ronstik/iStock via Getty Images

American Homes 4 Rent (NYSE:AMH) is a leader in the single-family home rental industry with a portfolio of over 55K properties in 22 states. These properties are located in key MSAs in neighborhoods that cater to those seeking move-in ready alternatives to home ownership. On average, their tenants have household incomes ranging from $70k to $120k and primarily consist of families with two adults and one or more children.

Outsized exposure to the sunbelt states of Florida, Texas, and Arizona is one strategic strength of the company that has yielded positive results as an increasing number of residents migrate in from other states. Additionally, historically low home inventories and an unfavorable outlook on new construction are likely to support higher home prices for an extended period, regardless of the demand environment. The resulting affordability constraints on prospective buyers is likely to force many into rental units. As a leader in this market, AMH is well-suited to continue reaping the benefits.

Over the past month, AMH is down about 5%. This outperforms the broader S&P, which is down over 7%. Nevertheless, shares are still down nearly 20% YTD. While this is, indeed, better than the market, there is upside potential at current trading levels, given the pullback. With shares trading in a narrow 52-week range, AMH also provides investors with protection against share price volatility. For investors seeking to add an industry housing leader to their portfolios, AMH is one to keep in mind.

Earnings Review and Other Reportable Events

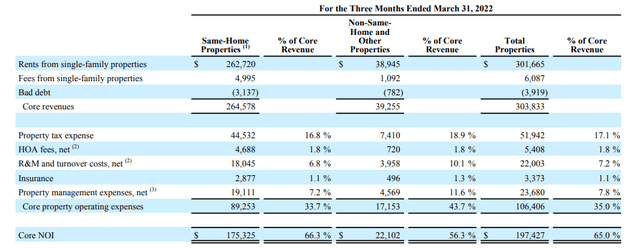

In the most recent quarter ended March 31, 2022, AMH reported results that were in-line with expectations. Total revenues were +$356M. This was up 13.7% from the prior year on an overall basis, with same home core revenues up 8.9%, driven by favorable occupancy and continued rental growth in both new and renewal/blended leases.

Within the same home population, average monthly realized rent per property exhibited growth of 7.5% for the period. And though turnover remained elevated at 6.2%, the rate was lower than the 7% reported in Q1FY21.

For the quarter, same home core NOI came in 10.8% higher. The strong performance within this population contributed to overall core YOY FFO/share growth of 18.8%.

Compared to last year, total core operating expenses were up about 11%, with savings on property management and tax expenses offset by higher R&M and turnover costs. While turnover was up, bad debt was down, suggesting collection trends are gradually returning to normalized levels.

Q1FY22 Form 10-Q – Core NOI Snapshot

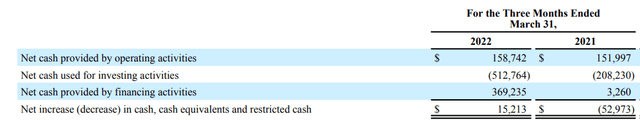

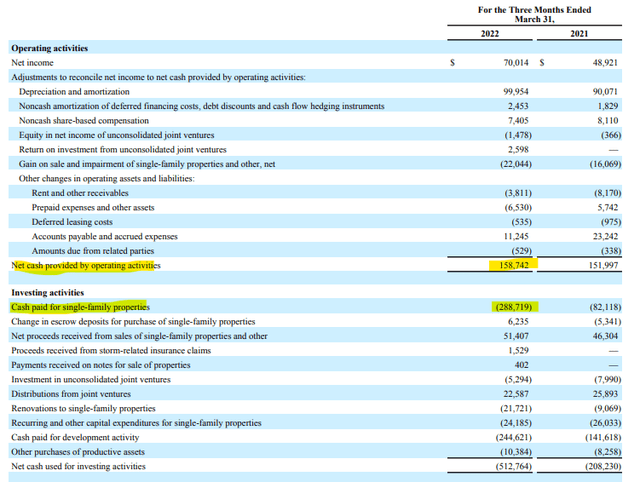

AMH remained active market participants in the quarter, adding over 1,000 homes to their wholly owned portfolio, representing a total investment of +$414M. Similar to 2021, the company’s expansion activities exceeded operating cash flows. Aside from +$50M received from dispositions, AMH’s activities were funded via the combination of debt and cash on hand. Additionally, AMH raised +$864M during the quarter through a common equity offering.

Q1FY22 Form 10-Q – Summary of Cash Flow Statement

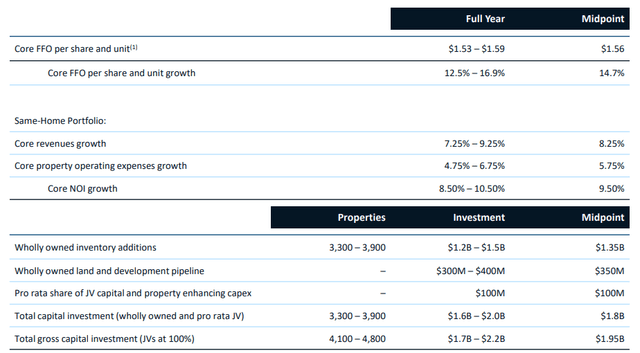

Looking ahead, AMH reaffirmed their full-year earnings guidance, which calls for FFO/share growth of 14.7% at the midpoint, aided in part by favorable affordability-related trends in the broader housing market.

June 2022 Investor Presentation – Full-Year Guidance Update

The Fundamentals

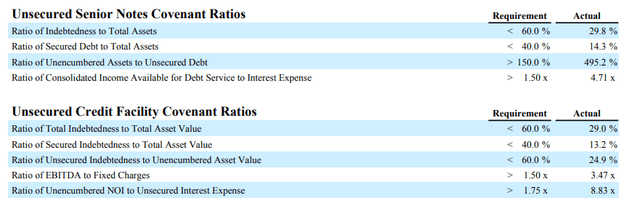

As of March 31, 2022, AMH had total assets of +$11.4B and total liabilities of +$4.3B. Total liabilities consisted of +$1.9B in net asset-backed securitizations, +$1.6B in unsecured liabilities, and +$410M outstanding on their revolving credit facility.

Net debt at period end was 6x, which is the same amount of leverage reported by Invitation Homes (INVH). Unlike INVH, however, 64% of AMH’s total debt is due after 2026, whereas INVH has two large maturities due in both 2025 and 2026. Extended maturities on INVH’s debt load serves as protection in the current rising rate environment. Rate risk is further mitigated by the fixed-rate nature of their debt.

AMH’s credit profile also includes an investment-grade rating from Moody’s and S&P Global with a positive outlook. With respect to outstanding covenants, the company has ample cushion to support increased borrowings, in the event their operations require it. Their fixed charge coverage ratio of 4x provides confidence that they can adequately meet their debt servicing obligations in the interim of maturity.

Q1FY22 Investor Presentation – Debt Covenant Compliance Summary

Total liquidity at period end stood at +$1.4B, which included a mix of cash and equivalents, unused capacity on their revolving credit facility, and estimated net proceeds from the future settlement of their January 2022 Forward Sale Agreements. At present levels, current liquidity is sufficient to fund the entirety of the current year’s external capital needs. While the proceeds from forward shares are, indeed, one liquidity source, the drawback is dilution to future EPS.

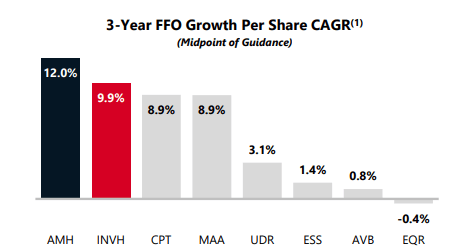

Declining earnings growth is not yet a concern for AMH. Over a three-year timespan, for example, AMH has outperformed their peer set, with a FFO/share growth rate of 12%. This is over 200 basis points better than INVH and significantly better their multifamily-focused counterparts. In addition, full-year earnings guidance includes FFO/share growth of 14.7% at the midpoint, which leads the SFR industry and demonstrates the consistent power of AMH’s platform.

June 2022 Investor Presentation – 3-YR FFO Growth Comparisons

For income-investors, shares in AMH offer investors an annual payout of $0.72. This represents a yield of just over 2% at current pricing. Though a payout has been reliably made for several years, the company doesn’t have as impressive of a track record of growth as their peers in the multi-family space. Over the past two years, however, the dividend has growth significantly from $0.20 at the end of 2020 to its current value of $0.72.

Still, there is a risk that shareholders will see slowing growth in the payout, especially as growth begins to cool in the broader market. While distributions to common shareholders in the current period accounted for just 45% of operating cash flows, AMH is burning through cash on acquisitions and development activity, as evidenced by the 146% increase in investing activities from the prior year. Though this very well could support continued growth, it could also prove a drag in an eventual slowdown. As it stands, the dividend payout ratio is just 50% of forward AFFO, which is significantly better than the sector median of 73%. So, while the risk of a cut is low, the possibility of slowing growth still exists.

Q1FY22 Form 10-Q – Partial Cash Flow Statement

Primary Risks to AMH

AMH’s portfolio is concentrated in single-family properties in ten geographic markets. For the full 2021 fiscal year, these markets represented 59% of their total property portfolio. While each market has its own strategic advantages, the company could be exposed to heightened downside risk if any of these markets were to experience an adverse change in economic, regulatory, or environmental conditions.

Additionally, in terms of relative affordability, while the rental of single-family units is currently more affordable than ownership, they are more expensive than their multi-family counterparts. With individuals significantly more cost conscious at present, this could result in underperformance of AMH compared to other REITs with greater holdings of multi-family dwellings.

Significant competition in their target markets with other large real estate investors, in addition to private home buyers and small-scale investors has impacted and is expected to continue impacting the level of purchases in certain markets. This has driven up the purchase price of acquisitions. With interest rates on the rise, there is the possibility that demand will trail off, resulting in lower valuations. Though this would favorably impact the acquisition market, AMH’s existing portfolio would be subject to a greater risk of asset impairment.

One strategy of AMH is bulk portfolio acquisitions, whereby the company purchases a large quantity of assets in bulk from other owners of single-family homes. In a competitive environment, there are certain benefits of employing this strategy, such as speed and cost. However, there is the risk that the quality of some of the properties are not consistent with the company’s property management and leasing standards. This would require AMH to incur additional development-related expenses in rehabilitating the affected properties.

Conclusion

AMH’s leadership in the single-family market positions them strongly to continue capturing the opportunities afforded by current market trends. With the broader housing stock chronically undersupplied, home prices are likely to remain supported at current levels regardless of the demand environment.

With prices at record highs, many prospective buyers are being pushed into rentals of either multi-family or single-family units. Though multi-family properties provide affordability advantages, the single-family option is more likely to appeal to renters seeking more space and privacy. For young families with children, this is just one draw of outbound migration from cities into more suburban environments.

At a beta of just 0.58, shares in AMH are significantly less volatile than the broader market, as evidenced by their narrow 52-week trading spread. This feature of the stock provides investors with protection against the volatility experienced in the broader market. Though shares are still down nearly 20% YTD, that is still better than the declines experienced by other names within the index.

Applying a discounted dividend cash flow model with a CAPM-derived discount rate of 6.7% and a long-term dividend growth rate of 4.5% would yield a target price of approximately $40. This represents upside of over 10%. In addition, investors would receive an annual payout of $0.72/share. While this is a yield of just 2%, the dividend has grown tremendously over the past two years. Growth is likely to slow but another large increase can’t be ruled out. For investors seeking to add an industry leader in single-family rentals to their long-term portfolios, AMH is one worth the add.

Be the first to comment