blackdovfx/E+ via Getty Images

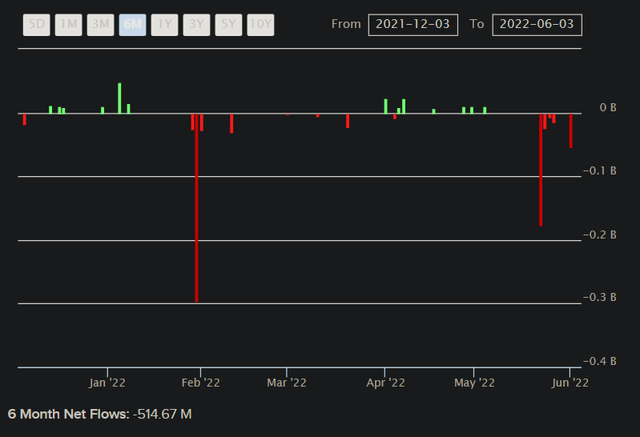

iShares Global Tech ETF (NYSEARCA:IXN) is an exchange-traded fund enabling investors to get diversified exposure to global tech stocks, or more descriptively, “electronics, computer software and hardware, and informational technology companies”. The expense ratio is 0.43% which is not cheap, but nevertheless the fund is popular, with $3.57 billion in assets under management as of June 3, 2022. Net fund flows have been negative over the past six months though (approximately -$515 million).

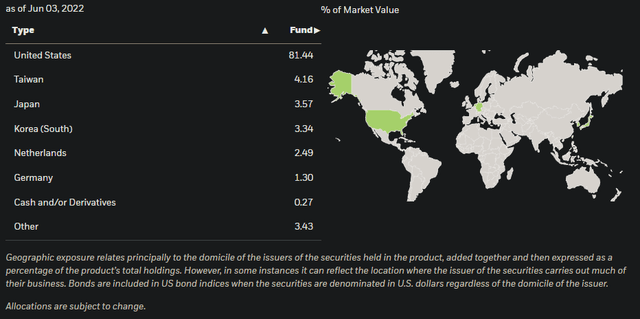

Sentiment has soured, but IXN remains invested in what summed to 132 holdings as of June 3, 2022. While IXN has a global mandate, most of the best-performing tech stocks are U.S. based. Therefore, geographically speaking, IXN is largely a U.S. equity fund.

Besides a circa 81% allocation to the United States, other exposures include Taiwan (4%), Japan (4%), South Korea (3%), the Netherlands (2%), and Germany (1%) among some other minor holdings.

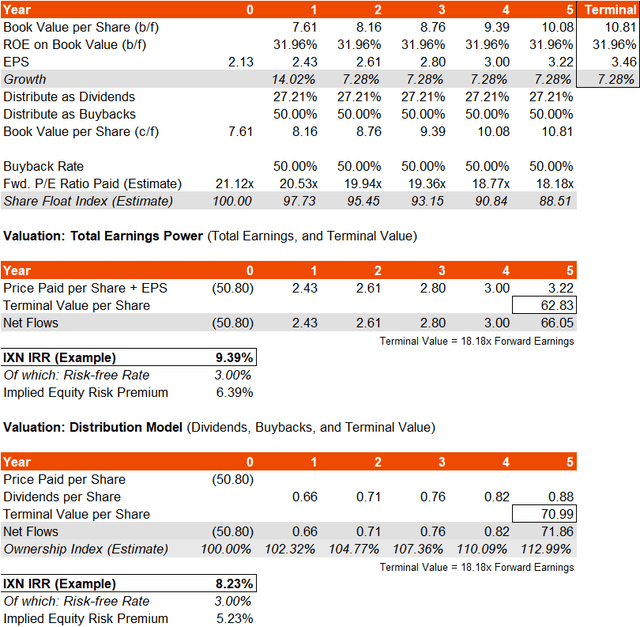

IXN’s benchmark index, which it seeks to replicate, is the S&P Global 1200 Information Technology Sector Index. A recent factsheet, as of May 31, 2022, gives us pertinent information as to the prevailing value and pricing of the fund: the trailing and forward price/earnings ratios were 24.08x and 21.12x, respectively, while the price/book ratio was 6.75x (not cheap). The indicative dividend yield was 1.13%. The implied forward return on equity was therefore estimated at circa 32%.

The value and allure in tech stocks is all in the earnings growth potential. Morningstar currently have IXN’s underlying three- to five-year average earnings growth rate pegged at 13.51%. If we assume a constant dividend distribution rate of circa 27% (the trailing number implied from the above data) and a 50% buyback rate (similar to the figure I used in my analysis of IVW recently, another growth stock equity fund), and keep IXN’s forward one-year return on equity of 32% constant, my three- to five-year earnings growth average is 8.60-9.48% or so. So, that is technically lower than the consensus, which nonetheless produces a strong IRR potential, even with an assumed drop in the ‘terminal value’ forward earnings multiple (to 18.18x in this case, my general estimate of a more conservative but still fair multiple).

I have set the risk-free rate to 3%, which seems roughly fair; while IXN has some exposure to nations with lower long-term bond yields than the United States, the overwhelming exposure to the United States (and IXN’s likely largely U.S. investor base) makes 3% seem reasonable. The implied equity risk premium (subtracting the risk-free rate from the implied IRR) is between 5.23% and 6.39% per my model, based on these assumptions.

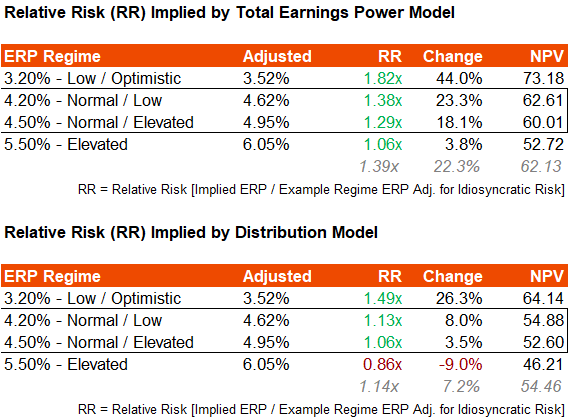

IXN carries a five-year beta of circa 1.10x, so adjusting the ERP for this across different ERP regimes tells me that IXN is probably undervalued (on balance), although there is room to consider possible over-valuation even at present prices.

Author’s Calculations

In my opinion, based on these assumptions, valuing IXN on its total underlying earnings power and a moderate underlying (unadjusted) equity risk premium of 4.20-4.50% would tell me that there is probably something like 18.1-23.3% of upside left from present prices (per the table above). That would mean a price per share of something like $60-63, as compared to $50.80 at the time of writing.

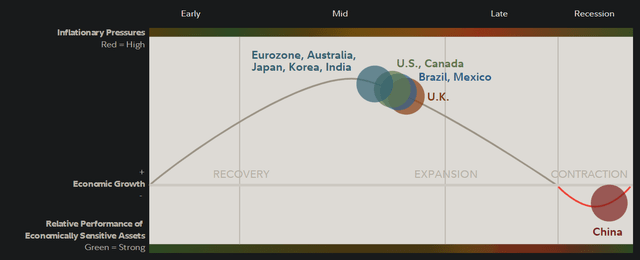

If Fidelity are correct that the United States is not even in its last stage of its current business cycle, it is possible that near-term recessionary fears will abate soon. Provided that inflation expectations do not break out into new highs, and remain within current bounds, there is every chance that equity risk premia among higher-risk (and tech/growth) stocks will contract, lifting valuations. This is actually my off-consensus base case.

Some consensus estimates for earnings growth are probably on the optimistic side, but nonetheless if I moved my estimates higher to a circa 13-14% average earnings growth rate over the forecast horizon, my model would tell me that IXN’s upside potential would be 50-100%, which is dramatic and probably unrealistic (this is also including experiments with the buyback and dividend distribution rates). Even my base estimate would indicate 50% or more upside potential if the forward earnings multiple can sustain itself.

Generally speaking, the large-cap tech stocks are highly productive companies with strong pricing power (although these companies are not immune) and underlying returns on equity. While tech and growth stocks are indeed, even by myself, conventionally viewed as higher risk (because more of their value are derived from future earnings as opposed to prevailing earnings power, like value stocks), they are in some sense lower risk because of their productivity levels.

It is safer to own a stock where the underlying business is highly productive, all else equal, even independent of initial valuation (within reason), as over time your return will converge on the underlying return on equity. This is why pricey tech stocks in the U.S. have managed to out-perform value stocks in Europe over long periods of time; value stocks can be decent shorter-term trades, but they can’t keep up with growth stocks over the long run.

Therefore, it is always nice to have an excuse to buy tech and growth stocks, and at present, I think a basic scenario analysis would tell you that the opportunity is skewed to the upside. I would be bullish on IXN at present prices.

Be the first to comment