asbe/iStock via Getty Images

Introduction

Following their solid financial performance during 2021 and the very strong oil and gas prices early in 2022, when last discussing Shell (NYSE:SHEL), my previous article saw higher shareholder returns on the horizon. Whilst their subsequent meager 4% dividend increase felt lackluster given the prevailing operating conditions, thankfully it seems that management is finally ready to unlock their full potential with their CEO wanting to share more of their profits with shareholders. After reviewing their latest numbers, I expect to see monster cash returns coming next week when they release their results for the second quarter of 2022, thereby hopefully boosting their moderate dividend yield of only 4.02%.

Executive Summary & Ratings

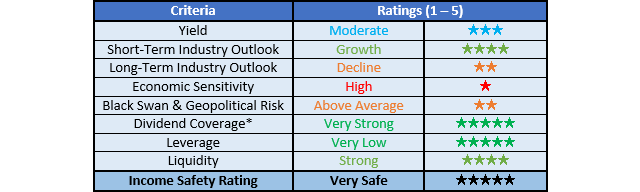

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

Author

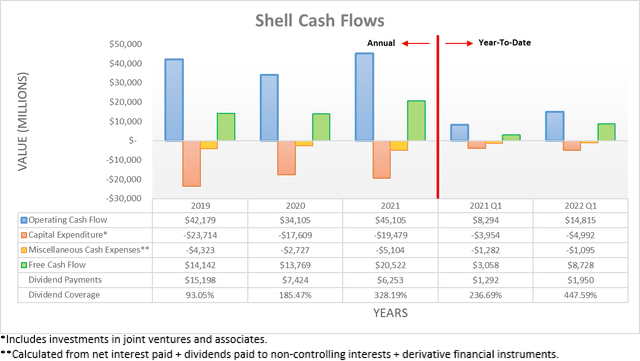

The booming operating conditions throughout the first quarter of 2022 unsurprisingly saw their cash flow performance surge ahead with very impressive operating cash flow of $14.815b that resulted in a staggering $8.728b of free cash flow. Even though their operating cash flow was already a massive 78.62% higher year-on-year versus their previous result of $8.294b, it was actually weighed down by a working capital build of $7.4b that nets out to $5.2b after counting the $2.2b they received from the settlement of derivatives. If added to their surface-level results, this would see an underlying operating cash flow of circa $20b for the first quarter of 2022, which is a truly massive number that annualizes to a nearly unthinkable $80b and given their capital allocation strategy, paints a very desirable outlook for the second half of 2022, as the slide included below displays.

Shell First Quarter Of 2022 Results Presentation

Even if the $22b upper end of their capital expenditure guidance for 2022 is subtracted, it still leaves estimated free cash flow of circa $58b for the year as per the operating conditions of the first quarter of 2022. Whilst these may vary going forwards, their operating conditions were very similar during the second quarter and looking ahead into the remainder of the year, the outlook still appears very strong with the International Energy Agency warning of further market tightness still to come regardless of recent recession fears that have resulted in the recent oil price slump. It should also be noted that even with oil prices falling back to the high $90 per barrel level, they remain higher than the start of the year and thus barring an unexpected event, it does not seem unrealistic to expect the second half of 2022 to be at least similar to the first quarter.

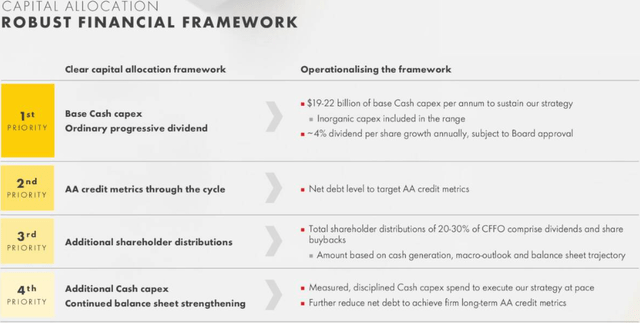

If zooming into the second half of 2022, they should see approximately half of this estimated free cash flow and thus leave a massive $29b that amounts to an astounding near 17% of their current market capitalization of approximately $174b. Apart from the supportive commentary from their CEO, their capital allocation strategy also places additional shareholder returns as a higher priority than additional capital expenditure and further balance sheet strengthening. Since they have now reached their targeted gearing ratio, as subsequently discussed, I expect management will begin returning all of their free cash flow to shareholders. This provides ample scope to announce monster cash returns next week, which given the free cash flow estimation, could quite possibly reach upwards of $15b per quarter and whilst it remains to be seen how these would be split between dividends and share buybacks, I personally remain hopeful for a weighting towards the former.

Shell

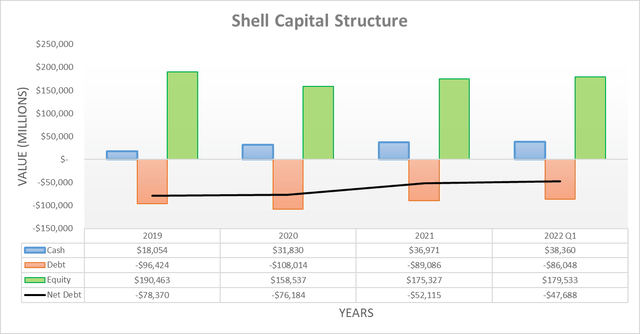

After seeing their debt end 2021 at $52.115b, thereby representing a rapid decrease of 31.59% versus its previous level of $76.184b at the end of 2020, the first quarter of 2022 saw this continue with an equally as impressive decrease to $47.688b, despite conducting $3.472b of share buybacks and their net working capital build of $5.2b. Meanwhile, if adding their leases and debt-related derivatives into the mix as practiced by management, it only sees their net debt immaterially higher at $48.489b with a gearing ratio of 21.30%. Apart from being significantly lower versus their result of 25.60% when conducting the previous analysis following the third quarter of 2021, it now sits right near the middle of their targeted range of 15% to 25%, as discussed within my previous analysis.

If looking ahead to next week when their second quarter of 2022 results are released, their gearing ratio will almost certainly drop below 20%. Depending upon working capital movements, this could possibly even reach close to 15% as they reverse upwards of $4.5b of impairments, which boosts their equity and by extension, lower than gearing ratio. This obviously gives management plenty of cause to ramp up their shareholder returns as soon as possible because waiting another quarter will likely see this fall beneath their targeted range. Despite the positive improvements, realistically, it would be redundant to reassess their leverage and liquidity in detail because their capital structure is still effectively similar in nature to when conducting the previous analysis.

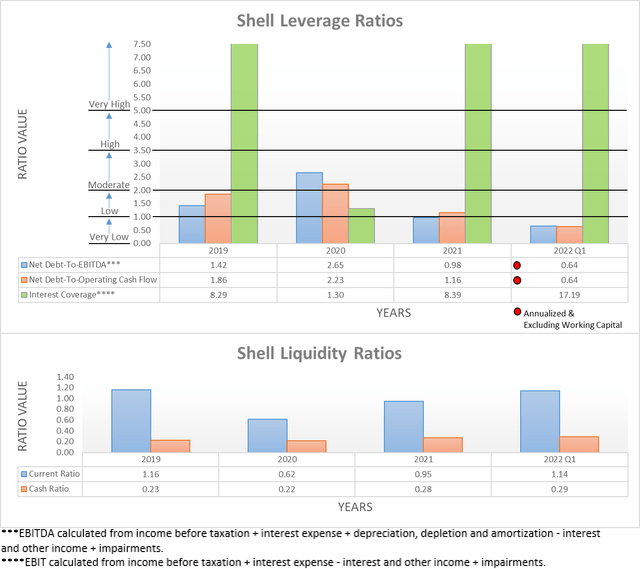

The two relevant graphs have still been included below to provide context for any new readers, which shows that thanks to their booming financial performance, their net debt-to-EBITDA, and net debt-to-operating cash flow both read 0.64 and thus are now below the threshold for the very low territory of 1.00. When looking elsewhere, their continued massive cash balance that is quickly approaching $40b unsurprisingly ensured that their liquidity is still strong with current and cash ratios of 1.14 and 0.29, respectively. If interested in further details regarding these two topics, please refer to my previously linked article.

Author

Conclusion

Since nothing is currently announced, it remains possible that shareholders will be disappointed once again. Although given their rapidly decreasing net debt and the priorities of their capital allocation strategy, this would be surprising and as a result, I expect to see monster cash returns coming next week when they release their results for the second quarter of 2022. Regardless of whether these come via dividends or share buybacks, one way or another, their shares should rally on the back of this tidal wave of cash heading to line the pockets of shareholders and thus I believe that maintaining my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Shell’s Quarterly Reports, all calculated figures were performed by the author.

Be the first to comment