D. Lentz

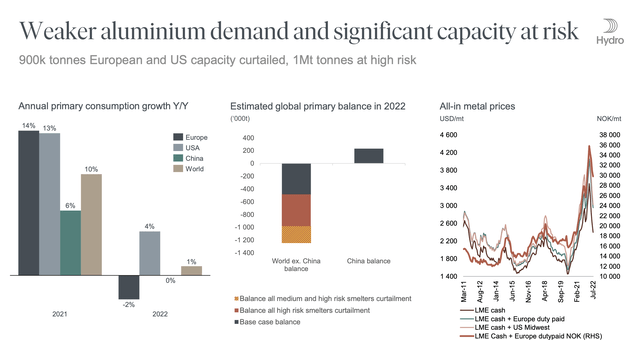

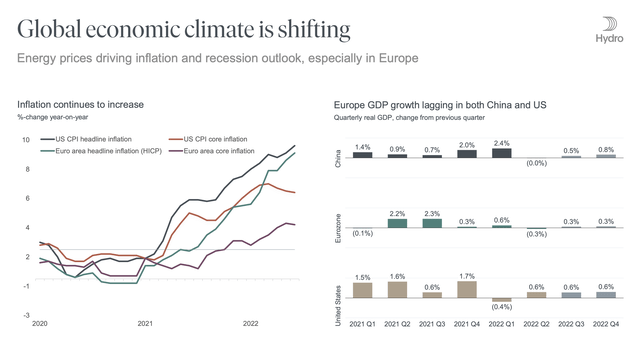

In my last article on Norsk Hydro (OTCQX:NHYDY), I made it clear that despite the company being one of my favorite Scandinavian investments and businesses, there’s a problem with a business that’s overvalued like this in a situation characterized by many headwinds. Headwinds in the form of macro, costs, energy pressure, and the raw cyclicality of the business, as well as massive slowdowns in China.

I was at a hold because of this, and in this article, and I’m now shifting my stance to a cautious “BUY”.

Let me show you why.

Norsk Hydro – Updating on the business

While valuation has improved for the company, by that I mean that it has dropped, there are reasons for this drop that cause havoc in the near-term/2022E forecasts. Macro and energy pressures are getting “real”, and of course, Ukraine doesn’t make it any easier either.

Now, it’s still fair to say that Norsk Hydro is one of the better companies prepared for these pressures. We’ve seen this very clearly. The company has its own electricity generation, which in some part insulates its Aluminum production from the issues faced by other companies. A lot of capacity is also located in South America, which further separates the company from Europe and the potential here.

Norsk Hydro IR (Norsk Hydro IR)

We have 2Q22 reported as of this date. Strong markets are causing good earnings, but uncertainty is increased, meaning visibility is actually lower. It creates an interesting situation of opposites, where Hydro is reporting record results, but the share price can fall over 20% in a very short period of time. The company is also seeing record volumes and overall momentum for its green products as the world becomes more and more focused on such ventures.

Hydro is making excellent progress on overall decarbonization and is ahead of its previously stated roadmap. In addition, Hydro is proposing additional shareholder distribution in the form of extra dividends in accordance with its dividend policy. This was something I expected – but since the share price has crashed since I sold my shares, I’m not exactly bummed out about missing what ended up as a smaller reward than harvesting the profits of my initial investment.

A few updates here.

The current situation for Hydro is essentially a play on the current energy trends going on, as well as the volatile supply/demand situation. Visibility, I argue, has very rarely been lower for the past 15 years that I have had Hydro in my sights.

Norsk Hydro IR (Norsk Hydro IR)

The company has slightly updated its capital structure, retaining focus on a BBB or above-rating from major credit institutes, and working with adjusted net debt to EBITDA of less than 2X, reflecting the current interest rate situation we’re going into. However, Hydro has among the strongest liquidity in the entire sector. Its dividend policy remains attractive, with a minimum floor of 1.25 NOK/share, even if the company has to tap debt to pay this, with a 50% target otherwise (adjusted net income), with the potential of additional dividends or buybacks as supplemental remuneration for shareholders.

As such, NHYDY shareholders are well-covered in their investment if they buy the company at a good price. The company proposes to pay yet another 1.45 NOK/share, which amounts to 3B NOK, as well as executing on its share buyback program with 2B NOK over the coming months, with all of this subject to approval at an extraordinary GM.

The company, simply out, delivered improved EBITDA for the quarter even compared to very strong comps. However, these upsides were nearly entirely on the basis of margins and pricing that the company was able to push due to very tight supply. Headwinds were, in fact, very visible, with Raw Material costs up, costs up, and energy prices up. Hydro is not immune to any of this.

When the global trends on pricing for Bauxite/Alumina start shifting, this will deliver negative trends for the company, and things should fall rather quickly. The nameplate capacity of alunorte, finally delivering on schedule, also works in the company’s favor here.

The current global situation and pricing for metals and commodities also work as a tailwind with the company’s inventory valuations, which are revalued at higher prices, and which can distort commercial results unless we’re aware of them. In the metal markets sector, the company delivered higher results to premiums and positive re-evaluations, despite lower commercial results for the sector.

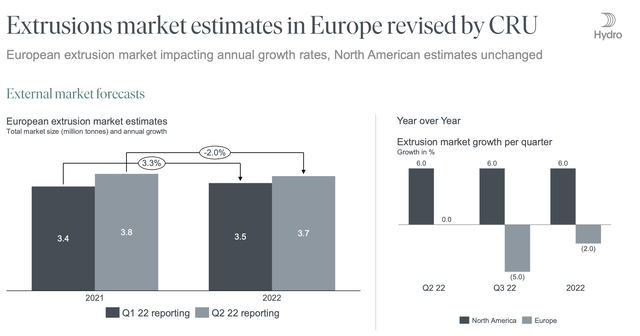

While NA growth rates for demand in extrusion remain on par, Europe has been updated and now expects negative growth for the coming quarters, as well as negative growth for the full year of 2022.

Norsk Hydro IR (Norsk Hydro IR)

The company had a net cash position (no net debt) going into 2Q22, but the dividend payment saw this going negative, to where the company’s adjusted net cash/debt is now at 6.3B NOK worth of debt, say around $600M. None of that is worrying for a company this size.

The company is also working to potentially M&A the company Alumetal, a polish recycler listed on the Warsaw Exchange. This is a relatively small M&A at a total tender value of around €232M, but it will significantly strengthen the company’s already-growing share of European recycling of scrap metal and lower its carbon footprint.

Alumetal is the second largest producer of casting aluminum alloys in Europe with a production capacity of 275,000 tonnes per year with three plants in Poland and one in Hungary. The company sells its products primarily within Europe and to the automotive sector, which represents the largest customer group. Alumetal is also experienced in the sorting of post-consumer scrap (PCS) and is currently constructing a new, state-of-the-art sorting line.

So, it’s well worth considering as a significant upside to the company.

Due to all of these positive trends, I see a sub-60 NOK share price as much more appealing than I did a few months back. Remember, my initial position in Hydro had a cost basis of less than 24 NOK/share and was an incredible overall investment seen to the returns I was able to get. I’m eager to get back fully into Norsk Hydro, and make it a 3-5% portfolio position once again – but I will not do so at a price that could derail my returns for the coming few years if the cycles invert and we look at years of substandard performance.

This would not at all be outside the character of Hydro.

NHYDY Share price (Seeking Alpha)

Looking at those trends, you see very clearly how an investment in Hydro can, and should be made.

Norsk Hydro Valuation

And while we’re down from its highs, we’re, as I see it, perhaps not close enough to the potential trough or low yet. Flying high due to market tailwinds doesn’t make a great company – or at least, it doesn’t make a superb investment. Good investments are made when buying undervalued businesses at great prices.

The volatility in forecasting Hydro is very evident when you look at the analysts’ accuracy here – because analysts usually (50%+) miss negatively on their forecasts for the company. It doesn’t help that and current forecasts call for a 3-year EPS growth rate of essentially 0% on average.

At this time, S&P Global considers Hydro to be a “BUY” with an average share price target range of 55 NOK on the low side to 100 NOK on the high side. Given the NAV target for this company, where it trades close to 0.9X at this price, I would seriously question the targets and details of that 100 NOK share price target. The average is around 78 NOK/share, which as far as its multiples go, is still too high for me.

Analysts hated this stock when it was priced at 25-35 NOK/share. That’s when I bought it, knowing the fundamentals and the substance of this company. Yet now, when it’s still priced at more than twice the price I paid, analysts suddenly love the company with 8 out of 13 analysts still considering it either a “BUY” or an “outperform” here.

Still, there are upsides here – that’s why I’m writing this piece.

NHYDY isn’t the same company that I bought at trough valuations years ago. It has more capacity and different upsides now. I consider the 2022E profit forecast to be at least in the ballpark sort of accurate, provided we don’t see material deterioration in some of the fundamentals. Once 2022E is over, I believe and forecast that profit levels will normalize, but I do think they will settle at significantly higher levels than we’ve seen historically, due to the appeal of CIRCAL and similar green initiatives that push NHYDY to the top of the food chain in terms of long-term appeal. Taxes on non-EU aluminum and cheap commodities will go further to insulate the company from competition here.

In short, I do see the potential for upside here – even if it’s long-term. You also can’t take this year’s dividend as indicative going forward but have to take the company’s floor and normalized earnings payout ratio as more of what you’re “going to get”.

In the end, I’m unwilling to go higher than an average weighted P/E of 10X for the company at this time, which puts us at a 2024E target of around 75 NOK/share, and an upside of around 18.5% annually, or 51% total. But there is plenty of volatility in this forecast, and many things that, to put it frankly, could go wrong or south that we can’t foresee here.

What’s clear is that the company is currently undervalued to 2022E. But I want more than 2022E if I’m going back into Hydro – because finding high-yielding companies with safeties in this market isn’t hard.

I like how much the company has fallen, and how quickly it has done so. My previous target for Hydro was 68 NOK – and I’m sticking to this PT here. That makes the company a “BUY” for me, but a volatile one, and I’m not going back in just yet.

I might regret this, but I also see better alternatives out there at this time. Still, seen by itself and in the context of the market and its forecasts, there is now enough potential upside in Hydro to make this an interesting prospect.

Thesis

My current stance on Norsk Hydro is the following:

- Norsk Hydro is currently fairly valued to normalized future earnings. While current trends are cyclical and will turn around eventually, there is enough value in the company to become positive here.

- The potential returns from today’s levels are now acceptable compared to what other investment alternatives in the market offer us.

- At current valuation, Norsk Hydro is a “BUY” with at least the beginnings of what I consider to be an attractive upside.

Thank you for reading.

Be the first to comment