Diana Herashchenko/iStock via Getty Images

Most investors are familiar with the payment company Stripe.

While it’s still private, Stripe is a behemoth. The company is one of the world leaders in payment processing. It recently said it processed $640B of payments in 2021 (+60% Y/Y). According to The Wall Street Journal, Stripe cut its internal valuation by 28% to $74B last month.

However, another payment giant has been performing at breakneck speed in recent years: Amsterdam-based Adyen (OTCPK:ADYEY) (OTCPK:ADYYF).

Adyen processed €516B in payments in 2021 (+70% Y/Y), so the company seems to have a slightly superior momentum. Adyen’s market cap, below $50B after falling 55% in the past year, also piqued my curiosity.

The company only reports its performance semi-annually (every six months) and just released its first half performance. So it’s an excellent opportunity to take stock of where the company is and review why investors should pay attention.

Let’s dive in.

A New Segmentation Highlighting Platforms

Adyen used to break down its business between Enterprise (processed volume > €25M), Point-of-Sale, and Mid-market (processed volume < €25M).

If Stripe is well known for addressing SMBs (small-and-medium-sized businesses), Adyen has been focused first and foremost on enterprise clients (Enterprise volume was 98% of the overall volume in H2 FY21).

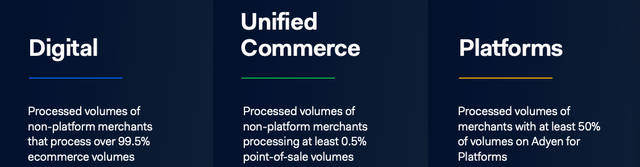

However, this segmentation is evolving in 2022 with the following breakdown:

New business segments (Adyen Capital Market Days)

- Digital (e-commerce): 63% of volume (+55% Y/Y).

- Unified Commerce (mix of e-commerce and POS volume): 23% of volume (+83% Y/Y). Of the Unified Commerce volume, the POS portion is increasing, reaching 53% in H1 FY22 (+2pp Y/Y). Unified Commerce has become a critical strategic initiative for Adyen. The premise is that merchants need to offer a seamless shopper journey (from self-checkout to ordering online to picking up in-store). This new focus has led to the launch of Adyen’s first in-house-built terminals alongside Tap to Pay on iPhone in collaboration with Apple. The company’s investment in Unified Commerce is paying off, as illustrated by the fastest growth across all segments.

- Platforms (at least 50% of volume on Adyen for Platforms): 14% of volume (+53% Y/Y). Adyen partners with platform businesses (think Amazon Marketplace or Etsy) to address smaller merchants. With powerful network effects, marketplaces are expected to continue to grow the long tail of the market. Small merchants have Unified Commerce needs, and Adyen wants to be their partner of choice.

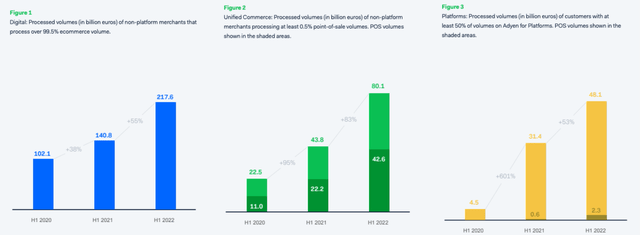

Processed Volume by Segment (Adyen H1 FY22 Shareholder Letter)

According to McKinsey & Company:

Marketplaces such as Amazon Marketplace, eBay, Etsy, Walmart Marketplace, and Wayfair continue to capture a significant share of the SMBs and microbusinesses that are shifting to e-commerce. Overall, we expect 50 to 70 percent of digital commerce will be conducted on these platforms by 2025, albeit with differences between markets. We can expect this shift to apply across multiple industries, including media (such as TikTok), retail (such as Amazon and MercadoLibre), and travel and hospitality (such as Airbnb).

Powering a broad range of platform business models.

Platform examples (Adyen Capital Market Days)

Many of these large platforms and marketplaces are among Adyen’s customers globally. So better serving them and growing alongside their merchants is a natural next step.

Adyen for Platforms is still the smallest segment, and it may take years before we see a meaningful change. However, there is a new catalyst at play for the company. Let me explain.

A New Catalyst For Adyen: Banking-as-a-Service

If you have followed me for some time, you know I’m a long-term focused investor. As a result, I generally hold positions for no less than five years, ideally a lot longer.

So when I talk about a catalyst, I don’t mean the next five weeks or the next five months. I’m referring to the next five years.

After making 98% of its volume from Enterprise customers, Adyen is embarking on a journey to serving SMBs and becoming a one-stop shop for all their needs.

If it sounds to you like competing directly with other companies like Stripe or Block (SQ), you’d be correct.

So how does Adyen intend to serve SMBs?

- Unified Commerce tools.

- Regulatory compliance.

- Consolidated services all in one place.

The SMB opportunity (Adyen Capital Market Days)

This new focus on SMBs brings us to a significant revenue opportunity in the years ahead: the Adyen embedded financial product suite.

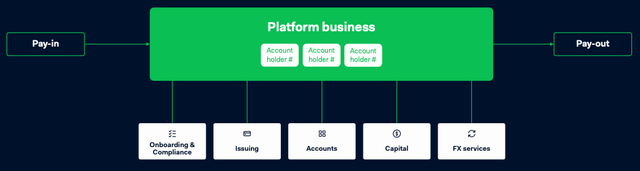

Adyen invested in its own banking infrastructure in the US and Europe. In parallel, Adyen recognized the potential market for helping SMBs run their financial process by offering embedded payments. They see what they call the “banking-as-a-service revolution,” and management believes Adyen is uniquely positioned to address this market from the Platform angle.

In short, imagine small merchants selling products on Etsy (ETSY) and processing payments via Adyen. These low-hanging fruits have tremendous potential for added services and incremental revenue.

Adyen wants to offer a single platform for embedded payments, finance, and compliance:

- Onboarding and compliance.

- Issuing (branded cards).

- Accounts.

- Capital.

- Fx services.

Embedded financial product suite. (Adyen Capital Market Days)

These embedded financial products can help merchants succeed and grow. You might recognize the path embraced by Block, the artist formerly known as Square. The launches of Square Capital and Square Banking have been a great fit for merchants already working with Square’s POS system.

For Adyen, it all comes down to the Platform angle.

Do you think platforms like TikTok, Airbnb (ABNB), Uber Eats (UBER), Etsy, or MercadoLibre (MELI) are here to stay and grow for the foreseeable future?

Now imagine a comprehensive banking-as-a-service solution addressing sellers on these platforms. The long-term opportunity is gigantic.

To win over time, Adyen has the following competitive strengths:

- Fully-integrated proprietary platform, which allows the company to support merchant growth around the world and across channels.

- Data-centric solutions can increase revenue by developing new features and services in a co-creation process with merchants.

- An experienced management team that actively fosters an entrepreneurial culture.

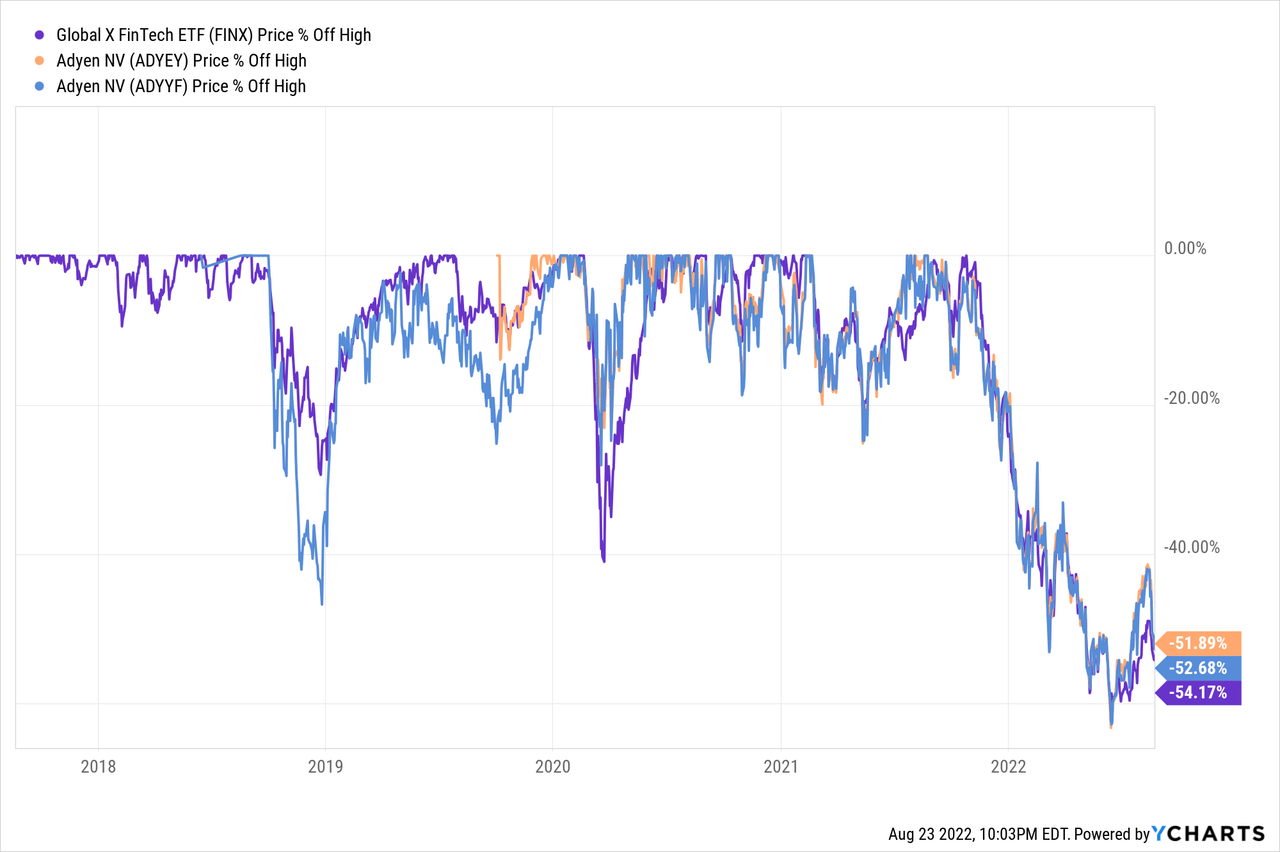

Meanwhile, the market has punished the entire fintech space, as illustrated by the Global X FinTech Thematic ETF (FINX), currently trading 54% down from the previous high. And Adyen is no exception.

In this environment, the market is not willing to give Adyen the benefit of the doubt with its new initiative. I believe investors with a multi-year time horizon could be handsomely rewarded.

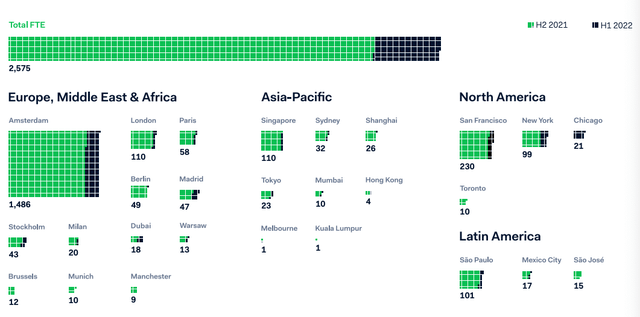

Growing headcounts

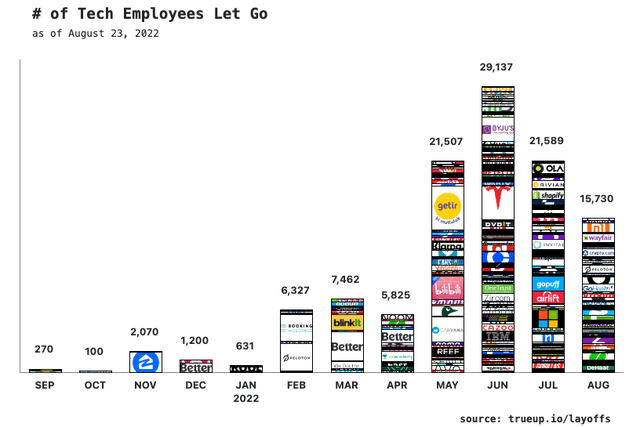

We are all too familiar with tech layoffs in 2022. The chart below illustrates how the past seven months have been devastating.

While large tech companies in the US are freezing hiring and parting ways with their contractors, Adyen is walking to the beat of its own drum.

Adyen accelerated its hiring pace in H1 2022, illustrating the strong business momentum compared to other tech businesses. The company counted 2,575 full-time employees at the end of H1 FY22 (+32% Y/Y and +18% in the past six months).

Adyen FTEs (Adyen Shareholder Letter)

When it comes to culture and leadership, Adyen is doing something right. While a company like Stripe is seeing a deterioration of its Glassdoor ratings, Adyen remains one of the top-rated companies on the platform with no sign of weakness in the past year.

Adyen has received many awards and accolades over the years, and I encourage you to watch their earnings discussions to appreciate the level of transparency provided.

Adyen Awards & Accolades (Glassdoor) Adyen Reviews (Glassdoor)

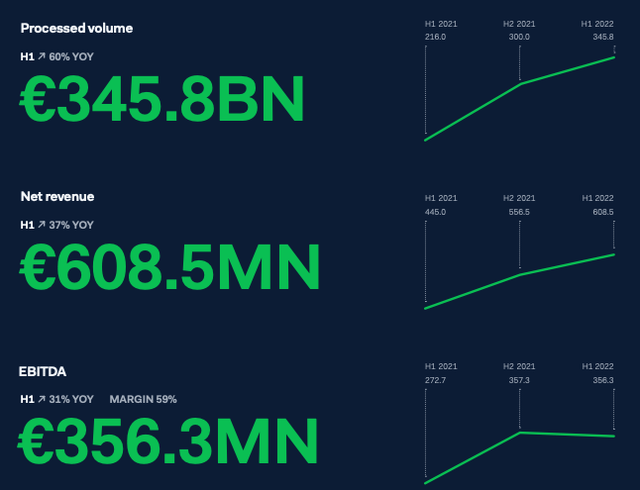

H1 FY22 Highlights

The success of Adyen’s global payments platform shows in its operating and financial track record to date.

Important note: Adyen is a Dutch company and reports its performance on a semi-annual basis (every six months). The most recent earnings report is for the first half of FY22. The next earnings report will be in 2023 for H2 FY22.

Net revenue is a non-IFRS metric (the equivalent of non-GAAP for non-US companies). However, it better represents the company’s performance than revenue.

Adyen H1 FY22 Metrics (Shareholder Letter)

Key Metrics:

- Processed volume was €346B (+60% Y/Y), vs. +72% Y/Y in H2 FY21.

- Of this volume, point-of-sale volume was €45B (+97% Y/Y).

- Take rate was 17.6bps (vs. 18.6bps in H2 FY21 and 20.6bps in H1 FY21).

Volume breakdown:

- Digital: €218B (+55% Y/Y) (digital-only merchants).

- Unified Commerce: €80B (+83% Y/Y) ([Digital+POS] merchants).

- Platforms: €48B (+53% Y/Y) (platform businesses).

In line with previous periods, 80% of the growth came from existing customers, and volume churned remained < 1%.

With excellent retention and expansion, the metrics that matter for the long-term look good.

Financials:

- Net revenue was €609M (+37% Y/Y) vs. +25%-35% CAGR guidance.

- Net income was €282M (+38% Y/Y).

- EBITDA of €356M (+31% Y/Y).

- EBITDA margin at 59% (vs. 65% long-term guidance).

- Free cash flow was €309M (+25% Y/Y).

- Free cash flow conversion ratio was 87%.

- CapEx at 6.6% of net revenue (vs. 5% guidance).

- Balance Sheet: Cash and equivalents: €5.6B. Long-term debt: €0.2B.

Guidance:

Management explained:

We maintain our long-term outlook amid increased investments in building the next phase of Adyen.

- Net revenue growth: 25%-35% CAGR.

- EBITDA margin: improving and north of 65% in the long term.

- Capital expenditure of up to 5% of net revenue.

The unchanged long-term guidance illustrates why the past six months have not changed the long-term thesis.

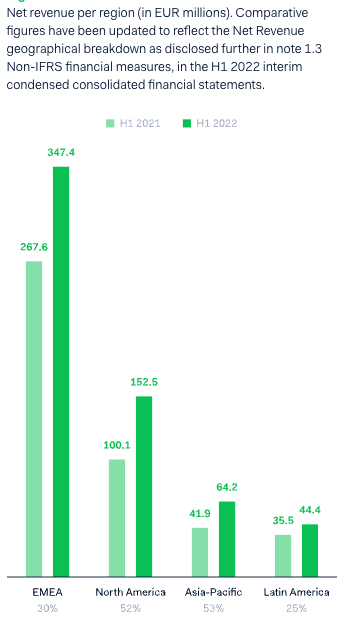

The breakdown by territory shows Adyen roots in Europe:

- EMEA: 57% of revenue (+30% Y/Y).

- North America: 25% of revenue (+52% Y/Y).

- Asia-Pacific: 11% of revenue (+53% Y/Y, accelerating).

- Latin America: 7% of revenue (+25% Y/Y, accelerating).

Net revenue per region (Adyen Shareholder Letter)

Of note, competitor DLocal (DLO) just reported its performance in Q2 FY22. The Uruguay-based payment platform is processing a larger volume than Adyen in LATAM and is growing much faster in that region (+63% Y/Y). So for now, DLocal appears to be the winner in this area of the world.

Net Revenue grew slower than processed volume because Adyen’s take rate decreases when customers bring more volume to the platform (tiered pricing).

CFO Ingo Uytdehaage explained on the call:

If a merchant brings more volume over time, you get lower price per transaction. So, decline in take rate. And that’s still the case. So, that’s a real driver in combination with the fact that the full-stack percentage has gone down. So, these are the drivers. It’s also the reason why we don’t really manage on take rate. We manage on absolute margins. And indeed if we continue to grow large enterprises on our platform, then there will be some pressure on take rates, which we think is a positive because then we are growing the business and that is actually what we want to achieve.

Net revenue growth was ahead of management’s long-term CAGR guidance, so there is nothing thesis-breaking here.

However, the company fell short of the EBITDA guide in the first half, with a 59% EBITDA margin (-2pp Y/Y and -5pp Q/Q).

The main reason? Travel expenses were partially to blame due to a return to in-person events after a long COVID-induced hiatus.

Capex were 6.6% of revenue, slightly worse than the 5% guidance. Why? Adyen invested in its data center infrastructure at a larger scale than expected to ensure that supply chain disruption won’t hinder the platform’s scalability. As a result, management considers this miss a non-recurring issue.

Again, the long-term profitability guidance (65% margin) remained unchanged. So it’s not a big concern for me.

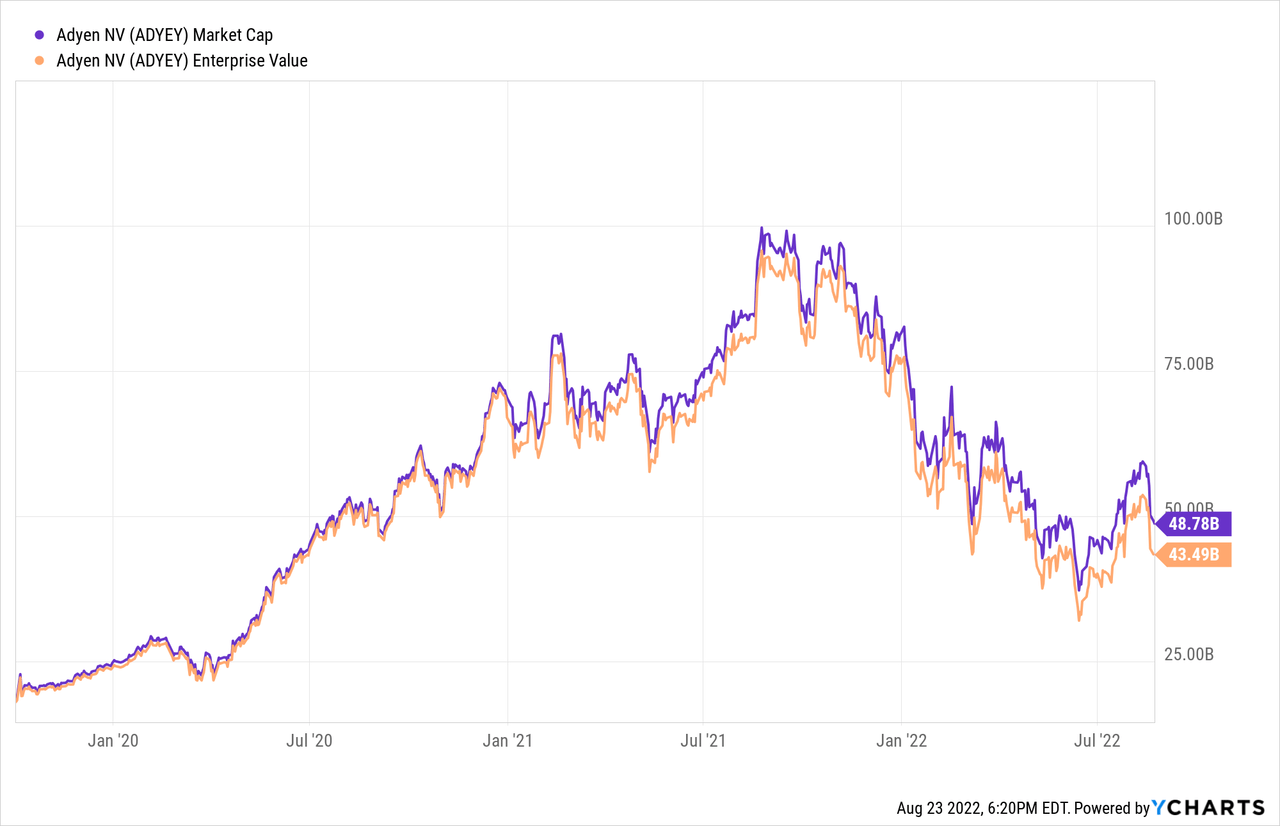

Adyen Stock Valuation: 2-year Low

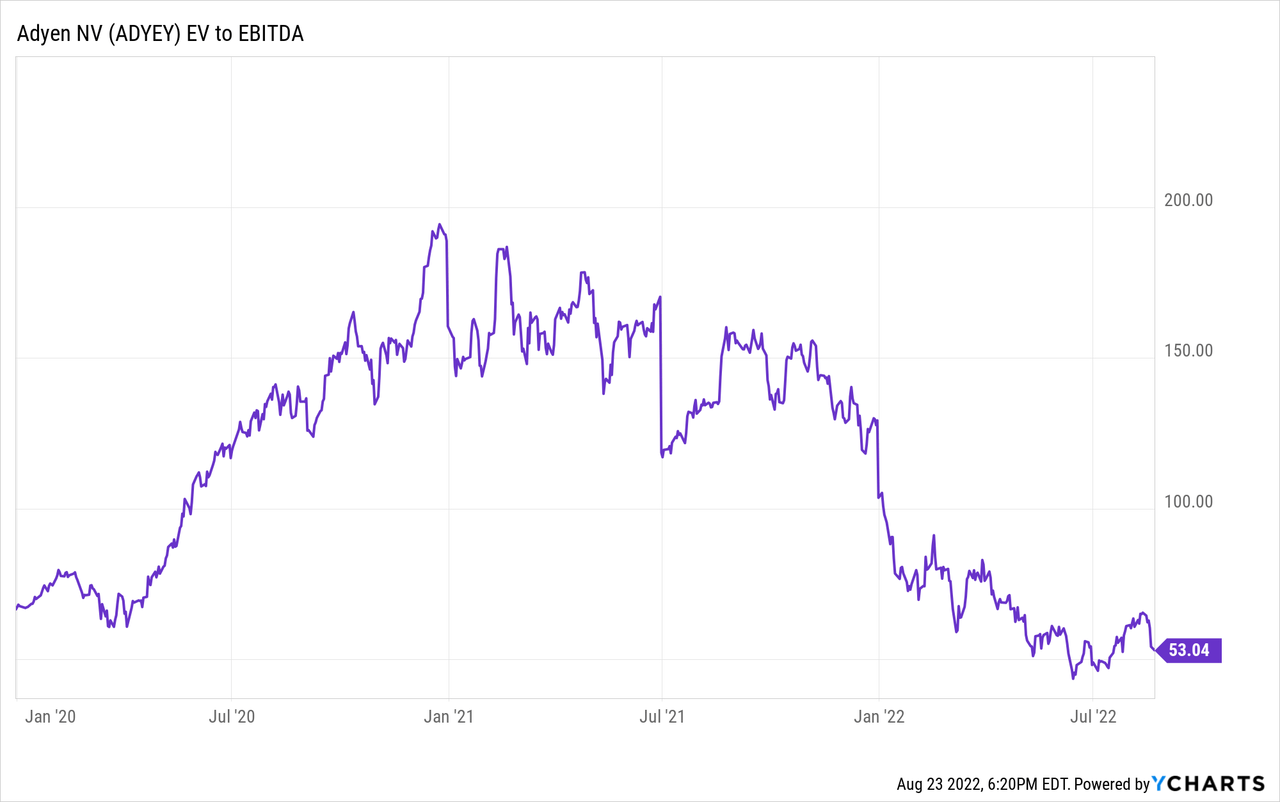

Adyen has an Enterprise Value of ~$43B today, essentially trading where it was two years ago.

Adyen is now trading on the low-end of its valuation spectrum, at about 53x EBITDA. Admittedly, it’s not a cheap multiple, but it has never been cheaper since the IPO.

Despite re-accelerating revenue growth, Adyen is at an all-time low on its EV-to-EBITDA spectrum.

Adyen net revenue trend:

- FY17 = €218M (+54% Y/Y).

- FY18 = €349M (+60% Y/Y).

- FY19 = €534M (+53% Y/Y).

- FY20 = €684M (+28% Y/Y).

- FY21 = €1.0B (+46% Y/Y).

- H1 FY22 = €0.6B (+37% Y/Y).

Adyen made €595M in operating income in FY21. Based on guidance, operating income could reach €1B by FY24.

I consider an investment worthwhile if I see a chance to double my money every five years, which is enough to beat the market by a wide margin.

Given the company’s growth profile, it could “grow into” its valuation rapidly. By sustaining revenue growth of ~30%, operating income could be north of €2B in five years. In addition, Adyen could accumulate close to €5B in cash over that time. If valued at 30-40 times EBITDA by then, I see a path for the company to be worth north of €80B by simply meeting management’s near-term outlook.

Of course, the SMB opportunity discussed above is the cherry on top here, and I believe it could lead to even more alpha over the next five years.

Bottom Line

To wrap it up:

- Opportunities:

- Unified Commerce is the next phase of growth for Adyen. H1 FY22 provided more evidence of its success, with processed volume growing +83% Y/Y and POS becoming a key driver.

- Banking-as-a-service for SMBs could become a new catalyst for the company for the years to come by addressing merchants operating on Platforms, from TikTok to Airbnb.

- Management sees a 25%-35% CAGR revenue growth combined with exceptional margins, which could lead to optionality with new solutions over time.

- Risks:

- The take rate is expected to decrease as processed volume increases (tiered pricing). As a result, it could lead to a “race to the bottom,” eating away at the overall opportunity.

- Fintech is a fiercely competitive landscape between local players like DLocal (DLO) in LATAM, Fiserv (FISV), and its point-of-sales solutions a la Square, or initiatives from global payment networks such as PayPal (PYPL), Visa (V) and Mastercard (MA).

- Targeting SMBs comes with new competitors like Stripe to Square, which could lead to a challenging growth path.

- In the short term, Adyen could face a slowdown alongside its customers if we face a macro slowdown (but you already knew that).

Adyen has the trajectory of a secular grower, creating tremendous value for its customers, employees, and shareholders.

What about you?

- Do you like Adyen’s long-term potential from here?

- Has the valuation cooled down enough?

- What are the main risks and opportunities you see for the company?

Let me know in the comments!

Be the first to comment