luza studios

Shares of Seagate Technology (NASDAQ:STX) have been on a steadily decline all year as questions increase over a turn in the technology cycle with all hardware providers, from semiconductor companies to equipment manufacturers facing significant selling. Indeed, PC demand fell 19.5% year over year in Q3 according to Gartner. Hard disk drive demand (which Seagate sells) fell 33% this summer from last year. Even with the stock down a third, it is not yet time to try to pick the bottom.

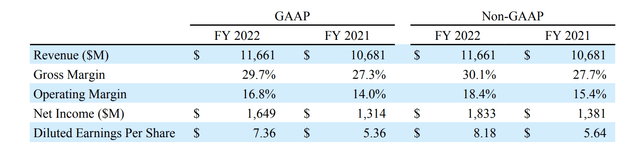

In the company’s fiscal fourth quarter, it is quite apparent the cycle is turning, Revenue was $2.63 billion, down 12.8% from last year. Non-GAAP gross margins were 29.3%, down from 29.6%, and non-GAAP EPS was $1.59 from $2. For the full year, the company earned $8.18 on a non-GAAP basis and $7.36 on a GAAP basis as the company actually expanded margins during the relatively strong first half.

I think it is important to note that share-based compensation (SBC) drives about 80% of the difference between GAAP and non-GAAP earnings. While SBC is a non-cash expense, it is still an expense as it dilutes shareholders’ ownership of the economy. Some of the $1.8 billion share buyback the company did last year was to offset these equity grants rather than reduce the share count. For that reason, I do think investors should rely on GAAP results as providing a more accurate representation of the company’s performance.

In the quarterly commentary, David Mosley, the company CEO said, “In this environment, we are reducing our production plans to maintain supply discipline as our customers manage through macro uncertainty.” This can be seen in the results because while the company’s mass capacity unit reported stable revenue quarter over quarter, the legacy unit fell 25%. It is also important to note that mass capacity shipments were up 4%, so the flat revenue points to pricing erosion. Legacy markets are being significantly impacted by China’s lockdowns and inflation with “consumer demand down more than anticipated.”

Whether China will stick with COVID-zero or not is unknown, though there are no signs of a change in policy. This is a particular headwind for Seagate because Asia accounts for 46% of revenue, the Americas 40%, and EMEA 14%. The strength of the dollar will also be a headwind as these results are translated back into USD.

For its fiscal Q1, guidance is for revenue of $2.5 billion (+/- $150 billion) and non-GAAP EPS of $1.40 (+/- $0.20). Share-based compensation is another $0.19. That points to another sequential decline in results. Given flagging demand, inventory rose $361 million last year, and the company has 76 days of inventory outstanding up from 51 a year ago. Ultimately, STX will need to cut production rates and likely prices to move through this excess inventory.

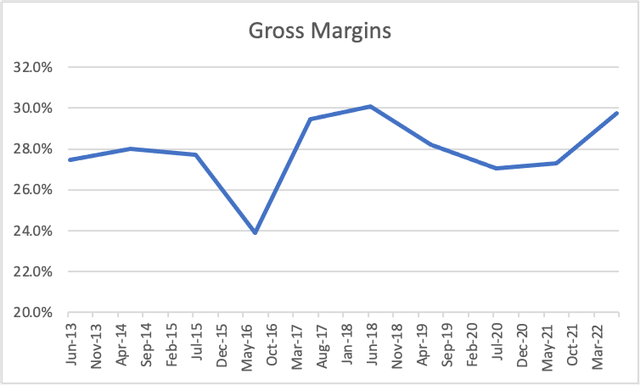

As you can see below, Seagate used the strong demand seen after COVID to push margins up, but the 2022 results were essentially as “good as it gets.” It is interesting to note that margins hit their weakest in 2016-a year where the company had to reduce its bloated inventories by $100 million. It was also a year of weak European and Chinese growth as the oil market bottomed out and Brexit occurred. The parallels to the current environment are quite similar, and investors should assume margin contraction is coming quarters.

Seeking Alpha and my own calculations

Based on Q1 guidance and the performance during downcycles the past decade, with headwinds for the sector building, revenue in fiscal 2023 could be down 7-12%, and as the company faces a loss of operating level and need to move through inventory, we are likely to see margins contract. So on a GAAP basis, Seagate can generate $4.00-$4.50 in EPS next year, for a forward multiple of about 12x.

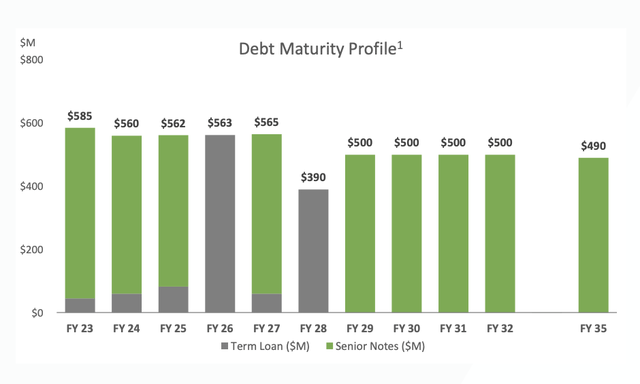

Now, one thing investors have liked about Seagate is its strong shareholder returns, but those will have to moderate as profits come down. In 2022, full year free cash flow was $1.276 billion (holding working capital constant, it would have been about $1.83 billion). The company bought back $1.8 billion, and it paid $610 million in dividends, so these payouts were already $600 million above its normalized free cash flow. As a consequence, its cash position was down $600 million to $615 million while debt rose by $500 million to $5.65 billion.

Seagate is not in a position to really do more debt-financed buybacks because it already faces a steady flow of maturity with a debt profile that has just a 5.5 year average maturity. STX will need to refinance over $1 billion in debt the next two years at higher interest rates, which will be a further drag on cash flow.

Now, Seagate will be able to fund is $0.70 dividend without issue, and I view that payout as very secure. Excluding working capital swings, at $4.25 in earnings free cash flow should still be a bit over $1 billion, amply covering the dividend. However in a largely commodity business where orders are falling, inventories building, and margin pressure increasing, a dividend alone is unlikely to be sufficient to support the stock.

Of course, if the global economy bounces back and fears of a slowdown in tech hardware proves overblown, allowing Seagate’s business to trough in fiscal Q1, the stock could bounce back. But, right now, there is little evidence this is occurring. The question is really how long and how deep the downturn is. And for Seagate, these cycles can be long with revenue falling essentially for four years after 2015 before finally bottoming. While I think $4.25 in EPS is a reasonable central case for earnings next year, investors should be aware that 2023 may not be the bottom.

Jumping into a stock at 12x earnings when earnings could still be falling in a year, especially as it faces exposure from higher interest rates, which will slow the pace of buybacks. Investors who like the dividend, which is stable, and can be patient could consider buying the stock at $43 or 10x 2023 earnings where the valuation can start to provide a floor But even then, investors should not expect a near-term rebounded. I see another 18% downside in STX shares and would not start trying to bottom fish here.

Be the first to comment