Nikolay Chekalin

Introduction

Over the past two years, we have spent a lot of time discussing fossil fuels in light of the post-pandemic demand recovery, subdued supply growth, progressive environmental policies, OPEC, and everything related to these developments. While we will certainly continue to do that given the ongoing energy crisis and buying opportunities, it’s time we dive into my favorite non-fossil fuel energy source: nuclear. I believe that nuclear energy is the only way to support long-term electricity demand and the trend to clean energy without creating a dependence on far less reliable and energy-dense renewables. The problem is that, like all other energy sources, we could be facing supply issues. Hence, in this article, I will highlight two mining stocks. Cameco Corporation (NYSE:CCJ) and Energy Fuels (NYSE:UUUU) offer investors exposure to short uranium supply chains in an increasingly risky world – geopolitically speaking.

Why I Don’t Like Wind And Solar

As I’ve often said in my bullish fossil fuel articles, I’m not against an energy transition. However, I’m against forcing an energy transition based on demonizing fossil fuels and pushing for sources that are not even remotely as green as one might believe.

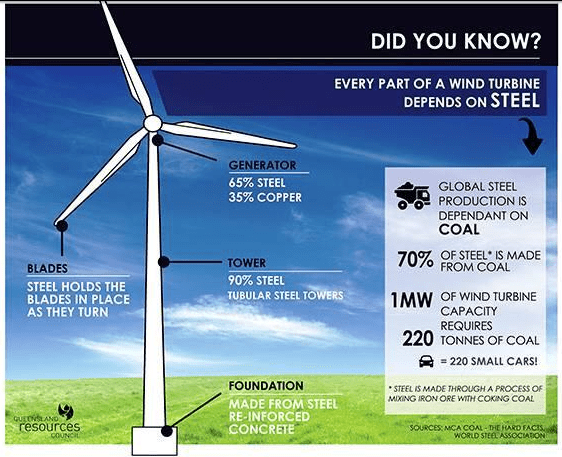

The other day, I shared a picture on Twitter showing the environmental impact of wind energy. Wind turbines are made almost entirely of steel and concrete, which requires a lot of steel. 70% of global steel is made from coal. Hence, it takes roughly 220 tonnes of coal to produce 1MW of wind energy. That’s equal to 220 small cars.

World Steel Association

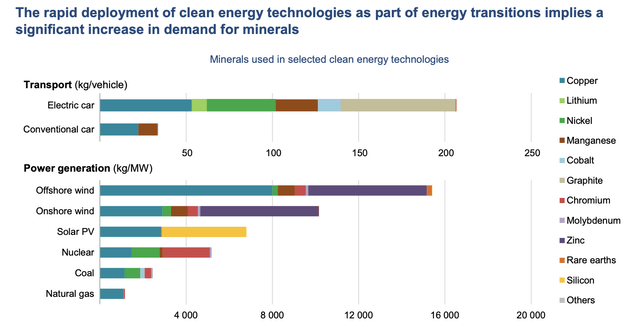

The graph below from the International Energy Agency elaborates on this, showing how much critical metal the energy transition will require. Wind (onshore and offshore) and solar require much more resources than natural gas and coal. The same goes for electric cars – compared to conventional cars.

International Energy Agency

Moreover, China processes roughly 90% of these minerals, which means economies will become increasingly dependent on China when it comes to the energy transition.

Why I Like Nuclear

Nuclear energy is often not included in the clean energy debate. Yet, it’s the second-largest source of low-carbon electricity in the world – behind hydropower.

The Office of Nuclear Energy in the United States (a government organization) published an article last year highlighting the three reasons why nuclear energy is needed. On a side note, the Biden administration launched a $6 billion nuclear power credit program to keep older reactors online.

With that said, nuclear energy generates power through fission, which is the process of splitting uranium atoms to produce energy. The heat released by fission is used to create steam that spins a turbine.

According to the Nuclear Energy Institute, the US avoided more than 471 million metric tons of carbon dioxide in 2020 thanks to its nuclear capacity. That’s like removing 100 million cars from the road and more than all other clean energy sources COMBINED.

Moreover, the nuclear energy footprint is small. A typical 1,000-megawatt nuclear facility in the United States needs a little more than one square mile to operate. Wind farms require 360 times more land. That’s far from optimal for many reasons.

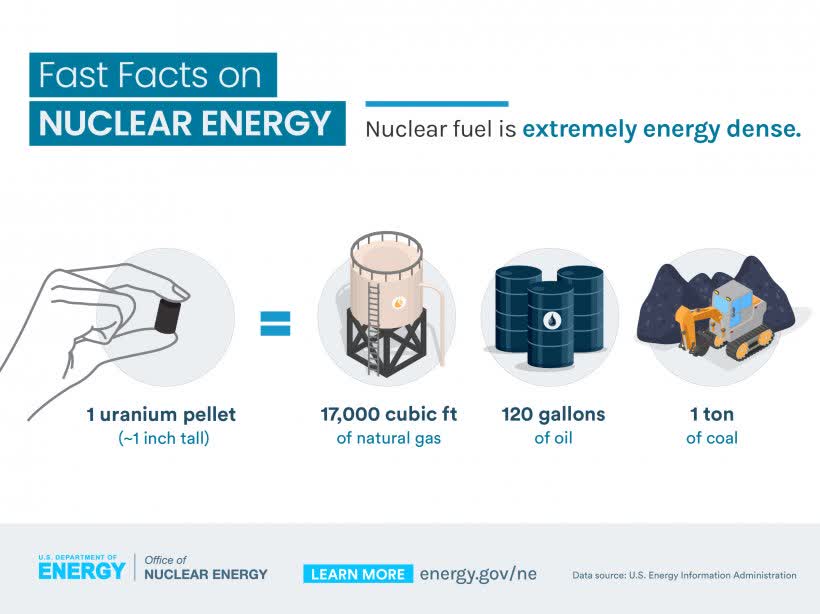

At this point, a lot of people will be thinking of nuclear waste. After all, that’s an actual issue. However, nuclear waste is extremely dense. Nuclear energy is roughly one million times denser than other traditional energy sources.

The energy created by one 1-inch uranium pellet is equal to 120 gallons of oil.

US Department Of Energy

All used nuclear fuel used in the United States over the past 60 years could fit on a football field with a depth of fewer than 10 yards.

Moreover, newer nuclear reactors can use nuclear waste for energy generation, leaving even less waste at the end of the process.

Nuclear Is Back

With all of this in mind, the current energy crisis is causing countries to accelerate investments in nuclear energy. In Europe, the UK and France are leading the way. The UK, which generated roughly 16% of its electricity from nuclear in 2020 wants to boost that number to 25% by 2050. It is building eight large reactors.

France, which already generates 70% of its energy from nuclear energy, is building six new reactors and extending the lifetime of all existing reactors – after assessing the safety situation.

But wait, there’s more. As I already said, the US is making $6 billion available to bail out nuclear power plants at risk of closing prematurely for economic reasons. Canada wants to become a leader in reactor technology. Japan is accelerating the restart of about two dozen reactors after the 2011 Fukushima disaster. South Korea announced the construction of four more nuclear reactors.

Even Germany, the biggest opponent of nuclear energy decided to extend the life of its remaining nuclear power plants – after deciding it wants to close all 17 reactors.

Russia is building new plants in Egypt and Turkey while adding business from Myanmar and Uganda. Also, Russia is the biggest exporter of reactors and nuclear fuel.

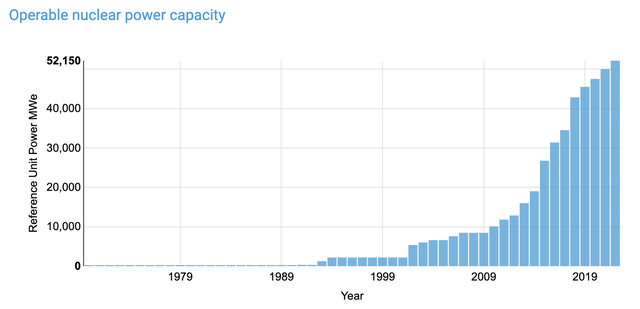

And then there’s China. The biggest user of coal accounted for six of the 10 global reactors whose construction began in 2021. India accounted for two. China now has 23 reactors under construction. The government aims to expand that capacity by almost a third within the next three years.

World Nuclear Association (China Nuclear Power Capacity)

Unfortunately, there are some issues. Nuclear comes with new geopolitical and supply chain decisions, which is one of the reasons why I’m writing this article.

The Big Issue Facing Nuclear Energy

Supply. That’s the big issue. if developed nations want reliable nuclear energy in the decades ahead, they need to start working on sourcing supplies. After all, we’re now (once again) finding out that energy supply is a geopolitical issue. For example, Russia is using its energy leverage over Europe as a weapon of war. And, so far, it’s working if Putin’s goal is to weaken European economies.

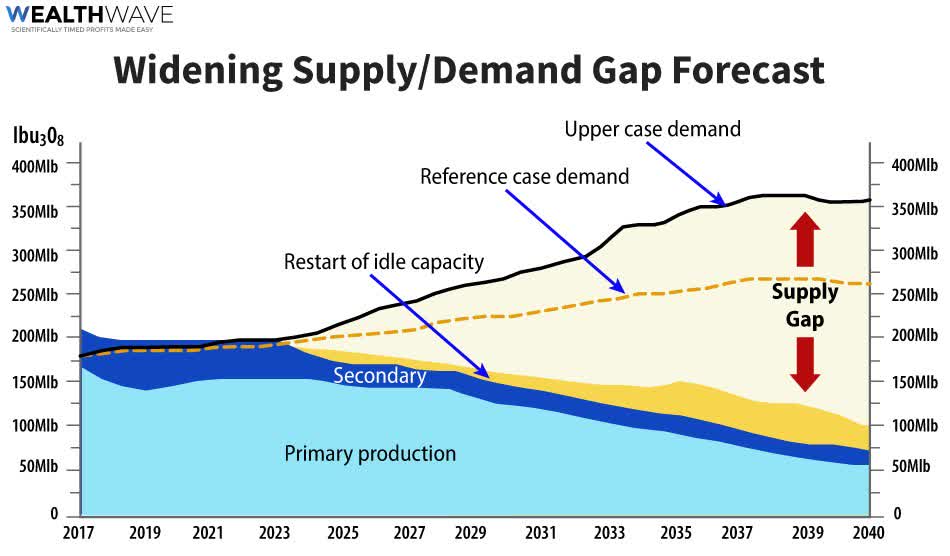

This is what uranium supply and demand developments could look like:

World Nuclear Association

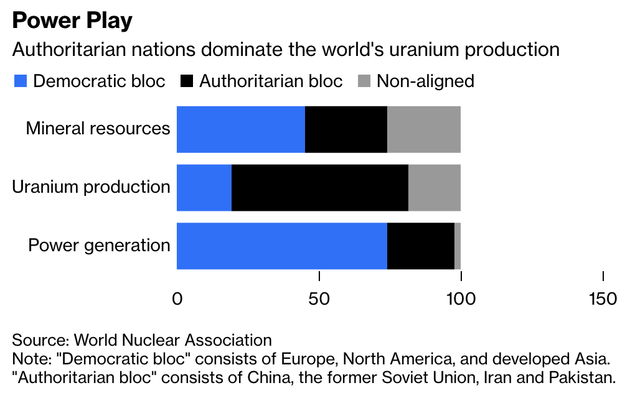

While roughly 75% of nuclear energy is created in Western nations, they provide just 19% of the 75,000 metric tons of uranium oxide needed to maintain that energy creation. China, the former Soviet Union, Iran, and Pakistan together account for 62% of mined production. That’s a huge deal as it comes with geopolitical implications.

Bloomberg

Kazakhstan alone provides more than 40% of the world’s uranium.

Hence, as reported by Bloomberg:

If a Ukraine-style situation unfolded that saw developed democracies pitched against authoritarian rivals and control of energy supplies used as a weapon of war, even air freight might not be enough to keep western reactors fueled, since Kazakhstan is almost surrounded by Russian, Chinese, Iranian and Pakistani airspace.

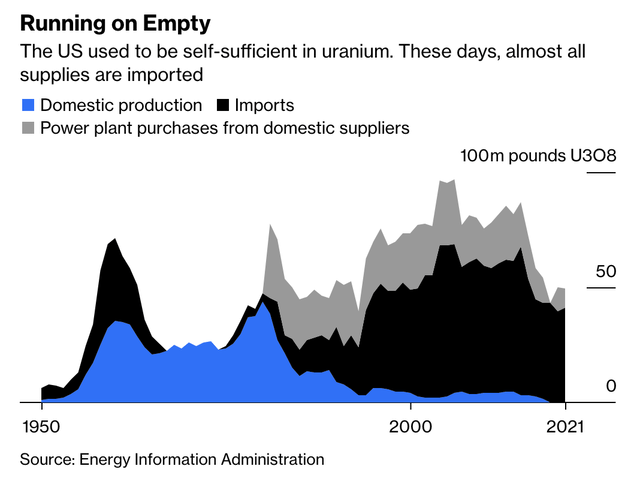

Moreover, the United States, which used to be self-sufficient, is now highly dependent on imports.

Bloomberg

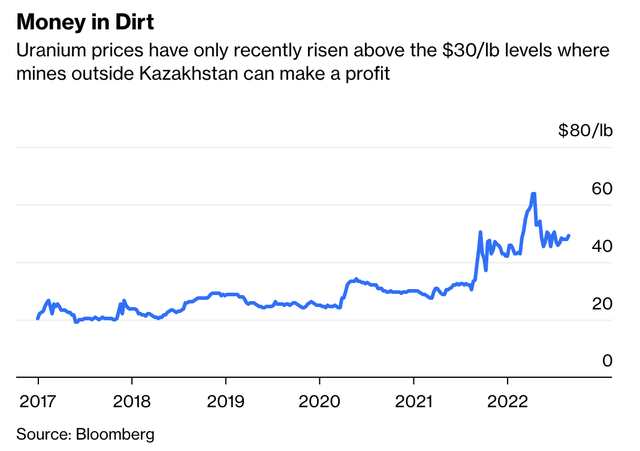

As a result, uranium prices are now trading at prices twice as high compared to pre-energy crisis levels. At these prices, less profitable mines become profitable again, which is good news for uranium supply outside of “less democratic” countries.

Bloomberg

This brings me to the actionable ideas of this article.

Cameco Corporation (CCJ)

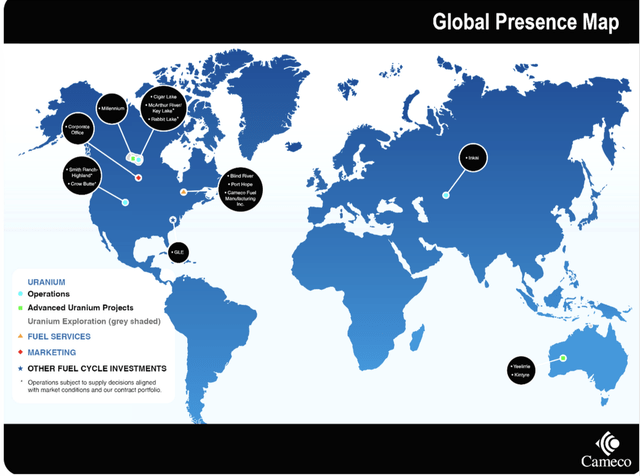

Like many mining companies, Cameco is a Canadian company. Headquartered in Saskatoon, Canada, the company has a market cap of $10.4 billion, which makes it one of the largest players in the industry.

Incorporated in 1987, Cameco produces and sells uranium. Its two segments are uranium and fuel services. The company has contracted roughly 23 million pounds of uranium over the next five years.

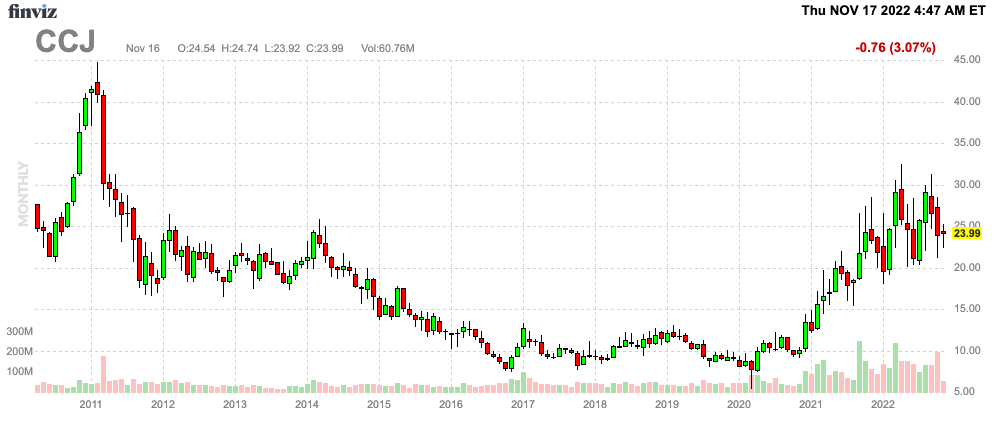

FINVIZ

The company has 464 million pounds of proven and probable reserves, it has 447 million pounds of measured and indicated resources, and 154 million pounds of inferred resources. Inferred resources are estimates based on sampling and geological evidence.

For example, in its McArthur River mine, the company owns 69.8% of production, producing 1.4 million pounds of average Grade U3O8 (Triuranium octoxide), which is a compound of Uranium. This number is expected to increase to 10.5 million pounds in 2024.

Cameco Corporation

The company also owns 40% of the Inkai mine in Kazakhstan.

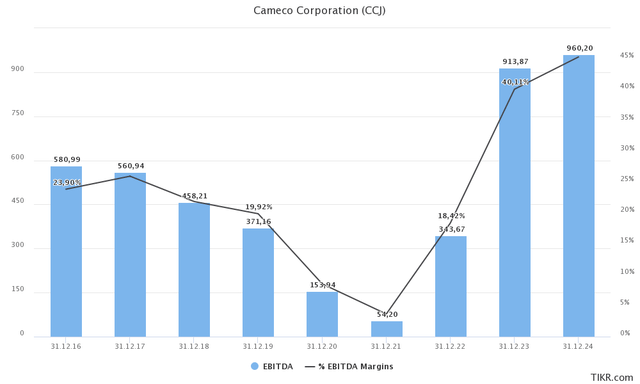

TIKR.com (Numbers are in Canadian dollars)

The company believes that it is one of the biggest beneficiaries of the global nuclear demand recovery. So far, this year, the company has added 50 million pounds of long-term uranium contracts. In its fuel service segment, prices are at an all-time high. Moreover, since January, Cameco has secured seven million kilograms of uranium under six long-term contracts.

Moreover, the company is about to accept another 27 million pounds of long-term uranium contracts. The key terms have all been agreed to, it just needs to be finalized.

Moreover, the company announced a deal with China, allowing it to benefit from the world’s fastest-growing uranium (demand) market.

[…] a uranium supply agreement with the China Nuclear International Corporation, a subsidiary of the China National Nuclear Corporation (OTC:CNNC), one of the country’s largest nuclear power operators.

According to a statement, the contract, finalized earlier this year, was marked as part of the China International Import Expo 2022.

“China is counting on nuclear energy to play a major role in its commitment to achieve net-zero emissions, and CNNC is a large and growing part of that effort,” said Cameco president and CEO Tim Gitzel. “Cameco is very pleased to continue increasing our contribution towards the attainment of China’s important climate goals.”

Moreover, in September, Cameco agreed to acquire Westinghouse in a joint venture deal with Brookfield Renewable Partners (BEP).

Cameco will own 49% of Westinghouse, bringing together its expertise in nuclear with Brookfield’s expertise in clean energy.

Westinghouse services about half the nuclear power generation sector and is the original equipment manufacturer to more than half the global nuclear reactor fleet. The company has industry-leading intellectual property and a specialized workforce of roughly 9,000 employees capable of operating in highly regulated markets around the world.

Going forward, CCJ is now able to provide investors with upstream exposure to valuable and strategic mining and milling assets, downstream exposure to valuable and strategic fuel service assets, and ultimately levering to improve prices and growing cash flow to boost shareholder returns.

With that said, CCJ is trading at 15.4x 2023E EBITDA of C$913 million. That’s based on its C$13,800 billion market cap and C$250 million in expected 2023E net debt. While this includes the Westinghouse deal, it is still just 0.3x EBITDA, which is terrific news for financial stability.

The company has a BBB- credit rating at S&P Global, with a stable outlook.

Given the bigger picture, I believe that CCJ should be trading at $35 per share before moving higher as global investments in nuclear energy continue to increase.

Energy Fuels Inc. (UUUU)

Energy Fuels is much smaller than Cameco. Incorporated in 1987 (the same year as Cameco) as Volcanic Metals Exploration, the company changed its name in 2006.

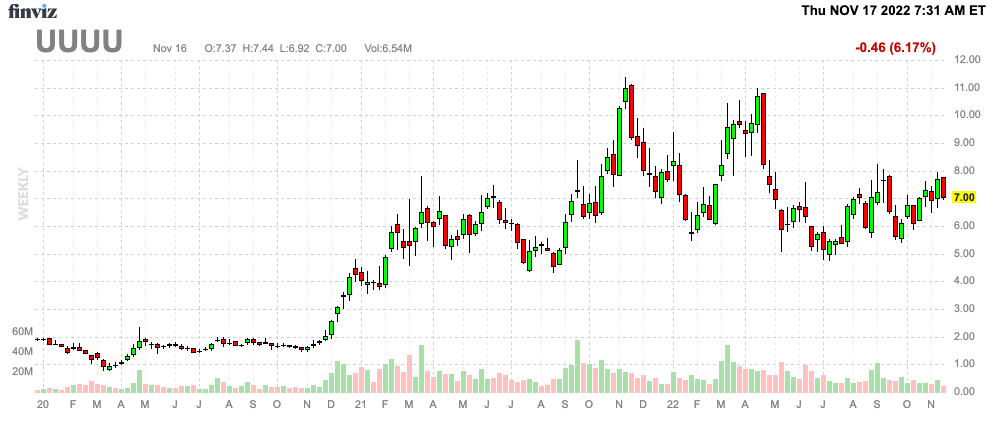

FINVIZ

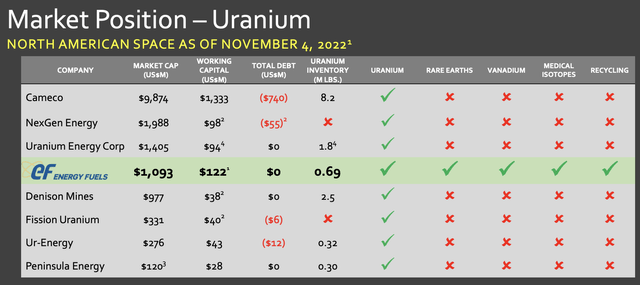

With a $1.1 billion market cap, Energy Fuels engages in the extraction, recovery, exploration, and sale of conventional and in situ uranium recovery in the United States.

The company owns and operates the Nichols Ranch project, the Jane Dough property, the Hank project in Wyoming, the Alta Mesa project in Texas, and White Mesa Mill in Utah. It also holds interests in uranium and/vanadium properties and projects in various exploration, permitting, and evaluation stages located in Utah, Wyoming, Arizona, New Mexico, and Colorado.

The company generated 54% of its full-year 2021 sales in the United States. 44% of sales came from Estonia.

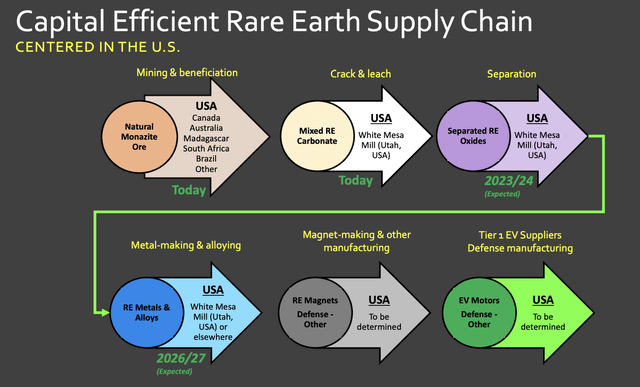

Estonia functions as a gateway for UUUU to the European rare earth supply chain. As reported in July 2021:

Energy Fuels Inc. (NYSE American: UUUU) (TSX: EFR) (“Energy Fuels”) and Neo Performance Materials Inc. (TSX: NEO) (“Neo”) are pleased to announce that the first container (approximately 20 tonnes of product) of an expected 15 containers of mixed rare earth carbonate (“RE Carbonate”) has been successfully produced by Energy Fuels at its White Mesa Mill in Utah (the “Mill”) and is en route to Neo’s rare earth separations facility in Estonia, creating a new United States-to-Europe rare earth supply chain. Additional shipments of RE Carbonate are expected as Energy Fuels continues to process natural monazite sand ore (“Monazite”) mined in Georgia (U.S.) by Chemours (NYSE: CC) for both the rare earth elements and naturally occurring uranium that it contains.

Moreover, the company believes that it has a competitive advantage based on its exposure to rare earths (including Vanadium), as well as medical isotopes and recycling.

Energy Fuels

At this point, I’m referring to the chart in the first half of this article sowing the need for rare earths in the energy transition. This is an additional tailwind for UUUU, as I expect rare earth prices (and demand) to accelerate in the years ahead.

In 2022, the company expects to produce between 130 and 140 thousand pounds of uranium with 760 to 900 thousand pounds of uranium in inventory at the end of the year. Moreover, the company expects roughly 205 tonnes of mixed REE carbonate production containing roughly 95 tonnes of TREO. In this case, REE stands for rare earth elements. TREO stands for total rare earth oxide.

Five years from now, UUUU will operate a top-tier rare earth supply chain including mining, cracking, separation, and metal-making.

All of it is located in the United States, which makes UUUU a strategic partner in an increasingly tricky geopolitical world.

Energy Fuels

With regard to the current geopolitical situation, the company commented:

[…] Energy Fuels has secured uranium supply contracts and we’re looking at additional contracts at support of pricing. For these contracts, we have significant uranium inventories, which will be fed into the contracts in the early years. And we are working on investing in our minds and hiring people to resume large-scale uranium production as soon as next year.

Moreover, the company’s uranium contracts are looking good. The base quantity for 2023 contracts is three million pounds, which could increase to 4.2 million mounts. This secured substantial revenue over the next eight years with mines coming back to production.

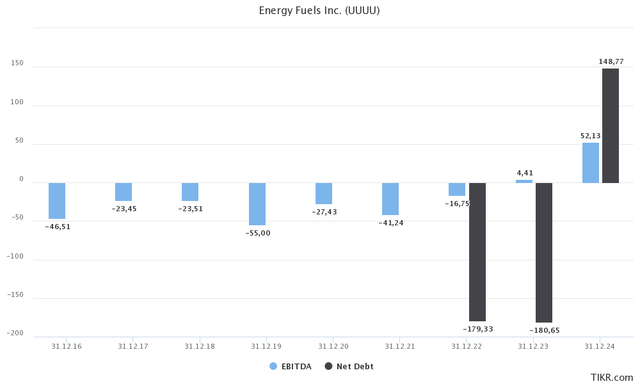

With that said, the company is not profitable. In 2024, the company is expected to generate positive EBITDA. However, it helps that the company has zero gross debt, which opens up new possibilities for higher investments down the road.

TIKR.com

With that said, UUUU is way more expensive than CCJ. UUUU is trading at 25x 2024E EBITDA of $50 million, which is very lofty.

However, unlike some tech stocks, it is extremely likely that UUUU will indeed achieve its targets. The demand is there, and if anything, both demand and pricing are likely to come in higher than expected.

The current consensus price target for UUUU is $10, which I believe is fair. An upside to $12 is likely as the nuclear bull case continues to unfold.

Takeaway

I am a big believer in the future of nuclear energy. And given the ongoing energy crisis, this thesis is getting more support by the day. New reactor plans are revealed almost on a weekly basis, western nations are investing billions in keeping existing reactors while working on new reactors that have the ability to use nuclear waste as well.

While nuclear energy has opponents who are concerned that safety isn’t guaranteed, it is by far the only clean energy source with extreme energy density, barely any waste, no pollution, and the ability to fuel the energy transition without creating energy security risks.

Unfortunately, there’s one bottleneck. That bottleneck is uranium supply as western nations have neglected uranium mining, making emerging markets the largest providers of input materials. This comes with new geopolitical challenges.

In other words, because of the energy crisis, we’re not only finding out that nuclear energy is a solution, but we’re also finding out that we need to work on secure supply chains.

That’s where Cameco Corp and Energy Fuels come in. In this article, I presented the bull case for the uranium players. Cameco is the largest, less volatile player with more mature (and increasingly diversified) operations. Energy Fuels is smaller, more volatile, and less developed when it comes to operations.

However, Energy Fuels is becoming one of the best uranium supply chain plays as it is working on a North American rare earth supply chain, including mining, processing, and further distribution.

I believe that both stocks offer tremendous long-term potential in light of nuclear energy developments.

(Dis)agree? Let me know in the comments!

Be the first to comment