jewhyte/iStock Editorial via Getty Images

Investment Thesis

Over the past year, huge European pension funds have been selling their stakes in oil and gas producers, citing “CO2 reduction goals” as the reason. These funds are selling cash producing assets that drive the world economy for what we believe is a temporary trend. European oil majors are investing in a green future, and it is likely that these cash-burning pension funds get back in one day at a much higher price.

As for climate change, the world’s climate has been changing for billions of years. Throughout Earth’s existence, it has gone through periods of being completely covered in both ice and tropical oceans.

Buying from European pension funds is easy money. BP p.l.c. (NYSE:BP) trades at a forward P/E of less than 4x earnings. With such a steep discount, we project returns of 13% per annum in the decade ahead.

The Geographical Discount

| As of July 5, 2022 | BP (BP) | Chevron (CVX) |

| Forward P/E | 3.7 | 8.4 |

| Price to Book | 1.4 | 1.9 |

| Free Cash Flow Yield | 17.7% | 9.0% |

| Dividend Yield | 4.9% | 4.0% |

| Working Capital | $18.95 Billion | $13.5 Billion |

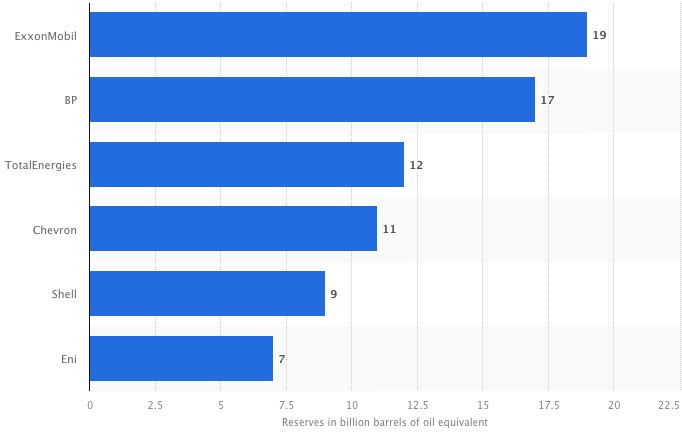

BP trades at an enormous discount to its American peer Chevron. In fact, it’s about a 40% discount, looking at the above metrics. Sure, there could be managerial and political reasons for this, but BP has way more oil reserves than Chevron:

Proven Oil Reserves By Company (Statista)

Downstream Weakness, Upstream Strength

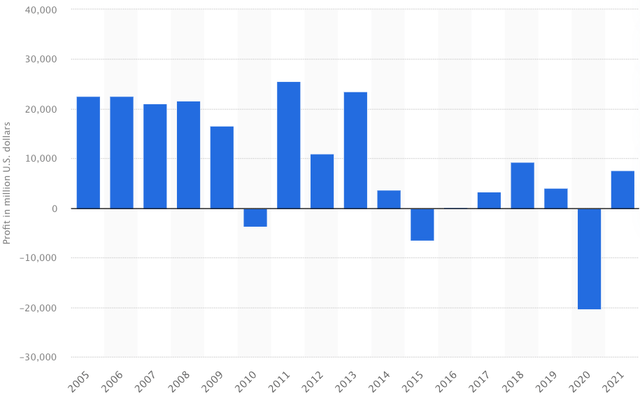

BP’s downstream business is still quite weak. In the low oil price environment back in 2015 and 2020, the company reported large losses. BP also had negative free cash flow in 2020.

Notice that BP raked in huge earnings from 2005 to 2013 when oil prices were high. The future does not have to look like the recent past. It all depends on where oil goes next.

The Future Of Oil & Gas

While in 2020 we saw all supply and no demand, the pendulum has since shifted dramatically. Big oil underinvested in exploration over what was a turbulent decade for the industry. Now, it seems the world is running out of oil again, and it is. The world is projected to run out of oil by 2052. Meanwhile, with gasoline prices soaring, President Joe Biden is urging oil companies to boost supply.

Warren Buffett began doubling down on his oil bet after the war in Ukraine broke out. It seems Buffett and Munger think the supply cut from Russia, as well as the industry’s underinvestment in exploration, will lead to sustained cash flows. Along with this, Charlie Munger said that he believes oil will be “precious stuff” in the future.

Oil prices should surge higher in the long-term as the resource dwindles in supply. The short to medium-term is more up in the air. The Balance expects oil prices of $66 per barrel in 2025, $89 in 2030, and $132 in 2040. This indicates we may be at a near-term peak in the price of the commodity. With electric vehicles taking to the road, oil demand will eventually peak; estimates range from 2025-2035.

Watch The Debt

BP is in a good position in terms of its working capital and short-term liabilities, but the company has far more long-term debt than its peers. As interest rates rise, interest expense tends to increase alongside. BP needs to pay down its long-term debt, which sits at $62 billion (including capital lease). This debt represents nearly 6x our estimate of normalized earnings, which is far too high for a cyclical business; despite this, Fitch still has an investment grade rating on BP’s bonds, with a stable outlook.

Normalized Earnings

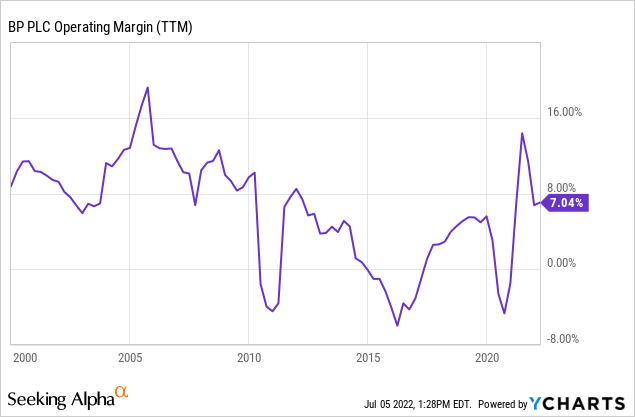

BP’s earnings are not representative of the company’s true value. We need to dig into BP’s financials to find its normalized free cash flow (FCF). Here’s a look at how BP’s operating margins have trended over time:

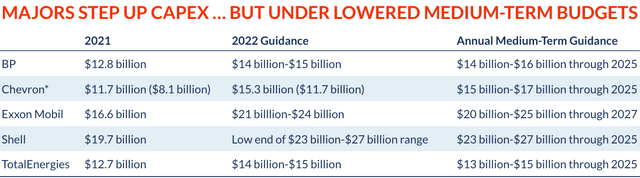

Oil hovered around $75 per barrel over BP’s last 12 months of reported earnings. We believe BP’s TTM operating income and operating cash flow are normalized figures. But, BP appears to be underspending on capital expenditures, and is guiding towards an increase through to 2025:

Capex Guidance By Company (Energy Intelligence)

$14 billion to $16 billion of Capex is more in line with BP’s depreciation and amortization of $14.8 billion (2021). If we subtract $15 billion of Capex from BP’s $25.7 billion of operating cash flow, we get normalized free cash flow of $10.7 billion ($3.31/share).

Long-term Returns

Our 2032 price target for BP is $64 per share, implying a return of 13% per annum with dividends reinvested.

For our projection, we’re using a 2032 Brent Crude price of $96/barrel, which gives BP some organic growth from here. In the future, BP should repurchase more shares. We estimate BP can grow its normalized FCF per share at 4.5% per annum through to 2032, resulting in 2032 FCF of $5.15 per share. Remember, BP will be paying down debt and investing some of its cash into the energy transition to strengthen its long-term position. BP plans on investing in:

“Bioenergy, convenience, EV charging, renewables, and hydrogen.”

We believe this type of long-term thinking is positive for European energy and should present favorable growth prospects. This could demand a multiple expansion in 2032. We’ve applied a terminal multiple of 12.5 for a business that is facing peak oil demand but should have a growing clean energy business and ample oil reserves in a decade’s time.

Conclusion

BP is on the verge of a “strong buy” rating for us, but we’d like to see the company reduce its long-term debt and improve its downstream business to protect itself from downturns. BP trades at a normalized PE of 8 and is generating substantial cash flows. If you’re looking to follow Warren Buffett into oil, European oil and gas is a great bet. The forward earnings and long-term outlook both look positive for BP. The company appears destined for outsized returns. We have a “buy” rating on the shares.

Be the first to comment