced CX market is still relatively fragmented, with global service providers competing with smaller, specialized service providers located in different regional markets. Even though there are still a lot of mergers and acquisitions happening in the industry, the CX market is becoming more attractive to both large service providers and smaller niche service providers with unique digital and automation skills. This is because the needs of enterprises are driving a wider range of service capabilities.

Customer concentration

Its top two customers, META and Airbnb (ABNB), accounted for 61.6% of FY21 revenues for TDCX, and the top five customers accounted for 84.4% of revenues. The potential loss of these types of customers poses a serious threat to TDCX’s bottom line.

Margin pressure from higher wage costs.

TDCX spends a significant amount of money on employee benefits. The fast growth of the industry and the war for talent that comes with it could cause wages to go up, which could hurt TDCX’s profit margin

Conclusion

TDCX may not have the best business in the world, as compared to the likes of S&P (SPGI) and GOOGL, but it has a decent value proposition that solves a growing problem for its targeted customer base, which is a very large TAM. As the New Economy continues to grow and takes up a large proportion of the world economy, TDCX should benefit and be able to grow its sales and profits along the way. The current valuation serves as a decent entry point (at 16x forward earnings) for investors to buy this company.

Be the first to comment