Justin Sullivan

Snap’s (NYSE:SNAP) business has become highly unpredictable due to headwinds in the digital advertising landscape. Growing competition from other social media companies that are making inroads with the younger population are also representing a growing risk for Snap’s profitability. The social media company did not give revenue guidance for the third-quarter which is adding uncertainty to the stock and which makes it hard to value Snap in the short term. Due to obviously deteriorating platform profitability, shares of Snap are exposed to persistent valuation headwinds!

Snap’s Q2: Terrible earnings card

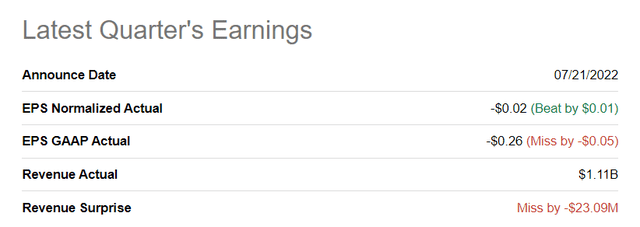

Shares of Snap went through a massive 39% drop in pricing on Friday after the social media company reported a larger than expected loss. Snap revealed a Q2’22 net loss of $422.1 million, or 26 cents a share which missed estimates. Compared to the year earlier period for which Snap reported a net loss of $151.7 million, or 10 cents a share, the social media company’s business appears to have taken a turn for the worse.

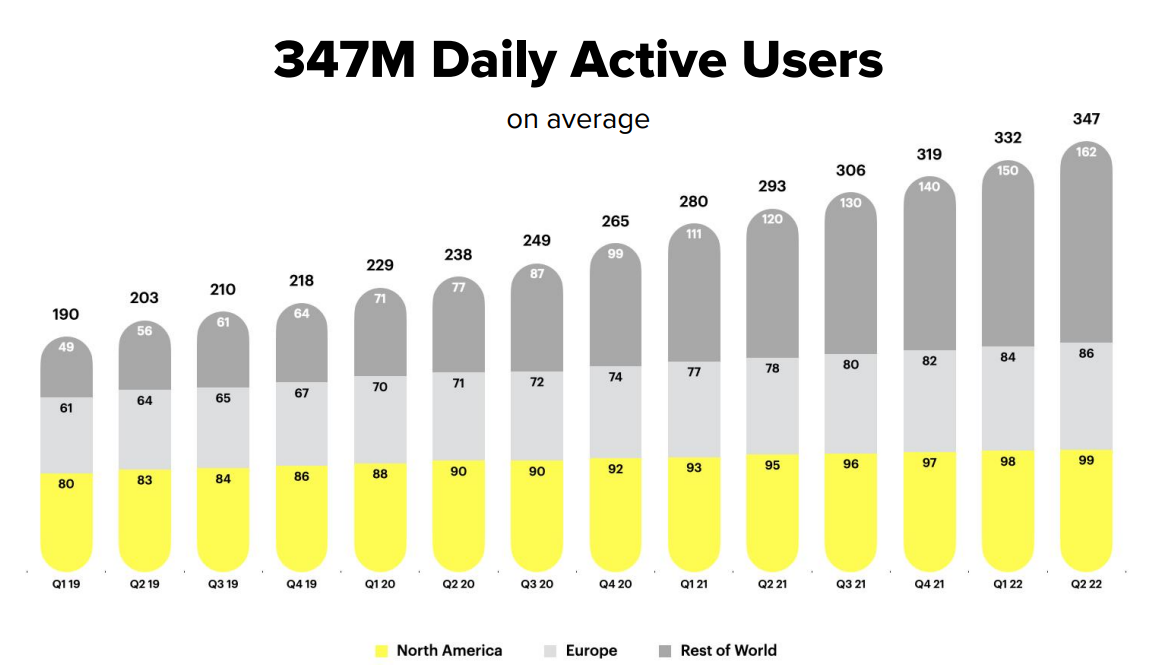

While Snap submitted a disappointing earnings card, there were some good things to say about the social media company as well. Snap’s daily active users/DAUs grew 54M year over year to a new user record of 347M, showing 18% year over year growth. Compared to Q1’22, Snap added 15M new users around the world in the last quarter, including 1M in North America, 2M in Europe and 12M in other regions. Growth in Snap’s “rest of the world” category has been driving the firm’s overall DAU growth in recent years: since Q2’19, North America, Europe, and ROW territories have seen 19%, 34% and 189% growth in daily active users. In total, Snap’s daily active users increased by 71% in the last three years or at an annual average rate of 20% annually.

Snap

Snap’s revenues, still having a bit of upside momentum due to growing DAUs, grew 13% year over year in the second-quarter, but average revenue per user/ARPU metrics have weakened as advertisers are taking a more careful approach to spending ad dollars in a world suffering from high inflation and an increasingly uncertain macro outlook.

Weakening monetization is a problem for Snap for obvious reasons: Lower ARPUs indicate deteriorating platform appeal to advertisers and unfortunately this is what Snap saw in Q2’22.

Snap’s average revenue per user remained flat quarter over quarter at $3.20, on a consolidated basis, but declined 4% year over year, indicating that platform’s monetization is weakening. In North America, the most lucrative ad market for Snap, ARPU growth slowed from 116% in the year-earlier period to just 8% in Q2’22. The same trend appeared in Europe with ARPU growth slowing to just 2% in the second-quarter while ARPU for the rest of the world declined 11% year over year.

|

SNAP |

Q2’21 |

Q3’21 |

Q4’21 |

Q1’22 |

Q2’22 |

|

ARPU |

$3.35 |

$3.49 |

$4.06 |

$3.20 |

$3.20 |

|

Growth YoY |

76% |

28% |

18% |

17% |

-4% |

|

North America |

$7.37 |

$8.20 |

$9.58 |

$7.77 |

$7.93 |

|

Growth YoY |

116% |

49% |

33% |

31% |

8% |

|

Europe |

$1.95 |

$1.92 |

$2.54 |

$1.93 |

$1.98 |

|

Growth YoY |

76% |

34% |

33% |

30% |

2% |

|

ROW |

$1.07 |

$0.98 |

$1.12 |

$0.95 |

$0.96 |

|

Growth YoY |

20% |

3% |

1% |

2% |

-11% |

(Source: Author)

Achieving profitability is now a challenge

With deteriorating platform metrics and weakening monetization, it will be so much harder for Snap to reach profitability… the expectation of which tempted me to buy Snap’s shares in the first place. Weaker platform monetization is as much a problem for the social media company as keeping costs under control.

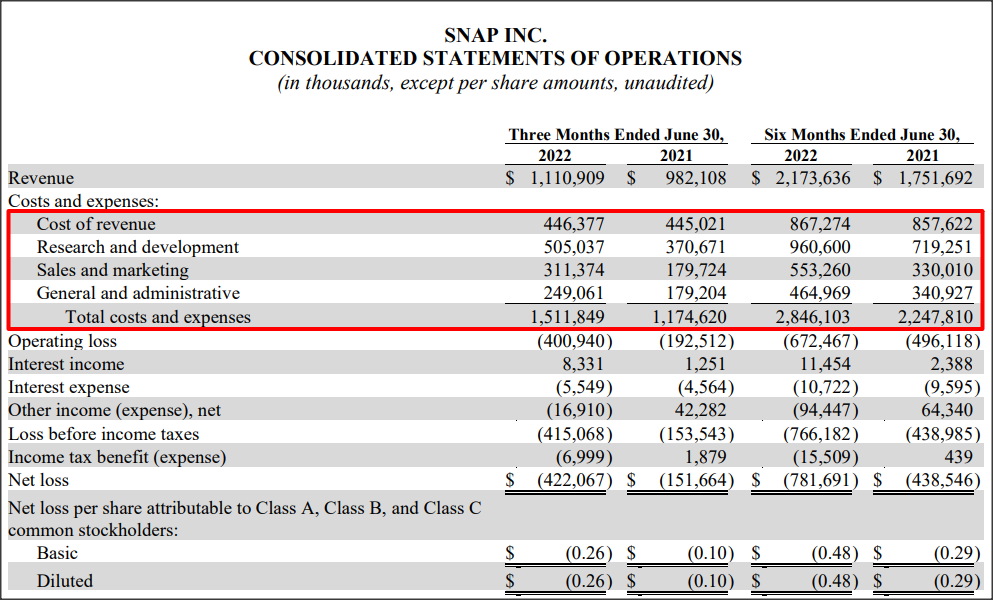

In the second-quarter, Snap reported a 29% year over year increase in operating costs which exceeded the firm’s 13% revenue growth rate and which was the reason for a doubling of Snap’s operating losses to $400M. Since operating costs are rising faster than the top line, Snap will likely not achieve profitability any time soon.

Snap

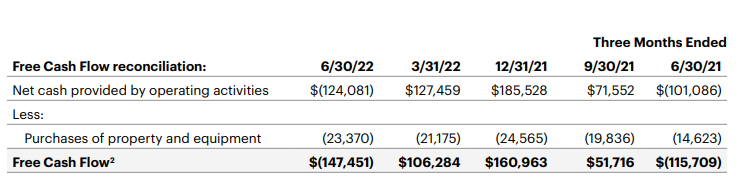

Prospects for positive free cash flow in FY 2022 have also been diminished after Snap reported $(147.5)M in FCF for the second-quarter. The possibility of growing FCF and improving margins was what made Snap attractive as a long term play on the digital advertising market.

Snap

Snap is a black box now

Snap did not give Q3’22 revenue guidance as management sees the ad market as unpredictable… which is not very reassuring. Since Snap’s profitability may be further delayed due to headwinds in the advertising market as well as growing competitive pressures from TikTok, Snap has essentially become a black box now: hard to predict revenues for and therefore harder to value.

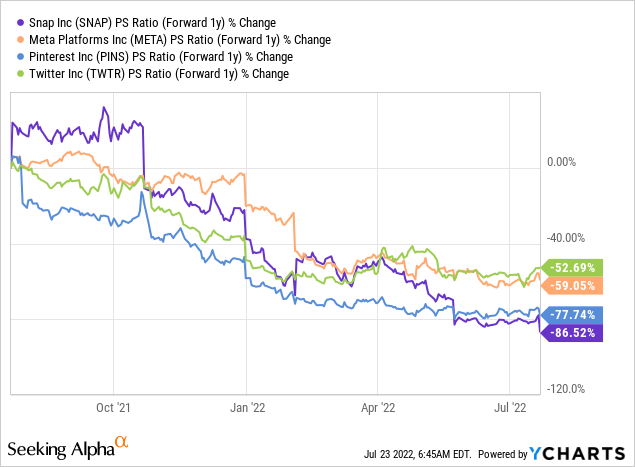

Social media platforms in general have seen a steep contraction in their valuation factors in 2022, but no social media company has seen as steep a decline as Snap. I like Meta Platforms (META) the most in the social media business based off of prospects for free cash flow growth and FCF margins.

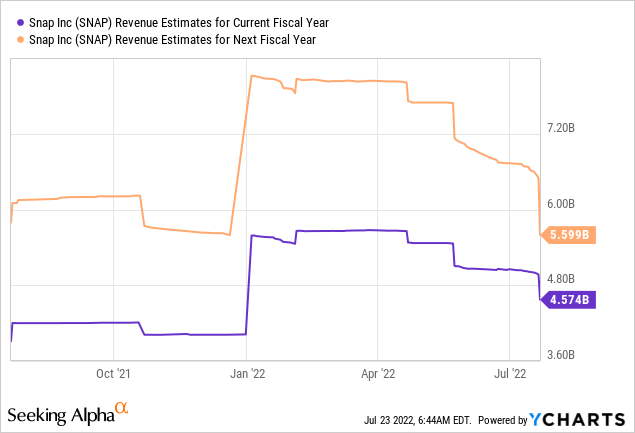

The P-S ratio for Snap is 2.9 X, but the ratio may rise as estimates fall. And Snap’s revenue estimates are falling fast…

Risks with Snap

The advertising landscape is experiencing headwinds, partly because of macro concerns and Apple’s iOS update in FY 2021 that limits the effectiveness of advertising campaigns on platforms such as Snap. Also, rival social media companies like TikTok have made serious inroads with younger users… which is the core demographic of Snap. Although Snap is still growing on a daily active user basis, TikTok has become a formidable challenge to US-owned social media companies and advertisers have taken notice. What I see as a related challenge for Snap is that user monetization metrics (engagement, average revenue per user) could deteriorate further going forward.

Final thoughts

Unfortunately, buying Snap was a big mistake as I didn’t expect conditions in the advertising market to change this rapidly. While I believe that Snap continues to have value for users and investors longer term due to its ability to grow its ecosystem and its revenues, I am more doubtful that Snap can achieve profitability. The lack of a revenue guidance makes Snap a black box and uncertainty can be expected to keep weighing on the firm’s shares!

Be the first to comment