gorodenkoff/iStock via Getty Images

Computer Services (OTCQX:CSVI) is a high-quality technology stock with an exceptional performance record and a reliable growth trajectory. Thanks to its appealing characteristics, the stock has almost always traded with a premium valuation and hence it has been hard for investors to identify an attractive entry point. However, this has changed lately. The stock has shed 24% this year due to the correction of the broad stock market and expected business deceleration in the second half of the year. As a result, the stock is currently trading at an 8-year low price-to-earnings ratio of 16.4. Given the promising growth prospects of Computer Services and its consistent business performance, the stock has become a great bargain.

Business overview

Computer Services offers innovative technology, regulatory compliance solutions and digital banking solutions to regional banks and other corporate customers. It signs multi-year contracts with its customers and thus its customers become highly dependent on Computer Services. After a few years of cooperation, it becomes costly and inefficient for the customers of Computer Services to switch to another financial services provider. In fact, whenever a customer of Computer Services terminates its contract, the most common reason is the acquisition of that customer by another company, which is not a customer of Computer Services. Thanks to the strong ties between Computer Services and its customers, approximately 90% of the revenues of the company are recurring.

The business model of Computer Services has proved rock-solid throughout the coronavirus crisis. In fiscal year 2021, which ended in February-2021, the company retained essentially all its customers and completed 32 bank mergers and conversions. As a result, in a year in which most companies saw their earnings collapse, Computer Services grew its revenues 2.5% and its earnings per share 5%, from $1.91 to a new all-time high of $2.01.

Even better, business momentum accelerated in fiscal 2022, which ended in February-2022. Computer Services grew its revenues 9% thanks to the addition of new customers, increased transaction volumes from existing customers, and growth in regulatory compliance services as well as in digital banking services. Thanks to its strong business performance, the company grew its earnings per share 12%, from $2.01 to a new all-time high of $2.25.

The only negative aspect of the report was the warning of management that earnings growth will somewhat decelerate in the second half of this year due to a planned increase in new investments, higher staffing levels and a return to pre-pandemic travel levels. As the market has got used to the consistent growth trajectory of Computer Services, it reacted negatively on the days following the statement of management. Consequently, the stock is currently trading at $41, which is a nearly 3-year low level.

However, it is critical to realize that the guidance of management is much better than it seems on the surface. First of all, despite the expected deceleration, earnings will remain in an uptrend. In addition, the deceleration will not result from weak business trends. Instead, it will result primarily from the increased investments of the company. It is certainly positive that Computers Services will boost its investments in its future growth, especially given the exceptional growth record of this high-quality company.

Computer Services has grown its revenues, its earnings and its dividend for 22, 25 and 50 consecutive years, respectively. This extraordinary performance record is a testament to the strength of the business model of the company and its exemplary management. It is certainly positive that management has decided to decelerate earnings growth in the short run in an effort to enhance future growth. To cut a long story short, patient investors, who can maintain a long-term perspective, are likely to be highly rewarded by the increased investments of Computer Services.

Dividend

As mentioned above, Computer Services has grown its dividend for 50 consecutive years and thus it is a Dividend King. There are only 44 Dividend Kings in the investing universe and hence the accomplishment of Computer Services is undoubtedly outstanding.

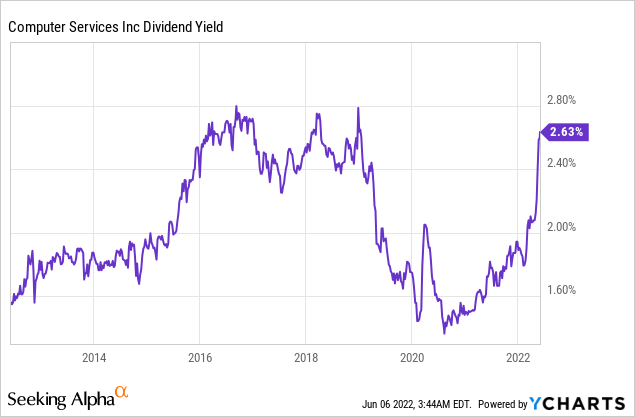

Moreover, thanks to the steep correction of the stock of Computer Services this year, the stock is currently offering a nearly 10-year high dividend yield of 2.6%.

This yield may not seem exciting on the surface, but it is nearly double the yield of the S&P 500 (1.4%). It is also really hard to identify growth stocks with such a reliable growth trajectory and such a high dividend yield.

Furthermore, Computer Services has an exceptionally low payout ratio of 25%. It also has a rock-solid balance sheet, with net debt (as per Buffett, net debt = total liabilities – cash – receivables) of only $63 million. As this amount is approximately equal to the annual earnings of the company and only 5% of the market capitalization of the stock, it is negligible. It is also worth noting that Computer Services pays negligible annual interest expense ($0.2 million). Overall, thanks to its exceptionally low payout ratio, its reliable growth trajectory and its solid balance sheet, Computer Services can easily continue raising its dividend for many more years. Therefore, investors can lock in a nearly 10-year high dividend yield of 2.6% and rest assured that the dividend will remain on the rise for many more years.

Valuation

Given the earnings per share of $0.61 in the latest quarter and management’s guidance for somewhat higher earnings in the second half of the year, one can reasonably expect Computer Services to earn approximately $2.50 per share this year. Due to its 24% correction this year, Computer Services is currently trading at a forward price-to-earnings ratio of 16.4, which is much lower than the 5-year average price-to-earnings ratio of 21.2 of the stock. In fact, Computer Services is now trading at an 8-year low valuation level.

The exceptionally cheap valuation of Computer Services has partly resulted from the surge of inflation to a 40-year high, which has been caused by the unprecedented fiscal stimulus packages offered by the government in response to the pandemic and the ongoing war in Ukraine. High inflation exerts pressure on the valuation of growth stocks, as it reduces the present value of future earnings.

However, it is reasonable to expect inflation to revert towards normal levels in the upcoming years, as the effect from fiscal stimulus packages and the war in Ukraine are likely to fade over time. The Fed is doing its best to keep inflation under control and is likely to achieve its goal sooner or later. As soon as inflation begins to revert towards the target level of the Fed (~2%), the market is likely to reward CSVI with a higher price-to-earnings ratio. Therefore, investors should take advantage of the 8-year low price-to-earnings ratio of Computer Services.

Risks

The above investment thesis is based on rational expectations that inflation will subside towards normal historical levels in the upcoming years. Investors who are afraid that inflation will keep hovering around its 40-year highs for many more years should probably stay away, not only from Computer Services, but also from the vast majority of stocks. However, this extremely adverse scenario is unlikely, as the Fed will exhaust its means to keep inflation under control.

Another point of concern is the low trading volume of the stock of Computer Services. The stock has an average daily trading volume of approximately 15,000 shares and hence it is not suitable for those who want to purchase many shares. The low liquidity also makes it harder to trade the stock and thus only the investors with a long-term perspective should consider this stock.

Final thoughts

During bear markets, some high-quality stocks are punished to the extreme. Investors should take advantage of the rare investing opportunities that arise when market sentiment is extremely negative. Computer Services certainly fits this description. It has grown its revenues, its earnings, and its dividend for 22, 25, and 50 consecutive years, respectively, and is trading at an 8-year low price-to-earnings ratio of 16.4. Those who purchase the stock around its current price are likely to be highly rewarded in the long run.

Be the first to comment