Marc Dufresne/iStock via Getty Images

Investment Thesis

The Coca-Cola Company (NYSE:KO) and PepsiCo, Inc. (NASDAQ:PEP) have both shown massive resilience over the past few years, given KO’s notable 5Y Total Price Return of 52%/ 10Y Return of 111.7% and PEP’s impressive 5Y Total Price Return of 68.8%/ 10Y Return of 214.6%. Despite the pandemic hyper-growth, both companies are not showing signs of growth normalization to pre-pandemic levels. By the last twelve months (LTM), PEP has recorded an impressive revenue CAGR of 6.82% and a net income CAGR of 8.08% since FY2019, compared to KO with 3.51% and 2.37%, respectively.

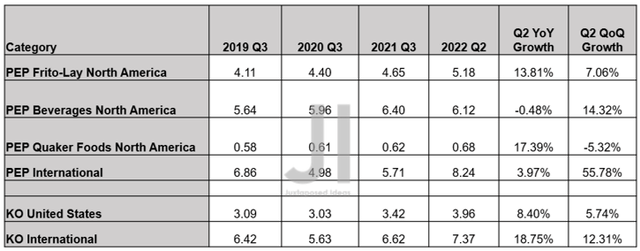

The Durability In Global Beverage Demand ( in billion $ )

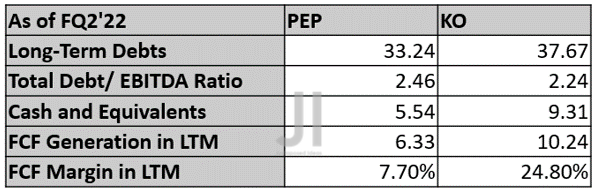

Both companies continue to report tremendous consumer demand for their beverage segments in North America in FQ2’22, with PEP reporting 14.32% QoQ growth compared to KO’s 5.74%. PEP similarly recorded 7.06% QoQ growth in its snack segment within the region. International demand remains robust, especially for PEP, which reported impressive QoQ growth of 55.78% in FQ2’22, compared to KO at 12.31%.

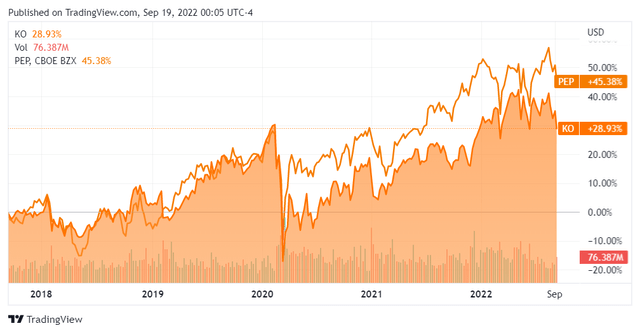

PEP & KO 5Y Stock Price

Combined with its exemplary dividend hikes thus far, it is no wonder then, that PEP has been outperforming KO in the past two years, with improved returns of 45.38% for the former compared to 28.93% for the latter, despite the equally drastic plunge during the start of the pandemic. Though the rising inflation and upcoming winter may potentially put a damper on consumers’ discretionary spending over the next two quarters, we expect these to be temporary headwinds, significantly alleviated by the improving macroeconomics by mid-2023. Investors, take note of the potential volatility in the short-term.

PEP/ KO Dividends Likely Remain Safe For Now

PEP/ KO Liquidity As Of FQ2’22

S&P Capital IQ

Both companies appear to be relatively balanced in their financial performance thus far, with comparatively similar liquidity over the next few quarters. PEP is expected to see $3.86B in debt maturity in 2022 and another $3.01B by 2023, with KO reporting only $3.1B due through 2023.

However, investors have nothing to worry about, given PEP’s war chest in cash and equivalents of $5.54B as of FQ2’22 and robust FCF generation of $6.33B in the LTM. At the same time, KO reported superior numbers of $9.31B and $10.24B, respectively. Thereby, preserving the companies’ dividend safety and liquidity ahead, assuming slowing consumer demand during the economic downturn through 2023.

PEP & KO Dividend Payouts & Yields

In addition, both PEP & KO have consistently been raising their dividends by 20.41% and 10%, respectively, since FY2019. Stellar indeed, since these directly translate to excellent forward dividend yields of 2.75% and 2.96%, respectively, despite the worsening macroeconomics. Assuming similar hikes in payouts, we may potentially see PEP outperforming KO’s dividend yields by a small margin over the next few years, triggering sustained stock outperformance for the former ahead, as seen in the past two years.

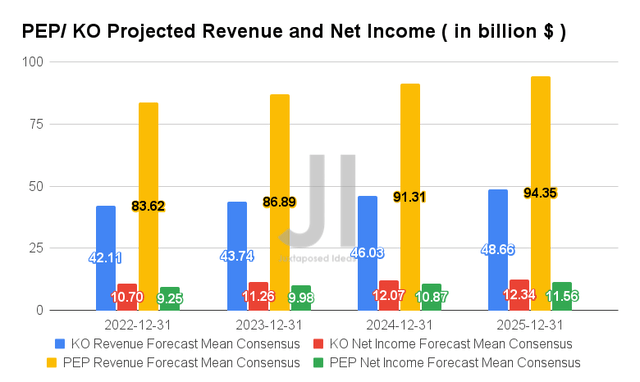

Mr. Market Is Still Optimistic About PEP’s & KO’s Forward Profitability

Over the next four years, analysts expect PEP to report revenue and net income growth at a tremendous CAGR of 4.38% and 11.02%, respectively, while KO is expected to report revenue and net income growth at a lower CAGR of 5.93% and 6.01%, respectively, faster than pre-pandemic and pandemic growth. Both are also expected to report exemplary growth in net income margins, with PEP improving from 10.9% in FY2019 to 12.25% by FY2025 and KO from 23.9% in FY2019 to 25.35% by FY2025.

In its upcoming FQ3’22 earnings call, PEP is expected to report revenues of $20.71B and EPS of $1.83, representing excellent YoY growth of 2.58% and 2.31%, respectively. For FY2022, the company is expected to report revenues of $83.62B and net incomes of $9.25B, representing an impressive increase of 5.22% and 21.55% YoY, respectively, despite the tougher YoY comparison.

In the meantime, KO is expected to report FQ3’22 revenues of $10.48B and EPS of $0.64, representing YoY growth of 4.38% though a decline of -1.81%, respectively. For FY2022, the company is expected to report revenues of $42.11B and net incomes of $10.7B, representing a decent increase of 8.95% and 9.51% YoY, respectively.

Given the notable differences in analysts’ projections, it is evident that Mr. Market is relatively more confident about PEP’s forward execution and improved profitability through FY2025. This is no wonder, given the stock’s stellar track record of outperforming consensus estimates for the past 14 consecutive quarters, compared to KO for the past six consecutive quarters. We shall see.

We encourage you to read our previous article on PEP & KO, which would help you better understand its position and market opportunities:

- Pepsi Keeps Pouring It On – But Do Not Add Here

- Coca-Cola: Premium Cash-Cow Business With Classic Great Taste

So, Is PEP & KO Stock A Buy, Sell, or Hold?

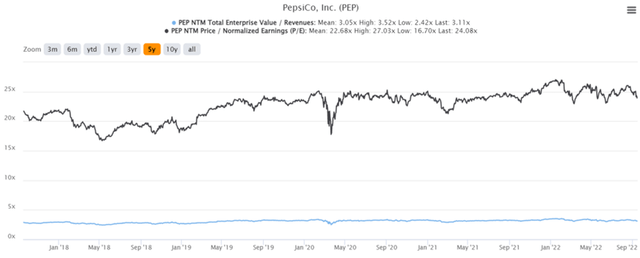

PEP 5Y EV/Revenue and P/E Valuations

PEP is currently trading at an EV/NTM Revenue of 3.11x and NTM P/E of 24.08x, higher than its 5Y mean of 3.05x and 22.68x, respectively. The stock is also trading at $166.97, down -7.78% from its 52 weeks high of $181.07, though at a premium of 11.7% from its 52 weeks low of $149.48.

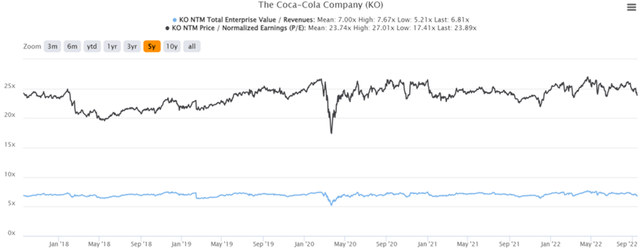

KO 5Y EV/Revenue and P/E Valuations

In the meantime, KO is trading at an EV/NTM Revenue of 6.81x and NTM P/E of 23.98x, lower than its 5Y EV/Revenue mean of 7.0x though massively improved from its 5Y P/E mean of 23.74x. The stock is also trading at $59.54, down -11.39% from its 52 weeks high of $67.20, though at a premium of 13.88% from its 52 weeks low of $52.28.

The recent market pessimism has provided opportunistic investors with excellent entry points, with PEP and KO astonishingly both trading below their 50-, 100-, and 200-day moving averages. In the meantime, consensus estimates remain bullish about their prospects, given their price target for PEP at $180.50 and KO at $68.40, with an 8.10% and 14.88% upside from current prices, respectively.

Combined with their excellent returns thus far, we surmise that these two stocks will always be perceived as “over-valued”, though with massive potential for price appreciation over the next decade, similarly to Costco Wholesale Corporation (NASDAQ:COST) with an outstanding 5Y Return of 234.7% and 10Y Return of 545.6%. Therefore, we rate PEP & KO stock as Buys at mid $150s and mid to upper $50s, respectively, which have proved to be their previous support levels over the past year. Do not miss these near-bottom levels for long-term investing and portfolio growth at the Fed’s upcoming interest hikes on 20 September and November 2022.

In the meantime, if we must choose only one, we probably will go with PEP, given its improved returns thus far. Though subjectively speaking, we prefer Coca-Cola’s taste over the Pepsi soft drink.

Be the first to comment