Derick Hudson/iStock Editorial via Getty Images

If any company in the tech space is a poster child for job cuts, Meta Platforms (NASDAQ:META) falls into that category. The business founded on the original success of Facebook has become increasingly less efficient over the last few years. My investment thesis is very Bullish on buying the stock already priced for a financial hurricane with the potential to boost profits from lowering costs.

Inefficient Growth

The news flow of the day has Meta potentially looking at job cuts. The human-resources chief apparently circulated an internal memo suggesting employees unable to meet expectations would be cut.

Back during an internal meeting reported on by Reuters, CEO Mark Zuckerberg had pushed the concept that employees should just leave.

Realistically, there are probably a bunch of people at the company who shouldn’t be here. Part of my hope by raising expectations and having more aggressive goals, and just kind of turning up the heat a little bit, is that I think some of you might decide that this place isn’t for you, and that self-selection is OK with me.

Meta was well documented as aggressively spending to capture opportunities in the Metaverse and video advertising via Reels. The social media giant was spending so much on the Metaverse to where the Reality Labs division was losing $2.96 billion per quarter. Yes, the annual losses were still set to top $12 billion without any drastic changes, with revenues at only $0.7 billion.

The Metaverse may eventually pay off, but the looming recession should cut into the spending of competitive threats in the sector while allowing Meta to reduce expenses. The company hadn’t expected the Metaverse to pay off for several years anyway.

Some rumors suggest the tech giant could lay off up to 10% of the employee base. Based on recent gains in employee headcount and the efficiency of those employees, Meta might need to actually cut employee counts. Though, Zuckerberg recently pushed for still hiring a large amount of engineers this year in a move suggesting a reduction in the expected hiring rate, not an actual reduction in the headcount.

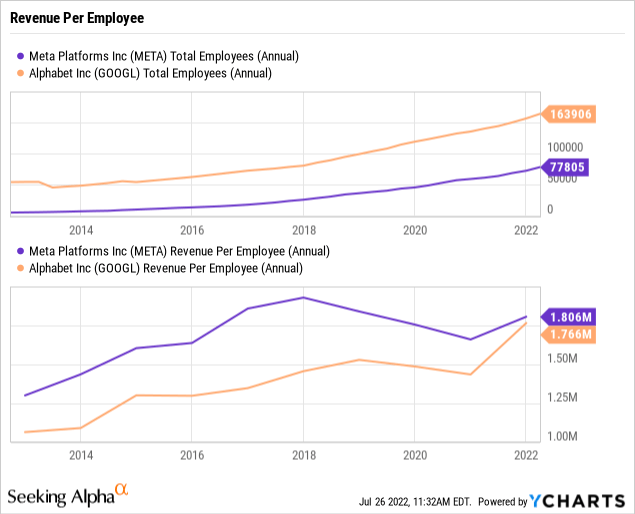

The company ended Q1’22 with 78K employees, up 28% YoY. While the revenue efficiency of employees improved over the last couple of quarters, Meta still only generates $1.8 million per employee, down from the 2017 peak up above $1.9 million.

Alphabet (GOOG, GOOGL) provides a prime example of how Meta has strayed from efficient spending. Alphabet has long been criticized for over spending, yet the Google parent has now virtually caught up to Meta at the $1.8 million in annual revenues per employee.

Going back to the end of 2017, Meta had a massive lead with nearly $1.9 in revenues per employee, while Alphabet was down below $1.5 million. Meta was over 20% more efficient than Alphabet, and the giant gap has been virtually lost over the last 5 years.

EPS Boost

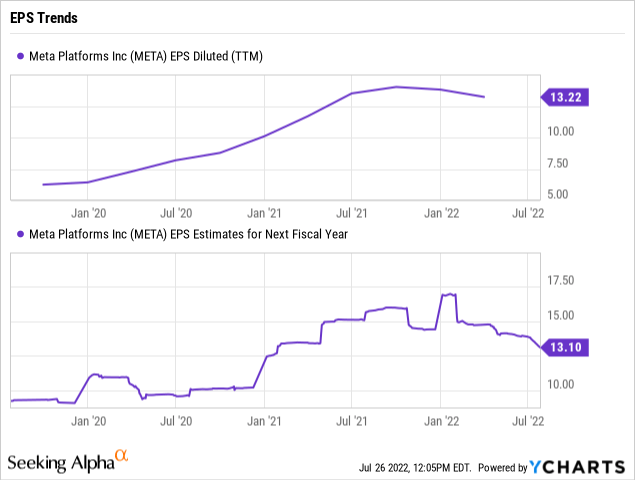

A prime example of the inefficient spending is that Meta still grew Q1’22 revenues by nearly 7%, but the company reported an EPS dip for the period. The company hit a $14 EPS peak last year and analysts now have a 2022 EPS target of only $11.39 for Meta with a bounce back to $13.10 per share next year (though this EPS estimate continues trending lower).

Analysts forecast Meta generating 5% revenue growth this year and 14% in 2023. The company isn’t expected to face a revenue issue, though the looming recession could end up impacting these forecasts.

The social media giant has 2.7 billion shares outstanding. Meta only needs to cut the Reality Labs losses by 25%, or $3 billion, to impact EPS by $1 per share. The company could cut the losses by half and boost EPS by $2. Meta would still have a pretty absurd $6 billion annual loss from Reality Labs.

The company reports after the market close on July 27. Investors should brace for some disappointing numbers, with signs that Meta might actually lay off employees. Ultimately, though, the tech giant has levers to pull to boost earnings via cutting costs and repurchasing cheap shares considering the balance sheet has a $44 billion cash balance amounting to 10% of the current market cap.

Takeaway

The key investor takeaway is that the stock only trades at 13x 2023 EPS targets and Meta has multiple paths to even higher earnings per share, making the stock extremely cheap. Investors should brace for a few tough quarters, but Meta is a buy at the lows based on valuation, the potential to actually boost earnings via job cuts.

Be the first to comment