peshkov

MV Oil Trust (NYSE:MVO) is a company receiving royalty payments on oil production in Kansas and Colorado. The company is currently experiencing record income thanks to high oil prices and rising production. The trust pays out more than 90% of the proceeds it receives each quarter as a distribution, providing a truly extraordinary forward yield of 26%. However, this yield has an expiration date, which significantly changes the calculus.

A Monster Yield Backed By High Oil Prices

MV Oil Trust announced its most recent quarterly distribution of $8,050,000 or $0.70 per unit. This is a massive increase from a year ago and even from the first quarter’s distribution of $4,887,500 or $0.425 per unit.

This enormous increase is thanks to the fantastic run oil has been on this year, breaking $100 per barrel for the first time in years.

MV Oil Trust receives 80% of the net proceeds from the sale of all oil and natural gas production on the underlying properties. Though at this point it’s just oil.

Production volumes from the underlying properties for the year ended December 31, 2021 were approximately 99% oil and approximately 1% natural gas and natural gas liquids

In addition to attaining higher prices for that oil, the trust’s properties have begun to pump more oil, presumably to capture the aforementioned high prices. If the company can maintain its current level of distributions, its forward yield is upwards of twenty-six percent!

Crude Oil Futures YTD Chart (Seeking Alpha)

Judging from the trajectory of oil prices, continuing tight supply, and the approaching fall and winter seasons, there is a good chance of oil prices staying above $100 per barrel for the next two quarters.

But, the Trust is Due to Expire

A yield of 26% is preposterously high and one might expect a company yielding so much to have garnered much more attention than MV Oil Trust has. However, the trust business is boring. And this trust is also set to expire, putting a definitive end date to its unit distributions and the shares themselves. For MV Oil Trust, there are two conditions:

The net profits interest will terminate on the later to occur of (1) June 30, 2026 or (2) the time when 14.4 million barrels of oil equivalent (“MMBoe”) have been produced from the underlying properties and sold (which amount is the equivalent of 11.5 MMBoe with respect to the Trust’s net profits interest), and the Trust will soon thereafter wind up its affairs and terminate.

Now in order to get a sense of which of these conditions is likely to occur later, we can look at how fast MV Partners (a significant owner of the trust’s units and the actual operator of the oilfields) is pumping by looking at the trust’s 2021 annual report:

The overall production sales volumes attributable to the net profits interest[…]from October 1, 2021 through December 31, 2021[…]a total of 128,824 barrels of oil equivalent. The overall production sales volumes attributable to the net profits interest[…]from October 1, 2020 through December 31, 2020[…]a total of 133,399 barrels of oil equivalent.

From the annual report, you might expect the trust to continue the same trend in 2022 and pump around 130,000 barrels of oil equivalent (BOE) per quarter.

That is, until you consider what you might do if faced with the situation precipitated by the Russo-Ukrainian War whereby the world is in a significant supply deficit for oil and prices have skyrocketed.

And of course, they’ve started pumping more.

For the first quarter, MV Oil Trust pumped 144,512 BOE. In the second quarter, it pumped 158,092 BOE. Nearly 30,000 barrels more than its quarterly average for the past two years.

So will the trust terminate in June of 2026 or sooner?

Well as of March 31, the company has pumped “13.0 MMBoe of production from the underlying properties (which is the equivalent of 10.4 MMBoe with respect to the Trust’s net profits interest).”

Adding the 158k from the second quarter, the total stands at 13.16 MMBoe out of 14.4 MMBoe before the trust terminates. If the company continues to pump 160k BOE per quarter, MV Oil Trust will have reached its upper limit within 7.75 quarters. Just under two years from now in 2024.

However, if you remember from earlier, the trust terminates on the later to occur. So all this extra pumping is actually just increasing the net proceeds due to the trust and total distributions, right?

Well, sort of. The good news is the underlying oil fields actually have enough proven reserves to continue pumping at this rate well until the 2026 trust termination and beyond.

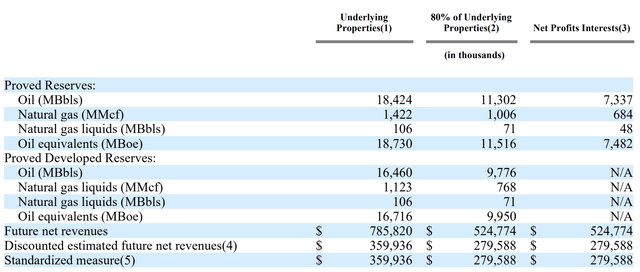

MV Oil Trust Proven Reserves (MV Oil Trust Form S-1)

There are an additional 4 billion barrels of oil on top of the 14.4 million BOE allotted to the trust in proven reserves according to the initial S-1 filing. You’ll note here too that the company’s “80% of the underlying properties” projection is based on the trust terminating at 14.4 million BOE, not as a percentage of 18.73 million BOE.

If the company continues drilling at the same rate, we are looking at 2.56 million BOE produced before the trust terminates. This is around 1.32 million BOE more than the 14.4 million BOE originally projected.

To this, there is once again an important caveat. Though MV Oil Trust and MV Partners share largely the same interests (to pump oil and sell it for high prices), if prices were to fall substantially, MV Partners might be incentivized to slow production for the remaining days of the trust so as to avoid paying out the net proceeds due to the trust and wait for higher prices to return. The trust itself has zero say in how production occurs.

How Might We Value The Remaining Days?

Putting a standard valuation using something like price to earnings on a trust due to expire would gravely misrepresent its value proposition. Instead, it is worth thinking about the potential value of the distributions that remain and whether you might make more than the share price back before the trust expires.

Well, let’s make those calculations, shall we?

For the first and second quarters, the trust had costs equivalent to roughly $30 per barrel extracted (slightly higher these past two quarters, but they have also been ramping up production so we will assume $30 going forward). After the trust receives 80% of those net proceeds, an additional 7% is taken for “trust expenses” (on average).

|

Expected Distributions Till June 30, 2026 |

Bull Case | Base Case | Bear Case |

| Production (BOE) | 2.56 million | 2.08 million | 1.6 million |

| Average Price of Oil (per barrel) | $100 | $70 | $50 |

|

Net Proceeds |

$179.2 million | $83.2 million | $32 million |

| 80% Net Proceeds to Trust | $143.4 million | $66.56 million |

$25.6 million |

| Distribution (after 7% cut) | $133.3 million | $61.9 million | $23.8 million |

| Distributions per Unit | $11.59 | $5.38 | $2.07 |

| Return on Current Unit Price | 7% | -50% | -81% |

Though it is impossible to predict what the future will hold, I imagine the company’s results will lie somewhere between the base and bull case laid out above, which means shares are priced for what the market expects the remaining payouts will be.

If the price of oil falls from its current highs within the next few years, you can certainly expect MV Oil Trust’s value to fall alongside as the expected distributions adjust lower. A long bet on MV Oil Trust must assume that $100+ oil and production of 160k BOE per quarter are the new status quo in order to be profitable (assuming you hold till the end).

If you don’t believe the oil market will stay as high as it is right now, perhaps due to recession clouds on the horizon, MV Oil Trust may be very overvalued (as seen with the 50% downside in the base case). Because MV Oil Trust so closely tracks crude oil futures, its shares reflect an assumption of whatever the current situation is as being the permanent state of affairs. If that were to change, shares could face a precipitous fall.

Our Takeaway

MV Oil Trust currently does have a monster yield which appears to be a prime candidate to pad any good income portfolio. However, the approaching trust expiration date changes that picture significantly for the worse. While you could still turn a profit by receiving more in distributions than shares currently cost before the trust expires, such an investment relies heavily on maintaining high oil prices and production levels. The company’s shares are roughly correlated with the price of crude oil, as the company’s expiration approaches, shares will likely begin to carry a steeper and steeper discount to reflect that reality, and holding till the end will leave you with worthless shares (unless the company decides to pay out any remaining cash reserve, but that is not likely to be much more than $0.10 per share as the company keeps around $1.25 million for future expenses).

In conclusion, MV Oil Trust could be an okay income play on sustained high oil prices but with the company’s production levels out of its control, there is a high degree of uncertainty for investors and no real prospect of future growth. As such, you could potentially profit from holding through the next year or two and collecting a massive yield, but there’s little long-term future for the company and a significant risk of unit devaluation that investors should remain aware of.

Be the first to comment