NicoElNino

In the following article, I’ll take a look at the popular software company Palantir Technologies (NYSE:PLTR). I’ll conduct a deep dive into the company’s business model, why I like the business and some key problems that have kept me from owning the stock.

As Palantir has grown in popularity, specifically within the Seeking Alpha community, I will be as unbiased as possible and approach this business from a fresh lens. The goal is to create constructive dialogue in the comments about the business, regardless of the investment recommendation.

Business Overview

Founded in 2003, Palantir builds software that empowers organizations to integrate their data and operations at scale. What started as software aimed at assisting in counterterrorism investigations is now a multi-billion dollar company serving both government and commercial clients through its three core software platforms.

1. Gotham

Primarily used by government clients, Gotham allows users to identify patterns deep within data sets such as intelligence sources and reports from informants. Further, the software enables the hand-off of data between analysts and operational users, thereby making it easier for operators to respond to real-world threats, thereby simplifying operators’ responses to real-world threats.

2. Foundry

Foundry allows users to create a central operating system for its data, allowing integration and analysis in one place. Palantir identifies this as its stickiest product and claims all of its commercial clients use the software. The main benefit of Foundry is the ability to test new ideas quickly.

3. Apollo

The newest software of the three, launched in 2021, allows customers to deploy their own software in virtually any environment.

Revenue Segments

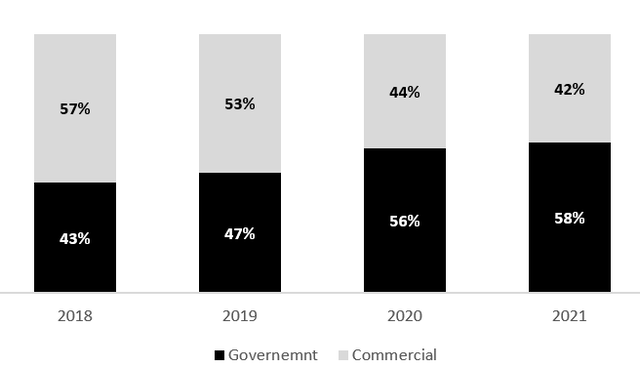

While the business offers three software products, PLTR reports revenue under two operating segments: government and commercial. In F’21, approximately 58% of revenue was generated through government customers, and 42% from the commercial segment. As depicted below, the government segment has grown as a percentage of revenue over the last three years.

Author Created (Company Filings)

Bullish Thoughts

Growth

Despite its balanced customer base, Palantir’s government revenue has witnessed exceptional growth over the three-year period as a segment of revenue. Even with the massive growth of its commercial customers, PLTR’s government revenue has been absolutely monstrous.

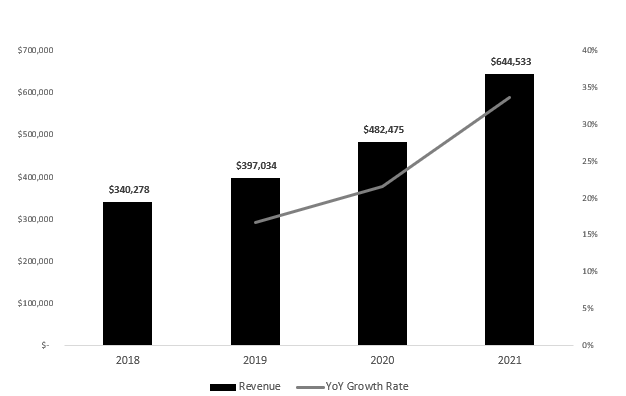

As depicted below, PLTR’s commercial revenue has grown exceptionally over the last four years (24% CAGR), albeit less than its government segment.

Commercial Revenue (Company Filings)

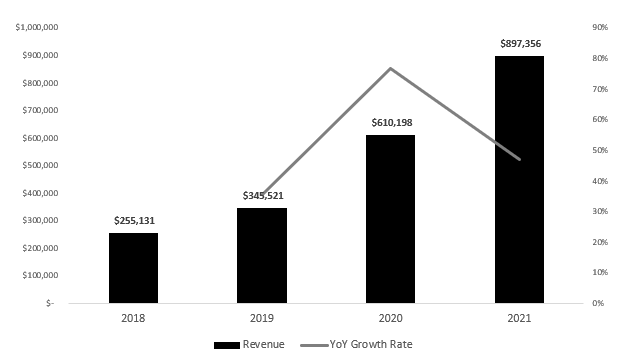

In spite of the massive commercial growth, PLTR’s government revenue more than tripled over the last 3-years (52% CAGR).

Government Revenue (Company Filings)

It’s clear PLTR didn’t rest on its laurels with its commercial success, with robust top-line growth across both segments posting $1.5B in F’21 revenue. In the first 2 quarters of F’22, PLTR has generated ~$919 million in sales, expecting $1.9B in 2022 revenue (27% YoY growth).

The Street did not react positively to the most recent earnings call, but we’ll get to that later on.

Switching Costs & Strong Customer Base

In Palantir’s line of business, switching costs are quite high within its customer base. Governments and commercial clients are unlikely to switch platforms as it can cause a heavy burden and inconvenience.

Many software companies benefit from switching costs as clients realize the benefits of using the software. Nonetheless, I believe Palantir’s switching costs are much higher than traditional SaaS companies due to the nature of its business and the types of customers it serves.

SaaS companies such as Twilio (TWLO), Olo (OLO), and Trade Desk (TTD), to name a few, utilize its software to assist outdated industries such as restaurants and advertising. However, the stakes are much higher for Palantir, whose customers span from the likes of the U.S. Army to NCMEC ((National Center for Missing & Exploited Children)), and deal with issues such as counterterrorism, child abuse, and large-scale financial fraud. Without discrediting the aforementioned SaaS companies above, Palantir’s software is used in high-pressure situations, and any mistakes can result in severe repercussions.

In short, Palantir’s customers are likely to thoroughly vet any software platform prior to usage – the US Army and NCMEC will not simply sign on any software business without doing its homework.

Furthermore, PLTR’s work with Airbus (OTCPK:EADSF) led to the development of Skywise, a central operating system for the airline industry. Connecting over 9,000 aircraft across 100 airlines, it’s safe to say that PLTR’s customer base is different than your traditional SaaS company.

Hence, if PLTR continues to pull the right growth levers and demonstrates its value-add services to its already strong customer base, a durable moat can be built around the software business.

In Q1 and Q2 of F’22, PLTR posted net dollar retention of 124% and 119%, respectively, signaling customer willingness to adopt the platform and spend more.

Attractive Business Model

The high growth and recurring subscription revenue make for a strong business model. As Palantir creates a lock-in effect amongst its customers, it will continue to generate high-margin revenue and provide value to its clients.

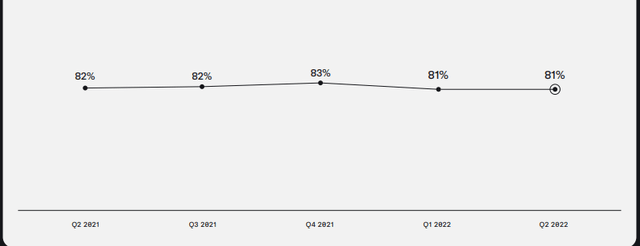

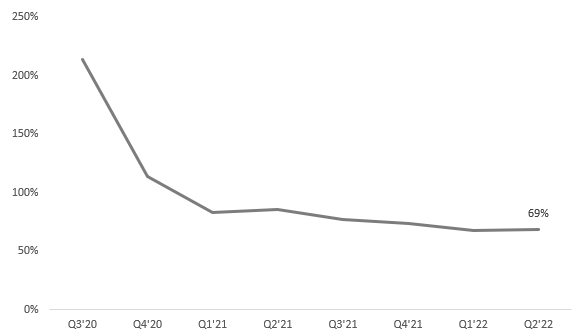

Gross Margins (Earnings Presentation)

Above 80% gross margins demonstrate Palantir’s ability to generate revenue through minimal input costs.

Bearish Thoughts

Bottom Line Still Matters

In spite of its exceptional revenue growth and strong gross margins, the bottom line still matters. In spite of its revenue growth, PLTR has yet to turn a profit on a GAAP basis, with a net loss of over half a billion dollars in 2021.

The following chart depicts SG&A as a percentage of revenue. While PLTR has significantly reduced this number, 69% is still very high.

Presentation

Nevertheless, this is an area PLTR continues to improve on, generating $300 million in free cash flow. While it may not be profitable yet, investors can rest assured this is an area Palantir is focusing on. Management noted that PLTR will aim to be profitable by 2025:

That combination of radical optionality on expenses and what we perceive to be macro conditions converging with product conditions allow us to kind of see what we think will be a profitable company in 2025.

Nonetheless, 3-years is what management thinks will be the inflection point of profitability for Palantir. Quite a long wait for an uncertain answer regarding profitability.

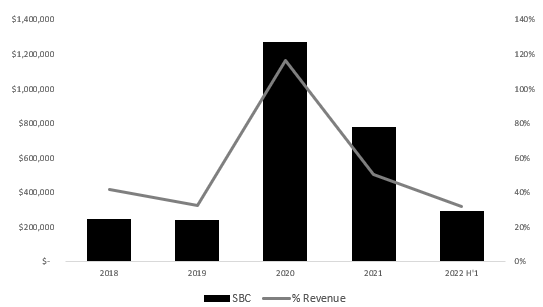

Stock-Based Compensation

Many small and high-growth prefer paying employees in stock options, saving cash for reinvestment. While exceptional for employees, shareholders are punished by dilution if the company abuses this form of compensation.

Author Created (Company Filings)

Regardless of the decreasing SBC trends, PLTR allocated a whopping 50% of revenue to SBC in F’21, further diluting shareholders.

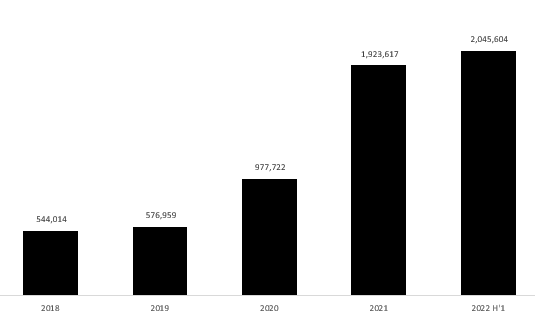

It is clear based on the weighted-average shares outstanding that Palantir shows no signs of slowing down in issuing common stock. The chart below shows the increase in shares outstanding from 2018.

Author Created (Company Filings)

Expectations

Since the onset of COVID, many technology companies skyrocketed in value due to demand shocks caused by COVID-19. However, the reason behind this was due to high future growth expectations. Since the public markets are a forward-looking mechanism, if high future growth is forecasted, it is likely the stock will increase in value. Yet, if those expectations are revised (negatively), the opposite happens, and the business will lose value quickly.

The case with Palantir was the latter, as revenue growth expectations were not met in the first half of 2022. In Q4’20, management made a commitment to keep growth at or above the 30% (annually) mark.

And to do that, we’re providing long-term guidance pretty radical in the sense that we are committing to keeping a growth threshold of above 30% for the next five years

CEO Alex Karp reiterated this target not too long ago in Q1’22, stating that:

we are providing and will continue to provide guidance of 30% or greater revenue growth for this year and the next 3 years at each earnings call.

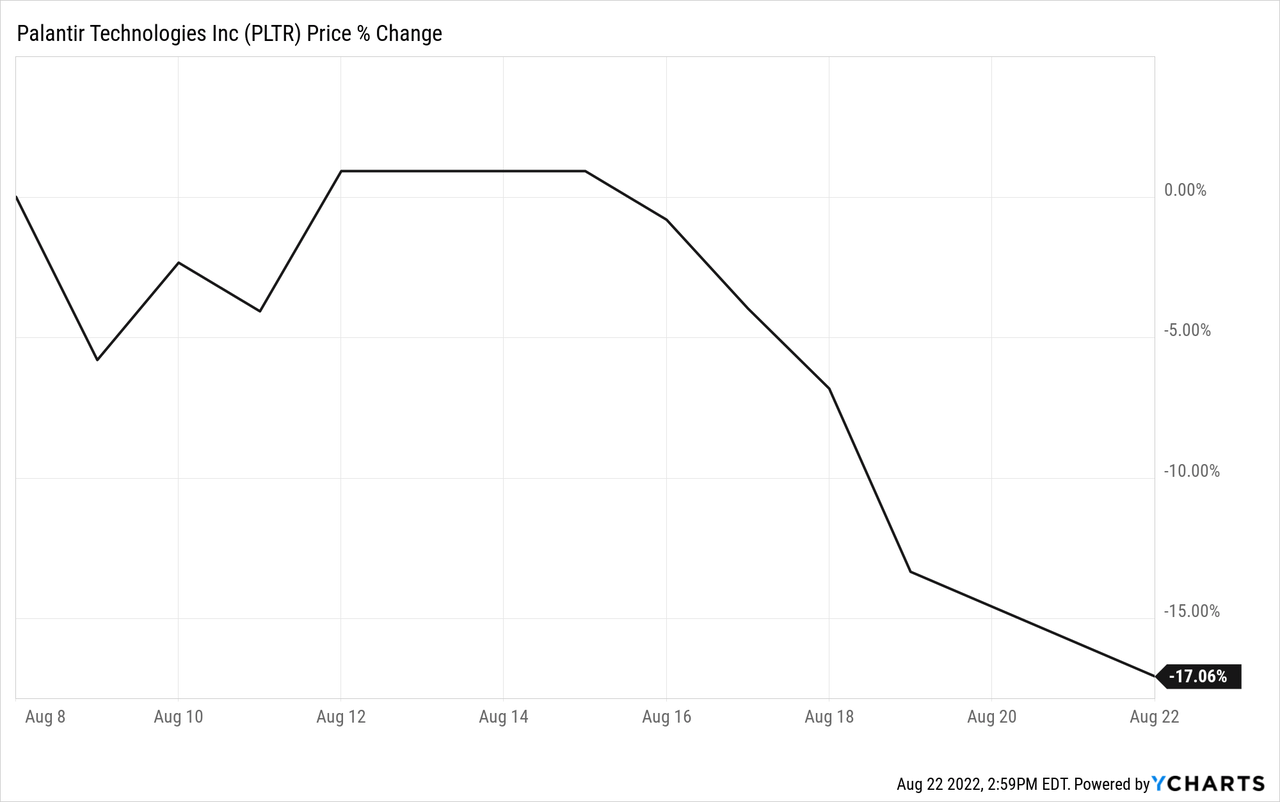

Quarterly Mess

Since releasing earnings on August 8th, the Street sold this stock off without hesitation. The crux of the matter appeared to be two-fold.

1. A slowdown of its government business

As mentioned above, PLTR’s government business is a source of the company’s monstrous growth. As a key component of the investment thesis, the Street did not take kindly to the mere 13% YoY growth in Palantir’s government segment.

YoY Government Revenue Growth Rate

| Q3’20 | Q4’20 | Q1’21 | Q2’21 | Q3’21 | Q4’21 | Q1’22 | Q2’22 |

| 68% | 85% | 76% | 66% | 34% | 26% | 16% | 13% |

Of course, extremely high growth rates are difficult to sustain over time, and too much optimism surrounding PLTR’s government business appeared to have been priced into the stock.

2. Reduced full-year guidance, breaking the “30%” commitment

Palantir also reduced its full-year guidance in revenue to $1.9B, implying a YoY growth rate of 23%, 7 points lower than the 30% threshold management was confident it could achieve. In the case of “high-growth” stocks such as Palantir, any adjustment in guidance can have a significant impact on a company’s share price, and PLTR shareholders have fallen victim to significant losses.

Concluding Thoughts

While short-term headwinds do in fact provide investors with buying opportunities, the issue lies in whether PLTR is a good investment today.

Guidance aside, Palantir has reported some exceptional top-line growth since 2018. With strong DBNRR, PLTR can benefit from switching costs and generate a strong moat.

However, all investments come with risk, and it is the job of the investor to identify if they are willing to undertake X amount of risk for a certain reward.

The lack of profitability, reduced guidance, high multiple, and increasing share count is not comforting qualities of a business. Despite the attractive business model and strong customer base, there are simply too many risks, including financial uncertainty, to deploy capital into Palantir at the moment.

For the reasons stated above, I will implement a Hold recommendation on Palantir. As I am not a shareholder myself, I believe there are plenty of other investments with a stronger risk-reward profile than Palantir. Of course, determining such investments is dependent on one’s risk tolerance.

All-in-all, I’d sit on the sidelines and urge investors to find better places to park their hard-earned capital.

Be the first to comment