balipadma

Today we are going to comment on Volkswagen’s (OTCPK:VLKAF, OTCPK:VWAPY) Q2 results. Last time, we were pretty optimistic for the following reason:

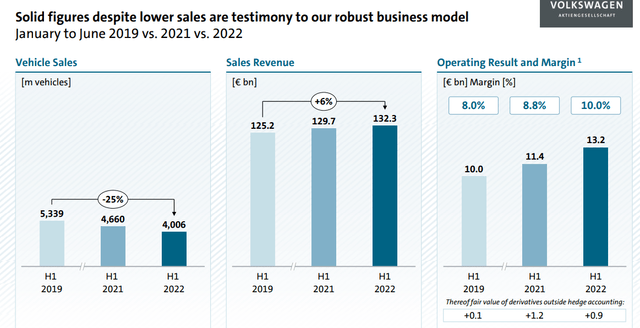

- We were forecasting a 12% revenue increase despite lowering by 6% vehicle productions. This was a testament to Volkswagen’s pricing power and strong portfolio product mix;

- We were supportive of the company’s electric vehicle productions. Indeed, the German car player is a leader in Europe and is in second place in the North American region;

- We analyzed Russia and most important Ukraine’s exposure;

- In a sum-of-the-part valuation, the Porsche spin-off was a positive catalyst. Thanks also to the Group’s cash-rich balance sheet, we were forecasting a higher shareholder remuneration while a continuous CAPEX investment.

Half-year results exceed our internal expectations. Let’s have a look.

In the first half of 2022, the Volkswagen Group delivered 3.875 million vehicles to customers against 4.979 million in the same period last year, a decrease of 22.2%. However, the company posted a higher turnover of €132.3 billion against €129.6 billion, which is 2% more. Despite the considerable decline in production due to the continuing difficulty in supplying components, better performances were achieved thanks to the production mix and sale of the most profitable models of the Premium divisions (Audi, Lamborghini, and Bentley) and Sport (Porsche). Going down to the bottom line, the results were even more pronounced. Thanks to model optimization and pricing policy, the operating return on sales (gross of extraordinary items) rose to 5.6% from 3.4% in the same period in 2021. Operating results stood at €13.2 billion with a plus 16.1% compared to the same period of 2021, while the group’s net profit has passed from €8.4 billion to €10.6 billion, with an increase of 25.8%.

Concerning EV production, in the first half of the year, electric car deliveries increased by 27% to 217k units. The BEV share of total deliveries reached 5.6% (they were at 3.4% in the first half of 2021). In China alone, almost 64k EVs were delivered more than three times the previous year. The undisputed leader was the ID.4 with around 63k deliveries.

Overall, demand remains high for both electric and internal combustion vehicles.

During these months, the German Group re-acquired Europcar, a car rental company, taking an important step towards mobility services. Here at the Lab, we have a long thesis on car rental. Have a look to Arval (BNP Paribas arm) and ALD (SocGen) recent publications.

It is worth mentioning that the battery business was enclosed under the “hat” of the new PowerCo company, formally established in July, and at the same time construction work began on the first gigafactory of the Volkswagen Group in Salzgitter (Germany). In the quarter, Volkswagen and STMicroelectronics team up to develop a new semiconductor for automobiles, which will be part of the family of microcontrollers.

Conclusion and Valuation

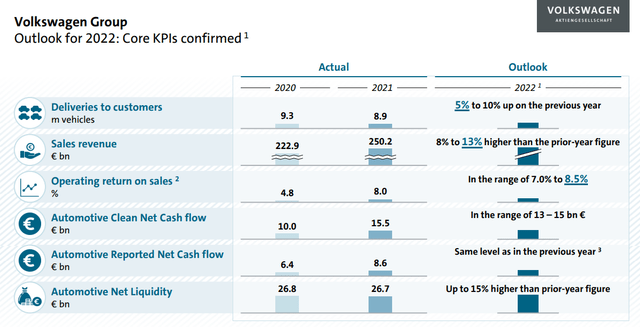

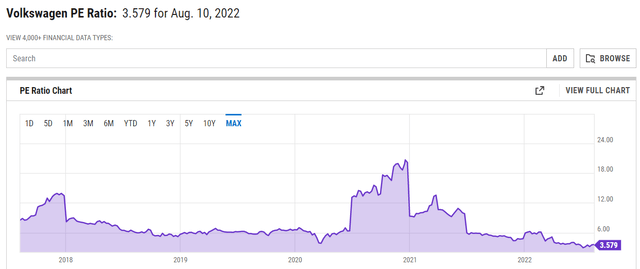

Aside from the Porsche spin-off, which is well on track for Q4, we intensively cover our buy case recap with particular emphasis on points 1) and 2). The management also reaffirmed and raised the 2022 guidance. After the Q2 results, our internal team forecast a higher EPS at €36 and a P/E more in line with Volkswagen’s historical average at 5x. We derive a target price of €180 per share versus the current €146 per share. Buy rating confirmed.

Source: Volkswagen Q2 results

Be the first to comment