AvigatorPhotographer/iStock via Getty Images

Investment Thesis

Cleveland-Cliffs (NYSE:CLF) is well positioned for a sudden improvement in the steel sector.

Here I discuss some of the rapid changes that have taken place in the past month since earnings come out. Accordingly, I update my previous hold position to a buy.

This is my point. I believe that steel prices have found a bottom and this positions CLF for a substantially improved next several months.

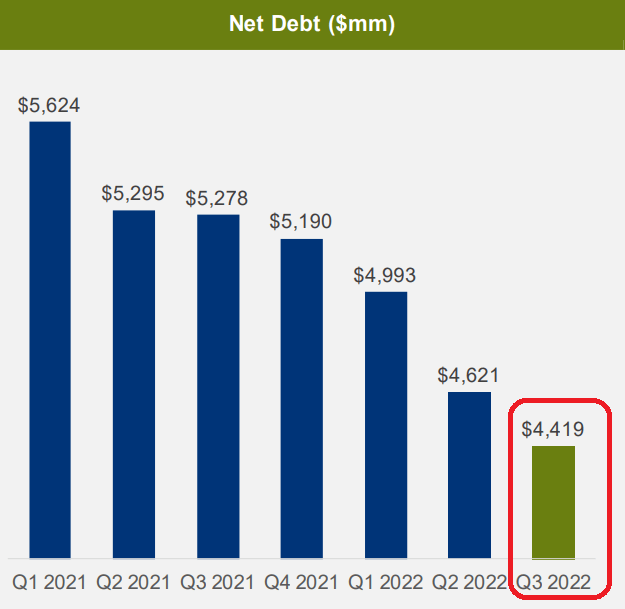

The one blemish here remains CLF’s balance sheet. At net debt of $4 billion, there’s still a lot of work to be done to make this more manageable.

How Long is a Month in Steel?

It’s been a month since my previous CLF analysis. At the time, the thrust of my argument was ”until steel prices start to bottom, investors will remain worried.”

This is what we are facing on 25 October.

Steel prices had been tumbling since April. It was doom and gloom throughout the steel sector. Being an investor in steel stocks myself, I know the feeling very well.

But then, out of nowhere, rumors started to percolate that perhaps China, the biggest importer of steel, might reopen. Of course, the rumors were promptly squashed by officials.

And then, another driver took place. China signaled that it might look for ways to support its crumbling real estate sector. Again, the stimulus package being considered wasn’t a meaningful needle mover, at $35 billion.

But what’s more important is what this signified to steel investors. Recall, the biggest customer for the steel market is the Chinese real estate market. By far.

And given that steel prices had been so compressed and there was so much pessimism being priced into the commodity, even as rumors were getting suppressed, steel speculators moved to put a floor on steel prices.

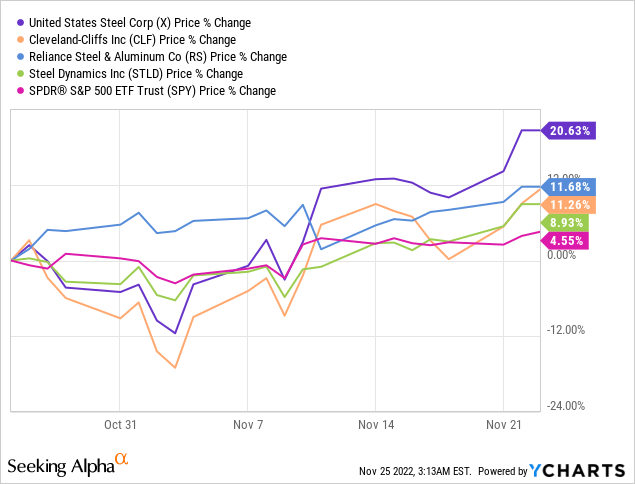

And within this respite from the consistent selling-off in steel prices, steel stocks jumped higher in the past 30 days.

As you can see here steel stocks have trounced the S&P 500 (SPY).

With that in mind, I’m going to address one significant blemish in my bull thesis.

CLF’s Balance Sheet is Constrained

I know that many investors will be quick to note that CLF’s net debt to EBITDA is 1x. But that figure doesn’t give enough consideration to the fact that we are talking about a steel company.

As such, as we look ahead to 2023, I believe that capex will end up at $800 million.

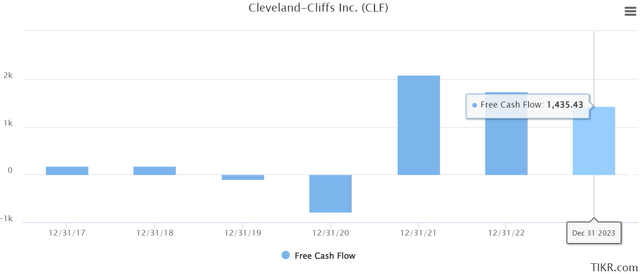

And interest expense by rough estimates will be around $350 million in 2023. Hence, the EBITDA that the company makes probably translates into little more than $1 billion of 2023 free cash flow.

CLF November 2023

Thus, even though CLF declares that it’s bringing down its debt, it still has a significant amount of debt on its books.

CLF Stock Valuation — 4x EBITDA

In my previous article, I stated that CLF would be making $1.5 billion of EBITDA in 2023. However, if the facts change, I must be willing to change my mind.

And this is what I’m thinking now. If steel prices improve from this point, given that steel companies have a significant amount of operating leverage, small improvements on their top line can lead to quite dramatic improvements on the bottom line.

Allow me to provide a brief example.

Time frame A:

- Revenues of $10

- Cost of $8

- Earnings of $2

Time frame B:

- Revenue of $12

- Cost of $9

- Earnings of $3 (50% increase)

We know that supply chain, inflation, and a tight labor market are leading to cost inflation going up in 2023 by at least 15% year-over-year. So, all else equal, we need at least 15% more revenues in 2023 simply for the same amount of earnings power.

However, I’m not sure that’s going to be possible in 2023.

And indeed, as you can see above, analysts following the stock also believe that CLF’s free cash flows will be lower in 2023 than they are in 2022.

But what I also know is that in a more stable environment, CLF could end up printing around $2.5 billion of EBITDA. This figure is a step down from my own estimates of $3.3 billion in 2022.

But nevertheless, this still leaves the company amply profitable in a downturn. And given that CLF is priced around 4x EBITDA, that’s really starting to become attractive.

The Bottom Line

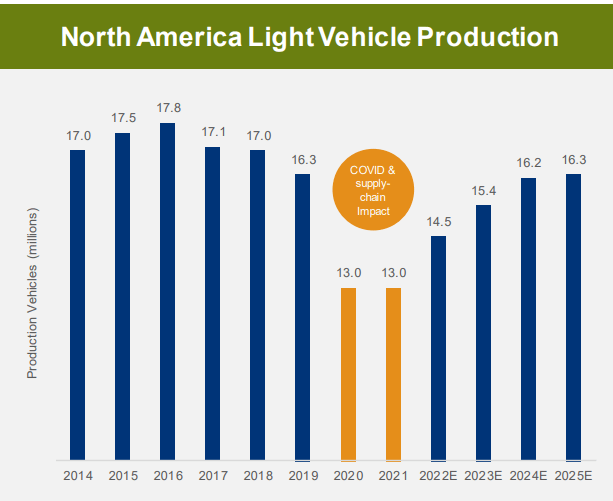

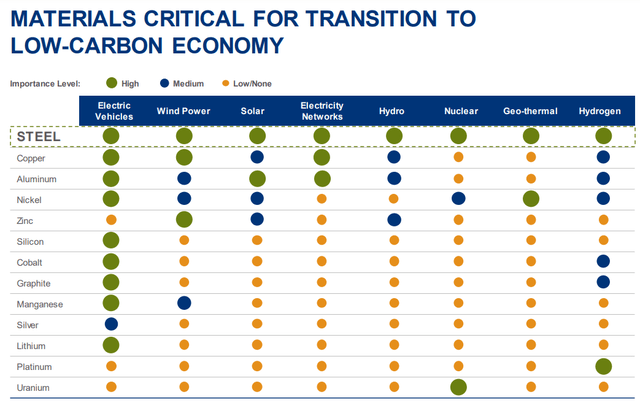

Personally, I love the following chart.

It highlights two crucial aspects. In the first instance, irrespective of what anyone says or thinks, steel is critical for our future. Our future energy transition to a green economy can’t happen without steel.

Have you ever seen a wind turbine? The base of a wind turbine alone is made up of 58 tons of steel. For one wind turbine. Now think about a wind farm.

Secondly, the use of steel is incredibly diverse. And arguably the biggest driver for CLF will continue to be EVs.

CLF November 2023

As you can see here, vehicle production has been supply-chain constrained in 2021 and into early 2022. But production is now ramping up as supply chains are easing.

In summary, there’s a lot to like about CLF. The one blemish to think about is that CLF’s balance sheet is going to be a headwind for a while. But I believe that CLF’s valuation of less than 8x free cash flow is cheap enough to make up for this consideration.

Be the first to comment