wundervisuals

The last time I mentioned Microsoft (NASDAQ:MSFT) in a full-length article was last September here. I suggested an exceptionally stretched overvaluation would make serious price gains difficult to achieve. While a final price top did not appear for a few months, this forecast proved more correct than not, as Big Tech names hit the skids in the first half of 2022.

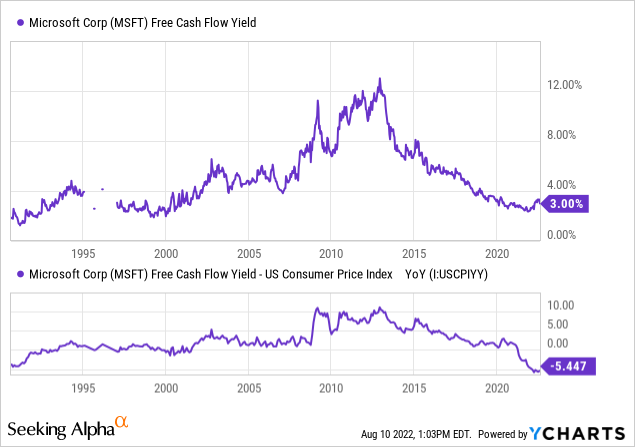

Nearly a year after my Sell call on Microsoft, I am still quite concerned about its valuation, which remains extended for a “slowing” growth selection. In addition, free cash flow generation of 3% does not come close to matching 8.5% CPI over the past 12 months. Outside of its early days of super-high growth in the 1980s and 1990s, Microsoft has NEVER been this expensive vs. cost-of-living changes. Below is a graph comparing free cash flow generation vs. YoY CPI inflation since 1990. Notice the superb buying opportunity at 13% free cash flow yields in late 2012.

YCharts, MSFT since 1990, Free Cash Flow Vs. Prevailing CPI Rate

Consequently, I am not exactly bullish on Microsoft until inflation rates come down, most likely through a recession into 2023. So, if prolonged economic weakness and a recession are next, how has Microsoft fared during previous contractions in “real” GDP? The answer is better than the typical S&P 500 company.

Just like my current Neutral/Hold recommendation for Apple (AAPL), expressed in April here, I am modeling flat total returns of +15% to -15% over the next 12 months for Microsoft (including a negligible 0.9% annual dividend yield). Wild forecasts for big gains or losses may not pan out is my view. The good news for shareholders is I am projecting shares will continue to perform in a similar to stronger fashion than the S&P 500 average blue chip equity. This estimate is somewhat more positive than last year, and I am upgrading my rating to Hold.

Recession History

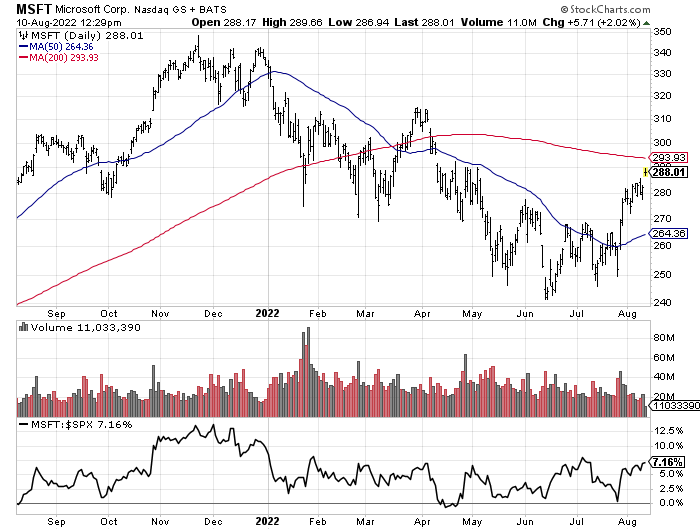

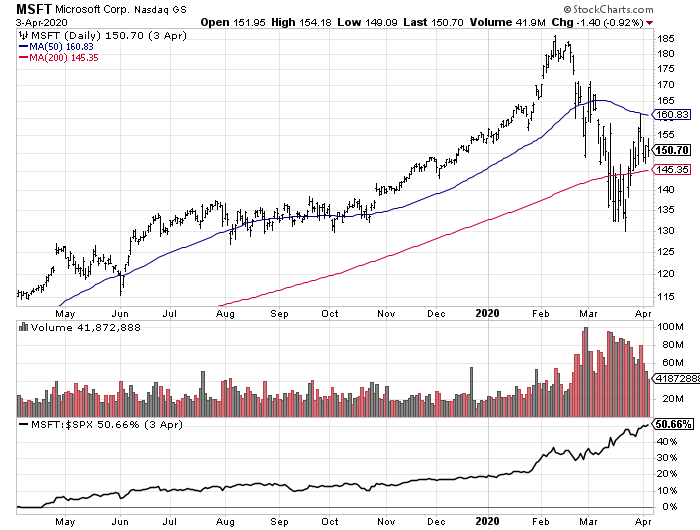

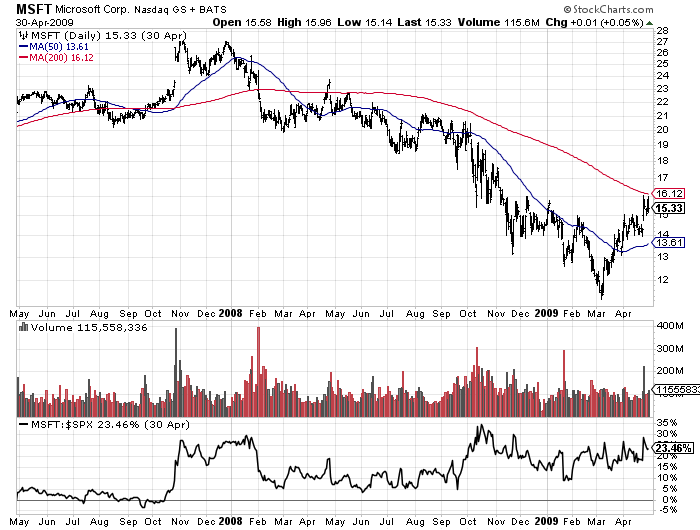

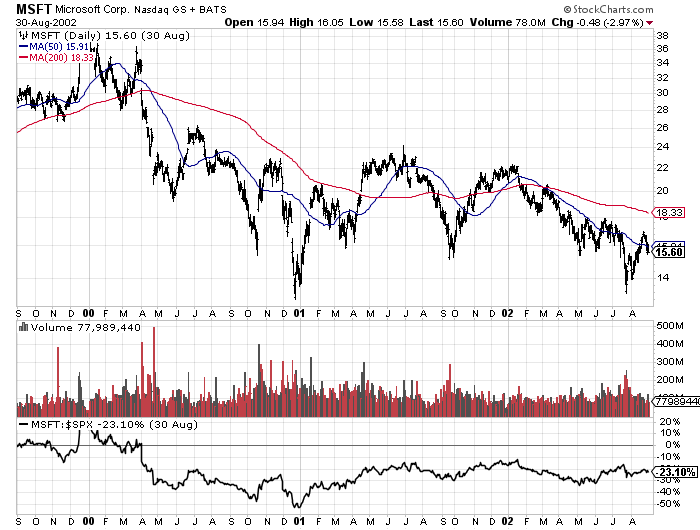

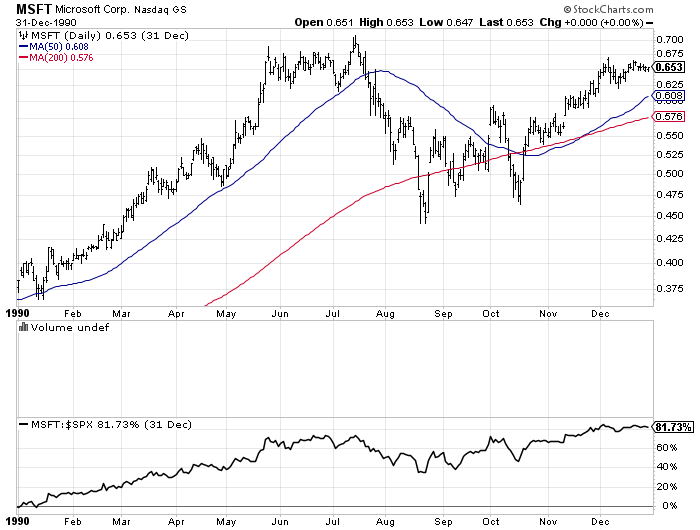

I am counting 2022 as a recession year, and the place to begin our review of the past five declines in GDP since 1990. Microsoft’s strong profit margin, higher growth rate, diversified setup selling to businesses and consumers all over the globe has helped the stock quote to survive recessions better than the S&P 500 (and recover rather quickly). Each chart below includes an S&P 500 comparison for percentage price change at the bottom. This year, the 2020 pandemic COVID-19 economic shutdown span, the Great Recession of 2007-09, the original Dotcom Tech Bust and recession between 2000-02, and the 1990 Persian Gulf War instance are pictured.

StockCharts.com – MSFT Daily Values – 2022 Recession StockCharts.com – MSFT Daily Values – 2020 Pandemic Recession StockCharts.com – MSFT Daily Values – 2007 to 2009 Great Recession StockCharts.com – MSFT Daily Values – 2000 to 2002 DotCom Bust Recession StockCharts.com – MSFT Daily Values – 1990 Persian Gulf War Recession

The worst times to own Microsoft shares during the last 32 years were the Dotcom Bust including a lingering recession, and the Great Recession real estate and financial/banking crisis. If we get something similar into 2023 as the Federal Reserve fights to lower inflation, MSFT could see outlier losses beyond the early 2022 dump. I honestly place the odds of 2022’s economic downturn getting worse in the months ahead in the 25%-50% range. This is a clear and present danger that should dissuade any investor from being overly optimistic on the stock’s immediate future.

Valuation Still High

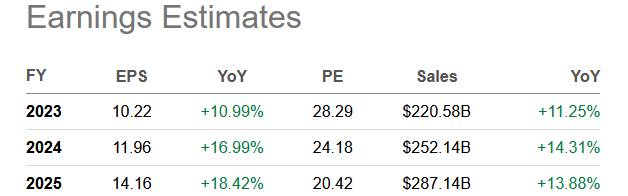

Another weight dragging on the price is its valuation remains extended, but not entirely out of bounds vs. the last three decades of trading action. You have to assume a weakening economy will keep Microsoft results lower than current analyst expectations, and an already rich valuation will bring another punk year (or worse) for total investment returns.

Seeking Alpha, MSFT Analyst Estimates – August 10th, 2022

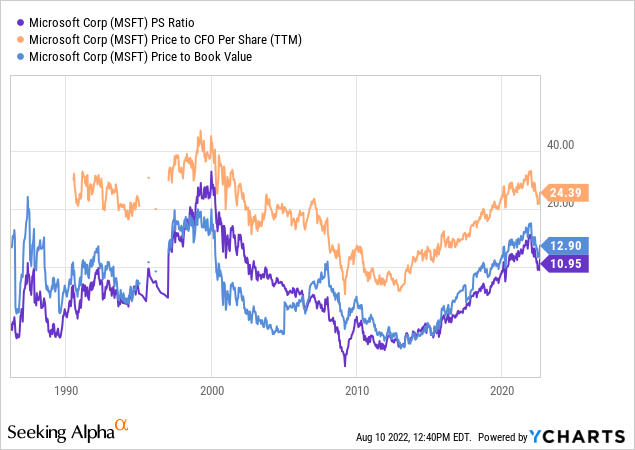

For one of the largest businesses in the world, high growth rates may be something of a pipe dream during a recession, in terms of what’s mathematically possible for compounding. With that in mind, price to trailing sales, cash flow and book value multiples are nowhere near bargain levels (pictured below since 1987). The smartest time to buy Microsoft based on fundamental valuations was between 2011-13, as the economy recovered from the recession hangover of 2009-10. Presently, most ratios and multiples on underlying business performance are double and triple this bargain buying period. A “fair value” number of $185 per share would represent the long-term average of the below ratios. On the positive side of the equation, MSFT’s super-high valuation of a year ago has improved dramatically.

YCharts, MSFT since 1987 – Fundamental Ratios on Sales, Cash Flow, Book Value

Final Thoughts

Although I am leery of the valuation today, especially as a function of the existing inflation rate, flight-to-safety and quality characteristics in the stock historically may allow for price to stay higher than one would think possible. This explains Microsoft’s above-normal investor returns vs. the Big Tech sector of the U.S. equity market since last summer. If you will, investor capital movement from less stable, lower-growth areas of Wall Street to blue chips like Microsoft (able to eke out a little bit of progress in its business operations during recession) could easily support an elevated valuation. In contrast to my semiconductor Sell/Avoid call over the last week on NVIDIA (NVDA) here or reluctance to hold entertainment/streaming giant Warner Bros. Discovery (WBD) explained here, continued ownership of Microsoft (even some buying on weakness) appears to be based in rational, reasonable logic.

That’s not to say Microsoft is a risk-free investment idea during a once every decade recession. Under a worst-case economic contraction scenario into 2023, I can model price selling under $200. However, this would likely turn out to be stronger relative performance than outlined by the vast majority of U.S. equities. The company is not completely recession-proof or immune from huge bear market declines.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment