Justin Sullivan/Getty Images News

Throughout the market weakness we’ve seen this year, one thing has been very clear; defensive stocks have outperformed for much of 2022. That’s to be expected, of course, as that’s what almost always happens during tumultuous periods. One stock that has been absolutely flying is pharma/consumer goods behemoth Johnson & Johnson (NYSE:JNJ). The stock is behaving extremely bullishly, and with the upcoming spinoff/separation, it certainly looks to me like this Dividend King can continue to run.

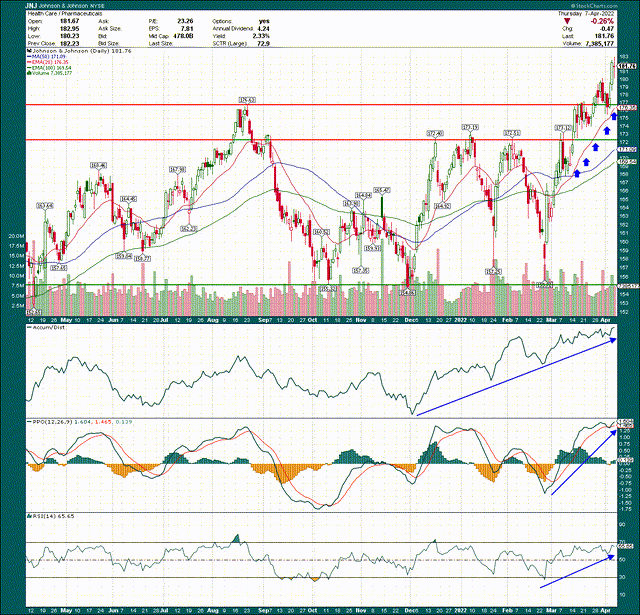

There was a very clearly defined range between ~$155 and ~$173 that was in place for a few months that the stock broke out of about a month ago. Since then, it has also overtaken the prior all-time high, tested that breakout, and moved higher once again. All of this is tremendously bullish as it means the buyers remain despite the fact that the stock is moving higher. Too many times in 2022 we’ve seen stocks break out, but then the breakout fails and the stock plummets. JNJ is doing the opposite.

In terms of support levels, the breakout level of $177, which was the former ATH, is one level of support. That happens to coincide with the rising 20-day EMA, and in a couple of trading days, the 20-day EMA will be higher than the prior ATH. Either one of those levels would serve as support on the next pullback, and would be great, low-risk buying chances.

If we turn to the indicators, the accumulation/distribution line portended bullish strength months ago as you can see the ramp higher. The A/D line rises when the stock ends the day closer to the high of the day than the low, which is indicative of investors buying the dip rather than selling the rip.

On a momentum basis, we see yet more strength, which isn’t always a given at a new ATH. The PPO is at a new high while the stock is making a new high, and the 14-day RSI is nearing overbought.

You get the idea, but this stock looks very bullish to me. There will be pullbacks but so long as we see JNJ remain over the 20-day EMA (ideally), or at least ahead of the ATH breakout point at $177, this one should go higher.

Now, let’s take a look at the fundamental picture, which I see as supporting the bull case, on balance.

Reliable organic growth leads the way

One thing JNJ has never lacked is reliable growth. It has been built over the past 136 years to offer consumers an enormous variety of staples, pharmaceuticals, and medical devices. It has done so through acquisitions and organic growth, and that’s very unlikely to change. The formula works, and JNJ has become truly outstanding at executing this strategy. After all, you don’t become a Dividend King through luck or chance.

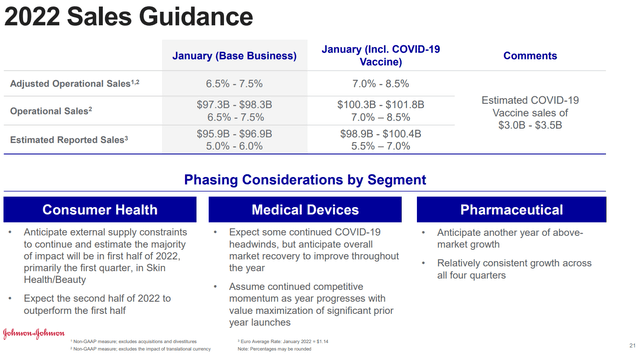

The company’s early guidance for 2022 is quite strong in my view, including adjusted sales growth of 7% excluding COVID vaccines.

It appears the tailwind of COVID vaccines is going to abate pretty significantly this year, as data suggests that the second booster has minimal benefits. That would then suggest the companies that make the shots – like JNJ – are likely to see lower sales on their vaccines, all else equal. We’ll see, but for now, let’s focus on the non-COVID vaccine business for JNJ.

JNJ grappled with supply chain constraints in 2021, and continues to in the early part of this year. The company noted in particular Skin Health and Beauty, which was the biggest drag on revenue in the final quarter of 2021. As supply chain constraints are removed into the back half of the year, we should see those incremental sales offset any potential declines in COVID vaccine revenue. In other words, while JNJ has struggled with sales growth in pockets in recent quarters, a company with more demand than it can fill is much better than the alternative of more supply than it can sell. We see these moves in JNJ’s portfolio all the time, but keep in mind also the very point of being as diversified as it is, is in part to deal with these fluctuations.

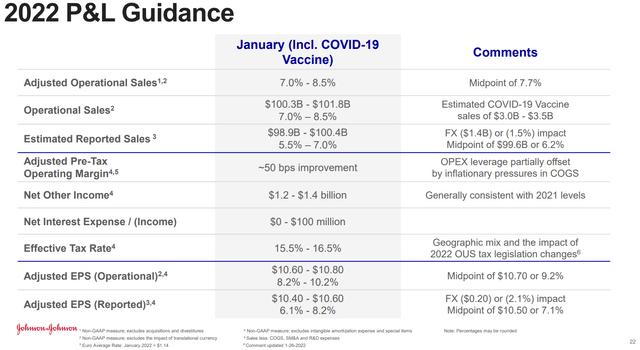

The other piece of this is the company’s margins, which were guided for another very strong performance this year.

Operating margin is set to rise 50bps this year despite the headwinds, which really bodes well for next year and beyond. If you consider that JNJ is still facing supply chain constraints, in addition to inflationary pressures on various inputs, this margin performance is all the more impressive. It also means that if inflationary pressures abate at some point – which they should – there’s a good chance we’ll see another round of margin improvement.

The net impact of rising margins on rising revenue is outsized earnings growth, and you can see JNJ expects ~9% adjusted earnings-per-share growth for this year. Keep in mind also that the number of share repurchases can impact this, but JNJ doesn’t spend a huge amount on buybacks, and it’s a tertiary consideration behind revenue and margin growth.

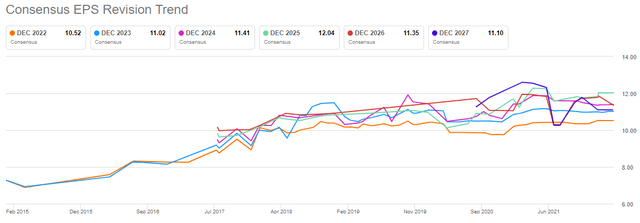

Now, one of the things investors should always keep in mind is the revision schedule for earnings, because it shows whether a company has bullish or bearish momentum from the analyst community.

Over time, we can see there is a slight upward slope to EPS revisions, but it is also worth considering that JNJ’s diversification and predictability means you are unlikely to see massive revisions in either direction. JNJ’s EPS revisions look fine, but I’d look for upside if inflationary pressures and/or supply chain pressures abate more quickly than expected.

Is JNJ stock fairly valued?

With a stock at its ATH, you’d expect the valuation to have followed suit. However, because JNJ’s earnings moved higher steadily for several months while the stock didn’t, the valuation picture is actually pretty decent considering the circumstances.

Let’s begin with a five-year look at the stock’s forward P/E.

Shares go for 17X forward earnings today, against an average of 17X in this period, and a low/high of 12X and 20X, respectively. Of course, the 12X value was a spike low during the initial pandemic panic, so I’m not sure that one counts. We’ll call the adjusted low 15X earnings, so all in all, JNJ trades in a pretty tight range.

On this metric, I’d say JNJ is probably right where it should be in the area of 17X/18X forward earnings. It isn’t cheap, but it’s certainly not expensive.

Now, we all know the company is going to separate its consumer health business out in a year or so, which will lead to a multiple re-rating process. We’ve seen plenty of other conglomerates do this in the past to unlock value, because more focused companies tend to receive better multiples than conglomerates, all else equal.

JNJ trades for 17X forward earnings today, but if we look at a consumer staples company like Procter & Gamble (PG), it trades for 27X forward earnings. Will JNJ’s spin off trade that high? Maybe not, but it certainly argues for a much higher multiple than 17X for that part of the business. Given you’re essentially buying that business for 17X earnings today, if you’re a longer-term shareholder, that should look pretty attractive in terms of valuation upside when the spinoff occurs.

I think JNJ is a buy with or without the spinoff, but when I consider the potential benefits of the proposed transaction, it certainly bolsters the bull case.

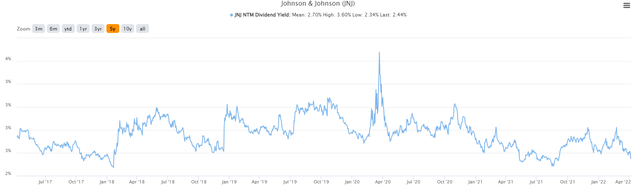

The one thing I’ll note is that JNJ’s yield – which is closely followed given its exemplary history as a dividend growth stock – is very near its historical lows.

The yield is just 2.4%, which is below its average and very close to the bottom of the historical range. For dividend stocks, the yield can be a useful valuation tool, and in JNJ’s case, it is pretty unattractive on a historical basis on the yield.

Keep in mind that if the company continues to grow earnings in the high single digits, dividend growth will follow suit and your income stream will grow meaningfully over time. However, while the P/E says JNJ’s valuation is good, the yield is saying otherwise. For pure income investors, this may be an issue depending upon your particular goals.

The bottom line

All things considered, JNJ looks like a buy today. The stock is trading very near its ATH, and it has already successfully tested its initial breakout. That’s exceedingly bullish, and there are key support levels just below that should hold on any pullbacks. Momentum indicators are signaling more strength ahead, so from a technical perspective, JNJ looks great.

In addition, for a business with the scale, diversification, and organic growth of JNJ, 17X forward earnings looks pretty attractive. I believe we’ll see multiple expansion as the pending spinoff nears, so that’s another tailwind that should gradually accrue over the next 12 months or so. The yield says JNJ is maybe slightly overvalued, but this is really the only point of caution I can see.

JNJ is a rare stock that is breaking out to new highs while simultaneously possessing a strong fundamental/value backdrop. For that reason, I like it a lot, and I think JNJ is a buy.

Be the first to comment