BING-JHEN HONG

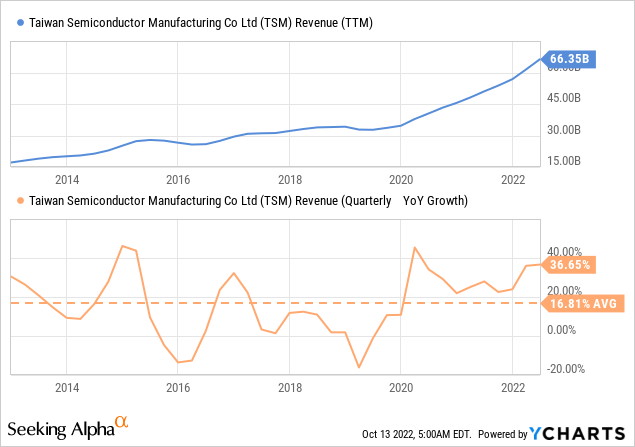

Taiwan Semiconductor (NYSE:TSM) has reported what we consider an excellent quarter, with profit surging ~80% year over year. For the third quarter profit was NT$ 280.9 billion compared to analyst expectations of NT $265.6 billion. Revenue was up 36% year over year, and the company expects fourth quarter revenue to be up ~29% year over year. We believe this deceleration in revenue growth is relatively minor compared to the degree the macro-economic conditions have weakened, and the fact that the company still expects significant year over year growth for the next quarter should reassure investors.

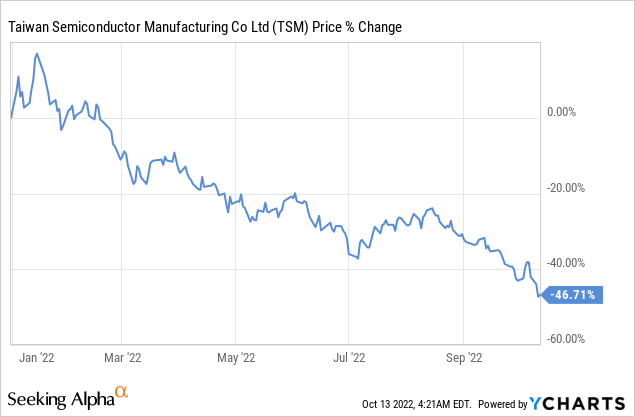

The company is becoming more cautious given the weakening environment, and decided to reduce its annual capital investment budget by roughly 10% to around $36 billion. Still, it does appear that the company has been navigating the downturn experienced by many of its customers rather successfully. Given the recent news out of semiconductor companies like AMD (AMD) and Micron (MU), 29% growth next quarter does not sound too bad. This resilience, however, has not translated to the share price, which has been cut almost in half year to date. This has reduced the valuation of one of the most important companies in the planet to a market cap of only ~$332 billion.

The data center and automotive businesses have remained steady for now, and it’s likely that the business overall will be more resilient than the broader chip industry, given the competitive advantages that Taiwan Semiconductor has over rivals.

Other recent news affecting the share performance include the U.S. Department of Commerce introducing new rules to restrict semiconductor related exports to China on Oct. 7. It is difficult to tell how much this will impact Taiwan Semiconductor at this time, but we remain optimistic since export licenses are still possible under the new rules.

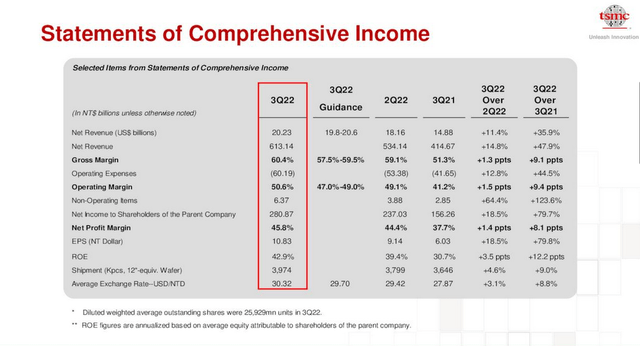

Taiwan Semiconductor Q3 2022 Results

For the third quarter of fiscal year 2022 GAAP earnings per ADR of $1.79 beat analyst expectations by $0.11. Revenue of $20.2 billion was ~36% higher y/y, and beat expectations by $1.1 billion. Gross margin was 60.4%, 1.3 percentage points higher than 2Q22 and 9.1 percentage points higher than 3Q21. Operating margin was 50.6%, up 1.5 percentage points from 2Q22 and up 9.4 percentage points from 3Q21. Advanced technologies, defined as 7 nano-meter and more advanced technologies, represented 54% of total wafer revenue. Return on equity was an impressive 42.9%.

Taiwan Semiconductor Investor Presentation

Growth

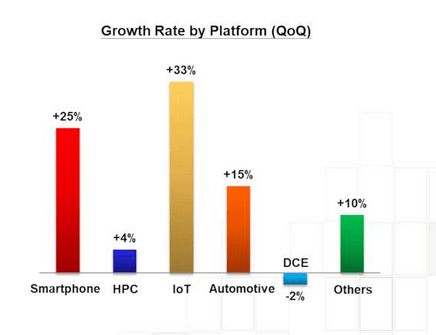

Despite much talk of a weakening smartphone market, Taiwan Semiconductor saw a +25% growth quarter over quarter for this category, which together with high-performance computing still represent the vast majority of its revenue. Growth in high-performance computing was less impressive at only +4%. IoT was the category that experienced the fastest growth at +33%, but this segment still represents only ~10% of total revenue.

Taiwan Semiconductor Investor Presentation

Revenue growth has been impressive the last ten years, and has had a marked acceleration the last couple of years. In our opinion this remains one of the best growth companies in the world.

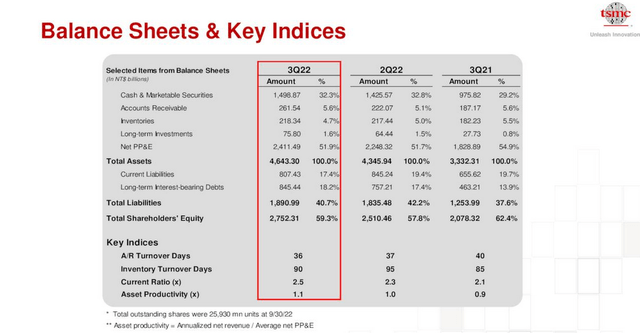

TSMC Balance Sheet

The balance sheet remains extremely strong, with the company having more cash and short term investments than long-term interest bearing debt. It is also reassuring to see shareholder’s equity rapidly increasing. The company is also generating significant amounts of free cash flow, even after capital expenditures and paying the dividend.

Taiwan Semiconductor Investor Presentation

TSM Stock Valuation

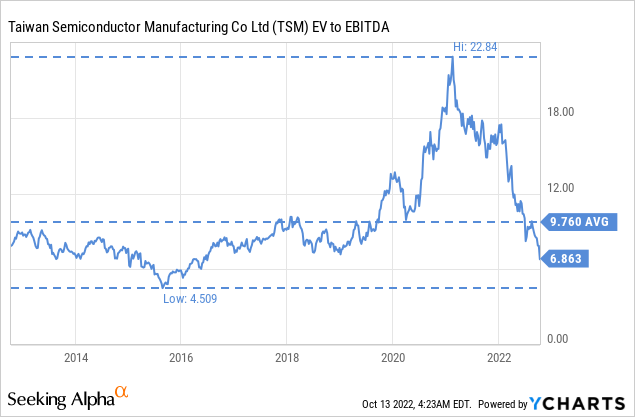

Given the drastic share price drop, together with the solid business performance the company has delivered, it is no surprise that the valuation has compressed significantly. The current EV/EBITDA is meaningfully below the ten year average, despite the company experiencing accelerated growth the last couple of years. We find it difficult to believe that one of the most important technology companies in the world can be bought for an EV/EBITDA of only ~6.8x.

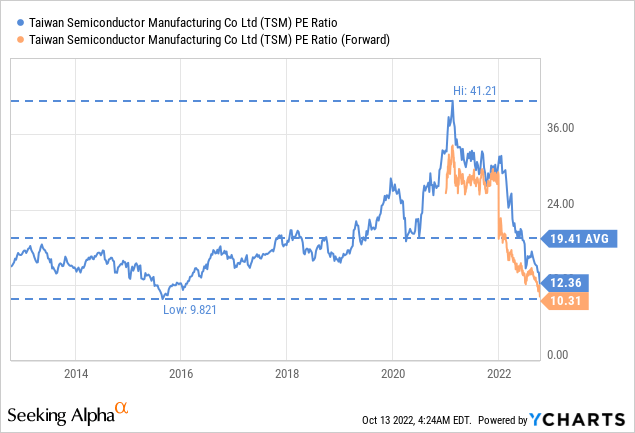

The price/earnings ratio tells the same story, currently several points below the ten year average of ~19x. The forward p/e is approaching the ten year low multiple of ~9.8x.

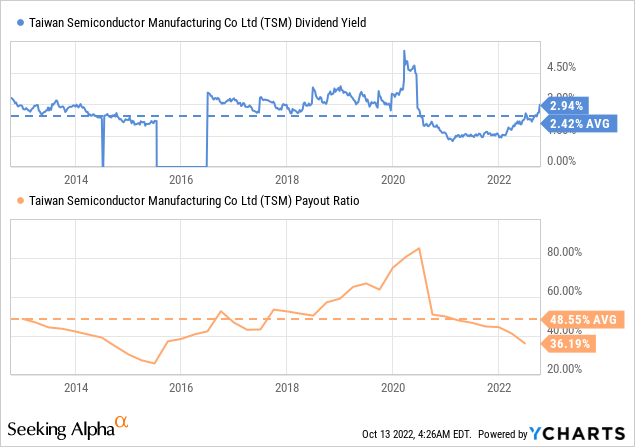

The dividend yield is also above the historical average, currently approaching 3%. Even though it has been higher in the past at certain points, it is important to note that the current payout ratio is below average, making the dividend very well covered and giving the company room to increase it should it decide to do so.

Risks

While the semiconductor market has been recently weakening, it is clear from the excellent business performance that Taiwan Semiconductor is delivering that its share price has been influenced by additional factors. These include geopolitical tensions, including fear of a Chinese invasion of Taiwan. It is difficult to assess the probability of this event occurring. We believe the possibility of such thing happening is low enough to still justify buying Taiwan Semiconductor shares, especially given the very attractive risk/reward we believe they offer. That said, this is a real risk worth considering when making an investment in the company.

Conclusion

Taiwan Semiconductor delivered another impressive quarter, and even though the company sounded a little bit more cautious, we believe the company remains very well positioned to face a potential semiconductor slowdown next year. We consider the current valuation to be extremely attractive, giving investors a rare opportunity to buy a technology leader at a deep discount. While there are risks to consider, we believe shares are offering a very attractive risk/reward, including a very solid dividend. It is often at times of maximum uncertainty that some of the best investment opportunities arrive.

Be the first to comment