mihailomilovanovic

Thesis

Leading shopping center REIT Simon Property Group, Inc. (NYSE:SPG) has recently seen its stock come under significant pressure as the headwinds in its retail customers intensified.

Therefore, we believe the market’s battering against SPG is justified to de-risk its execution risks through the coming macroeconomic recession. Consumer discretionary stocks have been de-rated significantly after they were lifted to unsustainable highs in 2021.

Notwithstanding, Simon’s average rent profile and occupancy rates have remained stable through Q2, corroborating management’s confidence. However, we assess that the market remains concerned about the worsening macro headwinds impacting the company’s investment cadence through the cycle.

Coupled with higher funding costs due to the Fed’s aggressive rate hikes, it could put further pressure on Simon’s ability to deliver robust FFO per share growth through FY23.

Therefore, we assess that the market had correctly anticipated the normalization in its growth cadence, as it lapped challenging comps from FY21. We also assess that its valuation has likely reflected much of its near-term headwinds. However, a worse-than-expected recession could impact its forward FFO estimates moving ahead, further compressing its valuation.

Coupled with the downtrend bias on SPG’s long-term chart, we believe it’s appropriate to be more cautious at the current levels as we navigate a potential global economic recession.

Accordingly, we rate SPG as a Hold for now.

Simon Property’s Growth Could Be Tepid Through The Cycle

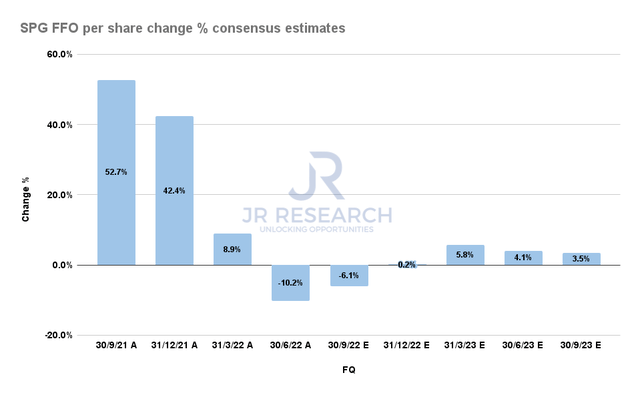

SPG FFO per share change % consensus estimates (S&P Cap IQ)

As seen above, even the bullish consensus estimates indicate that Simon’s FFO per share growth could continue to face headwinds through FY23. We believe the estimates could have also reflected forex headwinds and fair value adjustments indicating a weak market environment over the next year.

However, the Street analysts also expect Simon’s growth cadence to have bottomed out in Q2 before recovering. Hence, we assess that the analysts remain confident that the market environment could turn more favorable toward accretive opportunities to drive FFO growth from H2’22.

However, we urge investors to be more cautious in making such an assumption. It’s prudent to be circumspect, given the likelihood of further job losses over the horizon, amid the Fed’s commitment to combat record inflation levels. As a result, it could drive unemployment higher than expected, weakening consumer confidence further. Moreover, the housing market has also started to crack under the surface, leading to a negative wealth effect as consumers rein in discretionary spending further.

Hence, investors are urged to consider affording a more significant margin of safety to account for such risks in its underlying tenant base and its ability to drive FFO growth through 2023.

SPG’s Valuations Have Likely Reflected Near-Term Headwinds

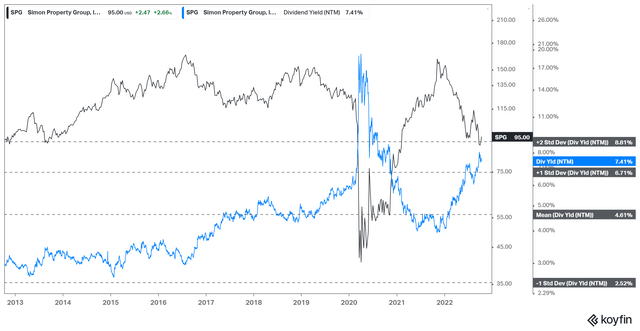

SPG NTM Dividend yields % valuation trend (koyfin)

SPG last traded at an NTM FFO per share multiple of 7.76x, well below its 10Y mean of 14.6x. Moreover, its NTM dividend yield of 7.4% has moved closer to the two standard deviation zone (8.81%) over its 10Y mean, as the marker de-risked its valuations.

Therefore, we deduce that the market has likely reflected the challenges in the retail and consumer discretionary sector in SPG’s valuation. Notwithstanding, a worse-than-expected recession could drive further value compression if its FFO estimates were to be cut.

As discussed earlier, we assessed the Street could be a few quarters early in projecting that Simon’s FFO per share could have bottomed in Q2.

Is SPG Stock A Buy, Sell, Or Hold?

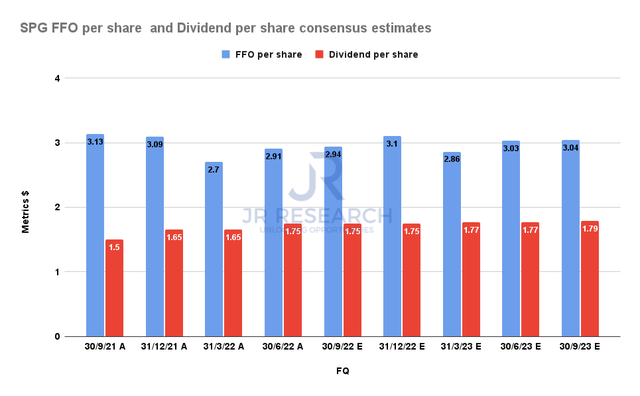

SPG FFO per share and Dividend per share consensus estimates (S&P Cap IQ)

With a well-covered dividend payout, we don’t anticipate significant risks to its dividend yields, which should help to underpin its valuation. However, investors should also note that SPG’s YTD total return of -39.4% indicates that its dividend payout has not been sufficient to mitigate the losses in the market.

Furthermore, its 10Y total return CAGR of -0.71% indicates significant market underperformance. Hence, investors are urged to consider less aggressive entry levels in SPG to improve their reward-to-risk profile.

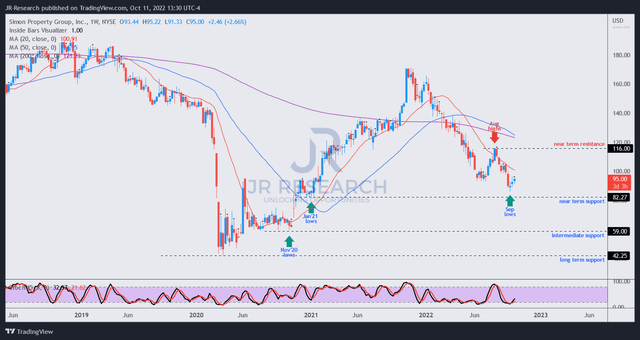

SPG price chart (weekly) (TradingView)

SPG formed a near-term bottom in September after getting pummeled from its recent August highs. However, we are not confident that the recovery has sufficient legs to carry it through to retake its near-term resistance, as its valuations remain well-balanced at best.

Hence, investors should remain patient for the market to potentially de-rate SPG further. Accordingly, we postulate an NTM Dividend yield of about 10% or higher is appropriate, which would take SPG above the two standard deviation zone over its 10Y mean. In addition, investors should monitor for consolidation in the zone between SPG’s near-term and intermediate support if the market sends it down further to break its near-term support.

We rate SPG as a Hold for now.

Be the first to comment