Justin Sullivan

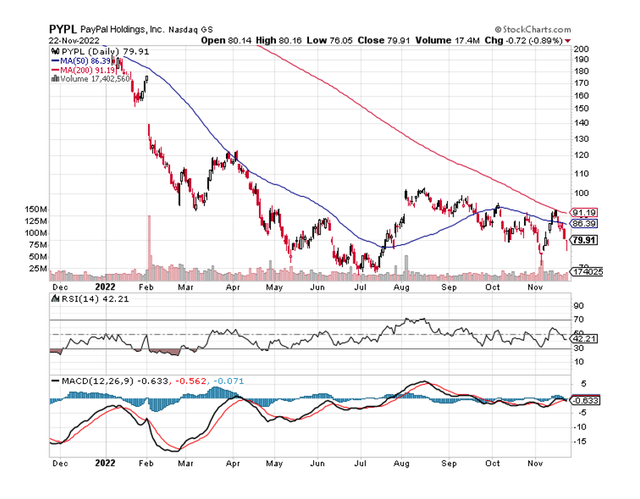

PayPal Holdings, Inc. (NASDAQ:PYPL) reported third quarter results in the first week of the month. While the results were still good enough for a short-term breakout to the upside, the 200-day moving average recently rejected PayPal’s stock price.

In addition to a bearish chart situation, PayPal’s 4Q-22 guidance strongly suggests that the company’s business is still losing steam.

PayPal also reduced its net new active account guidance to an 8-10 million range, which is why I believe PayPal stock should be avoided.

I also reaffirm my $50 price target for PayPal in the face of a growing set of business challenges with no quick and easy solutions.

Scary Times For PayPal

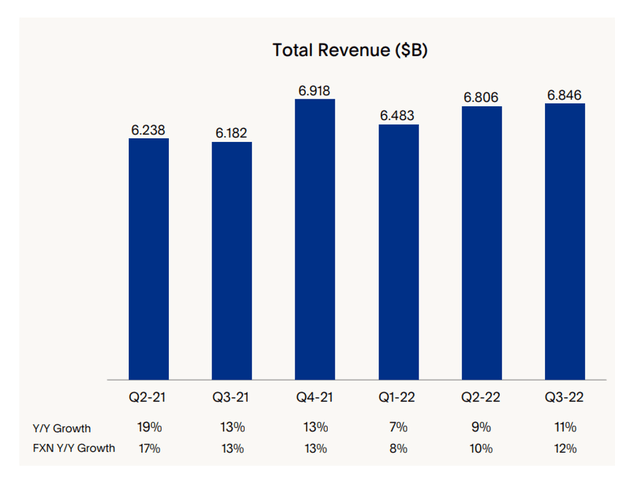

PayPal reported total net sales of $6.85 billion in the third quarter, a 12% YoY increase in currency-neutral terms. PayPal increased net sales by 17% YoY in the previous period, so investors are seeing a sharp slowdown in the fintech’s business.

Even though PayPal reported its second consecutive quarter of net sales growth in 3Q-22, investors should not expect the fintech to recover quickly. PayPal’s net sales have barely increased since the fourth quarter of 2021, as shown in the chart below.

Total Revenue (PayPal Holdings Inc)

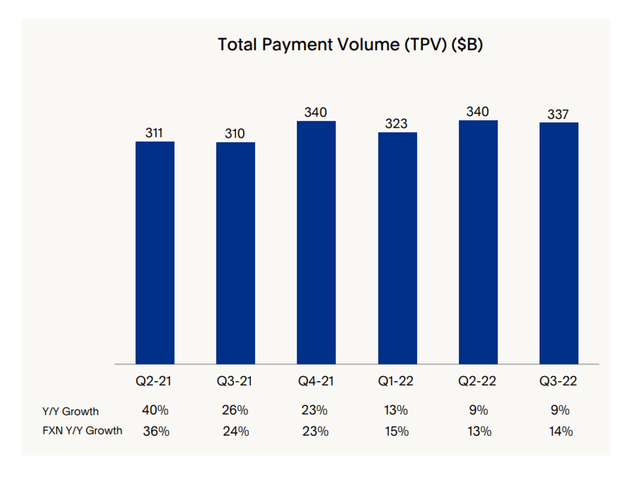

As I previously stated, PayPal’s net sales increased by 12% YoY in the third quarter, but the company’s Total Payment Volume, a measure used by fintechs to show how much money flows through them, remained flat for three consecutive quarters. PayPal’s Total Payment Volume was $337 billion in the third quarter, representing virtually no growth since the fourth quarter of 2021.

Total Payment Volume is slowing because the economy is slowing and consumers are facing an unprecedented rise in consumer prices. Fintechs are finding it more difficult to grow and expand their Total Payment Volume in this environment.

Furthermore, PayPal’s account growth has virtually ceased. The fintech had 432 million customers at the end of the quarter, representing a QoQ growth rate of less than 1%.

Total Payment Volume (PayPal Holdings Inc)

Troubling Outlook For 2022

The outlook for 2022 has been revised, and the revisions are concerning, pointing to a continued slowdown for PayPal.

In 2Q-22, the fintech forecasted 16% growth (in currency-neutral terms) in its 2022 Total Payment Volume, which was anticipated to translate into net sales growth of 11% for the full year. In addition, PayPal anticipates adding 10 million net new active customer accounts to its business in 2022.

PayPal’s new forecast calls for only 12.5% growth in Total Payment Volume (in currency terms) and 10% growth in net sales this year. Simultaneously, PayPal reduced its net new active account guidance from ~10 million to an 8-10 million range. PayPal forecasts only 9% net sales growth in 4Q-22, implying that after two quarters of increasing sales, net sales are expected to fall again.

Chart Setup Remains Highly Bearish

When I last covered PayPal, I performed a technical analysis, which revealed a bearish trend in the chart at the time.

Recently, the stock price of PayPal was rejected at the 200-day moving average line, followed by a sharp decline to the $80 support level.

If a stock price fails to break through the 50-day or 200-day moving averages, this is often interpreted as a bearish signal that the stock may be vulnerable in the short term. Unfortunately, I believe this will be the case here, and the stock may well make new lows in the near term.

Expectations Are Low And Might Head Even Lower

The market anticipates earnings of $4.07 per share this year, which is the lower end of PayPal’s guidance for 2022. PayPal expects full-year earnings of $4.07-4.09 per share.

According to the consensus estimate, PayPal’s stock is worth 17 times its earnings. In my opinion, the multiple is high given PayPal’s fundamental struggles in terms of Total Payment Volume, net sales, and account growth.

Revenue Estimate (Yahoo Finance)

Why PayPal Could See A Lower/Higher Valuation

Key performance metrics and measures indicate that PayPal’s business is experiencing a fundamental slowdown.

For PayPal’s stock to break out of its downtrend, I believe a couple of things must align, including the avoidance of a U.S. recession and, at the very least, a rebound in Total Payment Volume.

PayPal has yet to find a solution to its account-growth issue, so I believe the stock will continue to struggle in the short term. PayPal’s stock, on the other hand, could skyrocket if the fintech is able to attract a larger number of new customers.

My Conclusion

PayPal’s prospects are heavily reliant on growth in Total Payment Volume, net new active accounts, and net sales. PayPal’s new guidance for 2022 was extremely disappointing, but it did contribute to the existing negative perception of the fintech.

I believe that the slower growth in Total Payment Volume and net new active accounts is a major issue, and PayPal has yet to present a strategy for returning to stronger growth in the future.

I see no catalyst for PayPal in the near term, so I believe the stock has not bottomed out just yet.

Be the first to comment