mrtekmekci

Times have been tough for a number of companies across a number of industries. With recession fears increasing, high inflation, and rising interest rates, amongst other concerns, investors are right to worry about what will happen next. Some companies have performed better than expected in this space, while others have demonstrated rather significant weakness. In this latter category is Alico (NASDAQ:ALCO), a company that operates as a small agricultural firm that’s focused largely on the production of citrus. Shares have fallen slightly more than the broader market has for much of this year, with revenue and profitability taking a hit. If we see financial performance revert back to what it was in prior years, the company could offer investors some upside potential. But given where things are at the moment, I would make the case that now is not quite the right time to consider buying in. And because of this, I’ve decided to retain my ‘hold’ rating on the business for the foreseeable future.

Not sweet

Back in early January of this year, I wrote my first-ever article about Alico. In that article, I called the company an interesting firm. I acknowledged at that time that financial performance had been all over the map in prior years, with no clear trend for revenue or cash flows sticking out. I felt as though the pricing of the company at that time made it a decent prospect, but not anything special. And as a result, I ended up rating at a ‘hold’, reflecting my belief that it would likely perform along the lines of what the broader market would for the foreseeable future. Since then, things have turned out more or less as I would have anticipated. While the S&P 500 is down by 11.5%, shares of Alico have generated a loss for investors of 13.3%.

Author – SEC EDGAR Data

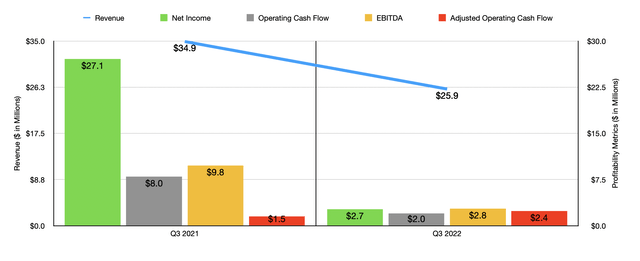

Some of you might think that this decline was driven by fundamental concerns. And you would be right. Consider how the business performed just the latest quarter of the year. Revenue came in at $25.9 million. That’s 25.8% lower than the $34.9 million generated the same quarter one year earlier. According to the company, this decline was largely due to a decrease in the amount of Valencia fruit that it harvested. Management chalked this decrease in revenue associated with lower harvesting to a 19.9% drop and processed box production caused by greater fruit drop that resulted from disease and poor weather conditions. The company was also hit to the tune of 4% by a decrease in pounds sold per box. This was mostly due to the internal quality of its fruit not being as strong as it had been in the prior year. The company also was impacted to some degree by a decrease in revenue associated with grove management services.

With this decline in sales, we also saw a decline in profitability. Net income of $2.7 million was significantly lower than the $27.1 million generated just one year earlier. This pain was driven in large part by sticky operating expenses associated with the company’s Alico Citrus activities. As a percentage of sales, this cost category went from 76.3% last year to 95.9% this year. Applied to the revenue associated with that particular activity in the latest quarter, and the impact on the company’s bottom line would have been roughly $5 million. Another contributor that was even larger involved a lower gain on the sale of real estate, property, and equipment, as well as other assets for sale. This number decreased by $24.5 million year over year. Other profitability metrics, naturally, followed suit. Operating cash flow from $8 million down to $2 million. If we adjust for changes in working capital, however, it would have increased modestly from $1.5 million to $2.4 million. Meanwhile, EBITDA for the firm plummeted from $9.8 million down to $2.8 million.

Author – SEC EDGAR Data

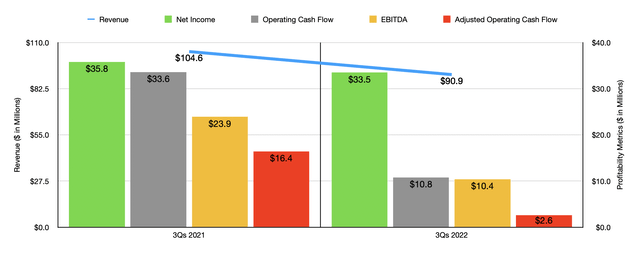

The pain for the company in that latest quarter also impacted financial results for the first half of the year as a whole. Revenue fell from $104.6 million down to $90.9 million. Net income went from $35.8 million down to $33.5 million. Operating cash flow declined from $33.6 million all the way down to $10.8 million. Even if we adjust for changes in working capital, the pain would have been significant, dropping from $16.4 million down to $2.6 million. And EBITDA also fell, dropping from $23.9 million down to just $10.4 million.

When it comes to the 2022 fiscal year as a whole, management now expects net income to be between $30.7 million and $33.3 million. However, on an adjusted basis, it should come in negative to the tune of between $4.1 million and $5.5 million. Given the nature of the adjusted earnings, this should be given more weight than the official earnings forecast. Meanwhile, management expects the company to generate EBITDA of between $11 million and $13 million. No guidance was given when it came to operating cash flow. But if it will change at the same rate that EBITDA is forecasted to, we should anticipate a reading of $6.9 million on an adjusted basis.

Author – SEC EDGAR Data

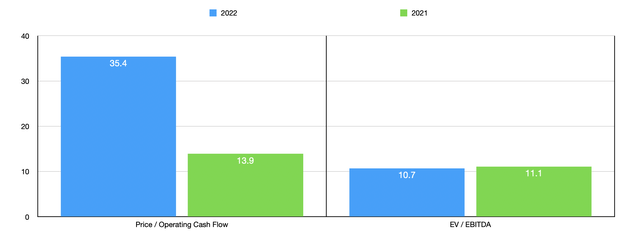

Using this data, I then valued the enterprise. On a forward basis, Alico is trading at a price to adjusted operating cash flow multiple of 35.4. This compares to the 13.9 reading that we get if we use 2021 results. The EV to EBITDA approach, meanwhile, yields a multiple of 10.7. That’s actually down from the 11.1 reading we get using last year’s figures. To put this in perspective, I compared the company to five similar firms. On a price to operating cash flow basis, three of the five companies had positive results, with their multiples ranging between 9.8 and 13.8. In this scenario, Alico was the most expensive of the group. Meanwhile, using the EV to EBITDA approach, the range was from 7.2 to 32.1. In this case, four of the five companies were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Alico | 17.8 | 14.7 |

| Bunge Limited (BG) | N/A | 7.2 |

| Ingredion Incorporated (INGR) | 9.8 | 8.8 |

| Archer-Daniels-Midland Company (ADM) | 13.8 | 9.5 |

| Darling Ingredients (DAR) | 12.6 | 8.7 |

| Limoneira Company (LMNR) | N/A | 32.1 |

Takeaway

At this point in time, Alico seems to be struggling to some degree. Unfortunately, this is just how this kind of industry is. For those who buy in at the right time and at the right price, the end result could be quite positive. I would argue that with the recent decline in price that Alico has experienced, the firm is definitely nearing that point. But on the whole, I see too many issues regarding profitability and declining sales to make me comfortable enough to change my rating.

Be the first to comment