CleoFilter

A Quick Take On Ruanyun Edai Technology

Ruanyun Edai Technology (RYET) has filed to raise $27.5 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm provides academic information and related technologies to K-12 schools in China.

Given the company’s many risks, slow revenue growth, and high valuation expectations, my outlook on RYET is on Hold.

Ruanyun Overview

Nanchang, China-based Ruanyun Edai Technology was founded to develop an Ai-enabled ‘question bank’ and related test data to assist teachers and students in collecting daily homework and prepare for a test of the Academic Proficiency Assessment.

Management is headed by founder and CEO Ms. Yan Fu, who has been with the firm since its inception in 2012 and was previously director of quality assurance at IgnitionOne and a principal quality assurance analyst at Manhattan Associates.

The company’s primary offerings include:

-

AI learning platform

-

Smart Homework

-

SmartExam

-

Test Preparation

As of March 31, 2022, Ruanyun has booked fair market value investment of $15.2 million from investors, including KWest Holdings, ZC Investment, Four Ocean Holding, Chao Xian Holding, LBH Hope Investment, and Five Mountains Holding.

Ruanyun – Customer/User Acquisition

The firm seeks to build strategic business alliances with large national publishers in China.

As of March 31, 2022, the company had 10,195 premium paying subscribers and 276,340 monthly active users.

As of November 30, 2022, the firm had ‘over 13.26 million K-13 students who were using our online SmartHomework learning platform, of which approximately 1 million were monthly active users.’

Selling expenses as a percentage of total revenue have risen as revenues have increased, as the figures below indicate:

|

Selling |

Expenses vs. Revenue |

|

Period |

Percentage |

|

FYE March 31, 2022 |

17.1% |

|

FYE March 31, 2021 |

12.9% |

(Source – SEC)

The Selling efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Selling spend, was 0.6x in the most recent reporting period. (Source – SEC)

Ruanyun’s Market & Competition

According to a 2019 market research report by iResearch, China’s online education market was valued at about $9.9 billion in 2012, reached $35.2 billion in 2018, and is expected to exceed $76 billion by 2025.

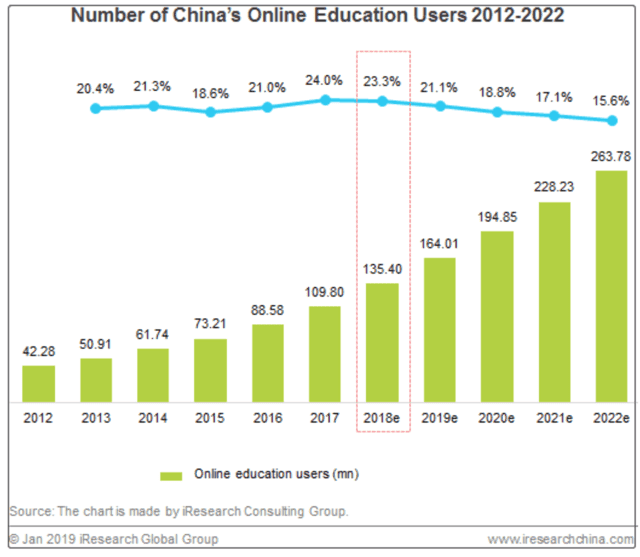

The number of China’s online education paying users reached an estimated 135.4 million in 2018, an increase of 23.3% year-over-year, as shown by the chart below:

China Online Education (iResearch China)

The main drivers for this expected growth are the increasing acceptance of online education among users, improving online service payment willingness, and enhancements in online learning experience and effectiveness.

Also, the firm competes with other online educational services providers, offline service providers, and large private education companies.

Ruanyun Edai Technology Financial Performance

The company’s recent financial results can be summarized as follows:

-

Slowly growing top line revenue from a small base

-

Increasing gross profit and gross margin

-

A swing to operating loss

-

Increasing cash used in operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

FYE March 31, 2022 |

$ 12,803,123 |

11.3% |

|

FYE March 31, 2021 |

$ 11,499,442 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

FYE March 31, 2022 |

$ 5,622,797 |

44.7% |

|

FYE March 31, 2021 |

$ 3,884,492 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

FYE March 31, 2022 |

43.92% |

|

|

FYE March 31, 2021 |

33.78% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

FYE March 31, 2022 |

$ (777,834) |

-6.1% |

|

FYE March 31, 2021 |

$ 9,081 |

0.1% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

FYE March 31, 2022 |

$ (593,963) |

-4.6% |

|

FYE March 31, 2021 |

$ 825,095 |

6.4% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

FYE March 31, 2022 |

$ (2,551,753) |

|

|

FYE March 31, 2021 |

$ (1,619,828) |

|

(Source – SEC)

As of March 31, 2022, Ruanyun had $1.1 million in cash and $7.4 million in total liabilities.

Free cash flow during the twelve months ended March 31, 2022, was negative ($3.1 million).

Ruanyun Edai Technology IPO Details

Ruanyun intends to raise $27.5 million in gross proceeds from an IPO of its ordinary shares, offering 5 million shares at a proposed midpoint price of $5.50 per share.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $172 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 14.3%. A figure under 10% is generally considered a ‘low float’ stock, which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

approximately 30% of the net proceeds of this offering for research and development of new products and services, approximately 25% for marketing and customer services, approximately 25% for new content creation, approximately 5% for cash reserves and approximately 15% for working capital and general corporate purposes, including, without limitation, costs to set up two additional regional offices.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said any ‘ordinary course matters will not have a material adverse effect’ on its financial condition or operations.

The listed bookrunners of the IPO are Univest Securities and AC Sunshine Securities.

Valuation Metrics For Ruanyun

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$192,500,022 |

|

Enterprise Value |

$171,711,032 |

|

Price / Sales |

15.04 |

|

EV / Revenue |

13.41 |

|

EV / EBITDA |

-220.76 |

|

Earnings Per Share |

-$0.02 |

|

Operating Margin |

-6.08% |

|

Net Margin |

-4.64% |

|

Float To Outstanding Shares Ratio |

14.29% |

|

Proposed IPO Midpoint Price per Share |

$5.50 |

|

Net Free Cash Flow |

-$3,140,721 |

|

Free Cash Flow Yield Per Share |

-1.63% |

|

Debt / EBITDA Multiple |

-5.86 |

|

CapEx Ratio |

-4.33 |

|

Revenue Growth Rate |

11.34% |

(Source – SEC)

Commentary About Ruanyun’s IPO

RYET is seeking U.S. public capital market investment to fund its continued R&D efforts and general corporate expansion plans.

The firm’s financials have produced growing top line revenue from a small base, higher gross profit and gross margin, a swing to operating loss, and growing cash used in operations.

Free cash flow for the twelve months ended March 31, 2022, was negative ($3.1 million).

Selling expenses as a percentage of total revenue have risen as revenue has grown; its Selling efficiency multiple was only 0.6x in the most recent fiscal year.

The firm currently plans to pay no dividends and to retain any future earnings to reinvest back into its growth plans.

RYET’s trailing twelve-month CapEx Ratio was negative (4.33), which indicates it has spent significantly on capital expenditures despite its negative operating cash flow.

The market opportunity for K-12 education services in China is large but has been whipsawed by unpredictable government regulatory changes in recent years.

Like other Chinese firms seeking to tap U.S. markets, the firm operates within a VIE structure or Variable Interest Entity. U.S. investors would only have an interest in an offshore firm with contractual rights to the firm’s operational results but would not own the underlying assets.

This is a legal gray area that brings the risk of management changing the terms of the contractual agreement or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

Additionally, the Chinese government’s crackdown on IPO company candidates combined with added reporting requirements from the U.S. side has put a serious damper on Chinese IPOs and their post-IPO performance.

A significant risk to the company’s outlook is the uncertain future status of Chinese company stocks in relation to the U.S. HFCA act, which requires delisting if the firm’s auditors do not make their working papers available for audit for three years by the PCAOB.

Additionally, post-IPO communications from the management of smaller Chinese companies that have become public in the U.S. has largely been spotty and perfunctory, indicating a lack of interest in shareholder communication, only providing the bare minimum required by the SEC and representing a very different approach to keeping shareholders up-to-date about management’s priorities.

Univest Securities is the lead underwriter and IPOs led by the firm over the last 12-month period have generated an average return of negative (62.7%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Risks to the company’s outlook as a public company include unpredictable Chinese government actions in the sector with respect to industry structure, rules, and regulations.

As for valuation, management is asking investors to pay an Enterprise Value/Revenue multiple of approximately 13.4x, a high valuation expectation given the firm’s slow revenue growth.

RYET is one of several Chinese education technology firms that has attempted to go public and I’m not optimistic about its chances of business success for investors.

Given the company’s many risks, slow revenue growth and high valuation expectations, my outlook on RYET is on Hold.

Expected IPO Pricing Date: To be announced.

Be the first to comment