Nordroden

Dear readers/followers,

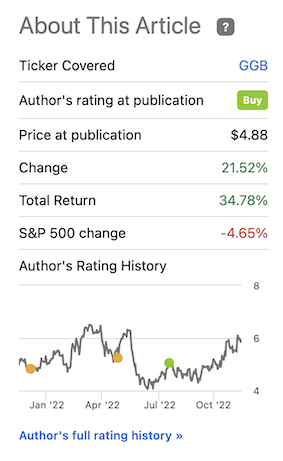

I’ve updated on Gerdau (NYSE:GGB) a number of times at this point, shifting my stance from “Hold” to “Buy” back on the 9th of August this year, and bought shares. The company and my investment since then have absolutely smashed expectations and the market overall. Here is the RoR since that time, despite some unfortunate timing in the short term.

Gerdau Article RoR (Seeking Alpha)

The time has come to provide an update for the company – and this recent action warrants this. Let’s see why I’m not shifting my thesis for Gerdau.

Revisiting Gerdau

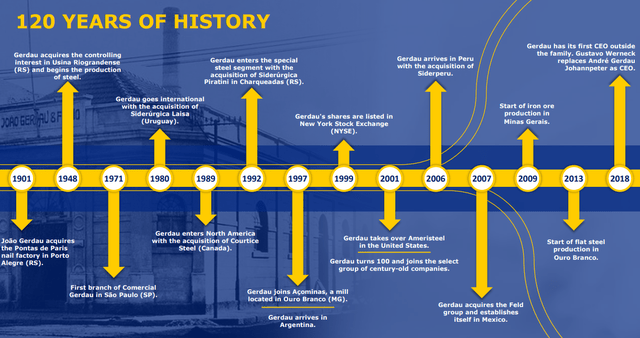

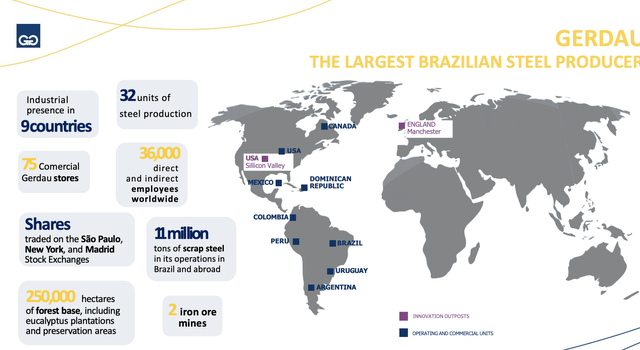

To my mind, the name sounds German – because there’s actually a municipality there known as Gerdau in Lower Saxony. In this case, though, Gerdau is a steel producer based in Latin America and headquartered in Brazil. A company that comes with 120 years of mostly solid history.

While the company was actually founded by a German, an immigrant leaving for Brazil in 1870, it’s been a Brazilian company since its inception in 1901. In the beginning, it was a nail factory.

Gerdau is one of the world’s 30 largest steel producers, with annual revenues of around $11-$14 billion, 30,000 employees, and a net income of north of half a billion USD per year.

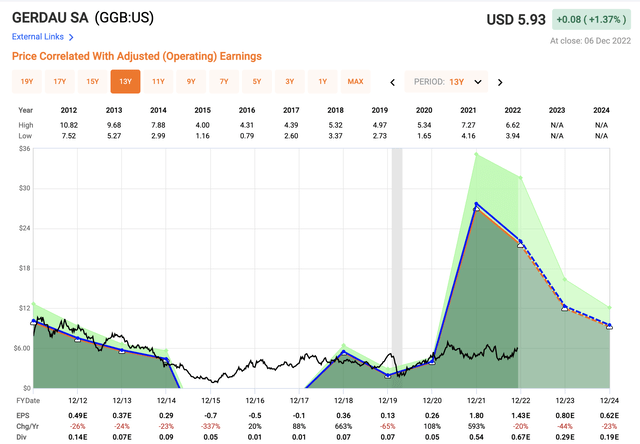

The company is incredibly volatile, seeing bounces in EPS, income, and revenues that move in accordance with market cycles – and these market cycles are no joke. The company can, at times, stay in negative earnings cycles for 6-7 years, as cycles “depress”, only to then give way to truly massive bounces that call into question just how high things can go – and what valuation the company may hold.

The recent trends are a very good example of this.

Gerdau earnings (F.A.S.T Graphs)

From a fundamental perspective, Gerdau has a high yield, investment-grade safety at a BBB- and has had an international presence on the market for over 40-50 years at this point, with a very early expansion strategy. Current operations are spread to 13 countries.

Gerdau mine iron ore, as well as transforming steel scrap and iron ore into steel products. Steel production around the globe is split into integrated and non-integrated mills, where integrated mills produce steel from iron oxide extracted from ore, whereas non-integrated mills produce their steel from scrap steel.

Over 70% of global steel production, most of which is currently done in China, is done through the integrated process.

Remember, the ebb and flow of steel production from a macro level has been increasing in lock-step with population growth and industrialization in emerging countries, increasing by 51.3% from the period of 2009-2019 alone. It’s a market characterized by demand increases, and the current heaviest consumer of steel is China. Brazil, in turn, is the world’s 9th-largest producer of crude steel. However, the demand from China is changing significantly, which impacts the company.

Overall, the steel industry across the world as well as in NA has seen massive consolidation over the past decade/s. There have been large amounts of M&As, where steel producers burdened with massive pension liabilities, healthcare, and other costs have been bought up.

Companies that exemplify this include Mad-Men-known Bethlehem Steel Corporation, Trico Steel Co, National Steel Corporation, LTV Corporation, and others, many of which were folded into ArcelorMittal (MT). At this point, only a few large producers with real competitiveness remain on the market, and Gerdau is one of them.

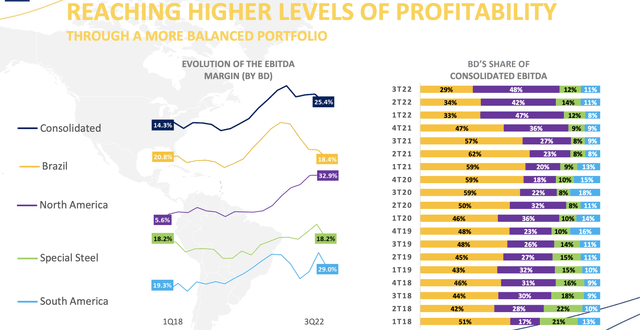

Recent results confirm the company’s improvements in profitability, which is something we’re looking for.

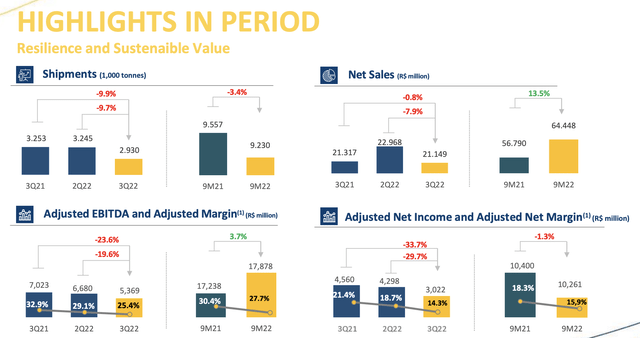

Because as we’re seeing now, the cycle is starting to reverse a bit. Shipments, net sales, and adjusted EBITDA are all starting to fall. The company’s shipments are down nearly 10% YoY for 3Q22, net sales are down a percent or so, and EBITDA is down around 20-23% on a YoY/QoQ.

The positive is that the company is showing more resilience in terms of margins, which is what we want to see to flatten out some of the downcycles in the company. On a segment basis, Brazil was one of the more negative, while NA was positive, and special steel delivered decent results as well, with a company asset utilization rate of around 60-62% on average. South America – ex-Brazil was a positive as well.

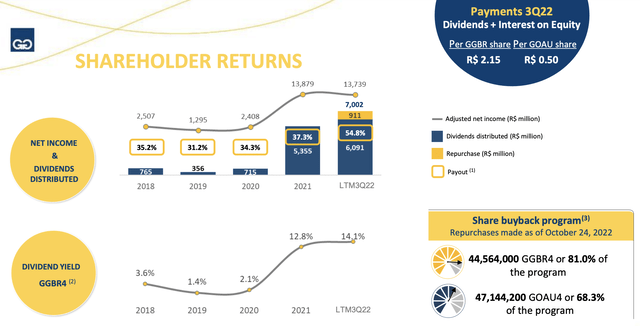

Overall cash flow was down – but still came to impressive levels, with 58% of quarterly FCF invested in shareholder returns and company buybacks. The company’s cash conversion cycle saw some increases due to the aforementioned lower net sales and demand compression

Perhaps more importantly at this point in the cycle, the company’s debt is lower now at 0.18x, which is the lowest historical level it has ever been, with company liquidity and revolvers over $R11B.

The company is currently at a very high point for its shareholder return cycle – as I’ve mentioned before because the dividend and buybacks are so high. This will change going forward.

Remember the fundamental risks to the business – because these are not small when considering this business as an investment.

- The iron/steel market is inherently volatile, best expressed by viewing this company’s earnings and sales over time.

- The Brazilian Real (R$) is not exactly known as the most universally stable currency, and over 50% of company earnings come from Brazil. The company’s FX exposure is massive. Nor is Brazil inherently known as the most geopolitically stable region, with plenty of ups and downs.

- While the company’s current debt level seems low thanks to high earnings, actual total debt is relatively high. With a high cost of capital and a historically low ROCE compared to a relatively high WACC of well over 9% at this point, the company has had a hard time, outside of this crisis, really driving shareholder returns. This is a problem, and not a small one.

These risks do lessen as the company performs better, and seeks to flatten its typically volatile cycles. Indeed, current expectations are for the downcycle to go slower and not dip as far as it perhaps did before.

Gerdau operates a total of 30 mills worldwide as of 2020. 26 of these are mini-mills, and despite their lower portion of global production, these offer capital advantages to Gerdau in the form of lower capital and operational costs, the proximity of production to raw material, proximity to local markets, and easier managerial structure.

Four of the mills are integrated – three in Brazil and One in Peru, with the Ouro Branco Mill being the largest.

All of these things mean that Gerdau is perhaps one of the better-prepared companies in its sector in the entire market – but as things stand now, we’re at a turning point where earnings have started to and may continue to dip lower going forward.

Let’s look at what this does to the company’s current valuation.

Gerdau’s Valuation

The company currently trades at a normalized P/E of 4x – but roughly the same share price was a normalized P/E of 35x back in 2019, showcasing just how little we can really look at P/E to rightfully consider such a volatile business and its valuation.

Gerdau’s valuation in terms of its earnings is a volatile history with very little, if any stability found anywhere. While 2021E is going to see a high dividend, you need only look at 2016-2017 to find that one-cent dividend yield together with extremely pressured earnings.

Other contributors have made articles about this company, focusing on singular multiples or what I view as relatively simple forecasts. I argue this cannot be made as simple as that. Forecasting Gerdau on the basis of EPS, or the basis of BV multiples is tricky.

Instead, let’s argue that, that Gerdau today trades at a pressure NTM revenue multiple of 0.75X, compared to peers of around 1-2X, with higher multiples in the US and Europe. Gerdau always trades at lower multiples here, and at such discounts, you could make an argument for why this company is attractive here.

Gerdau currently offers a 3.02X NTM EV/EBITDA ratio. Compare this to a company such as Nippon Steel, and you will find this very pressured – but there are again reasons for this. Compared to peers such as thyssenkrupp (OTCPK:TKAMY), Gerdau trades at a lower P/E multiple – quite a bit lower, yet thyssenkrupp’s operating geographies are typically far more stable – even if they may not be called that today.

There is no doubt that Gerdau is a well-established company in several markets. There is also no doubt that Gerdau trades to significantly cheaper multiples on virtually every basis compared to peers at this time, with some exceptions. However, these peers are almost universally better capitalized, with more attractive WACC and more stable fundamentals. Comparing a 3.45X Tangible BV/share Nucor (NUE) to a barely 1.5X for Gerdau can only be done so far when considering that 50%+ of EBITDA comes from Brazil and similar geographies.

I’ve typically said that I don’t want to pay above a 1x in tangible BV for the company – and there have been multiple times this year when this has been the case, which is when I bought the company. I’ve normalized this to a range of $4.8-$5/share for the time being, which means that the company did trade attractively not that long ago, but no longer does today.

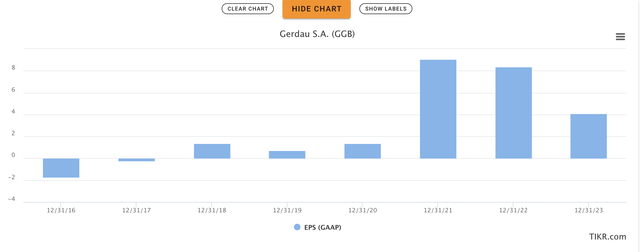

Analysts disagree with me. 6 S&P Global analysts follow Gerdau S.A., and 5 of them have the company at an outperform or “Buy” target with an average normalized upside of 25% despite the company nearly trading at $6/share, and their own forecasts calling for the GAAP EPS to start dropping more next year.

Gerdau EPS forecast (TIKR.com/S&P Global)

The same expectation for dividends, by the way.

So, how does Gerdau typically act in a downcycle when EPS normalizes? Not well, is the answer. In the last downcycle back in 2010-2014, the company started out trading at $15+/share, only to drop to its lowest point of below a dollar back in 2015. That’s not an attractive prospect if history were to repeat itself. Of course, we’ve not completely turned around yet, so the possibility that the company may climb further to a double-digit share price is still there.

But as I see it, this is the time to become more cautious about Gerdau, because the first signs of the EPS turnaround are here.

Here is my thesis on the company.

Thesis

My thesis for Gerdau here is the following:

- While Gerdau has some appeal from a fundamental point of view, active in good geographies with growth potential, the company still needs to prove consistent returns above the cost of capital and debt. For the time being, this is being achieved thanks to outsized demands due to recovery.

- I view Gerdau as a “Hold” here, because the company has outperformed and we’re currently above my target.

- The price target is below $5/share when tangible book value hits a 1X ratio.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

I don’t see the longer-term forecasts as attractive enough to justify more of a reversal to a double-digit share price. I’m starting to look at what prices I would start to rotate my position in Gerdau.

Be the first to comment