wellesenterprises

Microsoft (NASDAQ:MSFT) is a dominant player in technology globally. Its Office and Azure Cloud, Xbox and Teams, Windows and Dynamics franchises maintain powerful market share majorities in most markets. The company’s recurring revenue models, including enterprise license/maintenance agreements, provide stability and growth to both top and bottom lines throughout most market cycles. The biggest knock on the stock has become valuation, which has soared from the traditional 5-15x EV/EBITDA multiples in the 2002-2014 time frame to a high approaching 44x late last year. Today, MSFT trades around 17.8x forward estimates.

The bull case for the stock is that Microsoft is a powerhouse of earnings with the benefit of contractually binding 3-year license and maintenance contracts for enterprises and annual subscriptions for most of its cloud offerings. While a case can be made that its dominance is being gradually eroded by rival offerings that continue to improve in the marketplace, we don’t believe that competition will materially harm the enterprise within our limited (1-3 month) time horizons; franchises built over decades don’t breakdown in a few weeks. Hence, we recommend the stock with a stop-loss on a sustained basis below $235 and a price target of $300 (22% upside potential).

Dominant Market Position

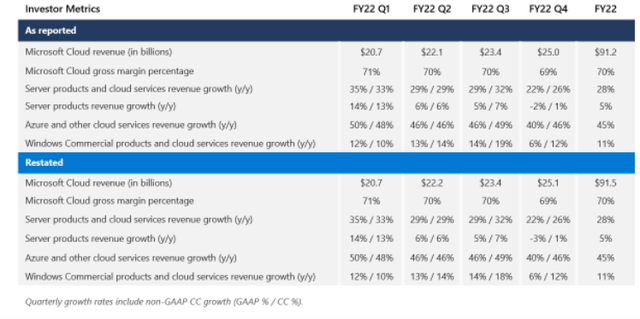

Because the company is on such a strong competitive footing with rivals, we believe the stock will benefit from a period of relative calm going into the election and the seasonally strong 4Q period, in general. For example, Microsoft’s Investor Relations site data shows that Azure holds 21% share in cloud computing compared to AWS at 34% and Google at 10%. While not by itself that impressive, though Azure has been able to grow by nearly 50% for much of the last decade. Combined with its clearly dominant share in office productivity (48% versus Google Docs 46%, but Office outearns rivals by a vast margin and maintains a clear technology lead), operating systems (45% versus MacOS at 29%), servers (11.2% which is 5x more than its nearest rival), gaming (50% share of US market per Statistica), Microsoft doesn’t need to come up with a new barnburner product for the stock to hit our target. It just needs to bounce off near-term recessionary and inflation fears while markets wait out the election. Share alone is not the only source of strength. Operating leverage is substantial as evidenced in its industry-leading gross margins that have been sustained for many years and seasonal strength benefits its growth segments such as Xbox and anything Cloud oriented. The benefits of the Activision deal are coming soon as well and should provide some lift to the stock valuation.

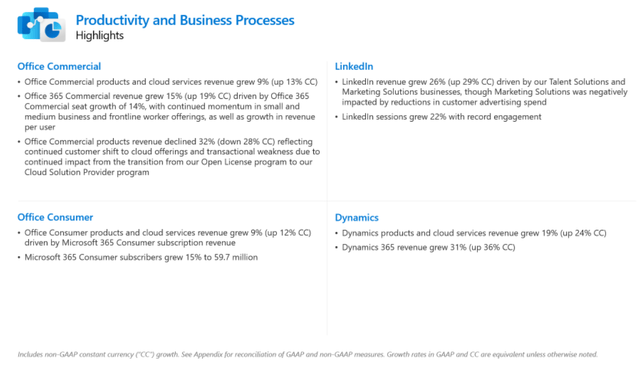

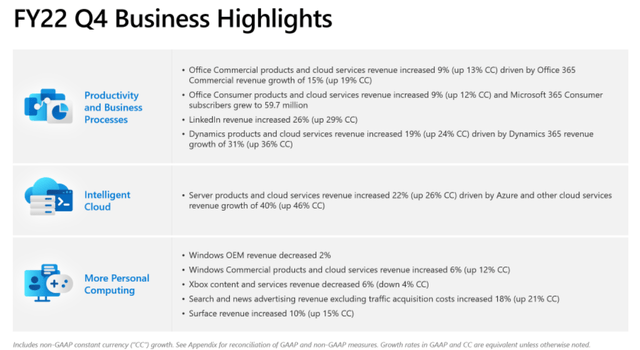

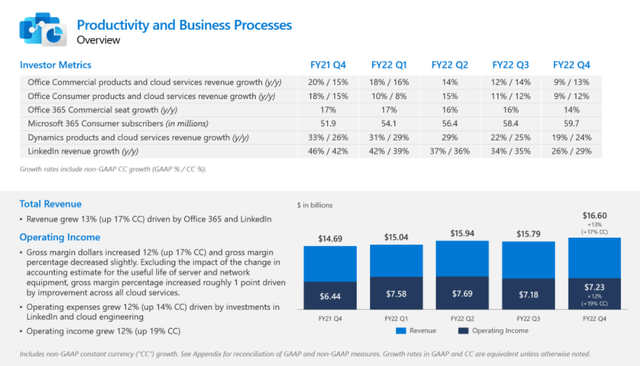

Segments Growth Reflects Operating Strength

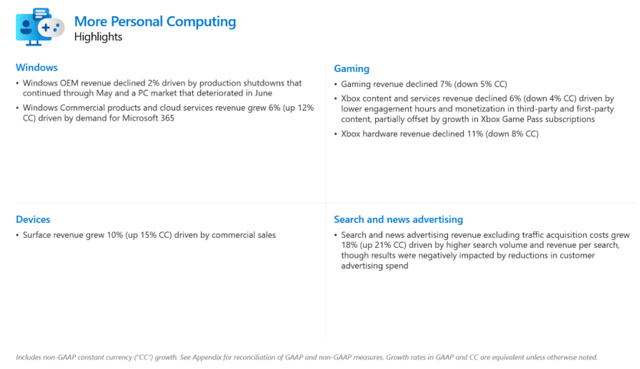

Microsoft’s segments show solid growth and profitability, as evidenced by the charts above and below. Its market share in all but search is strong and defensible, proven by stable share over many years. While we are no fans of monopolies or oligopolies, Microsoft has proven to be a worthy competitor over the years; the company has maintained its position in each segment for decades despite concerted efforts by rivals to unseat them (see below). We expect this to continue. President Brad Smith has proven to be an able negotiator and strategist, navigating many potentially risky situations to favorable outcomes for shareholders, such as Linux, Windows and EC anti-trust affairs. CEO Nadella has likewise guided the company to better outcomes than had been expected over his tenure, accelerating growth in cloud, servers and Dynamics. We believe the company is in good hands going forward.

Cloud Growth Remains Robust (Microsoft Investor Relations)

Risks

The risks to our call are largely macro in nature. If the Fed actually starts to fight inflation, rather than to largely talk about it, then rates would need to rise substantially in the near term, which would take all high multiple stocks down just on a duration adjustment. Any impact to top and bottom lines would likely take more time to filter through quarterly earnings reports. The more significant risk is that rates continue to rise and the economy falls into a sharp recession ahead of the election, which would negatively impact valuation multiples and forward growth expectations. We think that a recession that likely started in April is accelerating, but with elections coming soon, it is hard to see how political survivors like the Fed would act against their own institutional interests by squeezing the economy to slow inflationary pressures before the political coast is clear. This space gives us time to see some good news favorably impact Microsoft’s valuation equation.

Gaming & Commercial Remain Strong (Microsoft Investor Relations)

A Pause (for the Elections) That Refreshes?

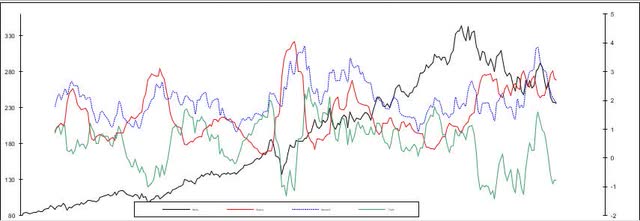

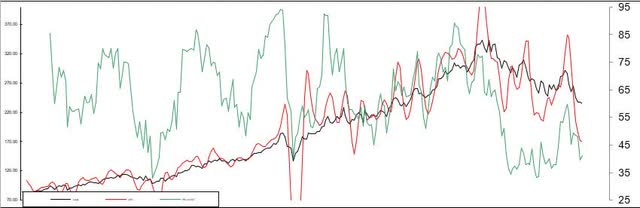

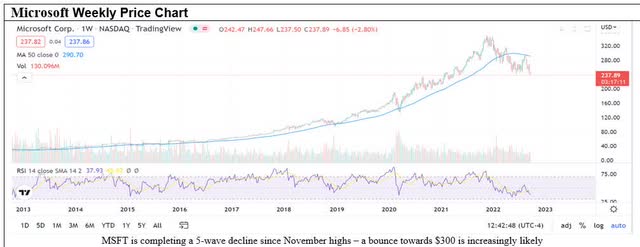

The stock has been in an extended decline phase since mid-November, when inflation began to emerge as a real threat to growth stocks. As inflation fears subsided somewhat in March, the stock rebounded. The summer rally also provided lift for the stock, again on hopes that a slowing economy would temper price pressures. MSFT may be forming a double bottom around $240, with upside to $300+ over the next several weeks. RSI shows a bullish divergence on the mid-September retest of lows, suggesting higher prices to come in the near term. Our Supply/Demand models (Below) show the sell signal from last Fall is coming to an end soon, suggesting that a more constructive tape could carry MSFT back up to around the $300 level. Should the double bottom pattern fail, we would stop-out positions below $235 to protect capital from what we suspect would be heightened recession fears.

Microsoft Has Enviable Margins (Microsoft.com)

Conclusion

Microsoft is a dominant player in many high-growth markets. Its management is excellent, and its tech continues to garner respect in industry circles. The operating leverage is substantial going into the seasonally strong C4Q. The company’s revenue models provide stability when rivals encounter turbulence from changing economic conditions.

A 5-wave correction is largely complete

Weekly Supply/Demand Model: A New Buy Signal Is Coming, i.e., Converging Red & Green Indicators

Summit Analytic Partners Research

Weekly Volume-Adjusted Price: Momentum Is Shifting Favorably As Well, With Green Indicator About To Rally

Summit Analytic Partners Research

While the stock is not immune to downside risk, we think the odds are stacked in favor of the bulls at least until the election and perhaps through the end of the year, as our technical models are signaling above.

Be the first to comment