teppakorn tongboonto/iStock via Getty Images

It’s been a few months since I wrote a cautiously optimistic piece about FreightCar America Inc. (NASDAQ:RAIL), and in that time the shares are down about 21% against a loss of 3% for the S&P 500. The company is expected to report earnings in the second week of August, so I thought I’d review the name to see if it’s time to actually start to buy. After all, an investment at $3.90 is even more attractive than one at $4.90. I’ll make this determination by looking briefly at the state of the industry, and developments at FreightCar America itself. I’ll also look at the valuation and ongoing insider buying activity. Finally, I’m absolutely champing at the bit to write about the put options I sold previously, so strap in for another of my “puts are a great way to reduce risk and enhance returns” homilies.

We now come to the “thesis statement” portion of the article. It’s here where I provide you the highlights of my thinking so you don’t have to wade through the entire article. This may be particularly helpful in this article, as I admit that here I’ll engage in some levels of bragging, even for me. I’m of the view that FreightCar America is now a buy. The ongoing insider activity offers a clue about the strength of the turnaround. The industry in general is improving, and FreightCar is improving particularly given what’s happening at their Castanos facility. The company is forecasting a huge revenue increase this year on the back of all of this. In spite of this, the shares are trading near a multi year low valuation. While I normally like to sell deep out of the money puts, I’d recommend simply buying the stock at current prices. The fact that the puts I wrote earlier haven’t moved far against me in spite of the slide in the stock price may be evidence that the options market is of the view that shares won’t drop further in price from here. That’s my thesis in a nutshell. If you continue reading from here, that’s on you. I don’t want to read any complaints in the comment section about the fact that I bragged, or made fun of the CEO for wearing a ridiculous hard hat, or the fact that I spell words like “favourite” and “recognise” the British way.

Financial Reminder

On the eve of the company’s next quarterly result, I think it’s worth remembering a few facts about the company’s latest financial results that may give us some insight into emerging trends. With the Castanos facility further along in its development, the company seems to be comfortable forecasting revenue of between $320-$340 million for the year, based on deliveries of between 2,800-3,000 cars. Note that the company hasn’t delivered revenue this high since 2017.

This may seem conservative in light of the quarter the company posted in May. The first quarter of this year saw revenue up a staggering 188% relative to the same period a year ago, and saw net loss shrink by about 33%. Although I fretted about the growth in liabilities, I was heartened somewhat by the fact that cash represented fully 16% of total liabilities.

I also compared that quarter to the same quarter just prior to the pandemic and found the same. I concluded that the company was in a turnaround from the doldrums it had been in since 2015-2016.

In spite of obvious inflationary headwinds, freight cars are being aged out all over the North American fleet. This is why there is increasing demand for railcars in general. Add to this the improvements at FreightCar specifically, and I expect the upcoming quarter to be quite good. This is obviously driven by improvements at the Castanos facility, now about 22 months old. Finally, in one of the articles referenced above there is a photo of the CEO wearing a hard hat emblazoned with his full name in very fancy script. Many, many, many decades ago, I worked in construction, and based on my experiences there I have to write that any man brave enough to have his full name stenciled on the front of his hard hat in this manner is a man I can respect.

Given the above, I’d be very happy to buy FreightCar America at the right price.

The Stock

If you subject yourself to my stuff regularly for some reason, you know that I think the stock is distinct from the business in many ways. If you’re one of my new followers, welcome. I should let all of you new people know upfront that I think a stock is very different from the underlying business. Also, the stock is often a very poor proxy for the business that it supposedly represents. A business buys a number of inputs, adds value to them, and then sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for the company, beliefs about the growth in freight rail backlogs and the like. Given stock volatility, it seems that the crowd changes its views about the company relatively frequently, which is what drives the share price up and down. Added to that is the volatility induced by the crowd’s views about “the market” in general. “Stocks” become more or less attractive, and the shares of a given company get taken along for the ride. Although it’s tedious to see your favourite investment get buffeted because of all of this, the tedium presents us with an opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

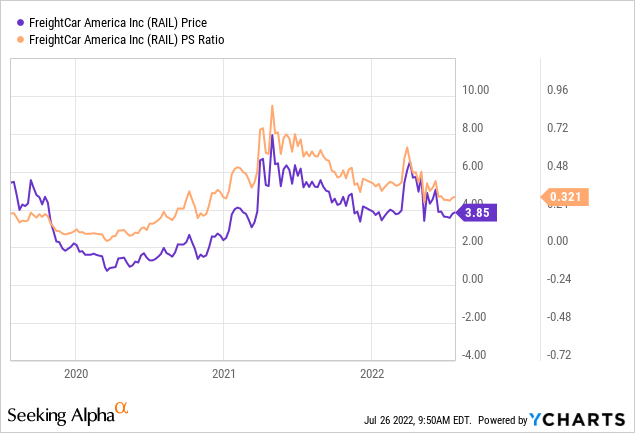

As my regulars know, I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins. I want to see a company trading at a discount to both the overall market, and the company’s own history. In my previous missive on this name, I noted that the shares were trading at a price to sales ratio of about .47x. They’re now about 32% cheaper on that basis, per the following:

With Further Apologies to Orwell

In my latest article on this name, I pointed out that insiders had been snatching up shares. That story continues apace. As I wrote previously, “all investors are equal, but some investors are more equal than others.” I meant by this that the fact of the matter is that some investors generally do better than average for a few reasons. Maybe they’re too unsophisticated to do anything but apply a bog simple, tried and true approach that tends to outperform the S&P 500 over time. Maybe they’re obviously not at all corrupt public servants who just happen to be really good stock pickers. Maybe they’re insiders who know more about the business than anyone on Wall Street, because they live and breathe the company. This last group offers a powerful signal that I think the rest of us should pay attention to. When these people put their own capital to work in the company, I think the rest of us would be wise to sit up and take notice.

With that thinly veiled excuse to brag and to poke at oily politicians aside (top 6% in spite of the fact that you don’t count my options premia? Thank you very much, Tipranks! I’m flattered!), I want to write about insider activity here.

On June 16th, Michael Riordan picked up another 2,500 shares at a price of about $3.90. This brings his stake to 70,807 shares. This is the latest in a long line of insider buys. The fact that the people who know the business best are confident enough to continue to add to their holdings in it speaks volumes in my estimation. I think the rest of us would be wise to at least take note.

Given this ongoing insider buy activity, and the growth in rail freight demand, and the ongoing FreightCar America improvements, and the fact that the shares are now trading near multi year lows, I think this stock is now a “buy.”

Options Update

My regulars know that I often generate income by selling deep out of the money puts in lieu of outright share ownership. I like these because they generate premia and/or the opportunity to buy stocks at great prices. Previously, I sold 10 of the January 2023 FreightCar America puts with a strike of $5 for $1.57 each. These are now priced at only $1.35-$1.90, so the trade hasn’t worked out too badly, in spite of the massive drop in the stock price. It may be that the options market doesn’t see much chance that the shares will drop much below $3.65 over the next several months and is therefore only bidding $1.35 for these. Either way, while I normally like to sell puts, I don’t recommend doing so at the moment. Puts are great when shares are overpriced, because they represent a “win-win” trade. The investor either collects premia only or they collect premia and end up buying great companies at amazing prices. In this case, though, I think there’s more value in simply buying the shares, which is what I’ll be doing. I don’t plan to buy my puts back, but I won’t be selling any more at the moment.

Conclusion

We’re told to “buy low.” the only way we can do that is when the market is excessively pessimistic about a given name. In my view, the market is overly pessimistic about FreightCar America at the moment. The shares are trading at multi year low levels on a price to sales basis in spite of the growing evidence of a turnaround here. I think we’d be wise to take advantage of this disconnect. I think “price” and “value” can remain unmoored for a long while but will eventually meet. I think investors would be wise to buy now before price rises to catch up with value.

Be the first to comment