Thomas Barwick/DigitalVision via Getty Images

Realty Income (NYSE:O) is back towards 52-week highs, with its more than $45 billion market capitalization, and dividend yield of roughly 4%. The company is known as the “monthly dividend company” from its impressive portfolio of real-estate assets and a focus on directing that cash to shareholders. Despite that lower yield, we see a strong potential for reliable shareholder returns.

Realty Income Overview

Realty Income has an incredibly strong portfolio of well distributed assets.

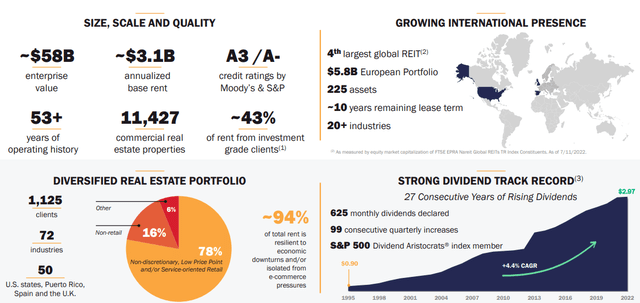

The company has an almost $60 billion enterprise value with a ~5% cap rate providing ~$3.1 billion in annualized base rating. The company has a A3/A- credit rating with a >50-year operating history and more than 10 thousand properties. That highlights the massive scale that the company operates at across the world.

Among the exciting nature of the company’s portfolio is its small store nature, with many stores like Walgreens that are resistant to economic downturns. The company is also one of the largest international REITs, exciting because the international markets have much less competition and are actually larger in their total market opportunity.

The company has a 4.4% annualized dividend growth track record, and we see no reason why that won’t continue going forward.

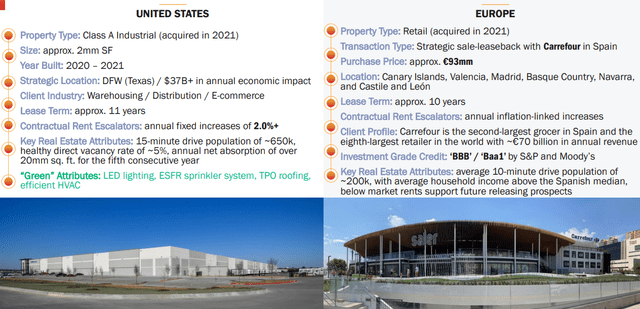

The company has done a great job of sourcing growth opportunities. In the United States the company has an example of a 2 million square foot project acquired in 2021 in a strategic location. The 11-year lease term has annual fixed increases of 2% and is incredibly well located in a strategic area. In a high inflationary environment those low strategic increases might hurt.

In Europe, another $93 million euro acquisition for the company has a 10-year lease term. Here the company has inflation-linked rent escalators with investment grade credit and a strong client profile. We expect the asset to continue generating strong income and helping to prove the European market for the company.

Realty Income Market Opportunity

Realty Income operates in growing markets with a significant amount of opportunity for the company.

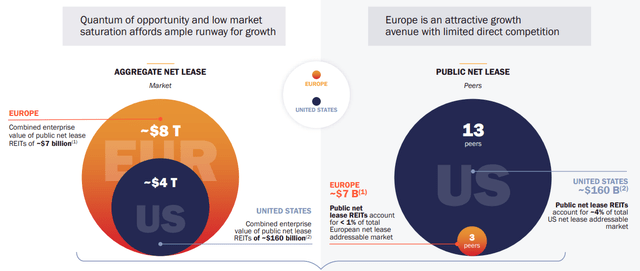

The total market opportunity for the company is enormous. REITs are an incredibly diversified business but they also have low-cost capital that can enable growth. In the United States the public net lease REITs is 4% of the total market value of $160 billion. In Europe, with a $8 trillion market, the value of REITs is <0.1%.

The company has become one of the largest players in the Europe but there’s much more substantial opportunity. That opportunity is worth paying close attention to.

Realty Income Financial Strength

The company has an incredibly strong and well distributed portfolio of assets, which help to support reliable earnings.

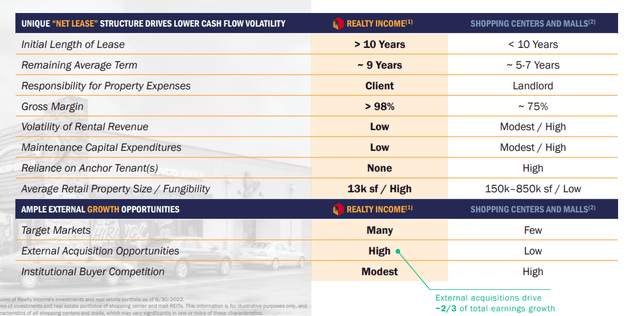

The company purchases numerous modest sized commercial properties (13k sq. foot average size) across numerous industries. The company is well diversified here, with Texas the largest state at 10.7%, Grocery stores the largest sector at 10.5%, and Walgreens the largest customer at 4% of the company’s revenue.

The company’s average initial lease length is >10% and the revenue that the company earns is effectively all profit as the client has responsibility for property expenses. That gives the company a >98% gross margin with extremely little volatility and maintenance capital expenditures and no reliance on anchor tenants.

The company has numerous markets varying it size that it can depend on and all of that means continued financial strength.

Shareholder Returns

The company has the ability to provide strong and continued shareholder returns.

The company has roughly $12 billion in debt that cost is several hundred $ million annually that it can comfortably handle. The company’s median AFFO per share growth has been roughly 5.1% and the company can comfortably cover its 4% dividend yield paid across a monthly basis. The AFFO growth is enough to cover dividend increases.

The company’s AFFO/share for the most recent quarter was just over $1/share. Annualized, that’s an AFFO/share of just over $4/share or a 5.5% AFFO/share yield. The company has a payout ratio of just under 75%, something that it can comfortably afford, and leaving it roughly $600 million in additional AFFO it can utilize how it wants.

Regardless of how the company spends its cash we expect reliable and growing shareholder returns.

Thesis Risk

In our view, the largest risk for the company is poor returns. The company currently has a 4% dividend that it can comfortably afford. However, inflation is currently at high single-digits and the company’s assets aren’t guaranteed to match that, nor are rentals. The company is safe but that means investors have bid it up, hurting its ability to drive future returns.

Conclusion

Realty Income has an incredibly unique portfolio of assets that it uses to be a monthly dividend company with a 4% dividend yield. That comes out to a just under 75% yield on the company’s AFFO/share showing that it can comfortably pay out its dividend. The nature of the company’s business is that maintenance obligations to earn its cash flow are low.

The company is becoming one of the few REITs to expand heavily into Europe, a much less crowded market, enabling the company to make a number of substantial deals. The company has numerous growth opportunity that it can comfortably afford, and while the returns might not be as high as others, we expect the company to continue to be a reliable source of cash flow.

Be the first to comment