AJ_Watt/E+ via Getty Images

Published on the Value Lab 3/4/22

Powersports is one of those industries we’ve basically only just discovered, and we quite like what it’s all about. Interest is at all-time highs with the pandemic promoting outdoorsmanship, but the industry is also plagued by supply side issues related to supply chain shortages, particularly in semiconductors. With the potential for more shortages on the horizon, large players will have to continue to prudently manage their supply chains, and small players will have to rise into the growing market with leaner than ever manufacturing concepts to win. Volcon (NASDAQ:VLCN) is one of these smaller players with a very cool looking line-up, but with so many operational risks on the horizon for powersports players, and with larger players entering into Volcon’s niche eventually, we wonder if the execution can come through and justify a higher valuation for Volcon tomorrow especially as they rapidly burn cash. At least the very first steps have been taken, getting their Grunt into dealerships.

Volcon’s Debut Year

2021 was the first year that Volcon traded on markets. They are still basically a pre-revenue company that has only just started on its concept. Their gross margins are in the pits, and they’ve only made $400K in revenues selling their first vehicle, the Grunt, in a direct to consumer effort. But their more serious commercial push has started, and their current vehicle concepts are allowed to be exported to LatAm with 90 orders already in ($550K more in orders), and they have started getting their bikes into dealerships, at least on paper.

The Grunt (Investor Pres VLCN)

The designs look great, and they got about 360 units in orders of the Grunt in 2021 in direct to consumer which has since been discontinued, representing a partially fulfilled orderbook of $2.2 million from US customers alone, with orders now starting with dealerships for 2022. The Runt, an even smaller EV bike, is also in the stages of development and prep for industrial production. 66 units of the grunt have been sold to dealerships in 13 states, 2 for each location. At a wholesale price of around $6K, that’s another $390K in dealership orders that we can add to the $2.2 million orderbook. This has all been accomplished starting with sales in the Q3, so a certain degree of interest has been proven.

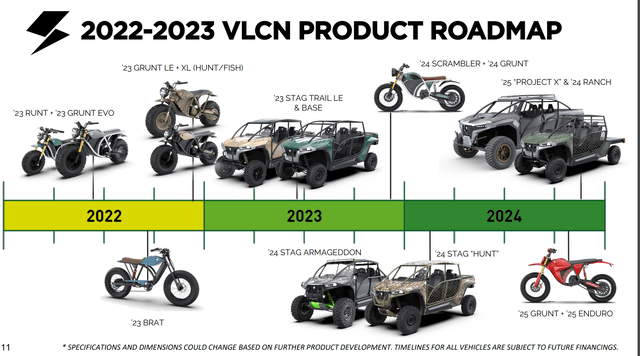

Further down the timeline come Volcon’s UTVs, where the company expects its flagships will be, with these bikes being more of an entry into the market.

Product Timeline (Investor Pres VLCN)

Supply Side Concerns

European sales are expected to start in 2022, and other dates in the timelines also indicate a more robust industrial business very soon, and this is where we begin to worry. In our last article, we explained a more far-out risk of the rubber shortage being yet another barrier to the powersports industry. In the time since then, the semiconductor shortage, which has been a very pressing problem for powersports, has not since abated despite the investment going into fabs, old and new, right now. BRP (DOOO) saw a quarter of declines in Q3 due to a sudden drop in inventories, and the need to make sales on a retrofit agreement basis while remaining components came into stock, and while Q4 was a success in terms of beating out supply chain problems, for a newer player without the highly developed facilities to manufacture and procure at scale in Mexico, a smaller player could have more trouble.

Moreover, Volcon is only now thinking about how to deal with assembly. A couple hundred units is not industrial level production when conducted over a couple of quarters. The company only just started building the grunts, and parts come from Asia, and even though major manufacturers have issues in getting a hold of components despite partnerships with manufacturers like Foxconn, Volcon thinks that profitable GM sales of the Grunt can start already by the second half of 2022. We are very skeptical, and we worry because much like Tesla (TSLA) in its short scare days, delays in orders could mean cancellations, with deposits being the holy grail for early stage automotive companies.

Conclusions

Volcon has achieved over $400K in sales, and its orderbook is ahead of $3 million at this point, calculated at DTC + LatAm + Dealership orders. They are actually delivering pretty quick, given that they only started assembly for sales in Q3 2021. The products also look very cool and the industry has interest levels at all-time highs, with many more new consumers in the market than ever before. The industry’s size is also attractive with a reasonable market size of $4 billion. We are just very worried about the possibility of execution. This is a very tough moment for the industry, with supply side issues being acute. These are not forces that are under Volcon’s control, and they are still needing to meet $3 million in orders, only 10% of the way there, with $3 million still being less than 0.1% of the overall ATV market which we deem the reasonably addressed opportunity. There is a lot of execution to go, and it’s all on the manufacturing side.

Moreover, big player BRP announced in its last earnings call that it has begun the process to address the EV bike opportunity. It is not totally clear how much this will encroach on Volcon yet, which focuses on off-road designs for its debut products, since early BRP concepts did not seem to target the same off-road concept that Volcon addresses. Moreover, BRP did mention that they are valuing things on the basis of the broader EV bike market opportunity. However, it is disquieting that larger players within powersports are taking a shot suddenly at the space. Addressing their traditional markets with products more in line with Volcon’s is possible.

On the point of valuation, it’s difficult to discuss how expensive Volcon is, but we maintain what we said in the last article.

What is implied [in a VC style approach based on current value] is a [somewhat] conservative market share approaching $100 million relative to the $4 billion size of the annual ATV market, marked as the competitive opportunity.

Yours Truly – 27/09/21

The problem is the supply side issues are so real and such a problem for broader industry, that it means a risk of Volcon not being able to make its mark. It’ll have to acquire enough parts to satisfy orders quickly enough to avoid cancellations, and then to be able to follow what they hope will be a lot of dealership interest. While it’s hard to know what their run-rate financial profile will be as they scale, because they have just started, if they continue to fulfil orders like they have, taking advantage of currently set up manufacturing and facilities connected to the founders’ properties, they have already started with burning $24 million in cash for 2021 operating properly for only 2 quarters. They have $5 million left over from SAFE funding, but it wouldn’t be unreasonable to expect a doubling of the share count in 2022, if not more due to stock-based compensation also being quite meaningful. On top of an annualised $50 million cash burn, equal to the market cap, there are also $50 million in exercisable options. With supply chain issues pulling out the profitability horizon, this could all lead to rapid dilution. So the implied market share expectations from the valuation actually look much less conservative now.

The company is worth 1% already of Polaris (PII) or of BRP, and all they really have is a concept, albeit a patented one, that they are building on one of the founder’s properties at a high rate of cash burn. The risks here are very substantial as we can plainly know by the early stage position of the company, and without being able to assume that they’ll have a straightforward path to manufacturing scale due to issues outside everyone’s control, we think the risks are too high to bother investing at this point. With the valuation already assuming they’ll get a hold of market share, implying perhaps quite a lot more given the dilution we’ll be seeing of the share price due to cash burn, we’d prefer to wait and watch.

Be the first to comment