Jonathan Kitchen

It’s been about two months since I suggested investors continue to avoid Lancaster Colony Corporation (NASDAQ:LANC) in an article with the very original title “Continue to Avoid Lancaster Colony.” In that time, the shares are down about 12.5% against a loss of ~8.4% for the S&P 500. The thing of it is that a stock that was a bad investment at $149 may be a great investment at $130, so I think the name deserves a look in once again. They’ve published financial statements since I last wrote about the business, and I’ll be commenting on those. Additionally, I’ll be writing about the stock as a thing distinct from the underlying business. Finally, I’ve avoided selling short puts recently, but that may change today. I want to have a look at the premia on offer for short puts.

I’ve heard from many, many, many people that my writing can be tiresome at best. In order to try to ease the suffering of these interesting souls who continue to read my stuff in spite of their problems with it, I offer a “thesis statement” at the beginning of every article. This ensures that you get the gist of my perspective, while limiting exposure to “Doyle mojo.” You’re welcome. In spite of the significant drop in price this year, I think Lancaster Colony remains overpriced. The shares have declined, but earnings have declined at a faster rate. The fact is that earnings are the source of all sustainable investor returns, so this is significant in my view. In spite of a rock solid capital structure, there’s not enough going on here to get me excited. This is especially the case in the context of a current 2.75% risk free rate. Finally, I generally like to write put options to either generate decent premia and/or buy stocks at great prices. I do this only if I can receive decent income for great strike prices. Unfortunately, the premia on offer are too thin to get me excited here. For that reason, I’m going to continue to avoid this name until either price falls further, or the company demonstrates that it can reverse the earnings trend here, or both. That’s my take in a nutshell. So, if you read on from here, any risk of exposure to my horrendous jokes or pomposity is all on you.

Financial Snapshot

I’ll admit to being a bit of an old fashioned stick in the mud. I don’t understand the fact that these kids today seem to be so taken by their hoola hoops and bee bop records, for instance. It’s probably because I’m such a conservative old fuddy duddy that I want to see a positive relationship between revenue and net income. If a company sells more stuff, I expect to see higher levels of income. Net income is important to me because it’s the source of sustainable owner wealth. I feel somewhat embarrassed that I feel the need to repeat that truism, but I do.

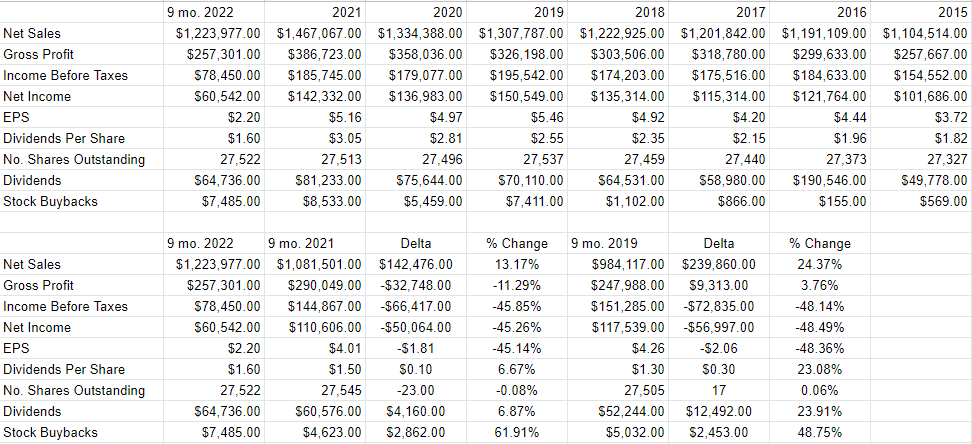

With that rant out of the way, I think it’s time to write about the most recent financial performance here. While revenue grew by a respectable 13% over the first 3 quarters of 2022 relative to the same period a year ago, net income actually fell precipitously, down by 45%. While it’s true that restructuring and impairment charges were greater by about $24.5 million from last year to this, the biggest culprit was a 22% uptick in cost of sales. You could make a reasonable argument that impairment charges aren’t going to linger. Not so for increased cost of sales.

In case there are bulls out there who want to take shelter in the possibility that 2021 was an extraordinarily good year, please allow me to blow that particular house down. When we compare the most recent 9 months to the same period in 2019, a similar pattern emerges. Revenue during the most recent period was 24% higher than it was in 2019, but net income was off by ~49%. If rising sales doesn’t grow net income, that’s troublesome in my estimation.

On the bright side, the capital structure remains rock solid, as the company has cash on hand of ~$67 million, which represents about 25% of total liabilities. There’s virtually no risk of bankruptcy or insolvency here.

Finally, in my previous missive on this name, I compared this stock (unfavorably) to the 10 year Treasury Note. I don’t want to travel over that ground again, and if you’re interested, I recommend you read my previous work here, but the idea was simple enough. At the time, the 10 year Note was yielding ~3%. If an investor bought the stock at the time, and the dividend continued on its historical growth rate, the stock investor would still end up with less cash in their pocket than they would receive from the much less risky Note. Since the yield is higher today, I’m open to changing my mind and going long this stock. It all comes down to price, though.

Lancaster Colony Financials (Lancaster Colony investor relations)

LANC Stock

If you read my stuff regularly, you know that I can be repetitive on occasion. That comes with the territory, and if you’re reading this, you kind of knew what you were getting yourself into. I write that as a preamble to point out, yet again, that I consider the company and the stock to be quite different, though related, things. Every business buys a number of inputs, performs value-adding activities to those, and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets passed around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. There’s often a very strong disconnect between the price of the stock and what’s going on at the business. We all believe this, otherwise, we wouldn’t be on this platform. Compounding this is the fact that stock price changes may have little or anything to do with the company, and may be more related to how the crowd feels about “the market” in general. This is troublesome, but I think we can take advantage of this tedious phenomenon. We take advantage of it by acknowledging that the only way to make money in stocks is to spot the difference in expectations embedded in the current price, and subsequent reality. Put another way, I think that a great, profitable business can be a terrible investment if you overpay for the stock. I’m also of the view that a terrible business has the potential to be a great investment if you can get it at a sufficiently great discount to intrinsic value. If the assumptions embedded in the price of the profitable business are too rosy, the stock will likely disappoint. If the assumptions embedded in the price of the struggling business are too pessimistic, the stock may eventually flourish. I should also point out that it’s typically the case that the lower the price paid for a given stock, the greater the investor’s returns over time. This idea shouldn’t need any explanation or elaboration.

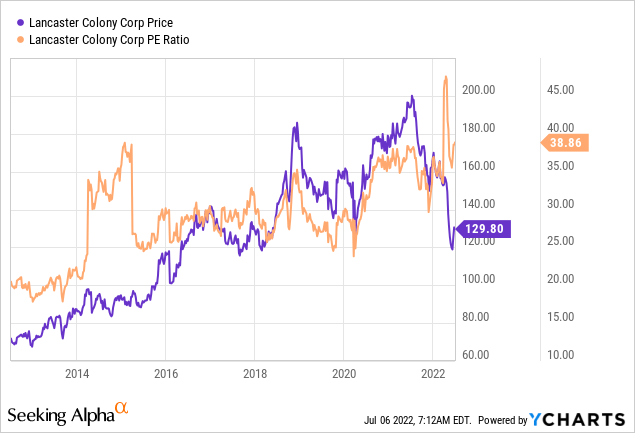

I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. When I last wrote about the stock here, I threw a virtual hissy fit over the fact that investors were paying just under 37 times for earrings. It struck me that a P/E that high was excessive, especially when the “E” in the ratio was on an obvious downtrend. In spite of the recent drop in price, the multiple is actually at a multi-year high per the following:

Source: YCharts

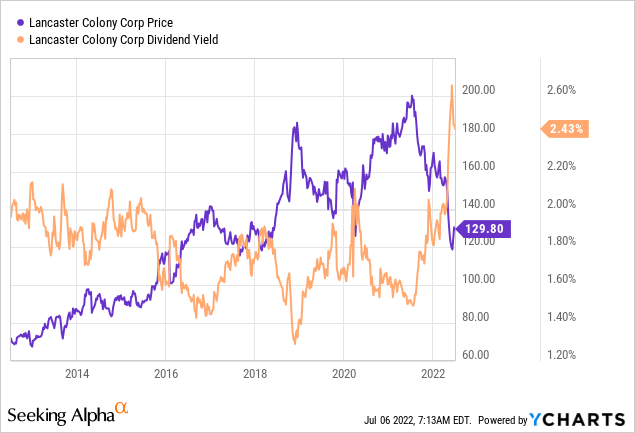

In fairness, though, the dividend yield is also on the high end by historical standards.

The problem for me is that there’s a significant risk that the dividend growth we’ve seen over the past several years will slow. After all, the payout ratio is currently sitting at ~72%, and if income remains on its current trend, dividend growth must inevitably slow in my opinion. Thus, I’m going to continue to recommend avoiding this name until the price drops much farther and/or net income picks up dramatically.

Options Update

Way back in April of 2020, I recommended investors sell the September 2020 puts with a strike of $100 for $4.90 each. I point this out in order to brag, obviously, but to also demonstrate that I’m obviously comfortable selling puts on this company.

This trade worked out rather well as the options expired worthless. I’d still be happy to buy at that price, as that would line up with a yield of ~3.2%. The problem is that the premia on offer for this trade are too thin in my estimation. For instance, at the time of writing, the December put with a strike of $100 is bid at $.50. That is too paltry a return to tie up this much capital for that long. Thus, while I normally love to sell put options, I can’t in this case until the stock drops further in price.

Conclusion

The problems I’ve written about previously linger here in my estimation. The disconnect between revenue and net income remains. More troublingly, this disconnect isn’t a consequence of anything that could be considered temporary. Even I’m willing to give a company a bit of a “pass” if income drops because a one off write-down. I don’t like it, I complain about it vociferously, but I’ll eventually accept it. In this case, though, the issue is that cost of sales growth continues to swamp revenue growth. This is obviously a trend that can’t continue. For that reason, I would recommend continuing to avoid the shares until one or all of the following happens: the price drops to the point where the dividend yield is greater than the rate on the 10 year Treasury Note or the company demonstrates the capacity to actually grow earnings at the same rate as sales.

Be the first to comment