DNY59/E+ via Getty Images

Article Thesis

Semiconductor stocks have recently come under a lot of pressure due to recession worries. I do believe that these worries are somewhat overblown and that the recent share price pullbacks provide for attractive entry points in some semiconductor stocks. Due to reader interest in this question, we’ll explore Micron Technology, Inc. (NASDAQ:MU) and Marvell Technology, Inc. (NASDAQ:MRVL) to see which of these semiconductor stocks might be the better buy at current prices.

How Are Micron Technology And Marvell Technology Different?

Both companies are semiconductor corporations, but there are nevertheless important differences. While Micron is a memory company that primarily manufactures DRAM memory, Marvell is active in other areas such as Ethernet solutions, application processors, and storage controllers. Micron is the significantly larger company, being valued at $59 billion today, whereas Marvell is valued at $39 billion right now. Micron operates its own production facilities, whereas Marvell Technology is a fabless business. Both of these strategies have their advantages. Micron, thanks to operating its own factories, is less dependent on other businesses and can extract more money across the value chain. On the other hand, Marvell’s fabless business model allows it to operate with very small capital expenditure budgets, which means that a higher portion of its operating cash flows can be turned into free cash flow that can benefit investors. Micron’s larger size allows it to operate its own factories, whereas Marvell’s smaller size and lower profits predestine the company to operate as a fabless company.

MU And MRVL Stock Key Metrics

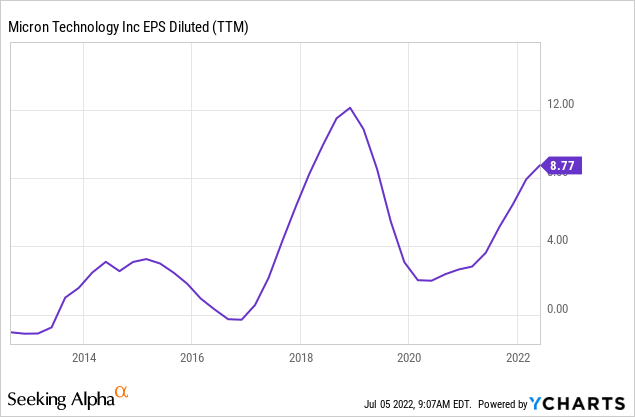

The semiconductor industry as a whole can be described as a growth industry. Technology is taking an ever more important part in our daily lives, both when it comes to hobbies/recreation as well as when it comes to doing business. Not all semiconductor industry segments are growing at similar rates, however, and profit growth can be different than business growth. That is especially the case in commoditized segments of the industry, such as the DRAM space Micron is active in. Right now, due to slowing demand and weaker pricing, Micron is experiencing a downturn. The company’s recently-announced quarterly results presentation included guidance that was considerably weaker than expected and that indicates that the current quarter will be way weaker than the previous one. While Micron earned $2.60 in Q3, current Q4 guidance suggests earnings per share of $1.60, a decline of close to 40%. That being said, even $1.60 in quarterly earnings still gets us to more than $6 in annual profit per share, which is still pretty nice for a company trading in the low $50s.

These ups and downs in profitability are to be expected from Micron, since its products are at least somewhat commoditized and since its business model of operating its own fabs does not allow it to bring down expenses quickly in a downturn. Still, over time the cyclicality has improved. Even at the recent bottom, Micron was still pretty profitable, which had not been the case in prior cycles, when Micron oftentimes reported net losses at the cycle trough. This improvement can be explained by consolidation in the industry that makes the oligopoly act more rationally when it comes to building out capacity. On top of that, Micron has been trying to move into less commoditized spaces where it is less dependent on pricing for overall memory products, which helps with its profitability during cyclical downturns (that are primarily price-driven, not volume-driven).

Marvell Technology, on the other hand, does not experience similar cyclicality, but that is reflected in its way higher valuation. Marvell’s recent growth history is almost perfect:

The company grew both its revenue as well as its profits very consistently over the last couple of years. Even better, the company also managed to beat estimates during almost every quarter, with not a single earnings per share miss over the last three years, and just one revenue miss in that period.

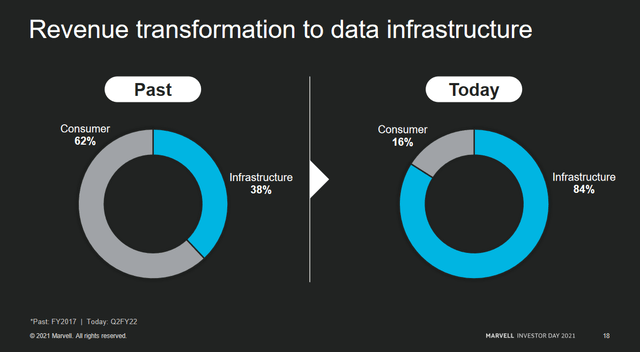

Marvell Technology is a more specialized company that is selling to a less commoditized market. Its product mix has shifted towards cloud computing in recent years, and infrastructure revenue now makes up more than 80% of Marvell’s revenue as can be seen in the following slide:

With low dependence on consumer items, a slowdown in PC sales, for example, does not hurt Marvell to the same degree it hurts Micron. Cloud computing companies may reduce their spending on new equipment during a huge economic downturn, but I do believe that it is unlikely that Amazon (AMZN), Alphabet (GOOG) (GOOGL), Microsoft (MSFT), and other cloud leaders will shrink their investments too much. Overall, this is still a major growth market as more and more data gets collected and needs to be processed and stored, thus the outlook for more infrastructure spending is positive – which should be positive for Marvell. The company has identified automobiles as a major growth market, forecasting that its market opportunity in this space will grow at a high-20%+ pace over the next couple of years. With autonomous driving becoming more and more of a trend and EVs generally requiring way more chips than comparable ICE-powered vehicles, there are good reasons to believe that Marvell could be right in identifying this market as a high-growth opportunity.

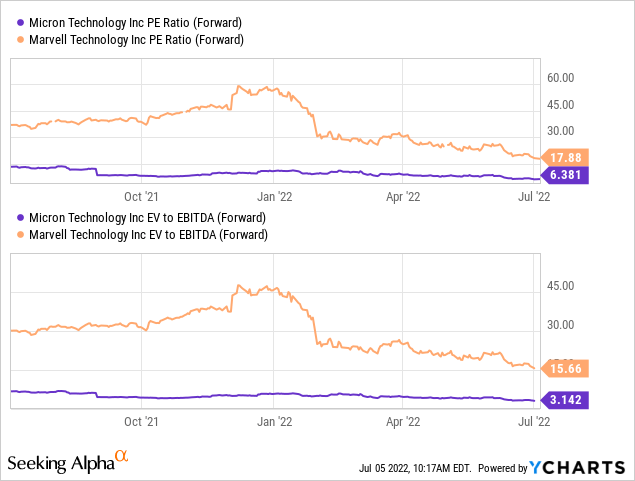

Micron’s business model is more cyclical and the company will likely generate less growth, overall, in the coming years. Marvell is forecasted to grow its earnings per share by 49% this year and by another 27% next year, according to current analyst estimates as shown here on Seeking Alpha. On the other side, Micron is forecasted to grow its earnings per share by 41% this year, but analysts expect that Micron’s earnings per share will fall by 18% next year. On a two-year stacked basis, Marvell’s growth rate is thus 38%, whereas Micron’s growth rate is 8% in the same time frame. Both from a growth perspective as well as from a recession-resilience/cyclicality perspective, Marvell is thus the better choice. But that does not factor in valuation yet, which is an important theme to consider when making investment decisions. On that front, Micron outclasses Marvell:

Micron trades at roughly one-third of Marvell’s earnings multiple, and roughly one-fifth of Marvell’s EV/EBITDA multiple. Since Micron has a way larger asset base, depreciation charges are significantly higher, and since those are added back when calculating EBITDA, its EBITDA towers over Marvell’s EBITDA. This is partially balanced out by the fact that Micron has to spend significantly more on capital expenditures compared to Marvell with its fabless model, thus a discount on the EV/EBITDA ratio is warranted. Nevertheless, the discount is so immense, both on an EV/EBITDA and price-to-earnings basis, that Micron clearly wins out on the valuation front.

When it comes to shareholder returns, both companies pay a relatively comparable dividend with a yield of around 0.5%. That’s not exciting, but Micron buys back shares at a meaningful pace on top of that. Over the last year, MU has bought back roughly $3 billion worth of shares, equal to around 5% of its market capitalization. Thanks to a strong balance sheet, investors can expect that Micron will continue to return surplus cash to them via buybacks over time. Marvell, on the other hand, has not offered meaningful buybacks in the recent past, which is why its shareholder returns are far from exciting. But due to stronger business growth momentum, that’s not a disaster.

What Is The Future Outlook For MU And MRVL Stock?

Both companies have pulled back massively this year. Micron is down 43% so far this year, while Marvell dropped by an even larger 53%. This is bad news for old investors that have seen their investment value shrink considerably, but good news for those seeking to deploy new money. At the current valuation, both Micron and Marvell look inexpensive. Micron is cyclical and not delivering overly consistent growth, but still has a positive long-term outlook as memory demand will grow over the years. It is trading at an ultra-low valuation of just 6x this year’s earnings and can buy back around 5% of its shares at the current pace. In the long run, i.e. over several years, that combination should lead to compelling total returns.

Marvell is way more expensive, but its 18x earnings multiple seems warranted based on the fact that the company is growing very fast and that its growth is not very cyclical thanks to low consumer exposure. Cloud computing will get ever more important, and with exposure to growth markets such as automobile, Marvell is poised to experience rapid business growth.

Is MRVL Or MU Stock The Better Buy?

Both companies have merit at current prices, I believe. Whether one favors Micron or Marvell depends on one’s investment style. Micron is a clear value pick, whereas Marvell is more of a growth-at-a-reasonable-price choice. In the near term, equity market troubles could result in declining share prices for both companies. But in the long run, both companies should see their shares climb from current levels, which is why neither company is a bad buy, I believe.

Be the first to comment