Mario Tama/Getty Images News

Bitcoin (BTC-USD) is easy to buy, but is it easy to sell? It is imploding because of Supply. It exploded to an enormous price of $69,000 simply because publicity inflated Demand well beyond the Supply, as most small speculators treated it as a “buy and hold” investment for the long term.

Other than exaggerated Demand driving price higher in an illiquid market, Bitcoin had no value except as a wire service like Western Union (WU). Such services have a very low valuation compared to Bitcoin. It was a craze speculation and now that the bubble has burst, price is dropping as fast as it went up.

It is now recognized as a highly speculative, risk on asset. The bear market and coming recession create a risk off environment. Risky assets fall. Purely speculative investments become worthless. Bankruptcy of firms involved in Bitcoin shake the market. If all the investors want their money back, it creates a run on the Bitcoin “banks.” We are used to being protected by a run on any bank in the U.S. because the government steps in and stops the run on the bank and covers all deposits. Bitcoin does not have that protection.

I can still see a famous, TV, talking head, Jim screaming at the camera that he could not liquidate his Bitcoin position and get his money back. This is a professional caught in the squeeze. The poor, small investors have no such recourse to get their money back. Now we know that some pension funds are going to take a Bitcoin hit as well as some professional speculators and investors.

Will Bitcoin ever see $69,000 again? Only if publicity can create more Demand than Supply for years to come. That seems unlikely with crypto firms going bankrupt. Yes, there is a limited Suppy of Bitcoins. Yes, if you are smart enough to create a narrative that will get all buyers to “buy and hold” and suck in more new buyers because the price is soaring, then there is no limit to how high price will go before the profit taking starts. Yes, if the Reddit network of traders decided to corner the Bitcoin market, price could rise rapidly. This is the old game of penny stocks and tulip bulbs. Bitcoin is just a new form of such old time speculations in the market. Its biggest advantage in the scheme is limited Supply.

As you can see the time to be in Bitcoin was when everyone was buy and hold and everyone wanted to get a piece of the action as price soared to $69,000. Could it happen again? Anything is possible. Could it happen now? Not with bankruptcy news, investors screaming like the talking TV heads losing money and the regulators swooping in after the horse is out of the barn.

Where is the bottom and can you make money during big bounces in a bear market? The good news is yes, you can make money in big bounces during a bear market. Just look at the current bounce in the stock market (SPY). The bad news is that Bitcoin is still diving, looking for support and the next bear market bounce.

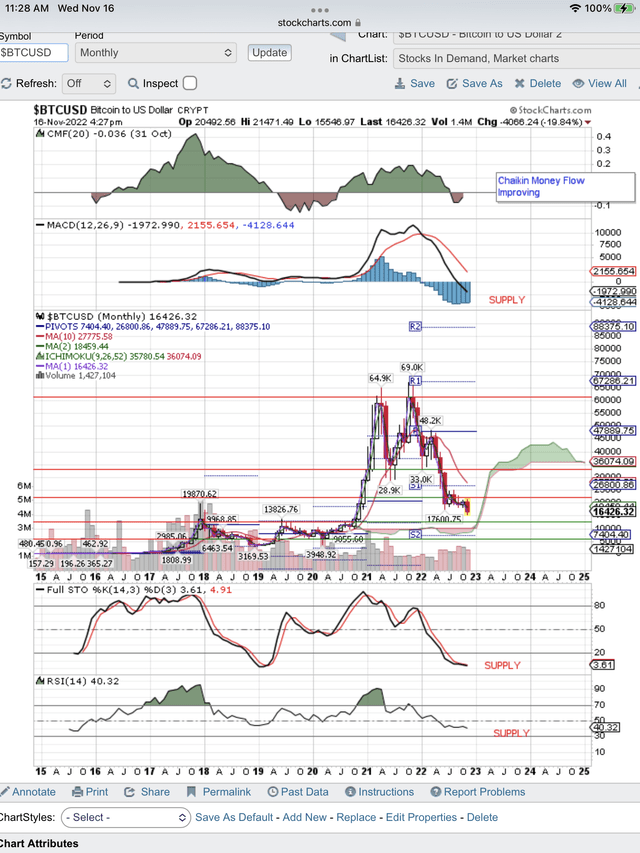

Here is our monthly chart showing the winners taking price up to its peak and now the losers left holding the bag. The winners were the smart traders on Wall St. who ran it up. The losers are the poor, small investors who used their retirement funds because they thought it was going to $400,000. When Elon said you could no longer buy a Tesla with Bitcoin, you knew the game was over. When the talking head on TV screamed that he could not get his money, you knew a bankruptcy was coming.

Notice the bounces in the Bitcoin bear market. We think that Bitcoin is targeting a test of support at $14,000. If traders corner the market or Tesla accepts Bitcoin to buy a car, or any other positive narrative, Bitcoin will get bear market bounces. We don’t think that will happen just now.

Here is the monthly chart showing the rise and fall of Bitcoin and note the Supply signals. Except for Chaikin Money Flow, they have not improved yet.

Rise and Fall of Bitcoin (StockCharts.com)

Be the first to comment