bizoo_n/iStock Editorial via Getty Images

Note: the following True Vine Letter is an extract of a Premium True Vine Letter originally published on December 2, 2021. Some time and performance data has not been updated and has thus aged a little.

A little over a year ago I wrote a True Vine Letter titled What Can We Learn From The Next 20? I essentially concluded that the extreme valuations of these 20 U.S. large cap stocks reflected the culmination of 12 years’ worth of momentum in a list of economic and monetary influences.

Three of these 20 stocks were Visa (V), Mastercard (MA), and PayPal (PYPL). The commonality of these 3 are that they are all in the Technology sector and the Data Processing and Outsourced Services industry. After generally all peaking in mid-2021, all 3 of these stocks are now down anywhere between 30% and 50% from their peaks. All 3 stocks are also underwater from the prices they were trading at 14 months ago when I wrote the before mentioned Letter. These stocks are not just correcting but are in the throes of a more serious bear decline despite the fact that businesses are doing just fine or even (still) great. Valuations still matter. A whole generation of new investors is just starting to learn this.

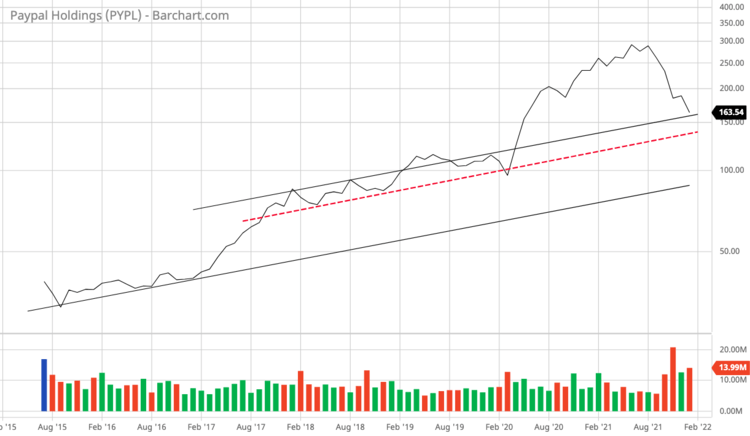

Here we have the monthly chart of PayPal going back to its IPO inception:

PayPal Monthly Log Chart

PayPal is indicative of a group of technology stocks that exploded higher after the Covid-crash but where the party is now over.

I started overturning some rocks in this industry this week and my efforts got me thinking about fintech, payments, and so on. I am still working through companies but PayPal continues to magnetize me.

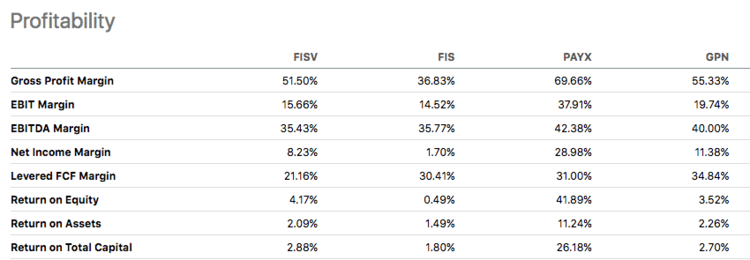

PayPal Peer Group Profitability

One sub-area in this industry that I am not interested in is the likes of Global Payments (GPN), Fiserv (FISV), and Fidelity National Information Services (FIS). They may have various qualitative merits but all three have atrocious returns on capital and returns on equity and low margins. Ignoring Paychex (PAYX), the comparison snapshot makes this clear.

All 3 of these stocks have been getting hammered in recent months, especially Global Payments and Fidelity National Information Services which are at multi-year lows. From my valuation lens, these stocks are still overvalued given their low capital returns.

PayPal

PayPal has an asset-light, high margin business model specializing in digital payments for both merchants and consumers. The business is thriving, but it also strikes me as one which could thrive in a protracted environment of higher inflation. As prices and wages rise over time, the nominal value of transactions will continue to rise which translates into seemingly automatic revenue growth.

PayPal’s digital infrastructure is positioned to scale while requiring minimal new amounts of capital investment. In the last reported quarter, PayPal brought on 1 new merchant every 6 seconds.

Almost all of PayPal’s revenues come from its transaction take on payment transactions. The dollar value of PayPal’s Total Payment Volume (TPV) has risen from $354 billion in 2016 to about $1.25 trillion at present. Average annual growth has been in the high 20% range. Growth in 2021 is on pace for 33.5%, the highest ever. The pandemic has clearly accelerated the use of digital payment transactions but there is an element of “network effect” compounding at play here. I put together a financial model for the company that ties into management’s 5-year free cash flow guidance and I have the company breaching $3 trillion in TPV in 2025.

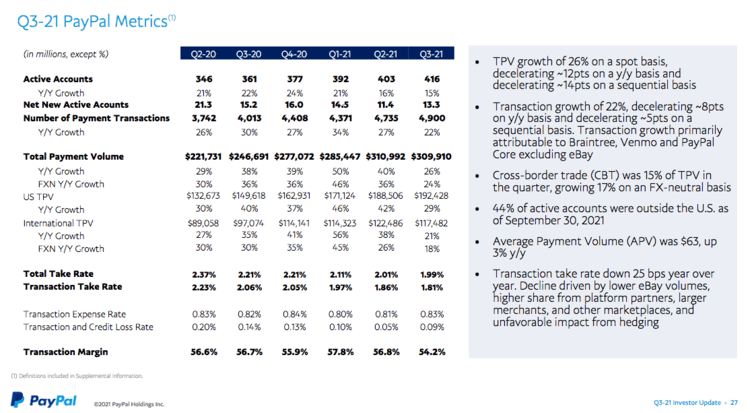

A key factor to watch with PayPal is the “take rate” which is their TPV divided by revenue. As you can see in the following Q3 2021 investor slide, it has been declining in recent quarters:

Q3-21 PayPal Metrics

The take rate was 3% in 2016 and has been declining ever since. In my financial model, I assume it continues to gradually decline to 1.5% later in the decade. This trajectory would put revenues at $50 billion in 2025 versus an estimated $25.4 billion for 2021. $50 billion in 2025 is roundabout what management has been guiding.

As revenues grow, more operating margin expansion is likely and this has been the trend in recent years. Assuming 21.5% operating margins in 2025, I get to almost $11 billion of free cash flow. Assuming 35% of free cash flow continues to go toward share repurchases, I get to $9.50 of free cash flow per share in 2025. My target forward multiple is currently 20. This gives me a target price of $188 per share in 2025 which is right about where the stock closed today. I am considering taking a position if it drops into the monthly channel in the above chart – call it $140. At this price, I would still be overpaying on a 12-month forward outlook but this is a decent long-term entry point. I used a similar approach earlier this year for Microsoft (NASDAQ:MSFT). I think I was buying in the $235 to $240 area. I sold out at $300 in just a few months and the stock was at $330 last I looked.

PayPal’s take rate is going to continue to decline as it closes in on its complete separation from being an eBay (NASDAQ:EBAY) payment option and as more transaction volume comes from its other apps and services. Analysts are not asking enough questions about this and I’m not so sure that the market is fully prepared for this. I had to do some transcript digging to find the following comments from CFO and EVP, Global Customer Operations, John Rainey, from a March 2021 Morgan Stanley conference:

… So let me start with addressing what I think everyone’s sort of main concern is, when they see declines in take rate, is are you seeing declines in same-store sales type pricing? And the very clear answer on that is no. Nor have we for several years. We tend to see a real stickiness to our pricing. The — our takeaway decline is really more a function of the diversification of our platform, that getting into new businesses. Paymentus, that’s as an example, were growth in P2P, things like that. If you look at our medium-term guidance, we got it to on average, 25% TPV growth and 20% revenue growth, that implies obviously, a take rate decline, but if you look since 2016, our transaction take rate has declined about 50 basis points, maybe mid-50s, 54, 55 basis points. And over that period of time, our operating margin has expanded 500 basis points. So that’s very clearly, like we are willing to accept a take rate decline that is the result of a mixed change in our business, if we can add dollars to the bottom-line. And that’s what we’ve seen. And then you can look to the most recent quarter, the first quarter, our incremental operating margin was almost 40%, 38% in the quarter, which were shows that we’re being very successful doing that in the face of take great declines.

So you take like the first quarter, about a third of the decline was related to the transition away from eBay. And we’re going to experience more of that going through the year. We had some, maybe some kind of noise, if you call it that related to a hedge loss versus again the prior year, but these things are transitory and change from one quarter to the next. The key message is like look, same-store sales or same merchants year-over-year, we’re not seeing any meaningful decline at all in that area.

The right outlook for PayPal is that the take rate continues to decline but this will be offset by operating margin increases. Assuming one buys at the right price, the hidden bull case is that this margin expansion exceeds expectation. This is quite possible given the scaling of these transactions on digital platforms.

PayPal is a quality business with exceptionally strong underlying momentum. The recent stock price drop is simply a reality adjustment setting in on an irrational valuation.

PayPal’s strategy is to be a payment option for all large merchants, the payment mechanism for small merchants, and the preferred digital wallet or super payment app for consumers. PayPal is now available across 75% of the top 1,500 North American and European retailers. PayPal owns Venmo and users of the app will be able to pay with it on Amazon (NASDAQ:AMZN) starting next year. PayPal app users can now use it to buy, sell, and hold popular cryptocurrencies. I generally think that they are fool’s gold but I am not against profiting off others believing in it. Still, herein lies a potential risk for the stock but probably not the company. A severe regulatory clampdown on crypto could cause the stock to fall; however, I don’t think there is enough of it going on in the app at this point to do any real damage to the business fundamentals. Such an event could be just the perfect catalyst to open up a brief window to buy the stock at a modest valuation multiple – an opportunity to buy the stock in the fog of war, if you will.

There is also more about to go on with the PayPal app that will strengthen the company’s strategy to make it the super app that quarterbacks consumers financial lives. A high yield savings option and, get this, stock trading are expected to be launched in the near future.

Finally, it is important to know that PayPal has roughly $10 billion in cash (current market cap is $217 billion) and will pull the trigger on a large acquisition if the right one comes along. Absent a large acquisition, this cash & short term investments war chest will continue to surge as management has guided that only 30% of free cash flow will likely go to share repurchases. I estimate it would be about $38 billion in 2025 under this scenario. Management has been clear that their guidance does not include any revenue or free cash flow from future acquisitions. The positive unknowns, if you will, from the future deployment of this cash is the main reason I would be willing to overpay a bit.

It is clear to me that the network effects at PayPal are accelerating. This would be a good business to own at the right price. The long-term chart at the beginning of this Letter is flagging the possibility that I might be able to catch this one at $140. We shall see.

Be the first to comment