marchmeena29/iStock via Getty Images

Stocks bounced back from what looked to be a third day of declines, as investors went bargain hunting in more defensive sectors of the market amid the uncertainty of war in Ukraine, runaway inflation, and tighter financial conditions. Healthcare and consumer staples were the top performing sectors because of the reasonable valuations and consistent earnings growth that can be found in both. At the same time, a new cycle high for the 10-year Treasury yield at 2.66% combined with a decline in 2-year yields to 2.47%, resulting in a renewed steepening of the yield curve, which portends a pickup in the rate of economic growth. With earnings season beginning in earnest next week, mixed signals abound.

finviz.com

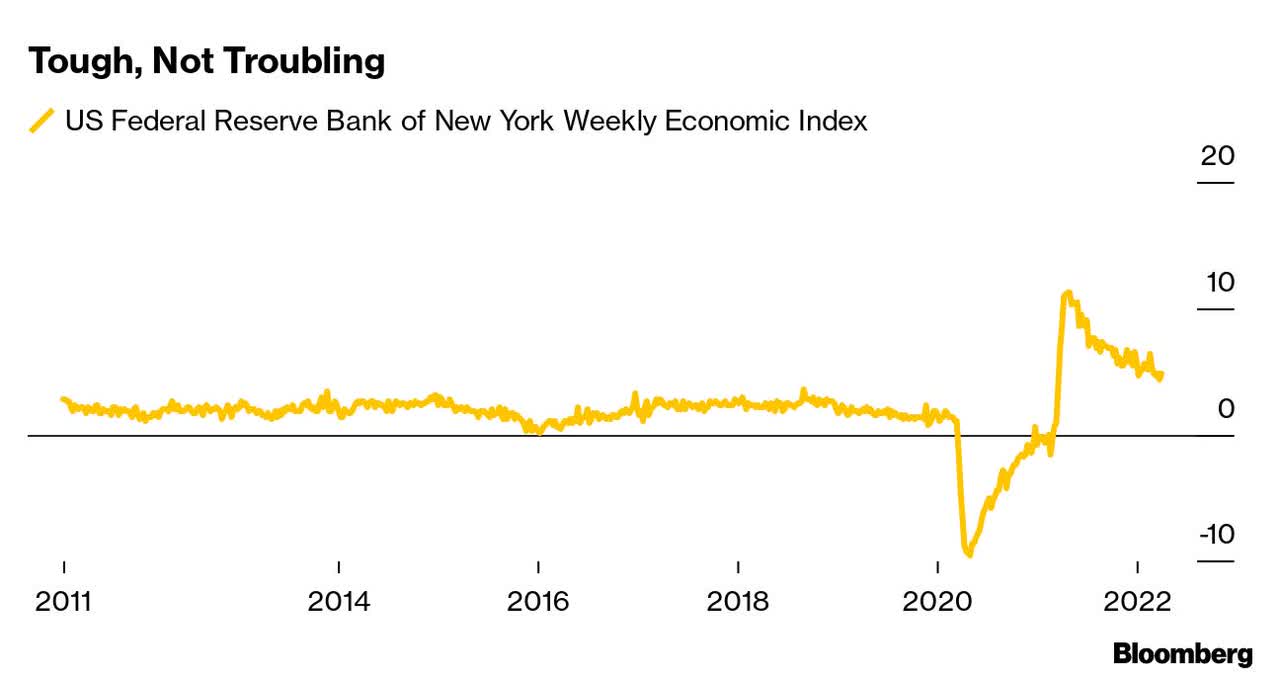

As stocks, bonds, and commodities go through a repricing stage, instigated by a new tightening cycle and the withdrawal of liquidity from the financial system, the debate will continue as to whether we are in the late stage of the economic cycle that precedes recession or a mid-cycle slowdown. I have advocated that we are in an economic slowdown from the unsustainable stimulus-induced levels of growth that characterized last year. This expansion only started in 2020. Yet that suggests that the Fed will be successful in navigating what is called a soft landing, whereby it tames inflation without stifling growth to the point that it results in a recession. Recession is the easy call with the Fed poised to aggressively raise interest rates and withdraw liquidity through a new quantitative tightening program, but I don’t see it in the numbers. In fact, the New York Fed’s Weekly Economic Index has slowed demonstrably from last year but remains well above levels over the past decade.

bloomberg.com

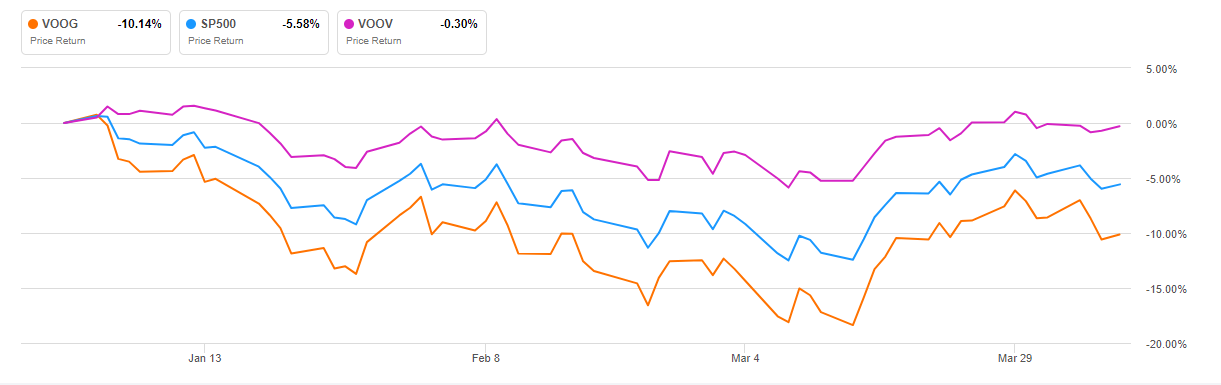

With respect to stock market strategy, irrespective of the current stage of the economic cycle, the safest approach is to focus on value. The Vanguard S&P 500 Value ETF (VOOV) has a commanding lead over the Vanguard S&P 500 Growth ETF (VOOG) on a year-to-date basis, as it declined less during the correction and has nearly fully recovered its losses on the rebound. This makes sense from the standpoint that undervalued stocks tend to outperform following interest rates hikes, which have already started, and that leadership tends to persist.

seekingalpha.com

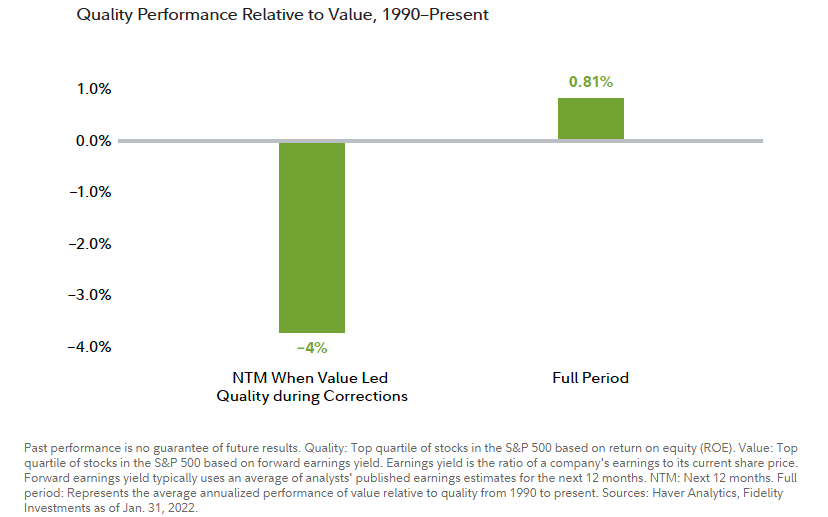

When value leads growth coming out of a correction, or what is otherwise known as quality, it tends to outperform over the next 12-month period. That makes a lot of sense today considering how cheap value stocks remain after the rebound in the stock market.

fidelity.com

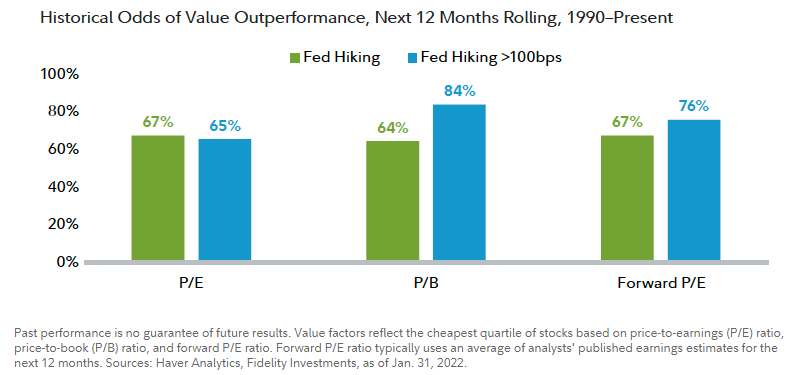

Lastly, the odds of value outperforming increase significantly when the Fed is hiking interest rates, which we know will happen at every meeting that remains this year. This means focusing on stocks with lower-than-average price-to-earnings and price-to-book multiples. Additionally, companies with strong balance sheets that can produce free cash and grow profits in the current environment.

fidelity.com

Taking this approach does not confine investors exclusively to the most defensive sectors of the market, as value can be found in every sector today if it meets such criteria. I will be touching on some of my favorite value-oriented names in coming daily briefs with a focus on one from each sector of the S&P 500 index.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment