BalkansCat/iStock Editorial via Getty Images

Investment Thesis

Xerox (NASDAQ:XRX) is now trading at levels not seen since it IPOed in June of 1982. While the reasons for this seem obvious, namely, a decline in its printing business, the company is significantly undervalued and is progressively transforming its business model from traditional printing to a business that is capitalizing on disruptive innovations. Now, this is not to say that Xerox is a de facto venture capital firm which has become so by way of a reluctance to return capital to shareholders. In fact, Xerox has committed to a “policy of returning at least 50% of our annual free cash flow to shareholders,” and quite often, they return well in excess of 50% of FCF to shareholders. With a forward FCF multiple (based upon management’s conservative estimates) of approximately 6, one might presume that this business is in irreversible decline. However, with the company’s investments in synergistic acquisitions and innovative technologies, not only is revenue bound to eventually stabilize once the decline of its printing business has been exhausted, but it is set to recover. In other words, what the market is failing to account for in XRX’s stock price is that XRX is not a declining business, but a temporarily declining business. Additionally, XRX is also priced as if it will not return to profitability approximating its pre-pandemic performance. The most compelling reason to invest in XRX is not that its technologies will work or that it will return to pre-pandemic profitability, but that even if XRX does not return to pre-pandemic profitability and if its technological investments do not yield outsized returns, XRX is still undervalued at today’s levels.

Background

Xerox has always been a printing products company. And while it has had a robust R&D program that led to many innovations, such as the computer mouse, it never ventured into high technology of the sort it is involving itself in now. However, it has had ventures into enterprise services. In fact, its business process service operation was fairly robust, although it was spun off in 2016 as Conduent Inc. (CNDT). However, it is currently investing its excess capital from its declining printing business not only into, “opportunistic share repurchases,” but into the “selective pursuit of acquisitions” in disruptive, innovative and synergistic technologies. These include an enterprise IT business driven by artificial intelligence (AI) and augmented reality (AR) known as CareAR which helps small and medium-sized businesses (SMBs) resolve customer complaints, IT issues and technician skill gaps remotely. Xerox has recently been involved in 3D printing whereby it produces and utilizes 3D printers for clients. The company is also providing robotic process automation services for SMBs to help automate services to promote cost efficiencies. In addition, Internet of Things (IoT) sensor-based technology is being distributed by the company to enable greater efficiencies in applications such as infrastructure. These businesses are among many more acquisitions and innovations spawned from the company’s R&D activities headquartered in Palo Alto, California.

Printing Business

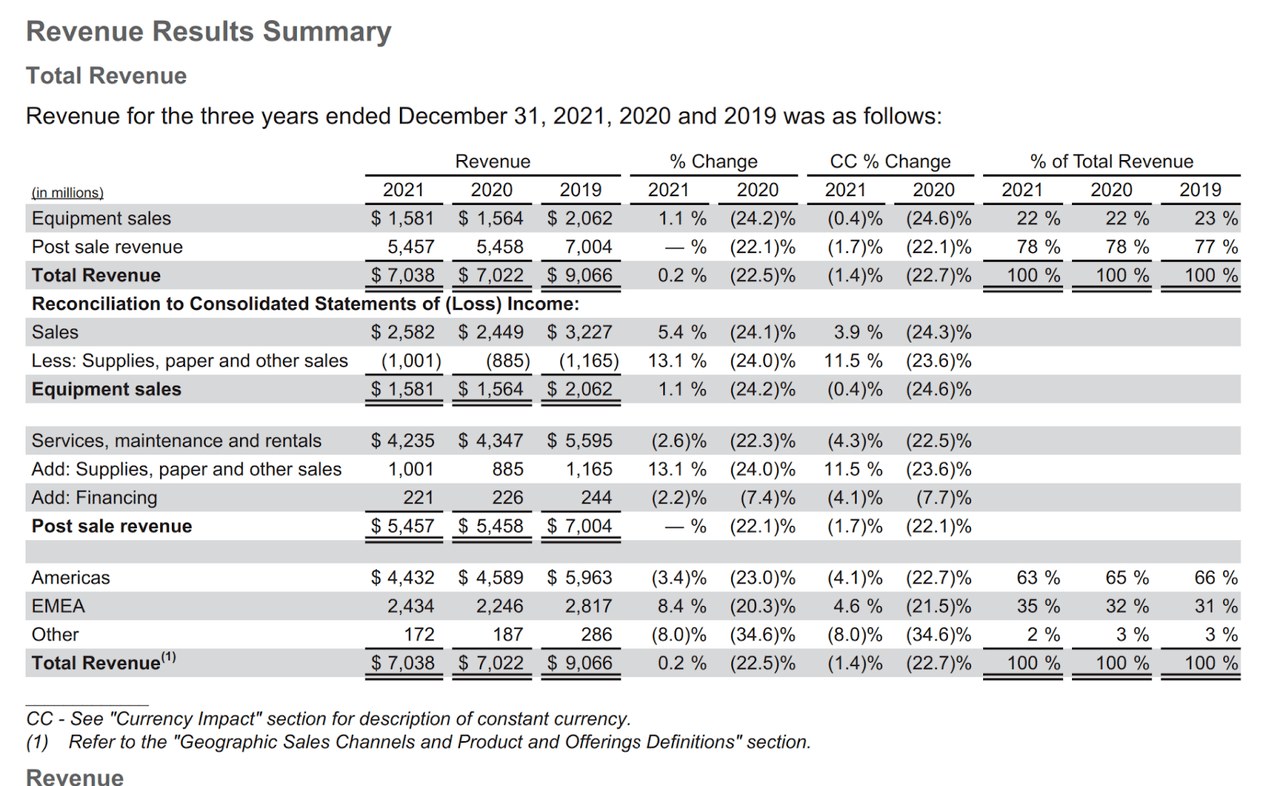

While the company’s future prospects seem promising, its core business of printing is likely to remain its primary source of revenues for the foreseeable future. While its printing business has not been capable of growth as of late, it is still a business with recurring revenues and moderate margins. In fact, 78% of XRX’s revenue in 2021 was post-sale revenue.

XRX 2021-2019 Revenue – in Millions USD

It should be noted that while XRX’s revenue is largely subscription-based, it has grown its margins. In 2016 its operating margin was approximately 10% and had grown to 12.8% as of 2019. While it was approximately 4% in 2021, this is due to the effects of Covid-19 on the business.

While the printing business has been in decline, its decline has not been rapid. In fact, from 2016 to 2019 Xerox’s revenue declined by only 5.6% per year. While this decline was accelerated during the coronavirus pandemic, management and analysts expect revenue to stabilize and even rebound in the coming years. What is also notable about XRX’s core business is that while Xerox’s revenue has declined by 5.6% per year, its operating margins have increased, albeit slightly, during the same period by 0.75% per year. Even more impressively its FCF has also nearly doubled from $660 million to >$1.26 billion during the same period. It should be noted that its FCF was bolstered largely by various divestitures. However, XRX also made many acquisitions during this period, making its pre-pandemic FCF more readily achievable in the future.

Capital Allocation

“[Xerox] is currently pursuing its strategy to develop and expand certain expected growth businesses, such as financing, software and innovation to offset and, eventually, exceed reduced cash flows from the print business, but this strategy will take time to develop” according to the company’s annual report. And while one may ask why the company does not instead return its excess capital to shareholders, it has pledged to return 50% of its FCF to shareholders, at a minimum, in the future. The company’s technologies allow for synergistic acquisitions and investments in R&D that allow for outsized gains, thereby justifying its retention of a maximum of 50% of FCF. It is my opinion that such investments are likely to be accretive due to the presence of the activist investor Carl Icahn’s position as a shareholder and his selection of a majority of 6 board members (including the chairman) on XRX’s board. In addition, Icahn successfully ousted the former CEO and he was replaced with John Visentin in 2018. While these new selections have yet to yield significant revenue growth for the firm, they virtually ensure that all M&A activities are propitious for shareholders. This is because Icahn Capital and Icahn Enterprises’ respective track records in capital allocation have outpaced that of even Warren Buffett with annual returns of 31% through 2011.

Competition

As the number one printing company by market share in the United States, Xerox is without peer in regard to its printing business. However, this relative advantage in the United States is an actual disadvantage as the majority of Xerox’s market exposure is also based in the US. While its competitors, such as HP, still have growing printing divisions, Xerox’s is in terminal decline.

Xerox’s competition in high-technology ventures such as 3D printing, AI and AR stretch from silicon valley giants to small venture-backed startups. For example, while Microsoft (MSFT) and Alphabet (GOOG) are involved in AR, so is Vuzix Corporation (VUZI), a company with a market capitalization of <$500 million. Xerox’s brand, being associated with the commercial uses and not consumer ones, may serve it well in such arenas as the company moves to market its products to SMBs, but it may well prove to be incapable of servicing customers at the cutting edge of the market. However, in relation to technologies such as IoT-based sensor technology, Xerox has already established a viable business by selling its technologies to municipalities, thereby proving its ability to compete effectively. In other words, while XRX’s established businesses, such as CareAR, are likely to produce in line with their momentous industry CAGRs, potential innovations cannot be guaranteed.

Share Repurchases and Dividends

The new shareholder-friendly management has embarked on a massive program of share repurchases as of late and has not forestalled its $1.00 dividend in order to do so. While one may regard its massive 6.4% yield as an adequate payout to shareholders, the price of its stock has made the buybacks too appealing for management to decline. In fact, in 2021 the company repurchased approximately 22% of the entire business for $888 million. However, the stock is now trading below 2021 levels. This can largely be attributed to unforeseeable macro factors (i.e., the prospect of a recession and declining asset prices). While this may lead one to believe that these repurchases were unjustified, I believe that the market, not the new management, is misguided as to the value of XRX shares. Additionally, the falling share price and stated commitment to return at least $400 million to shareholders will inevitably lead to more than $150 million in share repurchases in 2022, and given management’s belief in the undervaluation of the company, it is likely that more shares will be repurchased than the minimum payout ratio would suggest.

Valuation

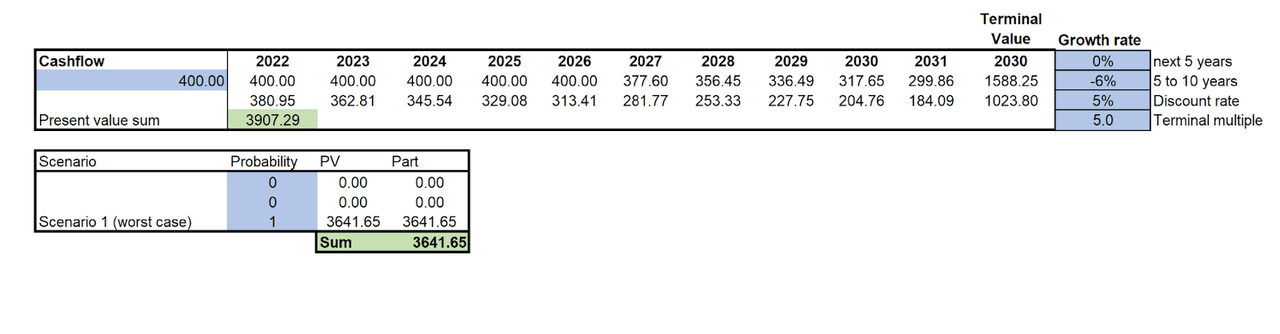

My investment thesis for XRX is not that it will return to pre-pandemic FCF, but that you take no risk in making that presumption. This is because the stock is valued as if it will not only not recover to pre-pandemic FCF, but that its FCF will stagnate as the company recovers from the pandemic and then continue its decline. That XRX will continue its decline in the next five years is highly unlikely. This is because the pandemic precipitated a decline in revenue that was unprecedented in its pre-pandemic days. So the most likely outcome is that XRX returns to FCF generation resembling its pre-pandemic FCF and then resumes its decline. While the prospect of an imminent recession could harm XRX’s revenue and FCF, that it would do so as much as the recent pandemic is improbable. Therefore, even if a recession does occur, XRX’s revenue should still recover. However, to add a large margin of safety to my DCF valuation of XRX’s equity, I only presumed that forward FCF would remain neutral for the next five years and then presumed that its subsequent revenue decline would translate into FCF decline in the next five years. To arrive at my discount rate I used the cost of equity. Namely, I used the current rate of the 10-year yield plus the highest expected rate of return on equities over the next decade (according to Vanguard) multiplied by XRX’s beta and rounded up to 5%. It should also be noted that although I’m calculating the value of the equity, I used simple FCF instead of levered FCF because it is likely that management leverages the company in order to repurchase more shares at these levels and conservatism would dictate that I use the lower and more consistent figure of simple FCF.

XRX Valuation – in Millions USD

Even though this valuation encompasses the worst outcome, within reason, that an investor could anticipate, based upon the company’s current market capitalization of $2.47 billion, this still leaves the company undervalued by approximately 45%. If XRX can return to FCF levels of >$1 billion the upside will be greater. In addition to the prospect of a return to pre-pandemic FCF, it is also possible that XRX’s investments in disruptive, innovative technologies will begin to yield sufficient revenue growth to not only stop the revenue decline but eventually effectuate revenue growth. While it is possible that this may contribute to increased FCF, it is more likely that this leads to multiple expansion as the market recognizes that XRX’s technological endeavors are, in fact, viable.

If this revenue growth takes place within the 10 years, my DCF projects the terminal multiple would certainly increase to more than 10 and, depending upon the magnitude of the revenue growth, even increase beyond 15. Such revenue growth could therefore raise the company’s valuation to >$5 billion. In such a scenario, investors would be looking at a potential upside of 100% or greater. While I am not passing judgement on the possibility of such revenue growth, I do think that such growth would result in the aforementioned reappraisal of the company. Therefore, if such revenue growth does not occur, you are left with 45% upside and if it does occur a realizable upside of >100% may be present.

Risks

The primary risks associated with an investment in XRX common stock is a more rapid decline in its printer business than would be suggested by the company’s past performance. Notwithstanding accretive and synergistic acquisitions, such a decline would result in permanent capital loss as shareholders would be left with an assortment of high-technology ventures with incommensurate cash flows and revenues to justify their original investment. The cash flows would also inevitably lead to a progressive decline in the company’s dividends. Compounding this risk is the, albeit minor, possibility of improper capital allocation by XRX’s management. As previously mentioned, I think such an outcome is improbable due to the presence of Carl Icahn’s selection of the company’s CEO and six board members. However, even the most competent capital allocators are destined to fail a portion of the time. Even if the acquisitions made and R&D allowed are appropriate given the company’s market projections, such technologies may be irrelevant as the economy fails to adopt the technologies invested in at a sufficient pace. While I believe that the prospect of value being destroyed by the company’s ambitious technological investments or the printer business declining more rapidly than can be foreseen is exceedingly unlikely, they are certainly possible. XRX does not have the impenetrable margin of safety, such as a market cap well below liquidation value, that many value investors look for in their investments. Therefore, if you are unprepared to assume any risk of loss, XRX is not an appropriate investment.

Conclusion

Xerox’s core business of printing is indubitably in decline. That its FCF will be lower, although not entirely disparate from pre-pandemic levels, is the most likely outcome. However, even assuming that FCF will not recover to pre-pandemic levels and presuming that pandemic-level FCF will begin to decline in line with pre-pandemic revenue decline in 2027, Xerox is still severely undervalued. But, if the company’s FCF returns to any amount reflective of pre-pandemic FCF, or if its technological ventures begin to yield significant revenue or FCF for the company, the XRX stock will increase by way of multiple expansion, share repurchases, or FCF growth. The company could also increase its dividend. While the most compelling part of the potential gains from this stock seems to lie in the narratives about its synergistic acquisitions or in its shareholder-friendly management, the primary reason to invest in XRX actually resides in its lack of downside risk. In other words, it is precisely because the stock is already priced for catastrophe that it is poised for outperformance.

Be the first to comment