Tropical Borneo

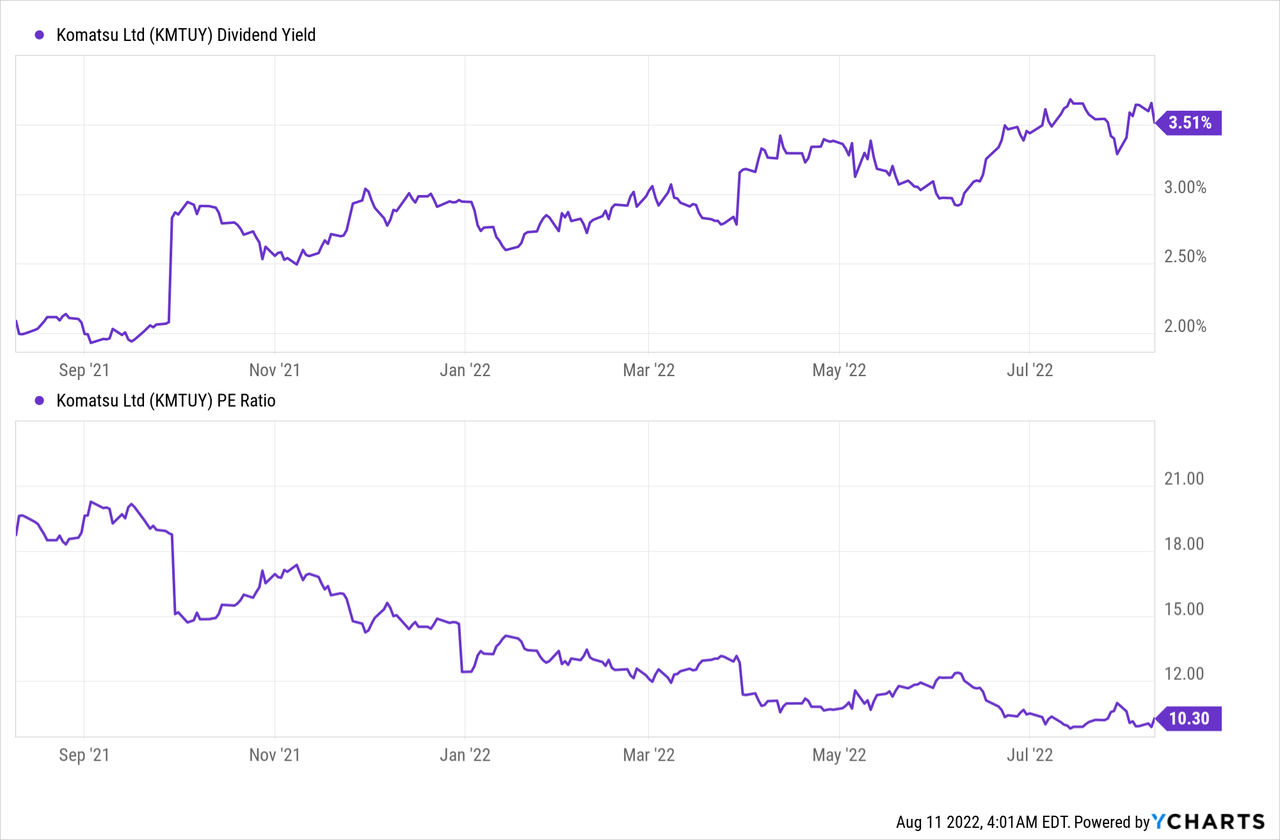

Komatsu (OTCPK:KMTUY) posted surprisingly strong numbers this time around, with its net profit coming in at an all-time high for the opening quarter of the year. Despite an improving demand backdrop amid easing supply chain issues, management’s tone remained cautious on the call, with forward guidance reiterated. Market expectations are in check as well – the ~10x P/E multiple is far below historical levels accounting for the ongoing headwinds in the market for construction equipment in China, along with the grim near-term outlook for business in Russia.

Thus, the potential for more upward earnings revisions is still intact, particularly if the improving global demand for construction and mining equipment & parts continues, alongside elevated commodity prices. Even if things go south, Komatsu offers some attractive defensive characteristics, including ~25% of its revenue base coming from more “sticky” parts sales revenue and a decent, well-covered dividend yield through the cycles.

Positive Sales Trend Against a Challenging Backdrop

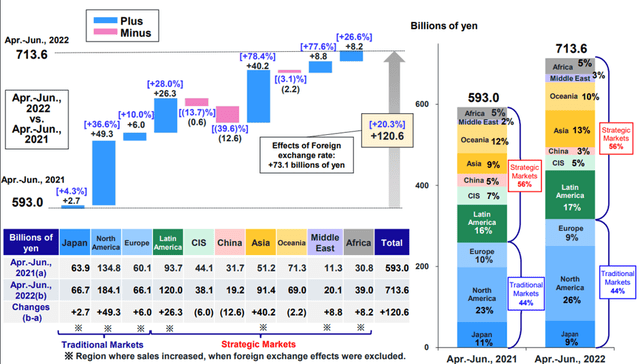

Komatsu kicked off Q1 with strong mining sales and double-digit % growth in its highly profitable spare parts business, driving overall Q1 sales up ~18% YoY. Adjusting for FX, organic growth was closer to +8%, though local currency growth was still strong outside of China – in contrast to the ~46% decline in China, North America was up ~18%, and Latin America was up ~11%, while in Asia, total sales growth surged +78% (mainly led by Indonesia). Per management, the Shanghai lockdown during the quarter had a ~JPY20-30bn negative impact on wholesale shipments due to delays in parts supplies, but given this is a transitory headwind, expect a China-led rebound in Q2.

Of note, Komatsu is seeing strong demand tailwinds in mining-focused geographies like Indonesia, Chile, and Australia. The strength of the Indonesian business was reflected in upbeat monthly results announced by local dealer PT United Tractors Tbk (OTCPK:PUTKF) – overall sales volume was again up MoM at ~473 units in June, as sales to the mining industry remained high compared to the prior year’s levels. Meanwhile, Komatsu Mining Corp’s strong performance in the more ‘sticky’ services revenue streams also bodes well for the through-cycle outlook. With the overall performance also ahead of Hitachi Construction Machinery (OTCPK:HTCMY), Komatsu remains the frontrunner in the Japanese construction/mining equipment space, in my view.

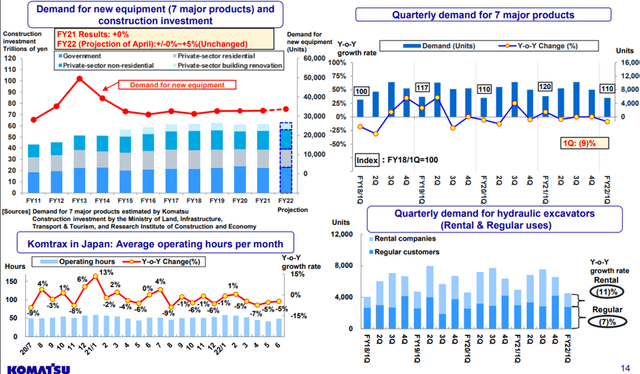

Puts and Takes from the Forward Demand Outlook

Looking beyond Q1, the mid to long-term demand path isn’t entirely clear – on the one hand, prices of copper and other commodities have begun to ease, but on the other hand, Komatsu also cited little waning of appetite among its customer base in the mining industry. The ongoing yen depreciation will also help heavy machinery companies like Komatsu with a high weighting of parts and services within its mining machinery business. Meanwhile, the construction machinery market in North America, under pressure from falling housing starts amid rising interest rates, could see some support from a ramp-up in infrastructure investment. Going forward, all eyes will be on the measures that companies are taking in anticipation of a downward run in the cycle as well as the demand outlook in areas such as energy development, which are more likely to see structural growth.

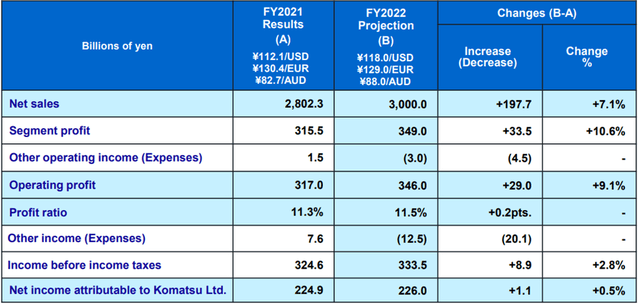

Reiterated Full-Year Guidance Signals Conservatism

In contrast to its domestic peers, Komatsu’s operating margin posted an impressive QoQ expansion to 12.2% despite facing similar supply chain, material, and logistics headwinds in a seasonally weaker quarter. Yet, management has retained its full-year guidance, citing risks of changes in the broader macro sentiment despite the boost to profits from a weaker yen. Its other main concern is materials cost, which, combined with annual variable costs including logistics, is set to total ~JPY100bn. This view does not account for a potential boost to profits from future price hikes, though, as management has yet to fully pass through the impact of higher input prices.

With supply chain disruptions also showing signs of easing in recent months, volumes should improve from here, providing a nice tailwind for the bottom line. FCF generation has also been weighed down by a YoY jump in inventory due to delays in shipments from parts bottlenecks, although given this headwind should reverse down the line, there remains ample room for upward revisions ahead.

Earnings Outlook Buoyed by Overall Resilient Demand Trends

With its outperformance relative to key peers Hitachi Construction Machinery and Kubota (OTCPK:KUBTY), Komatsu’s strong quarter highlights the company’s through-cycle resilience. Not only has it successfully offset cost/production headwinds through positive demand trends, but the company’s ability to capitalize on the weak yen has further accelerated wholesale revenue growth.

Admittedly, there are demand headwinds ahead, including a gradual slowdown in the US and Europe as well as a weak market for construction equipment in China. That said, there are clear bright spots in the overall earnings outlook as well, led by improving global construction and mining demand, helped by higher commodity prices. Plus, the stock offers some useful defensive characteristics against a macro downturn, with a sizeable % of its revenue base generated from more “sticky” parts sales and a relatively high dividend yield on offer.

Be the first to comment