Orla/iStock via Getty Images

Investment Thesis

The Downfall Of FAANG Stocks

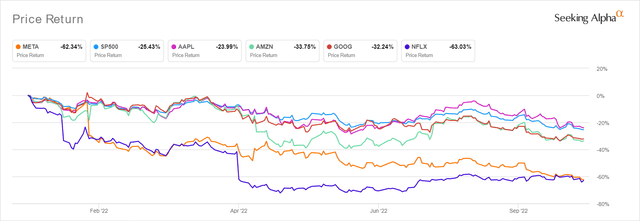

Meta Platforms, Inc. (NASDAQ:META) has been absolutely decimated by now, with a -66.36% plunge since its September 2021 peak. Though the rest of the FAANG stocks have also suffered, none are as bad as Meta at -62.34% YTD fall and Netflix (NFLX) at -63.03% YTD, obviously. While we remain Meta bulls and are confident of its rebound prospects once macroeconomic conditions improve, we are no longer confident of the stock’s support level. It continued to hit new lows previously never seen before in the past few years, pointing to the extreme levels of FUD in the stock market.

It doesn’t help that US payrolls increased by 263K and the unemployment rate fell by 3.5% sequentially in September, pointing to the relatively robust labor market conditions. The September PPI Index continued to prove that the elevated inflation rate is sticky, given the sequential 0.3% increase and YoY 7.2% increase in the core index. In light of this, we expect the September CPI to be released by 13 October 2022 to still show elevated inflation rates. Thus, the Fed’s November meeting is projected to result in another 75 basis points hike, causing more pain for the stock market, significantly worsened if the Feds increase their terminal rate from the previous projection of 4.6% to 5%. Ouch.

Mr. Market Downright Obliterated Meta’s Estimates & Valuations

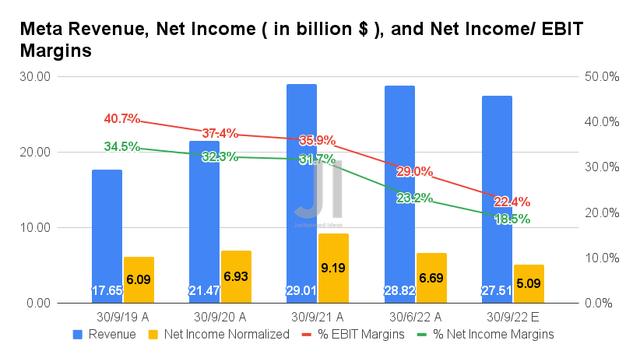

For its upcoming FQ3’22 earnings call, META is expected to report revenues of $27.51B and EBIT margins of 22.4%, representing a notable QoQ moderation of -4.54% and -6.6 percentage points, respectively. Otherwise, another tragic decline of -5.17% and -13.5 percentage points YoY, respectively.

As a result, META’s profitability continues to suffer, with projected net incomes of $5.09B and net income margins of 18.5% for the next quarter, indicating a drastic fall of -23.91% and -4.7 percentage points QoQ, respectively. Otherwise, an even more worrying YoY plunge of -44.61% and -13.2 percentage points, respectively. Therefore, it is no wonder that the stock has suffered thus far, with a massive -62.34% plunge YTD compared to the S&P 500 Index at -25.43% at the same time. The Meta stock has already been overcorrected to its previous October 2016 levels, with more potential bloodshed ahead if the Feds stuck to their hawkish stance.

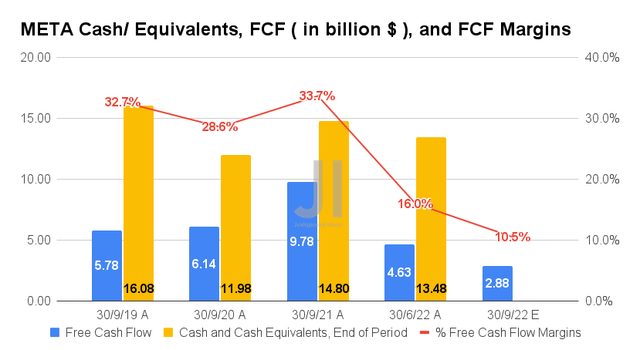

Furthermore, META’s Free Cash Flow (FCF) is also impacted, with a projected generation of $2.88B and an FCF margin of 10.5% for FQ3’22, indicating a notable decrease of -37.79% and -5.5 percentage points QoQ, respectively. Otherwise, an eye-watering plummet of -70.55% and -23.2 percentage points YoY, respectively, due to its elevated capital expenditure of $22.68B in the last twelve months, representing a tremendous increase of 31.63% sequentially.

In the meantime, META investors need not worry about its immediate liquidity, due to the robust cash and equivalents of $13.48B on its balance sheet by FQ2’22. Nonetheless, its infamous choice of $10B debt offering in August 2022 has indeed caused some concerns, further fueling its stock pessimism.

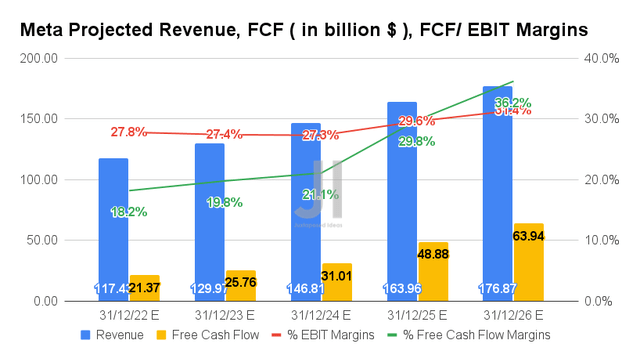

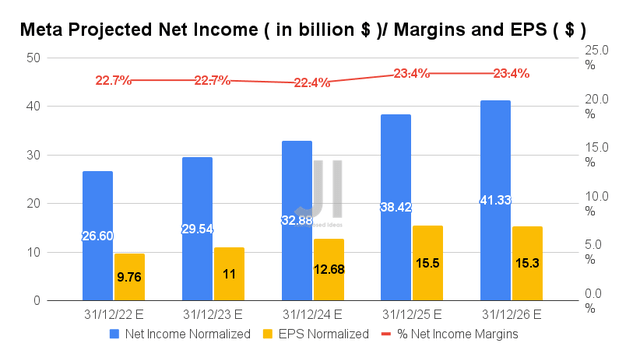

Over the next five years, META is expected to report revenue and net income growth at a CAGR of 8.45% and 10.18%, respectively. By now, it is apparent that Mr. Market is more bearish than we thought, given the massive downgrade in top-line estimates by -20.09% since February 2022 and -4.84% since August 2022.

Nonetheless, given the stellar growth in META’s FCF generation at a CAGR of 17.07% between FY2019 and FY2026, we are cautiously hopeful for a turnabout, as the management tries to work through the Apple privacy changes and the normalization post-pandemic hyper-growth. The downgrades are unfortunate, but, well, it is what it is, as the world weathers the worsening macroeconomic conditions with the Metaverse left behind in the dust.

In the meantime, consensus estimates that META will report revenues of $117.43B and FCF generation of $21.37B in FY2022, indicating relative inline YoY though a massive decline of -45.35%, respectively. Its margins also suffered YoY, with a notable fall in EBIT margins by -11.8 percentage points and FCF margins by -15 percentage points.

Thereby indicating Meta’s declining profitability, with consensus estimates further downgrading its projected bottom line by -32.89% since April 2022 and -7.58% since August 2022. Its projected net incomes of $26.6B and EPS of $9.76 in FY2022 also represented massive cuts of -32.43% and -29.12%, from the record-breaking FY2022 levels of $39.37B and $13.77. With the overly pessimistic Mr. Market cutting estimates left and right, it is evident that the carnage is not over, since the S&P 500 Index has also hit new lows with a -25.43% plunge YTD.

Meanwhile, we encourage you to read our previous article on META, which would help you better understand its position and market opportunities.

So, Is META Stock A Buy, Sell, or Hold?

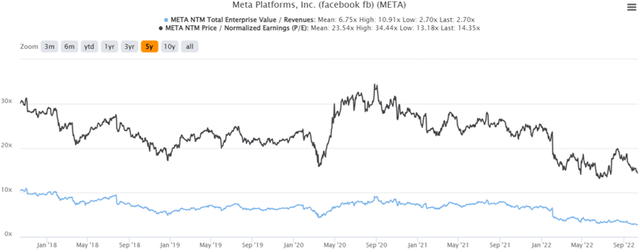

META 5Y EV/Revenue and P/E Valuations

META is currently trading at an EV/NTM Revenue of 2.70x and NTM P/E of 14.35x, lower than its 5Y mean of 6.75x and 23.54x, respectively. The stock is also trading at $127.50, down % from its 52 weeks high of $353.83, nearing its 52 weeks low of $126.25. Nonetheless, consensus estimates remain bullish about META’s prospects, given their price target of $208.54 and a 63.56% upside from current prices.

META 5Y Stock Price

Despite our previous buy rating on META, we are no longer convinced that there is a floor forming from these extreme levels of FUD. The stock had continued to plunge to new lows, no matter the uptick from its FQ1’22 and FQ2’22 earnings call. Further pessimism was triggered by the overly bearish market that slashed the company’s forward estimates several times. Combined with the worsening macroeconomics, it is unlikely that we will see META recover in the short term, barring a highly positive catalyst ahead.

META has been valiantly trying to cut costs through remote work strategies and office closures, while also freezing hiring through 2023. Nonetheless, we do not expect to see a meaningful impact on its profitability and cash flow in the short term, given its massive FY2022 capital expenditure of up to $34B indicating a massive 83.18% increase YoY. The rising inflationary costs and the notoriously unprofitable Metaverse strategy are not helping the recessionary fears as well.

Therefore, we prefer to rate META stock as a Hold for now, since it is entirely possible that it may plunge to $100, if not worse.

Be the first to comment