CHUNYIP WONG

On Thursday, August 4, 2022, liquefied natural gas producer Cheniere Energy, Inc. (NYSE:LNG) announced its second quarter 2022 earnings results. The production of liquefied natural gas is a sub-sector of the energy industry that has been in the news a great deal lately, which is perhaps not surprising since it has been sometimes considered a possible solution to the European energy crisis. While that may not pan out as some hope (although we are currently seeing an increase in the compound being shipped to Europe), the industry will certainly not be bereft of growth as I discussed in a previous article. We can see this quite clearly in Cheniere Energy’s results as the company delivered incredible year-over-year revenue and cash flow growth. The company did admittedly miss analysts’ expectations, but overall, there was a lot to like here as Cheniere Energy made a great deal of progress in strengthening its balance sheet and was able to increase its guidance. These two things are always nice to see with a company like this.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Cheniere Energy’s second quarter 2022 earnings report:

- Cheniere Energy brought in total revenues of $8.007 billion in the second quarter of 2022. This represents a substantial 165.40% increase over the $3.017 billion that the company brought in during the prior-year quarter.

- The company reported an operating income of $1.477 billion in the most recent quarter. This represents a substantial 911.64% increase over the $146 million that the firm reported in the year-ago quarter.

- Cheniere Energy and Chevron (CVX) agreed to early termination of its Terminal Use Agreement in exchange for a $765 million payment to be made by Chevron.

- The company reported a consolidated adjusted EBITDA of $2.529 billion during the reporting period. This compares very favorably to the $1.023 billion that the company reported in the equivalent quarter of last year.

- Cheniere Energy reported a net income of $741 million in the second quarter of 2022. This represents an enormous improvement compared to the $329 million net loss that the company reported in the second quarter of 2021.

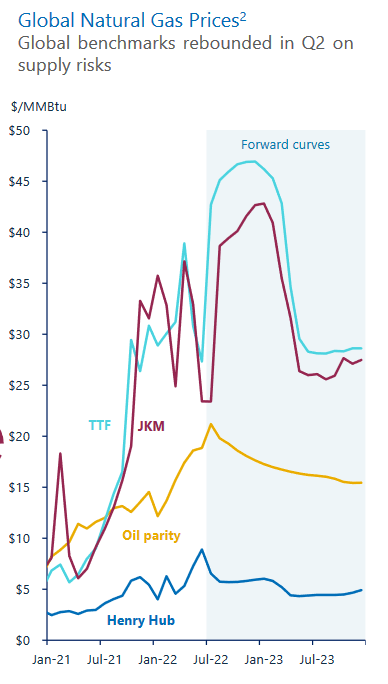

It seems essentially certain that the biggest thing that anyone reviewing these highlights will notice is that essentially every measure of financial performance showed considerable improvement compared to the prior-year quarter. This is primarily due to the fact that liquefied natural gas prices were substantially higher than a year ago. This is not likely to be a surprise to anyone reading this, especially people that heat their homes with natural gas:

Cheniere Energy

One of the reasons for these higher average prices was the higher risk of potentially not obtaining supplies due to the conflict between Russia and Ukraine but there are of course many other reasons. While this was the primary driver of the higher revenues and cash flow, it was not the only one. Cheniere Energy also delivered higher volumes of liquefied natural gas than in the prior year’s quarter. The company reports that it sold a total of 564 trillion BTU in the most recent quarter compared to 499 trillion BTU in the prior year’s quarter. It should be pretty obvious why these things would increase the company’s revenues and cash flows. After all, it had a greater amount of products to sell and received substantially higher prices for them. The steep increase in revenues naturally meant that a much higher amount of money was available to make its way down to the company’s cash flows.

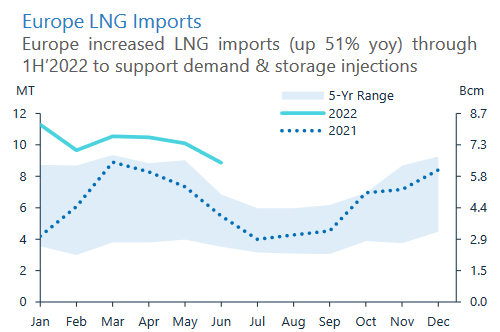

One of the biggest stories in the news over the past several months was Russia severely curtailing the flow of natural gas to Europe in response to the sanctions that have been placed on it. Indeed, there are some predictions that Europe may not have sufficient supplies of gas to make it through the winter. As might be expected then, one of the destinations that some of this increased supply of liquefied natural gas is going to is Europe. In fact, European imports of liquefied natural gas were up by 51% year-over-year:

Cheniere Energy

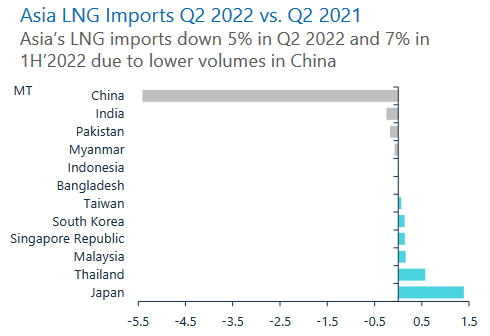

In my last article on Cheniere Energy (linked in the introduction), I showed that it is Asia that will likely see the biggest increase in the demand for liquefied natural gas. The continent is expected to boost its demand for the substance by 40% by 2030 compared to today’s levels. However, we certainly do not see that reflected in Cheniere Energy’s results as the continent as a whole reduced its imports by 5% during the quarter and the continent’s imports were down 7% in the first half compared to prior year periods:

Cheniere Energy

This is primarily due to the COVID-19-related lockdowns in China, which actually might be immediately obvious by looking at the chart above. Although this situation is quite disappointing, the improvements that we saw in Europe were more than able to offset this decline.

As we can deduce from the above-mentioned demand projections, Cheniere Energy boasts significant forward growth potential. The company currently has a few projects underway that are expected to substantially increase its production of natural gas. The most notable of these is an expansion project at its Corpus Christi facility, which the company has dubbed the “Corpus Christi Stage 3 Project.” The point of this project is to add seven liquefied natural gas trains that are capable of producing approximately ten million tonnes per year of liquefied natural gas. Cheniere Energy expects that this project will start operation around the end of 2025 so we can clearly expect that the firm will begin to see its profits grow substantially from this project as we enter 2026. The nice thing about this project is that Cheniere Energy has already secured contracts from various customers for its use so we can be very certain that the growth projections will actually play out.

In various past articles on Cheniere Energy, I stated that one of my biggest concerns about the company is that the firm’s leverage is incredibly high. This is mostly due to the incredibly high costs of constructing liquefaction plants, which can easily run into the billions of dollars. We can easily see the weakness of the company’s balance sheet in the fact that its net debt-to-equity ratio consistently sits at negative levels. Fortunately, Cheniere Energy made some significant progress at improving its situation during the quarter. The company repaid or otherwise redeemed its debt by a whopping $1.1 billion, which brings it to a total of $3.1 billion so far in 2022. The company did not state exactly how much progress it intends to make over the remainder of this year, but it is conceivable that the $765 million that it expects to receive from Chevron will assist with this. This money will be received sometime before the end of the year. Admittedly though, Cheniere has not stated exactly what this money will be used for.

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of Cheniere Energy, we can value it using the price-to-earnings growth ratio, which is a modified form of the familiar price-to-earnings ratio that takes a company’s growth into account. As a general rule, anything below 1.0 is a sign that the stock may be undervalued relative to its forward earnings per share growth and vice versa. Cheniere Energy is substantially undervalued according to this ratio. According to Zacks Investment Research, the company will grow its earnings per share at a 55.39% rate over the next three to five years. This gives the company a price-to-earnings ratio of 0.15 at the present price, which is a clear sign that the stock appears to be undervalued relative to its earnings per share growth. When we consider this along with the company’s improving financial strength and performance, it might be worth taking a position in the stock if you can stomach the risk involved with respect to its debt.

In conclusion, Cheniere Energy reported phenomenal results during the most recent quarter. The company saw tremendous year-over-year growth driven by high prices and growing imports from Europe and it appears likely that the firm will be able to generally continue its growth over the coming years. Indeed, that very likelihood of forward growth is why the company appears to be substantially undervalued at the present price. Unfortunately, Cheniere Energy continues to have a very high debt load but the strong increase in cash flows is certainly improving its ability to correct this problem, which it has been doing. Overall, it appears that the company could be a good investment today.

Be the first to comment