YurolaitsAlbert

Over the past few months, there has been a shift in market sentiment. Investors have moved away from aggressively delivering alpha through risky assets to finding investments that will help them lay low for the next few quarters as they digest inflation, the Federal Reserve’s massive rate hikes, and the aftermath of the Russia-Ukraine war. During this period we believe that the S&P’s 4th best-performing sector YTD, healthcare, can offer some help.

Historical Similarities

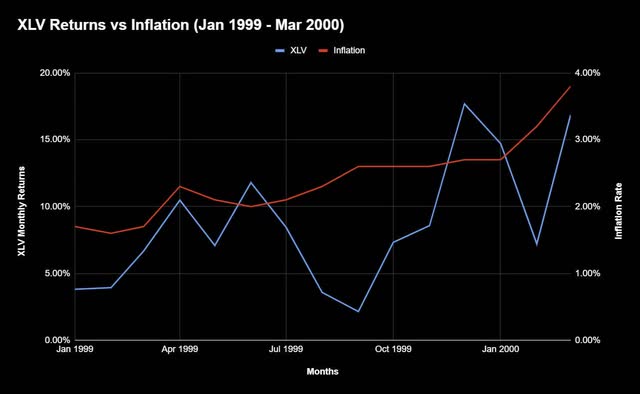

Healthcare and inflation have historically been positively correlated. The last time we had an inflationary period that compares to the present day was from 1999 to 2001. From trough to peak, the Health Care Select Sector SPDR (NYSEARCA:XLV) had a positive correlation coefficient of 0.54 with inflation:

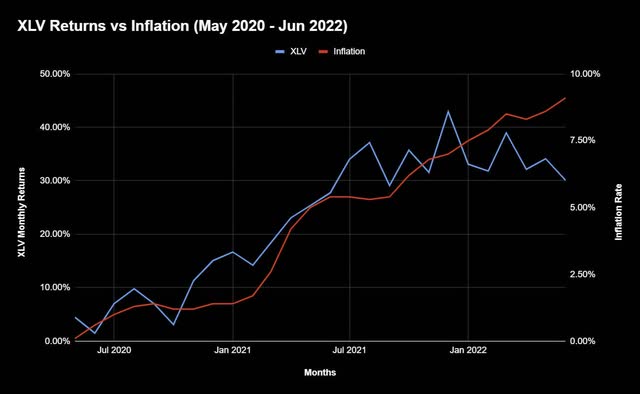

A correlation coefficient measure how closely related two data sets are on a scale from -1 (inverse relationship) to +1 (direct relationship). We find an even stronger connection from 2020 to 2022, which has a trough to peak correlation coefficient of 0.91:

Both instances reflect how healthcare stocks tend to have strong returns when inflation skyrockets. While other sectors must worry about consumer purchasing power, eroding margins, etc., capital tends to flow into healthcare which steers clear of these issues.

Inflation can also spark recession fears with the federal reserve raising rates to cool off the economy. Both 2000 and 2022 saw this, and investors flew from growth equities to pockets of the market like healthcare, which is more value-oriented.

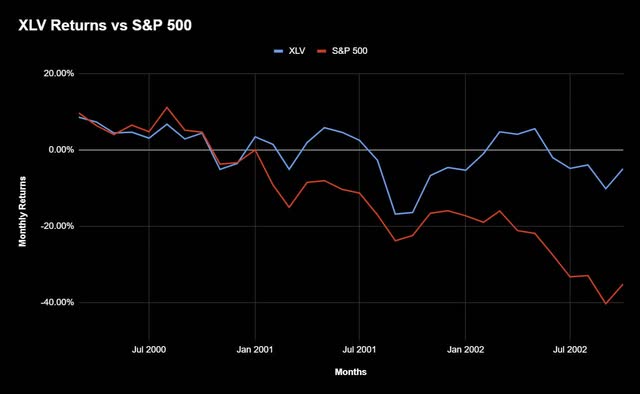

From March 2000 (highest inflation read during the crisis, the beginning of the recession, and near the last rate hike of 50 basis points) to October 2002 (end of the bear market), healthcare was the second-best performing sector, handily outperforming the S&P by 30.2%:

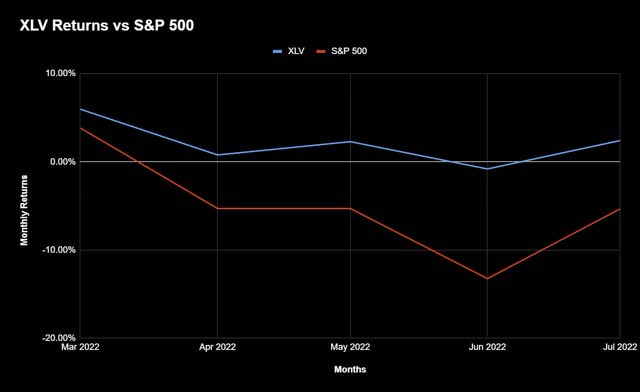

And a similar story has unfolded since March 2022 (yield curve inversion that signals recession and first rate hike of 0.25), with healthcare outperforming by 7.8%:

It’s key to remember that our Fed was extremely late in responding to inflation compared to other cycles in history. They had to deal with the unique problem caused by massive amounts of social welfare in the form of stimulus checks. As such, the time periods compared may not perfectly match, but are rather rough estimates of each other.

Front-end (rapid rise of inflation) to back-end (rising rates and economic downturn) healthcare is almost always a winner. Companies creating medical treatments, providing healthcare plans, and delivering life science services base their business model on universal health needs, which will keep growing. To get exposure to all these recession-proof areas, the XLV, a best-of-breed ETF, is the best way to play this theme.

Inside The Low-Risk ETF

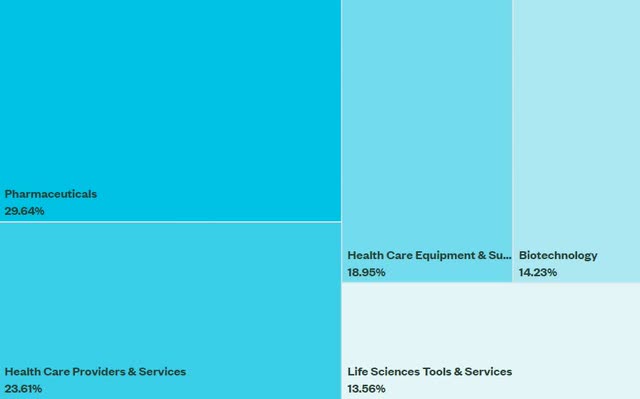

The XLV’s investments in only S&P 500 healthcare companies are favorable given the current macro environment. Only top companies in each of the five major subsectors are included in this concentrated portfolio, meaning value and quality gets precedence over growth.

Of the holdings that the market would put in the growth category, they make up less than 8% of the total value and are quality long-term plays in their own right, including:

- Moderna (MRNA): Deep pipeline with a head-start in revolutionary medical technology

- Abiomed (ABMD), Align (ALGN), DexCom (DXCM), Intuitive Surgical (ISRG), IDEXX Laboratories (IDXX): Innovate medical device products that have carved out a market and have double-digit earnings growth

- Charles River Laboratories (CRL), Bio-Techne (TECH), Bio-Rad Laboratories (BIO): Fast-growing leaders in providing services to life sciences companies

- West Pharmaceutical (WST), Catalent (CTLT): Essential players in the drug production, packaging, and delivery space

This differentiates itself from iShares U.S. Healthcare ETF (IYH) or Vanguard Health Care ETF (VHT) which invest in hundreds of companies from standard blue chips to frothier stocks in speculative biotechs and healthcare tech. With the XLV, they don’t own any healthcare tech after Oracle’s (ORCL) acquisition of Cerner was completed in Q2.

A Minor Risk

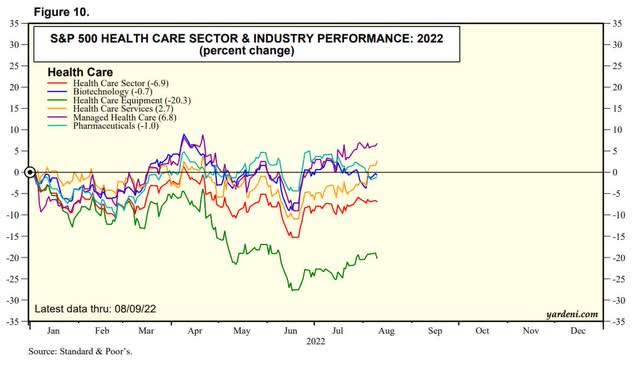

Healthcare equipment has been the worst performer in healthcare, even underperforming the S&P 500.

It also represents about a fifth of the XLV, has the third highest weighting, and by total value, holds most of the risk growth assets we earlier identified.

The subsector has been under constant pressure all year, facing headwinds as companies decrease CapEx spending to protect margins in the wake of inflation.

Although it’s expected to remain a laggard for the foreseeable future, investors should be confident that the fund’s largest holding of Abbott (ABT); Boston Scientific (BSX); Medtronic (MDT); Stryker (SYK); and Becton, Dickinson and Company (BDX), which make up 50% of the subsector, understand how to manage cyclical downturns. Additionally, look for rebalancing away from healthcare equipment in the ETF’s next report.

Conclusion

Despite inflation moderating in July, some things, like the XLV consistently outperforming the S&P 500, never change. Find certainty with an ETF that has already done the hard work in finding quality companies to provide stability over the next few years.

Be the first to comment