peterschreiber.media

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

Glowing Green, Unlike Most Other Stuff Right Now

A hundred years ago, in June this year, we wrote up an energy sector note with two ‘Buy’ ideas in the uranium sector. It has proven righteous.

Our June Uranium Note (Seeking Alpha)

Since the market is thinking about re-testing the June lows, we thought, why not revisit the uranium sector to see if this remains a good idea?

We’ll cut to the chase: yes, we think it remains a good idea.

The fundamental upside drivers in the sector are:

- Production of shippable, storable uranium ‘yellowcake’ remains low versus long-term utility provider demand.

- Production of refined uranium hexafluoride remains low vs. long term utility demand.

- The sector is becoming increasingly financialized, most notably by the Sprott Physical Uranium Trust fund (U.UN, OTCPK:SRUUF), which both buys physical pounds of uranium using an ongoing at-the-money equity raising facility, and is a way for investors to play the uranium spot price.

- Political pressure to decarbonize power production is not going away; the supply of other forms of non-carbon power is not rising very quickly either – leaving few viable options other than to increase the generation of power from uranium sources.

This is the backdrop to the stock analysis we conduct – we work with the specialist research provider Uranium Insider Pro in this regard – if you’d like to learn more you can watch our joint webinar with them that we conducted yesterday – that’s here.

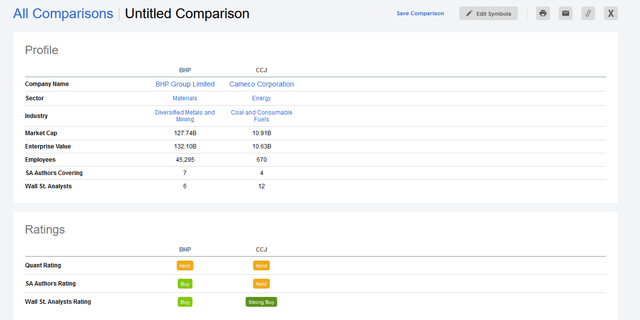

With that in mind let’s consider how to play the sector. One route is to simply own diversified miners such as BHP Group (NYSE:BHP), or a specialized miner such as Cameco (CCJ). Your choice of risk – own stock in a large and relatively stable company with some exposure to uranium, or go pureplay with a much smaller business but sole leverage to the uranium sector.

Seeking Alpha’s ‘Comparison’ toolkit is helpful in this regard – snapshot below and live page, here.

Diversification vs Pureplay (Seeking Alpha)

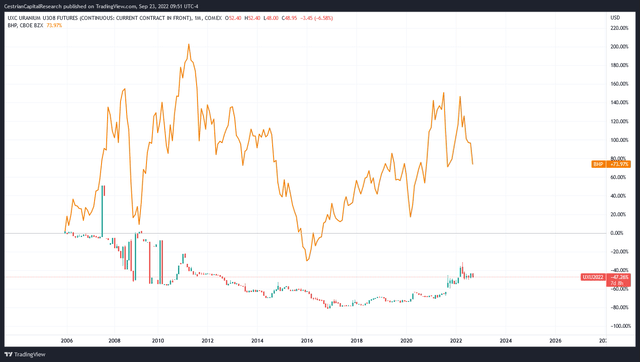

In our own staff personal account holdings we favor the pureplay approach, not least because we aren’t generalized mining experts and prefer to invest where we have knowledge. Although a major uranium miner, BHP’s stock isn’t particularly correlated to the uranium spot price, as you might expect.

Uranium Futures vs. BHP Stock Price (TradingView)

Choosing a pureplay like Cameco is a better method of tracking the commodity, if you want to go the miner route.

Uranium Futures vs. Cameco Stock Price (TradingView)

In our opinion, a good way to build exposure to uranium is to use 2-3 traded funds. Our own top pick in our subscription services, and in staff personal accounts, is U.UN in its Canadian form; you can play this using the US ADR, SRUUF too.

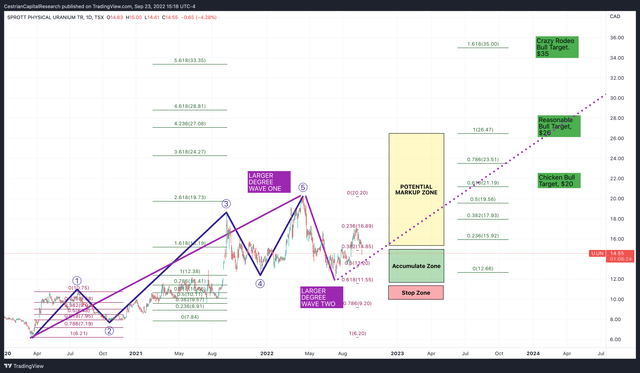

Here’s our take on U.UN. (You can open a full page version of the chart, here).

U.UN Chart (TradingView, Cestrian Analysis)

The stock put in a 5-wave up cycle from the Covid lows to the high point in April this year, forming a larger degree Wave One up. Then a larger degree Wave Two down, troughing in July and since then moving up strongly. We believe the stock warrants accumulation in the $11-$15 region – that’s the zone between the July low, more or less, and the 0.382 retrace of that larger degree Wave One down. Volatility comes with the territory here, so whether you choose to use stops or hedge (by going short U.UN in a different account say) below the July low is your call but risk management is wise here – with position size if nothing else. Of course when volatility is in the direction you trade it’s wonderful and if indeed we see a larger degree Wave Three here, as our chart suggests, then U.UN could reach targets of $20 (minimum expectation of a Wave Three), $26 (reasonable expectation) or even $35 (bullish but not a silly expectation). Whereupon we might be taking profits awaiting the next drop.

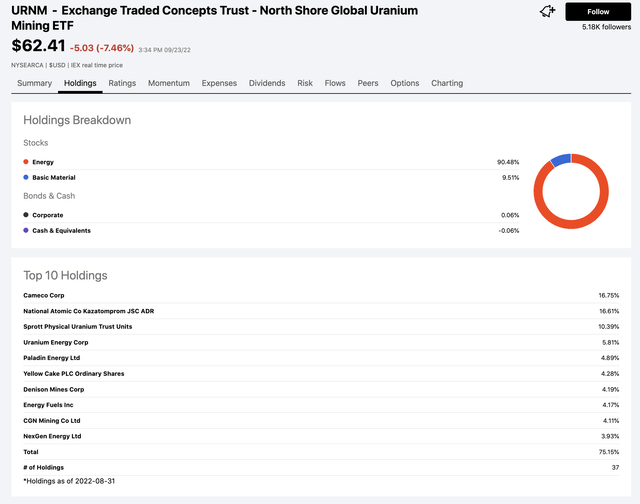

OK, next – here’s another Sprott fund, a miner ETF (URNM). Holdings include Cameco that we mentioned above – here’s the top 10 positions (full page, here).

URNM Top 10 Holdings (SeekingAlpha)

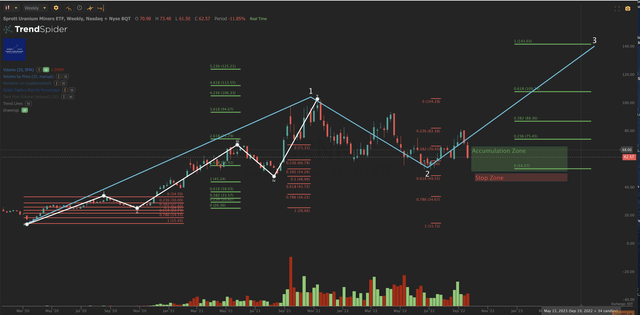

Here’s the chart. Easier to view in the full page version, here.

URNM Chart (TrendSpider, Cestrian Analysis)

Similar story really, slightly different timeframe. This is a relatively new ETF and volumes are rather thin, so bear that in mind when you consider the fund. Five waves up from the Covid lows to November 2021 high forming a larger degree Wave One up; a larger degree Wave Two down triple-bottoms in June and July this year – and the fund appears now to be in a larger-degree Wave Three up with the potential to reach at least $103 (the Wave One high) and maybe $143 (the 100% extension of Wave One) or $198 (the 161.8% extension of Wave One, not shown because, you know, there isn’t time for all that trolling). We believe accumulation is viable between those June/July lows of $53/$54 and the 0.382 retrace of the Wave One at $71 or thereabouts – again, a stop or hedge below the June/July lows and then see if the fund delivers that Wave Three up.

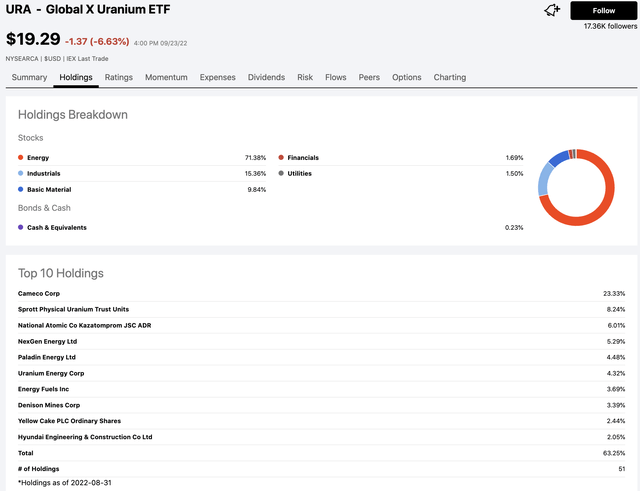

Finally – an older ETF with not quite such a purist set of holdings, but more liquidity – the Global X Uranium ETF (URA). Full page version, here.

URA Top 10 Holdings (Seeking Alpha)

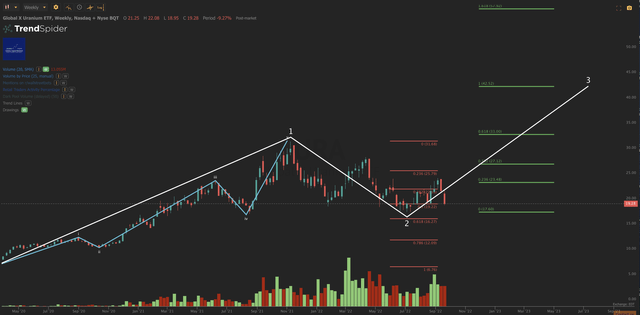

You know the drill. Full page chart, here.

URA Chart (TrendSpider, Cestrian Analysis)

Once again we would propose accumulation in the zone between the June lows (around $17) and the 0.382 retrace of that Wave 1 up (around $22); stop or hedge below the June lows; and hold in anticipation of a Wave 3 target of min. $32 (above the Wave 1 high), $42 (the 100% extension of Wave 1) or $58 (the 1.618 extension of Wave 1).

In short – we believe uranium offers very compelling long run investment returns and, further, that the recent lows give you a proximate level at which to set stops or hedges. Stops are no fun if they blow a large realized hole in your account – buying near the lows here means that if you do choose to manage risk with stops, the damage potential is small vs. the upside potential.

In staff personal accounts we own U.UN and URNM; we may add URA at some point but generally speaking we prefer the purist approach in this sector.

Cestrian Capital Research, Inc – 23 September 2022.

Be the first to comment