Hirkophoto/iStock Unreleased via Getty Images

Bridgestone (OTCPK:BRDCY), the largest global tire producer by market share, recently raised its sales and adjusted operating profit guidance for the full year, as the company leveraged its brand strength and pricing power to boost profits through the inflationary headwinds. While there were signs of a growth slowdown in certain products, such as off-road radial (ORR) tires for the quarter, this was mainly due to the suspension of exports to Russia. At the operating profitability level, the tailwinds from higher selling prices, favorable product mix shifts, and resilient volumes still more than outweighed any headwinds from higher operating and processing costs.

With a pending recovery in mining tires and a further profitability boost from price hikes, as well as the elimination of one-off costs booked in the previous fiscal year, I am upbeat on the Bridgestone earnings outlook. At the current ~10x fwd P/E, the stock trades at a slight premium to key tire peer Toyo Tire (OTCPK:TOTTF), but given Bridgestone’s competitiveness in the high value-add segment, its restructuring opportunities, and its solid balance sheet (reflected in its high RoE), I view the premium as warranted. The upcoming long-term strategy update (planned for month-end) will be worth looking out for, particularly on the development of electric vehicle (EV) tires and the monetization plans for the solutions business.

| FY2023 | FY2024 | |

| P/E Ratio | 10.9x | 10.1x |

| ROE | 12.0% | 12.0% |

Source: Marketscreener, Market Data at 24th August 2022

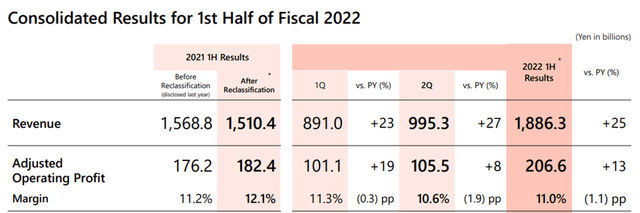

Strong Earnings Through the Headwinds

Adjusted operating profits for the quarter were largely in line at JPY105.5 bn (up from JPY93.8 bn in the prior year) and a 10.6% operating margin, despite higher input costs. The result also factored in the negative impact of unrealized inventory gains, which reduced profits by JPY10-20bn. As this was an industry-wide issue and should ease in the coming quarters, however, the reported earnings should be viewed excluding this headwind, in my view. Within the quarterly result, the product margin of specialty tires (i.e., mining tires) was the key highlight, improving sharply for the quarter. More broadly, the company successfully implemented price hikes across its product lines, which has already provided a ~13% boost to overall earnings and should offer further tailwinds in the coming quarters.

Bridgestone

The result was particularly impressive given the suspension of mining tire exports to Russia, which has led to a temporary decline in overall shipments. That said, elevated demand in other markets has helped offset this headwind, as shipments were successfully re-routed to other regions. As Bridgestone finalizes its adjustments to existing production lines for Russian shipments, expect incremental earnings contribution from other regions going forward. Another key implication from the result is the potential share gains – for context, Michelin’s (OTCPK:MGDDF) production in Europe was impacted by procurement issues caused by the Russia/Ukraine conflict, so Bridgestone’s earning strength implies likely share gains in the mining tire market. In addition, accounting adjustments toward the fiscal year-end in response to the ongoing yen depreciation should also boost headline earnings in the coming quarters.

Raised Full-Year Guidance Signals Underlying Strength

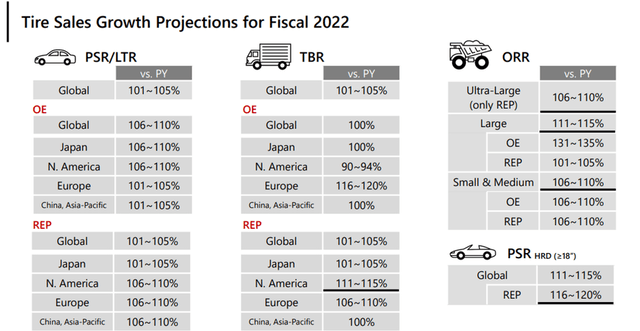

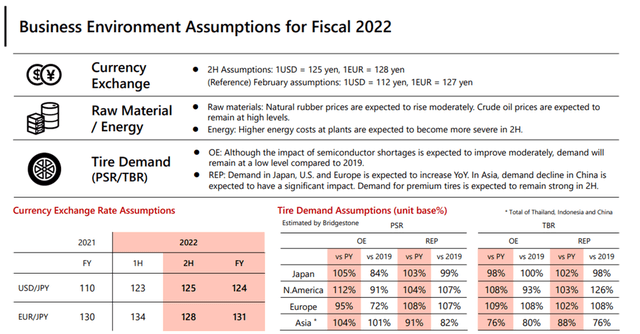

Building off the resilient quarter, Bridgestone has raised its full-year adjusted operating profit guidance to JPY450bn (up from JPY425bn prior). Most of the delta is attributable to a JPY25bn boost from price hikes and a JPY56bn boost from the weaker yen, partially offset by lower volumes and higher energy costs. By product, the company now expects sales growth of 1–5% YoY (vs. 6–10% YoY previously) for passenger car/light truck radial tires (PSR/LTRs) and 1–5% YoY (vs. 6–10% YoY previously) for commercial truck tires (TBRs). Similarly, the volume outlook was also lowered slightly for ultra-large ORR tires. By region, the revised operating profit guidance reflects downward revisions for Japan (-JPY18bn) but a +JPY21bn upward revision for North America. While the Japan segment should still benefit from yen depreciation, the downward revision likely reflects the impact of halting mining tire exports to Russia and relative difficulty in raising prices in Japan (compared to overseas). Though the North American segment is also experiencing challenges due to cost inflation, earnings levels are on the rise amid successful price hikes – a testament to the Bridgestone brand strength.

Bridgestone

There is some conservatism in the adjusted operating profit guidance, in my view, given it accounts for potential profit erosion from raw materials and energy. To recap, the company is guiding to a ~JPY50bn headwind from higher processing/manufacturing costs due to higher electricity prices and labor costs in Japan and overseas, while the rubber production volume growth assumption has also been lowered to +3% YoY or ~1.8m tons (down from 1.9m tons or +8% YoY prior). That said, the profit increase projected from selling prices affirms the underlying strength of the Bridgestone brand. As a result, even amid rising inflationary pressures, Bridgestone has been able to shift to a value-focused sales strategy (rather than volume). As one-off factors such as Russia, the China lockdowns, and costs related to a cyberattack in the US fade as well, underlying earnings have ample room to outperform guidance. The H2 2022 assumption of 125 JPY/USD could also prove conservative, given the current FX trend, and thus, I am upbeat on the near-term earnings outlook.

Bridgestone

Navigating the Macro Headwinds Unscathed

Bridgestone’s stock price has outperformed in recent months, and rightly so, given its best-in-class supply management capabilities that have allowed it to push through with product launches through a macro slowdown. Its leading brand and pricing power have also shone through, allowing the company to sustain profitability through a challenging auto production backdrop. Any auto downturn will likely prove cyclical, though, and as output inevitably recovers, Bridgestone is in a prime position to benefit.

While inflation is impacting household demand in the near term, particularly in the US, demand for large tires (>18 inches) and tires for mining vehicles should pick up the slack. As these products also offer greater scope for price hikes, expect the added benefit of product mix improvements and the increased contribution of high value-added products to kick in as well. The current ~10x P/E screens reasonably relative to the double-digit RoE, and even though the stock trades at a modest premium to its key peer Toyo Tires, Bridgestone’s competitiveness in high value-added tire products, as well as its net cash balance sheet and potential restructuring benefits, more than justify the valuation. Key upcoming catalysts include Bridgestone’s long-term strategy update at the end of this month, where management will likely provide incremental color on the buildout and monetization of the EV tires and solutions businesses.

Be the first to comment