Oselote

Published on the Value Lab 22/8/22

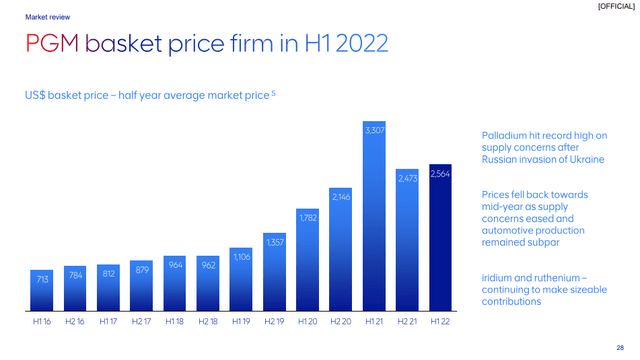

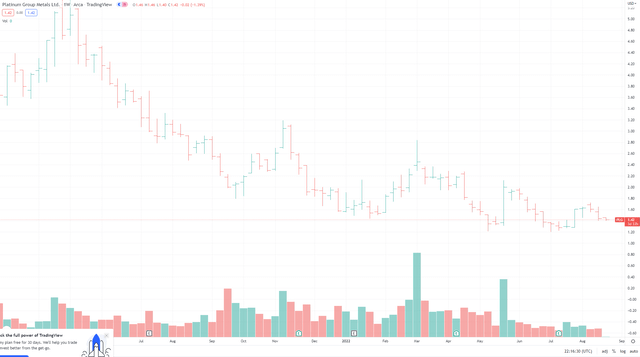

Commodities have been such a prominent theme these last several quarters. Indeed, PGMs are one we’ve discussed a lot, and Anglo American Platinum (OTCPK:ANGPY) follows PGM prices almost 1:1. We had put this stock to rest after a great speculative run around the Russian invasion, where the stock did not immediately respond to the supply shock risk with Russian reserves being large. The shock did not come to pass, and also automotive supply continues to be a problem with China’s COVID woes. Finally, the latent issues with the economy could be the death knell for this cycle for ANGPY. The associated Hydrogen thesis remains strong, but we’d be wary in the short to medium-term.

H1 Note

The company recently reported H1 results that we can shortly examine. The first thing we notice is their celebration of the wage agreement they reached with staff. While we’re happy for the staff, the agreement looks very generous, and shows wage scaling along with inflation that might be ill-timed. PGM prices have come down, and we think they will continue to fall. Operating in South Africa, layoffs will be difficult given the state of government and their effective stake in the company as royalty collectors and concession beneficiaries. Sticky downward wages are a little bit of an issue and monetary authorities tackle inflation.

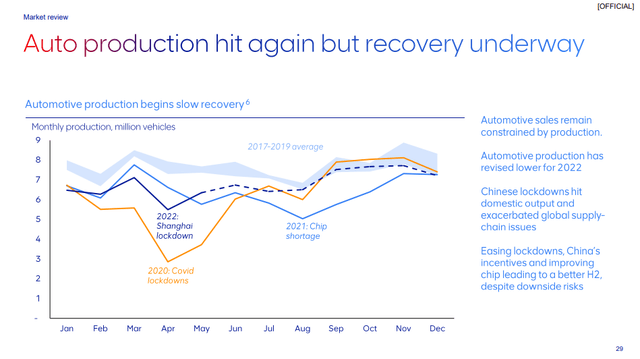

The ANGPY price follows PGM prices one-to-one. The current average price for H1 shows that while a peak in March, things came down once it became clear that Russian PGM supply remains more or less available, to the extent that speculators haven’t gone in and ruined things. The recent issues have been the China lockdowns, where domestic production for the automotive industry halted for a while and created newfound supply chain problems.

Automotive Production (H1 2022 Pres)

The US auto industry expects a 17% decline in auto sales as these supply chain issues refuse to see an end and are still far from being digested.

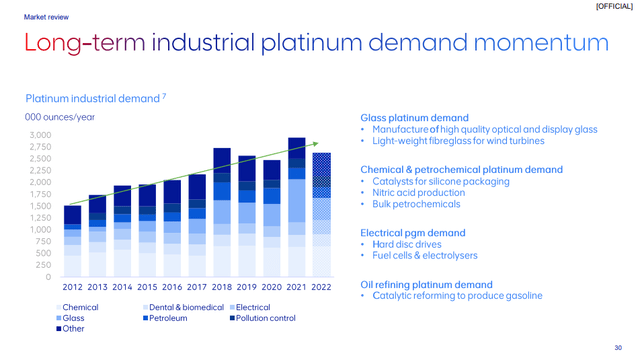

Platinum is the only PGM that is a little more insulated since it has applications that are less skewed towards auto than the others. Still, those industrial end-markets will still suffer in a recession, save for perhaps in the petrochemical industry and catalysts in some other more resilient industries. It still also depends quite meaningfully on auto, perhaps with 60% of its use cases being there.

Platinum Demand (H1 2022 Pres)

Final Remarks

There is the hydrogen thesis that stands behind the stock. This remains relatively intact, despite the ongoing risks with Russian supply. This is because the Middle East remains relatively neutral if not positive about the conflict, and certainly not directly on the West’s side. South Africa is in a similar situation, where they have always been very neutral to West vs East conflicts. With Middle Eastern goals to diversify away from their massive oil wealth already being worked towards, PGMs will continue to find markets there.

Moreover, there is the dividend to discuss. Almost all incremental cash flow is paid out as the dividend, and on net income the payout ratio is around 80%. The yield stands around 8%. This is a great yield, but US investors should understand that unlike with US companies, there is no promise here at all, not even an implicit one, that the yield will stay at this level. It will vary and has always varied with the state of the PGM markets and the direct association to cash flows that those markets have for ANGPY, which mines only PGMs. We expect this dividend to fall as the PGM environment deteriorates.

PGM prices are trending to lower levels and the latent issues in the economy around reduced consumer confidence could take its toll and break resistance to the downside quite firmly. We just think that in general, many commodities are late in the cycle. Better to avoid.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment