imaginima/iStock via Getty Images

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on April 5th.

REIT Rankings: Self-Storage

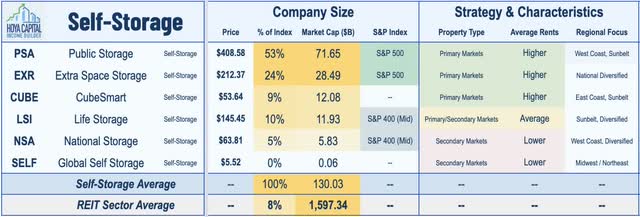

Self-storage REITs – which delivered the most impressive rebound of any property sector throughout the pandemic – have built on their gains in early 2022 following a jaw-dropping 80% surge last year. In the Hoya Capital Self-Storage REIT Index, we track the five major self-storage REITs, which account for roughly $130 billion in market value: Public Storage (PSA), Extra Space Storage (EXR), CubeSmart (CUBE), Life Storage (LSI), National Storage (NSA), along with micro-cap Global Self Storage (SELF).

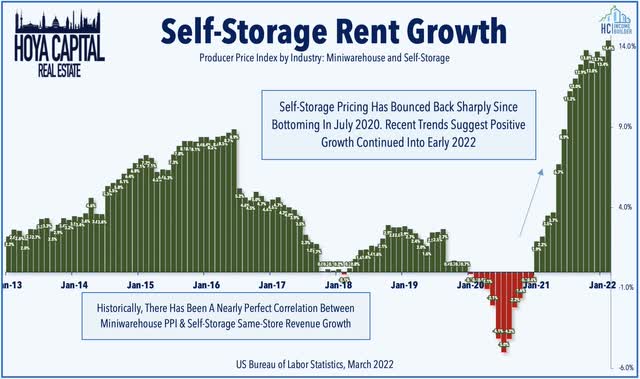

Stumbling into the coronavirus pandemic with challenged fundamentals and an outlook for near-zero growth amid oversupply challenges, self-storage demand soared over the past year, powering record occupancy increases and rent hikes. The Producer Price Index for self-storage facilities – which has historically exhibited a near-perfect correlation with rent growth – illustrates this incredible turnout. The most recent PPI report showed the strongest year-over-year rise in self-storage rents on record in February with prices rising by 14.4% year-over-year. Before the outset pandemic in the final quarter of 2019, storage rent growth had averaged less than 1%.

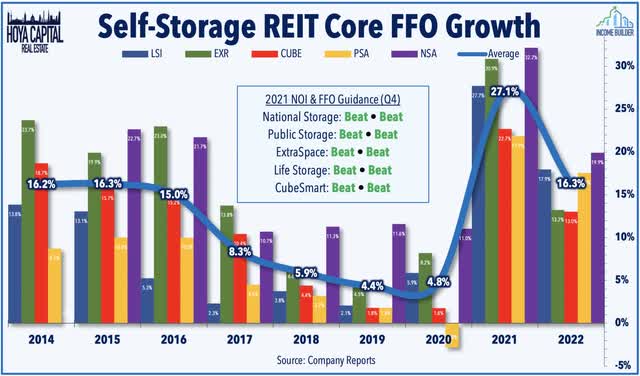

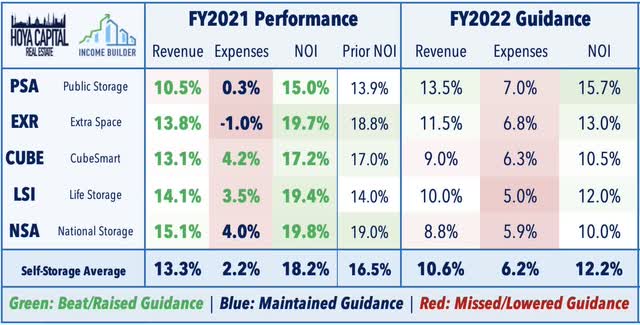

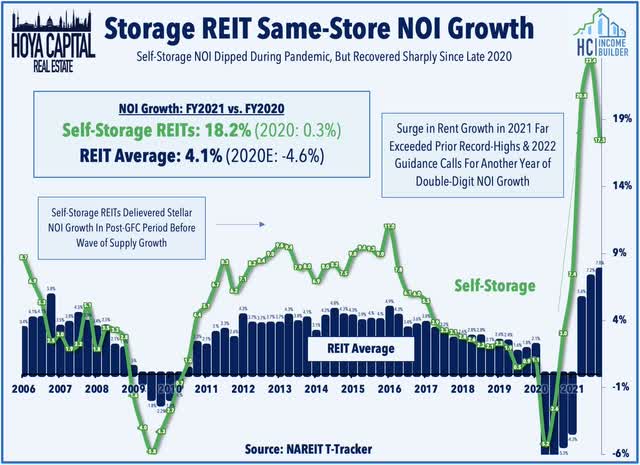

As discussed in our Real Estate Earnings Recap, with these demand tailwinds at their backs, self-storage REITs continue to ride one of the most impressive turnarounds in recent memory and posted yet another comprehensive “beat and raise” quarter in Q4 – completing a “perfect year” of earnings results in which all five REITs beat estimates in all four quarters. Driven by record-high occupancy rates, double-digit rent growth, and accretive external growth through acquisitions and development, Storage REITs delivered FFO/share growth of 27.1% in 2021 – far exceeding the prior record-high of 16.3% in 2015. The initial outlook for 2022 provided during recent earnings season was also quite impressive with these storage REITs expecting FFO growth in 2022 to match the rate of pre-pandemic record-high of 16.3%.

Storage REITs hit ‘rock bottom’ of a multi-year downtrend early in the pandemic and were left for dead by many analysts and investors after reporting a sharp slowdown in leasing activity in Q2 2020. Green shoots began to emerge by late 2020 and after these signs of strength were initially dismissed as a short-term blip, these REITs have sustained and built on the rebound in each of the subsequent quarters. Following several years of heavy discounting and “free rent,” pricing power strengthened considerably over the past eighteen months with move-in rental rates surging by roughly 14% year-over-year in the fourth quarter while ending occupancy rates and Net Operating Income Margins both to fresh record highs at the end of 2021.

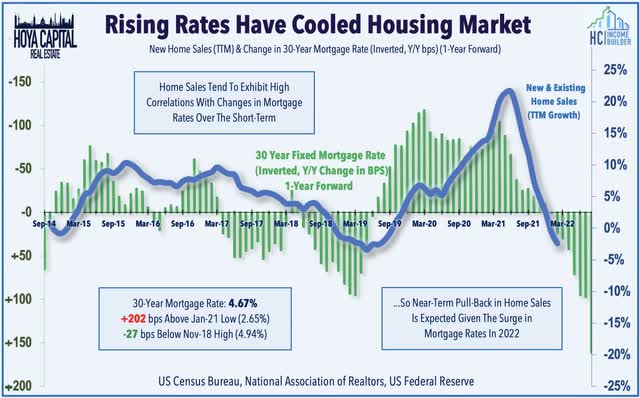

Storage demand is closely-correlated with housing market turnover: specifically home sales and rental turnover. Both new and existing home sales posted impressive gains throughout the pandemic as households sought additional space and more at-home amenities, but the surge in mortgage rates this year appears likely to slow turnover and temper storage demand over the next several months. Storage REITs have been persistently under-estimated over the past two years, so the degree to which this expected slowdown is priced-in is not entirely clear, but we do believe that some increased level of caution is warranted until we see a “leveling-off” of rates.

With storage facilities already operating at record levels of occupancy, the reduced velocity of “change” may have a more muted impact than it otherwise would, and some of the downward effects could be offset, in part, by strength across the broader rental markets. Historically, self-storage rents have also been closely-correlated with apartment and single-family rent growth, both of which have continued to post record levels of increase over the past several months. Zillow (Z) reported last week that multifamily and single-family rents rose 17.0% in February – the highest national average on record. Also of note, Google Search traffic for “storage unit” has exhibited some moderation during this recent upswing in mortgage rates, but remains higher by roughly 4% from last year and higher by roughly 50% from March 2019.

Self-Storage REIT Performance

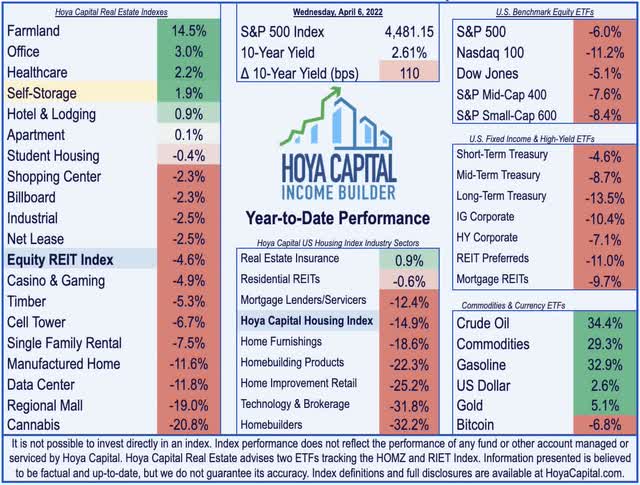

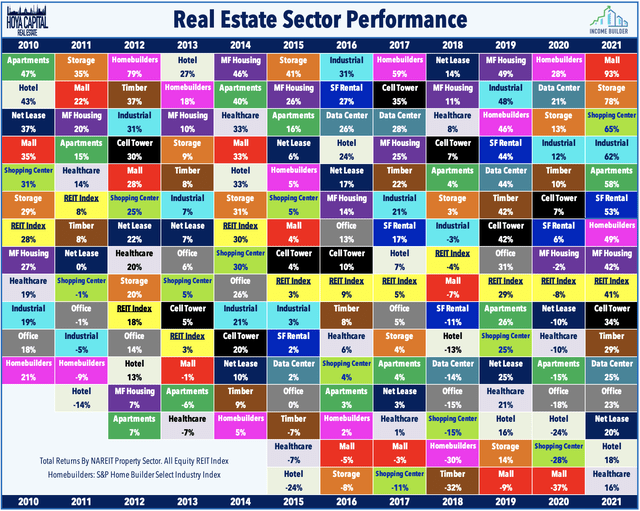

The momentum has continued into 2022 as self-storage REITs are one of just five property sectors in positive territory this year, hanging onto gains of 2% compared to the roughly 5% decline from the Vanguard Real Estate ETF (VNQ). The strong performance in 2021 followed returns of 12.9% in 2020, which was well above the -8.0% total returns of the REIT Index. A much-needed reversal of fortunes, self-storage REITs entered 2020 having lagged the REIT Index in three of the prior four years, a stretch of underperformance that came after a half-decade of sector-leading growth early in the 2010s.

Self-storage REITs were the second-best-performing property sector of 2021 with total returns of 78%, significantly outpacing the returns from the 41% returns from the market-cap-weighted Vanguard Real Estate ETF (VNQ) and the 28% total returns from the S&P 500 ETF (SPY). Over the last five years, National Storage – which focuses on secondary and tertiary markets – has been the top overall performer in the sector with average annualized returns of 26.8% over the past five years, followed by Extra Space with average returns of 26.6%. Public Storage has led the gains this year, however, after underperforming its peers in 2021.

Deeper Dive into Earnings Reports

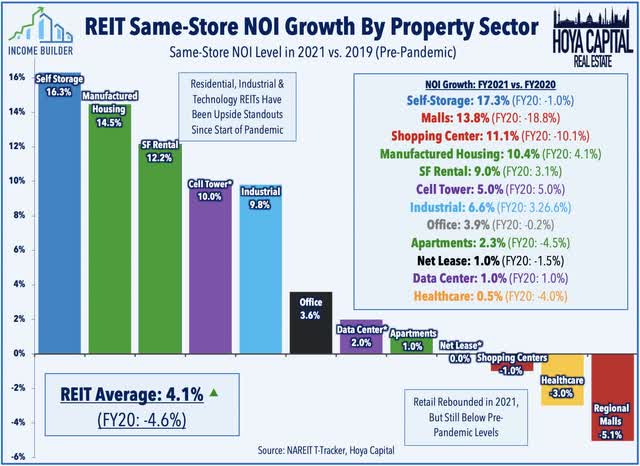

Self-storage REIT fundamentals were among the softest in the REIT sector heading into the coronavirus crisis, but after same-store NOI growth underperformed the REIT sector average in 2018 and 2019 storage REITs have posted the strongest two-year NOI growth of any property sector in 2020 and 2021. Storage REITs recorded NOI growth of 18.2% in 2021 according to NAREIT T-Tracker data, by far the strongest growth ever recorded for the sector. The record-high surge in same-store NOI growth was driven by three factors: a 13.9% average rise in realized rents, a 270-basis point improvement in occupancy rates, and a 120-basis point improvement in NOI margins.

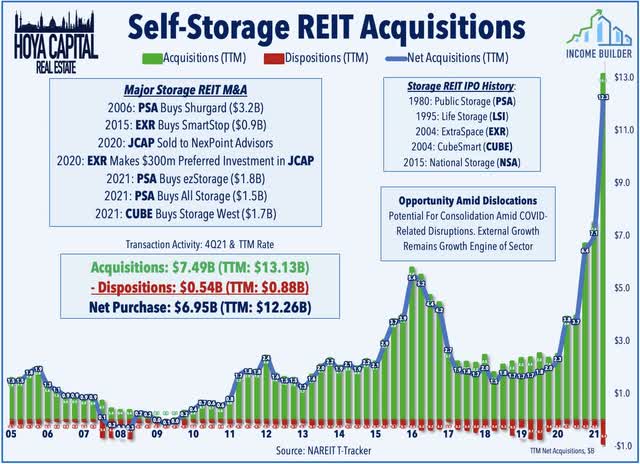

Acquisition and consolidation opportunities should remain plentiful over the next decade for these storage REITs following the late-2010s supply boom, and we did indeed acquisition activity ramp up over the past several quarters as these REITs acquired more than $13B in assets over the past year and $7.5B in Q4 alone. Fueling this record pace was a pair of acquisitions from Public Storage: a $1.8B acquisition of ezStorage – a 48-property portfolio in the Washington DC region, and a $1.5B acquisition of All Storage, which owns 56 properties in the Dallas market. Additionally, CubeSmart completed a $1.7B acquisition of Storage West – an owner and operator of 59 self-storage assets in Southern California, Phoenix, Las Vegas, and Houston.

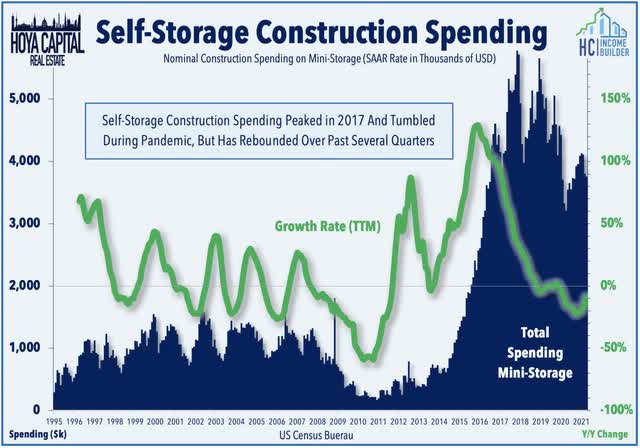

Importantly, on their earnings calls, all five major storage REITs discussed their expectation for moderating supply growth in 2022 and into 2023 as the lagged effects of the weak pre-pandemic fundamentals along with elongated construction timelines continue to suppress speculative development, which should help to alleviate the oversupply issues that weighed on fundamentals in the late 2010s. Consistent with this commentary in earnings calls, construction spending data from the Census Bureau has indicated that the peak in development appears to have occurred in 2017 and declined by more than 10% in 2021, but soaring rents and record-high occupancy rates have spurred a rebound in starts over the past several quarters.

Deeper Dive: Self-Storage Fundamentals

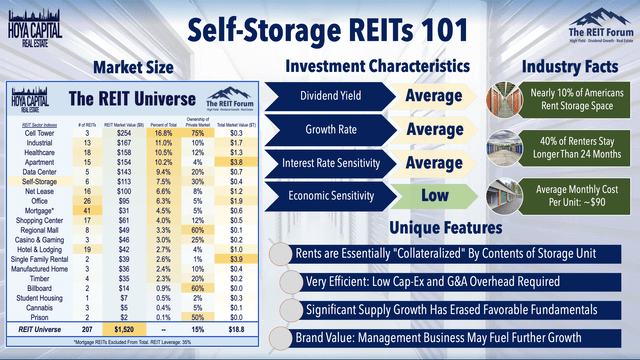

There are roughly 50,000 self-storage facilities in the United States, and proximity to one’s home (generally 3-5 miles) is typically cited as the most important feature. One in ten US households rent a self-storage unit, and 70% of self-storage customers are residential, with the other 30% split between businesses, students, and the military. Nearly half of renters stay longer than two years, and about a quarter rent for at least a decade. The self-storage industry remains a highly fragmented industry, and these six REITs own roughly 20% of the total square footage in the US. Self-storage REITs comprise roughly 5-8% of the broad-based “Core” REIT ETFs and also comprise roughly 3-4% of the Hoya Capital Housing Index, which tracks the performance of the US housing industry.

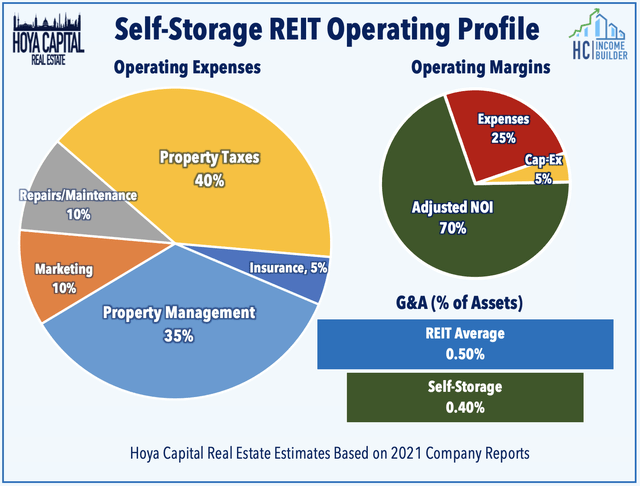

Additionally, the operating efficiency of the self-storage business is second to none in the real estate sector, commanding some of the highest NOI margins in the real estate space at over 70% while requiring minimal ongoing capital expenditures to maintain the facilities. A double-edged sword for these REITs, the ease and efficiency at which operators can enter the market has resulted in a wave of speculative supply growth coming online over the last half-decade, a large chunk of which has come from developers with limited previous experience in the self-storage business. Revenue and expense management technology, brand value, and cost of capital have historically given these REITs a competitive advantage over private market competitors and smaller brands.

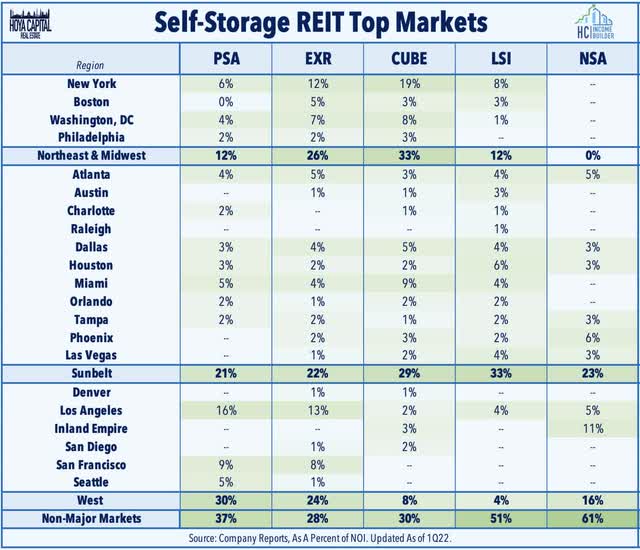

Storage demand exhibits high correlations with moving rates, and recent reports from U-Haul (UHAL) and Zillow indicated an ongoing “coastal exodus” out of many higher-tax and less business-friendly urban metros in the Northeast and California. All six REITs are well-positioned for the “suburban revival” theme with a high percentage of their portfolios in Sunbelt and suburban markets. The three largest REITs – Public Storage, CubeSmart, and Extra Space – operate relatively higher-rent portfolios in more primary markets, while Life Storage, National Storage, and Global Self Storage operate facilities with lower rents in secondary and tertiary markets.

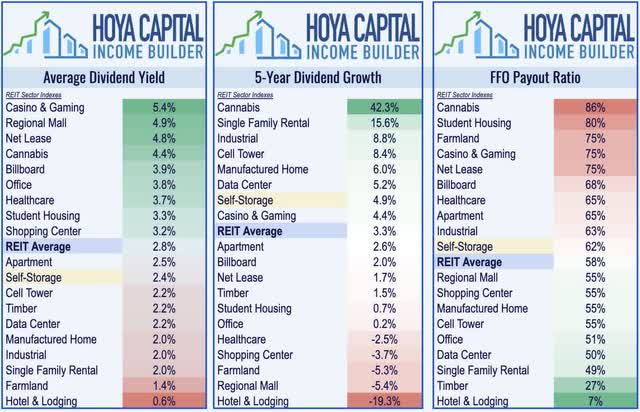

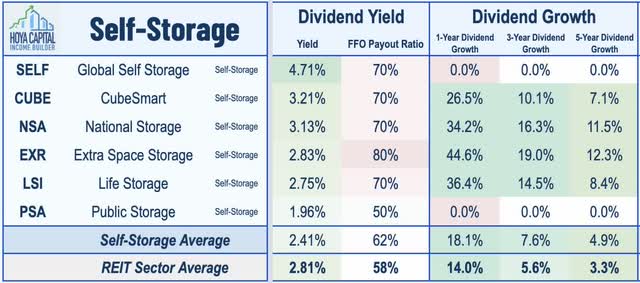

Self-Storage REIT Dividend Yield

Storage REITs were one of the only property sectors that went completely unscathed by the wave of coronavirus-related dividend cuts that sweep across the REIT universe in 2020 and were among the leaders in dividend growth in 2021 as well. Storage REITs pay an average dividend yield of 2.4% which is slightly below the market-cap-weighted REIT sector average of 2.8%. Self-storage REITs pay roughly 60% of their available cash flow, leaving plenty of cash flow to fuel accretive growth through acquisitions and development.

Diving deeper into the sector, we note that the dividend yield ranges from a high of 4.71% from micro-cap Global Self Storage to a low of 1.96% from Public Storage. Notably, CubeSmart, National Storage, and Extra Space have been among the leaders in dividend growth across the REIT sector over the past five years with 7-11% average annual dividend growth rates.

Takeaway: Stabilizing, But Still Some Upside

Stumbling into the coronavirus pandemic with challenged fundamentals and an outlook for near-zero growth amid oversupply challenges, self-storage demand soared over the past year, powering record occupancy increases, and rent hikes. Storage demand is closely-correlated with housing market turnover: specifically home sales and rental turnover. The surge in mortgage rates this year appears likely to slow turnover and temper storage demand, which may be partially offset by the tailwinds from rising residential rental rates. While valuations are not as compelling as last year, the sector’s strong balance sheets, low cap-ex profile, and above-average external growth potential warrant a premium multiple and long-term allocation.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Prisons, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment