everythingpossible

A Quick Take On Computer Task Group

Computer Task Group, Incorporated (NASDAQ:CTG) reported its Q3 2022 financial results on November 8, 2022, missing expected revenue and EPS estimates.

The company provides digital transformation consulting services for companies worldwide.

Given the downside risk to growth and the company’s current revenue contraction and apparently full valuation, my outlook on CTG is on Hold.

Computer Task Group Overview

The company offers a wide range of business, technology, and operations transformation solutions, as well as staffing services, to multiple industries including financial services, healthcare, manufacturing, and energy.

Additionally, it serves major industry verticals such as healthcare, financial services, energy, technology and manufacturing.

The firm is headed by Chief Executive Officer Filip Gyde, who has been with the firm since 1987.

CTG acquires customers through its in-house direct sales and marketing efforts as well as through referrals from a variety of technology and implementation partners across numerous industries.

Computer Task Group’s Market & Competition

According to a 2021 market research report by 360 Market Updates, the global market for digital transformation strategy consulting was an estimated $58.2 billion in 2019 and is forecast to reach $143 billion by 2025.

This represents a forecast CAGR of 16.2% from 2020 to 2025.

The main drivers for this expected growth in IT consulting are a large transition from on-premises, legacy systems to cloud-based environments with complex architectures.

There is also expected growth in the number of industries adopting digital transformation strategies, such as manufacturing, finance, and retail, as well as a growing demand for improved customer experience.

IT consulting firms can also leverage their expertise to help companies develop and maintain new or better business models which are better suited to the digital world. Many organizations are turning to IT consulting firms to help them align their digital transformation strategies with their business objectives. This can help companies better leverage technology to improve customer engagement, boost collaboration, and reduce costs.

Also, the COVID-19 pandemic has likely pulled forward significant demand to modernize enterprise systems resulting in increased growth prospects for digital transformation consultancies.

The growth of IT consulting is expected to continue due to the evolving digital landscape, increased demand for improved customer experience, the need to develop and maintain new or better business models, and the accelerated demand for modernization due to the pandemic.

Major competitive or other industry participants include:

-

Globant

-

Thoughtworks

-

EPAM

-

Slalom

-

Accenture

-

Deloitte Digital

-

McKinsey

-

BCG

-

Ideo

-

Cognizant Technology Solutions

-

Capgemeni

-

Company in-house development efforts.

Computer Task Group’s Recent Financial Performance

-

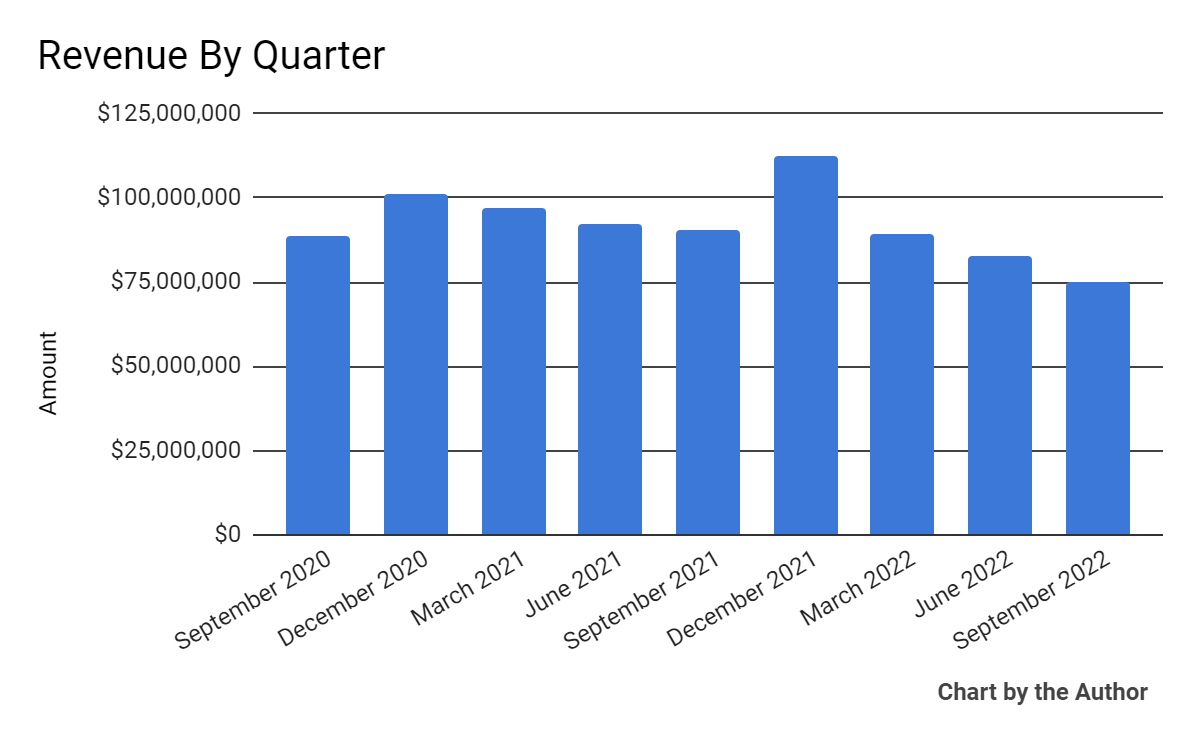

Total revenue by quarter has trended lower in recent quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

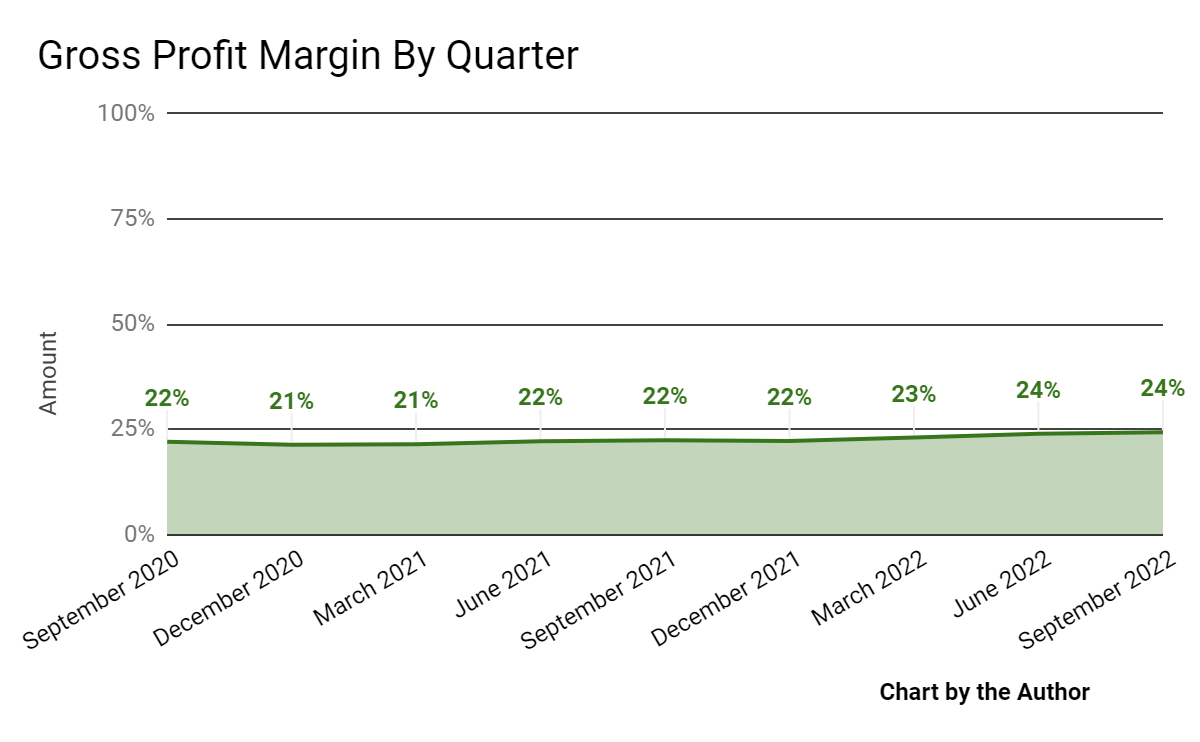

Gross profit margin by quarter has risen in recent reporting periods:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

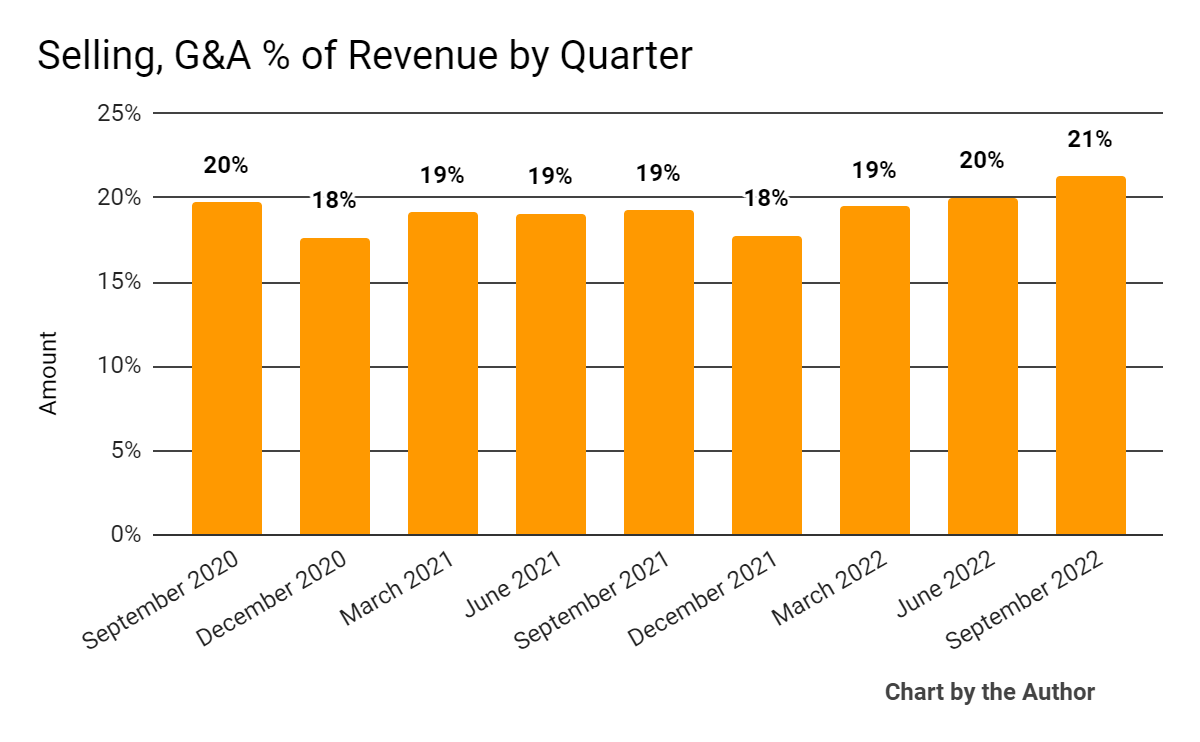

Selling, G&A expenses as a percentage of total revenue by quarter have increased in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

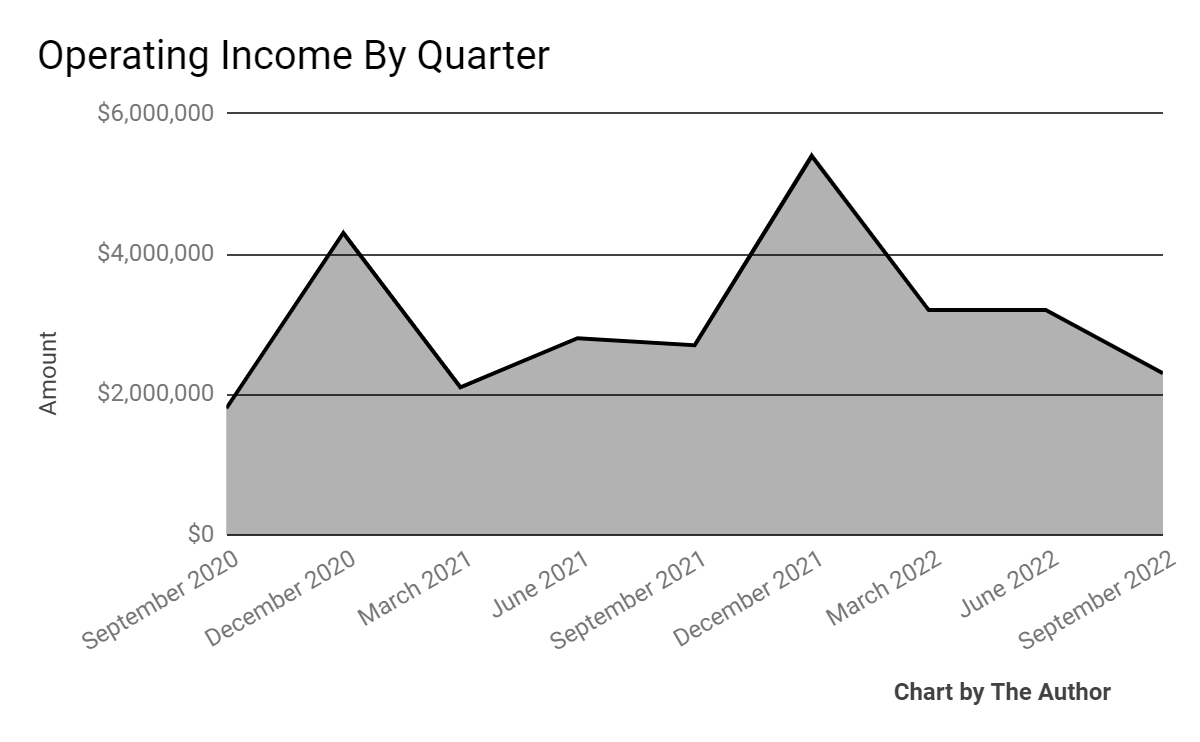

Operating income by quarter has fallen recently, as the chart shows below:

9 Quarter Operating Income (Seeking Alpha)

-

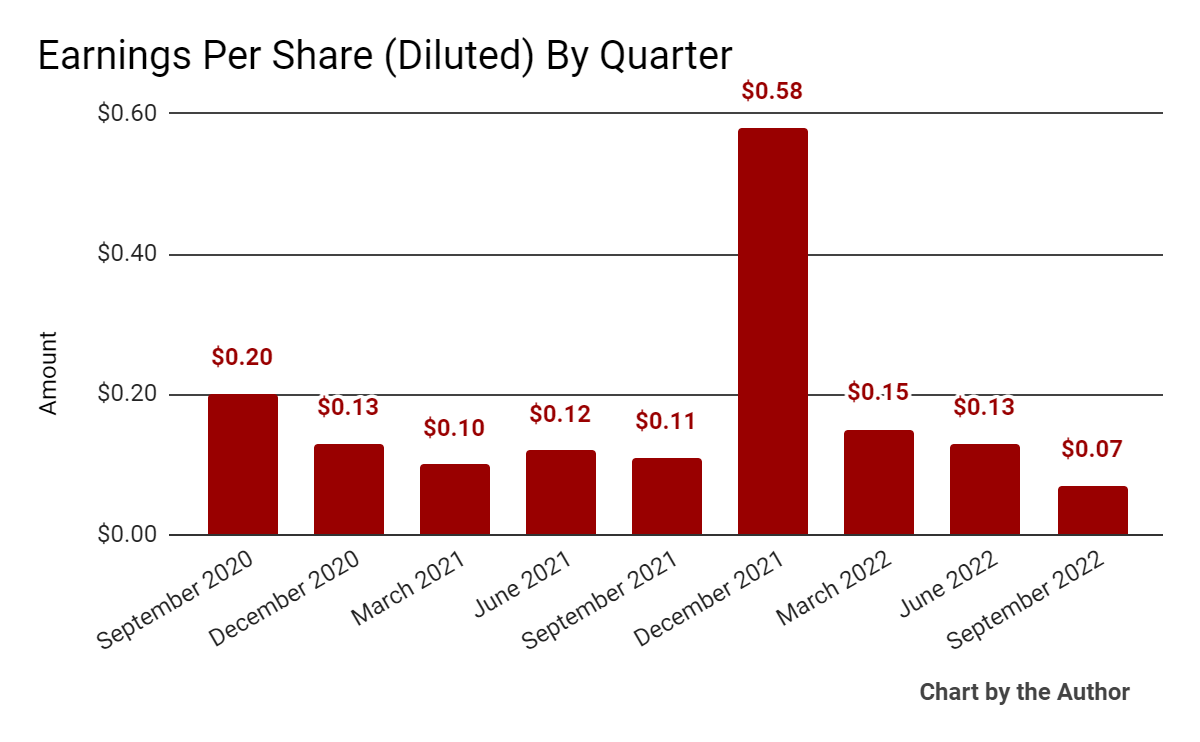

Earnings per share (Diluted) have remained positive, as shown below:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP).

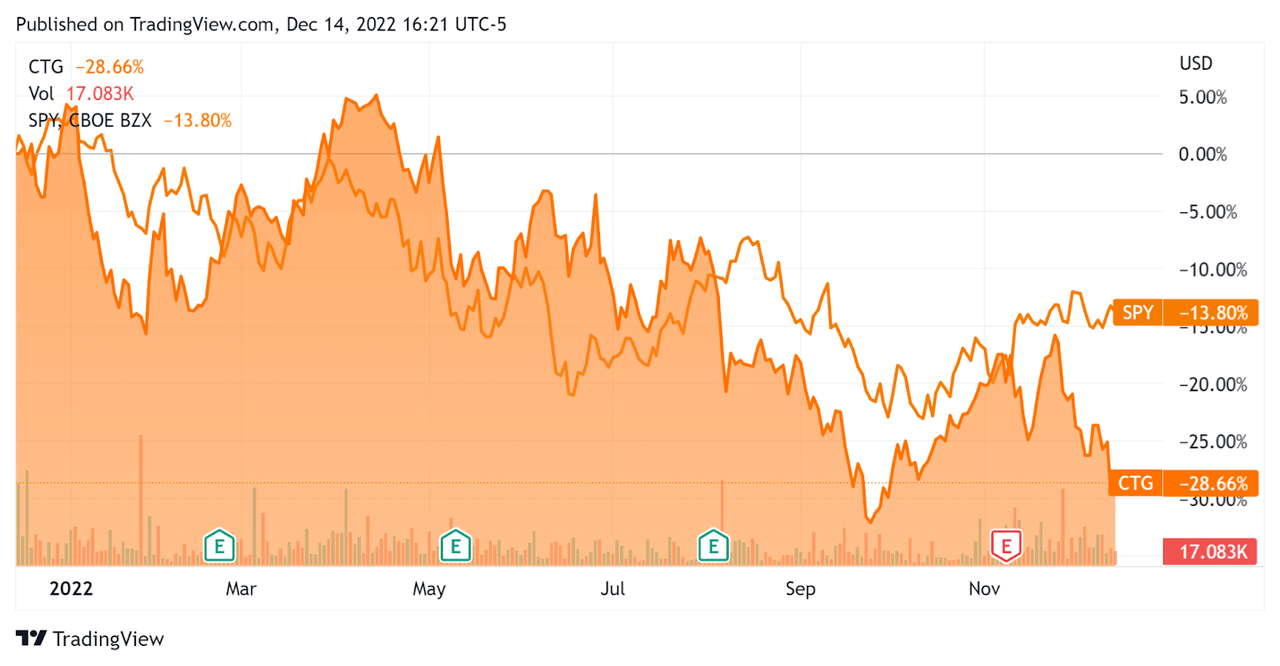

In the past 12 months, CTG’s stock price has fallen 28.7% vs. the U.S. S&P 500 index’s (SPY) drop of around 13.8%, as the comparison chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Computer Task Group

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.3 |

|

Enterprise Value / EBITDA |

6.2 |

|

Revenue Growth Rate |

-5.7% |

|

Net Income Margin |

3.9% |

|

GAAP EBITDA % |

4.6% |

|

Market Capitalization |

$112,501,152 |

|

Enterprise Value |

$102,748,152 |

|

Operating Cash Flow |

$17,687,000 |

|

Earnings Per Share (Fully Diluted) |

$0.93 |

(Source – Seeking Alpha.)

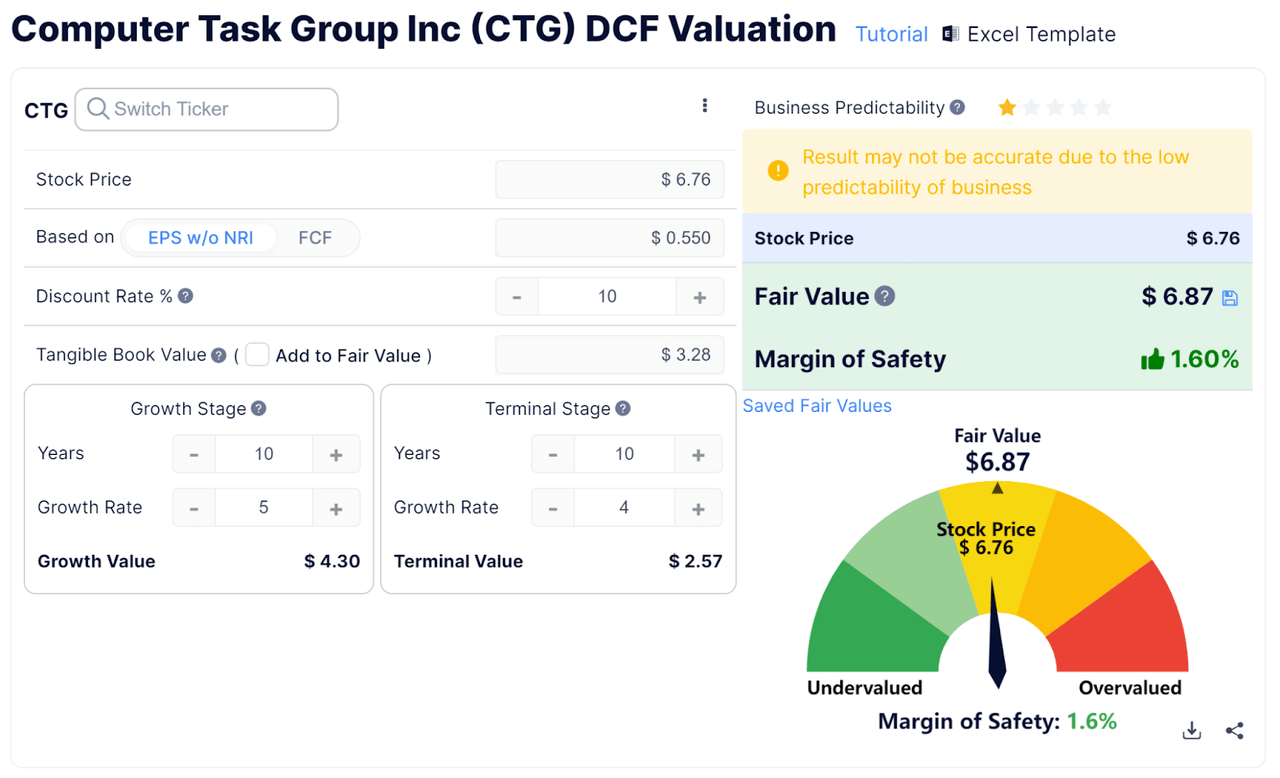

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

CTG Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $6.87 versus the current price of $6.76, indicating they are potentially currently fully valued, with the given earnings, growth, and discount rate assumptions of the DCF.

Commentary On Computer Task Group

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the firm’s plan to reduce its focus on low-margin business from its non-strategic technology services segment.

The company is instead focusing on what it calls a “higher-level mix of digital solutions” in its primary markets in North America and Europe.

CTG recently closed its acquisition of Dallas, Texas-based Eleviant Tech, a digital transformation company “with expertise in mobile, cloud, web, blockchain, robotic process automation [RPA], and artificial intelligence [AI] technologies.”

As to its financial results, total revenue dropped 17% year-over-year, due in part to foreign exchange headwinds from the strong US dollar against the euro.

Gross profit margin rose 2 full percentage points year-over-year.

However, SG&A expenses as a percentage of revenue continued to grow, indicating lower SG&A efficiency.

Operating income dropped, as did earnings per share.

For the balance sheet, the company finished the quarter with $26.8 million in cash and equivalents and no debt.

Over the trailing twelve months, free cash flow was $16.7 million, of which capital expenditures accounted for $1 million.

Looking ahead, management reduced full-year 2022 revenue guidance by almost 10% at the midpoint of the range, but for operating margin to improve and earnings per share to be $0.45 at the midpoint.

Regarding valuation, my discounted cash flow calculation indicates Computer Task Group, Incorporated’s stock may be fully valued at its current price, given the relatively modest assumptions for growth.

Potential risks to Computer Task Group, Incorporated’s outlook include a worsening macroeconomic slowdown, especially in the European region, which will serve to reduce client budget and slow down sales and implementation cycles.

Given the downside risk to growth, the company’s current revenue contraction, and apparently full valuation, my outlook on Computer Task Group, Incorporated is on Hold.

Be the first to comment