Kameleon007

** As I’ve done for the past several months, I am making my last of the month SUBSCRIBER ONLY Equity CEF Performance update from July 29th available to the general Seeking Alpha audience.

I think you’ll find my general market and fund recommendations to subscribers have been right-on-the-money and I would encourage you to review CEFs: Income + Opportunity and see if my services might be able to help you navigate the current market environment. Sign up for a free trial **

Below is your YTD Equity CEF Performance spreadsheet link updated through July 29th, 2022:

2022CEFPerformance.7.29.2022.xlsx

Though equity closed-end funds (“CEFs”) and even bond CEFs like, say, the Nuveen Municipal Credit Income fund (NZF), $13.47 current market price, seem to be breaking out to the upside, there are still some bearish signs out there.

For every large cap tech name like Microsoft (MSFT), $280.74 current market price, up 7.8% for the week, there were 10 smaller names like Roku (ROKU), $65.52 current market price, that went the opposite direction, with ROKU down -26.2%. Roku may have been an outlier in terms of percentage loss, but on Friday alone, a subscriber pointed out that there were 344 new 52-week lows on the NYSE composite while only 18 new highs.

That’s not a healthy market if we are, once again, seeing a narrow number of big cap stocks driving the indices higher while giving the impression that everything is OK and a new bull market has been born.

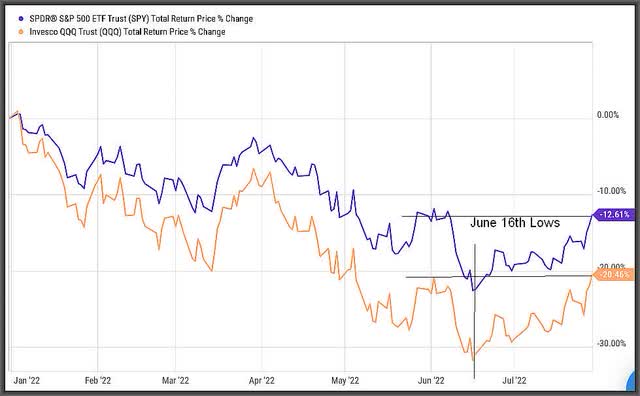

So with both the S&P 500 (SPY), $411.99 current market price, and the NASDAQ-100 (QQQ), $315.46 current market price, having bounced roughly 10% off their lows from June 16th when SPY was down about -22% at its worst YTD and QQQ was down over -30%, it was probably not unexpected to see a bounce. But are we now due for some resistance at these levels?

YTD Total Return MKT for SPY and QQQ:

Just based on resistance levels (see above), I think so. Considering the headline news this past week regarding earnings, GDP and the Federal Reserve meetings, the most positive takeaway was theoretically from the Fed and Jerome Powell hinting that they may be more dovish going forward.

But that may not be the case, especially if we see oil and energy prices moving back up. Already, oil is approaching $100/barrel again. The concern is that inflation will be sticky and be with us longer than expected, and with the Fed intent on bringing inflation down to their target 2%, the markets may not like what they hear out of the Fed going forward after all.

I wouldn’t necessarily take that as a reason to sell aggressively, but I have in recent days added back to hedges such as the ProShares UltraShort -2X S&P 500 (SDS) at $41.90 current market price. I have also added to the ProShares UltraShort -2X Russell 2000 (TWM), $15.70 current market price.

Again, you have to think of hedges as insurance policies just in case we get an abrupt turnaround. Because betting on a new bull market being born at these levels seems pre-mature with many of the same problems that started the bear market in the first place, continuing to pose problems.

Maybe the worst of the markets has already been absorbed and there will be buyers now who will step in to limit any significant downside, but the flood of buyers last week had the feel of many investors who were either under-invested and/or highly hedged going into this week’s news and thus, were scrambling to get more exposure or cover hedges once the upswing was confirmed.

And if that’s the case, much of the firepower has probably been already used up.

Equity CEFs

The fact that most equity CEFs, both leveraged and option-income, tend to include mostly large-cap stocks in their portfolios, unless they specifically focus on smaller stocks like from the Royce family of funds, meant that most CEFs also enjoyed a very good week last week as well.

And my emphasis on energy, utility and infrastructure CEFs like (SRV), (NRGX), (BGR), (MFD), (MGU) over the past few weeks after an oil/energy sell-off, has also helped portfolio performance significantly. Just go to Sheet1 or Sheet2 of the Equity CEF Performance link above to see how well these funds have performed this year.

The biggest question for me is whether or not the large cap technology strength in Microsoft, Amazon (AMZN), Apple (AAPL), Alphabet (GOOG, GOOGL), etc. will broaden out to the more risk-on and higher P/E technology names. Unfortunately, I think that’s also premature, and most of these smaller-cap technology stocks that have seen -50% or more losses this year (and there are a lot of them) will continue to be faced with tax-loss selling throughout the year, thus limiting any strong recovery.

The other question I have is if international markets will be able to follow the U.S. markets to some resemblance of a recovery? That may also be wishful thinking as many analysts believe the worst is still yet to come for European economies due to the Russia/Ukraine conflict and the lack of energy and gas supplies they face for the upcoming winter. And if that’s the case, along with a more desperate Russia, that may also be a catalyst for a U.S. market pullback.

But in the meantime, let’s enjoy the bounce we have seen in the markets and hope it continues into August. But be prepared to hear from the nay-sayers who will say how July, up an impressive 9.2% for the S&P 500, was just a bounce in an overall bear market and we will be headed back down soon enough.

I don’t know about that since they have been calling for the S&P 500 to hit anywhere between 3300 to 3500 before it’s all over. But with June’s low of roughly 3650 or $365 on SPY, I don’t see that happening. But just the same, be prepared for a reality check whether it comes from the Fed or somewhere else since I do think that is still to come.

I hope all of you had a wonderful summer and as for me, vacation is now over and I will be back in the office come Monday.

Be the first to comment