jetcityimage/iStock Editorial via Getty Images

The first quarter earnings season is on our doorstep. Alcoa Corporation (AA), once a Dow Jones Industrial Average component, used to be the kick-starter to reporting season, but after it was booted from the index, the largest bank by market capitalization in the world, JPMorgan Chase & Co. (JPM), has that moniker.

A Bearish Outlook

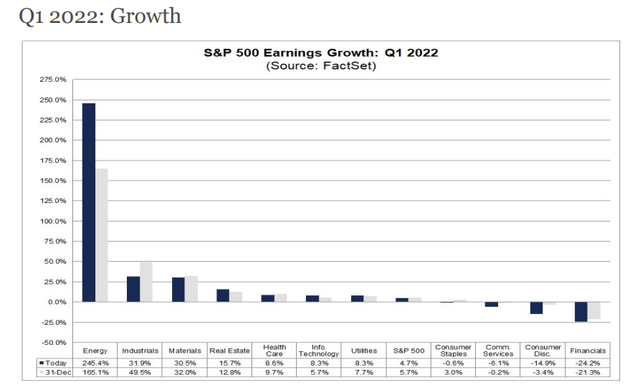

The market does not have high hopes for banks, though. According to FactSet, Financials are expected to show dismal profit figures. In fact, the year-over-year earnings growth rate is forecast to be negative 24%, per John Butters’ earnings insight report.

Within the Financials sector, banks are seen as having the worse change in profits from a year ago at -34%. Consumer Finance and Capital Markets are the other two segments of the underperforming sector, both of which are expected to report earnings decreases from Q1 2021.

Commodities’ Comeback

The clear bright spot this upcoming reporting season is undoubtedly areas tied to commodities. The Energy and Materials sectors are forecast to report stellar earnings growth. Of course, soaring oil, gas, nickel, copper (the list goes on!) prices buoyed those areas. Stocks like Exxon Mobil (XOM), Chevron (CVX), and Freeport-McMoRan (FCX) will be important movers and shakers this go-around.

Moreover, some economically sensitive niches, like those within the Industrial sector, are poised to post solid results. Consider that Q1 last year included some Covid-related restrictive measures in place. So, the YOY comp is somewhat easy.

Watch the Reactions

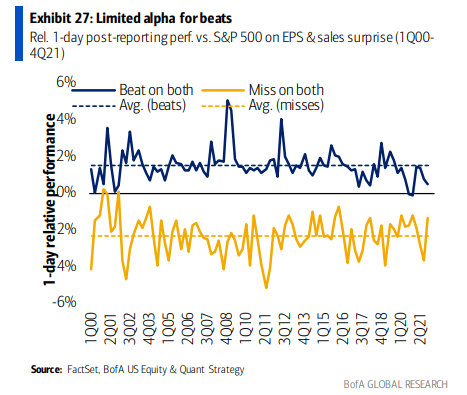

For traders, though, the stock price reactions to earnings reports and conference calls matter more. Last quarter was hallmarked by dismal share price changes in the days after firms reported. According to Bank of America Global Research, earnings reactions were muted in Q1 with just a 0.43% positive share price change in the days after firms that beat on both the top and bottom lines.

Bank of America Global Research

How Should Traders Play This Season?

I would tread very carefully in the coming weeks. Amid geopolitical risks, inflation that is on a tear (perhaps peaking this month), and recessionary fears everywhere, I assert that CEOs and CFOs might attempt to temper earnings outlooks for the balance of the year. If that is the case, then there could be a near-term weakness in the market.

The upshot is that this lowering of the bar could set the stage for bigger gains for the bulls in the second half. In the immediate time, though, you might look to place bearish bets on ETFs such as SPDR S&P Bank ETF (KBE) or even the brokers via the iShares U.S. Broker-Dealers & Securities Exchanges ETF (IAI).

Be the first to comment