MCCAIG/E+ via Getty Images

Investment Thesis

Alphabet’s (NASDAQ:GOOG) recent pricing action has been underperforming for the past two weeks, pointing to more pessimism in the stock market, considerably worsened by the gargantuan $25.4B in potential damages from the British and Dutch lawsuits. The S&P 500 Index has also broken previous June lows on 30 September, with a -25.18% YTD plunge at the time of writing. In addition, the market seemed to be heading toward more destruction in the short term, despite GOOG’s catastrophic loss in Enterprise Value by -$614B YTD, or the equivalent of -32.41%. Other FAANG stocks have not fared better, with Meta (META) plunging -62.03%, Amazon (AMZN) -34.15%, Apple (AAPL) -23.64%, and Netflix (NFLX) -64.13% at the same time.

The recessionary fears are unlikely to lift in the short term, pointing to more pain ahead in the market. There are already whispers of the Feds raising their terminal rates to reach 5% by 2023, beyond the previous projection of 4.6%. However, these extreme FUD levels have also provided investors with an excellent entry point at the time of maximum pain since these would provide a higher margin of safety for long-term portfolio growth and investment. Needless to say, the market will always be full of pitfalls for anyone who tries to pitch the perfect timing, since there may still be some downsides from current levels, depending on the September CPI and the Feds’ upcoming interest hikes through 2023.

GOOG Continues To Impress With Record Profitability

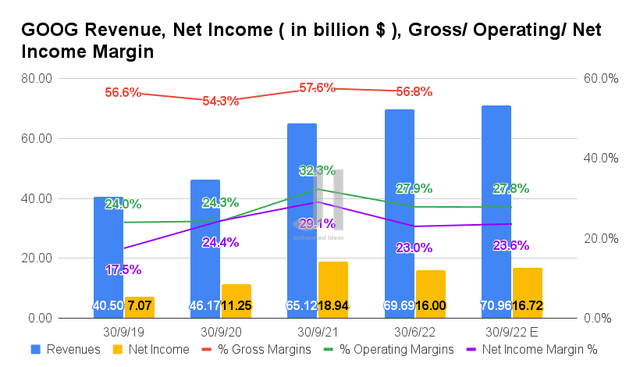

For its upcoming FQ3’22 earnings call, GOOG is expected to report revenues of $70.96B and operating margins of 27.8%, representing a minimal increase of 1.82% and in line QoQ, respectively. Otherwise, an excellent YoY growth of 8.96% though a moderation of -4.5 percentage points, respectively. Similarly, the company will also report impacted profitability, with net incomes of $16.72B and net income margins of 23.6% for the next quarter. Thereby, indicating relatively inline QoQ and a decline of -11.72%/ -5.5 percentage points YoY, respectively.

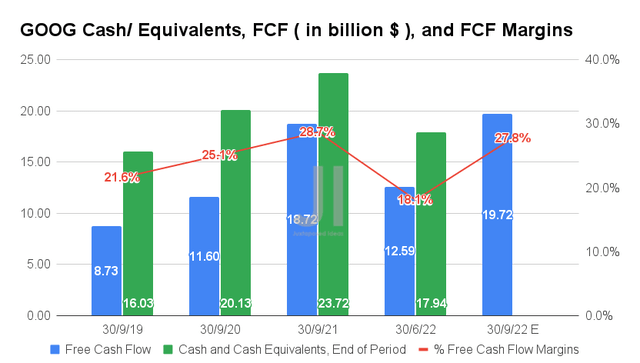

On the other hand, GOOG may report record-breaking Free Cash Flow (FCF) generation of $19.72B and an FCF margin of 27.8% in FQ3’22, indicating a remarkable increase of 56.63% and 9.7 percentage points QoQ, respectively. Otherwise, a notable YoY growth of 5.34% though a decline of -0.9 percentage points, respectively. In the meantime, the company’s cash and equivalents of $17.94B on its balance sheet in FQ2’22 remain robust for the economic downturn ahead.

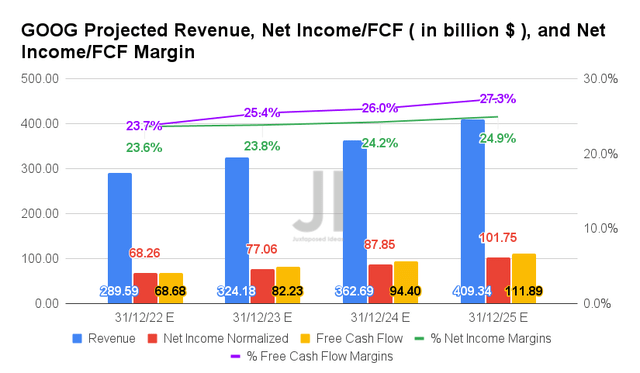

Over the next four years, GOOG is expected to report revenue, net income, and FCF growth at a CAGR of 12.27%, 7.56%, and 13.67%, respectively. Despite the notable downgrade in top-line estimates by -7.82% and bottom lines by -12.2% since our analysis in May 2022, the growth in its profitability remains astounding from net income/ FCF margins of 14.7%/19.1% in FY2019, 18.9%/26% in FY2021, and finally improving to 24.9%/27.3% by FY2025.

Meanwhile, GOOG is expected to report revenues of $289.59B, net incomes of $68.26B, and FCF generation of $68.68B for FY2022, representing an excellent increase of 12.4%, -10.21%, and 2.49% YoY, respectively, despite the tougher comparison from the hypergrowth post reopening cadence in FY2021. Nonetheless, since these numbers indicate a consensus downgrade by -9.14% since May, it is also understandable why the stock has had a continuous downward slide of -32.41% YTD, significantly worsened by the deteriorating macroeconomics and the Fed’s hawkish commentary thus far.

The S&P 500 Index had also plunged by -25.18% YTD, indicating the extreme levels of fear, doubt, and uncertainties in the market. Assuming another GOOG earnings miss as witnessed in the past two consecutive quarters, we may also see more volatility over the next few weeks.

In the meantime, we encourage you to read our previous article on GOOG, which would help you better understand its position and market opportunities.

- Google: The Expert Bullfighter In A Bear Market

- Google: The Market Is Wrong In Punishing This Giant – Buy Now During Dips

So, Is GOOG Stock A Buy, Sell, or Hold?

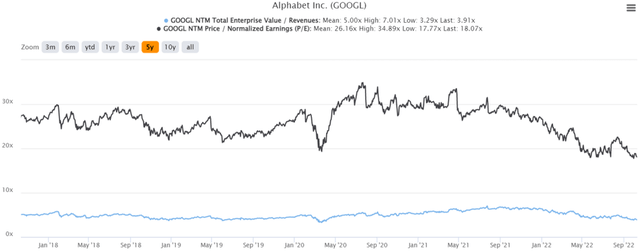

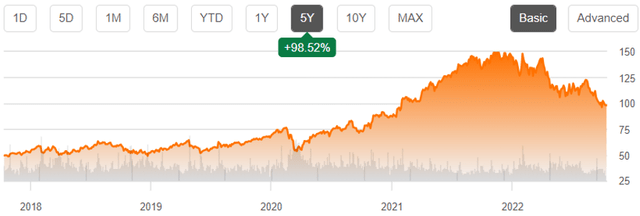

GOOG 5Y EV/Revenue and P/E Valuations

GOOG is currently trading at an EV/NTM Revenue of 3.91x and NTM P/E of 18.07x, lower than its 5Y mean of 5.00x and 26.16x, respectively. The stock is also trading at $98.05, down -35.30% from its 52 weeks high of $151.55, nearing its 52 weeks low of $95.56. Nonetheless, consensus estimates remain bullish about GOOG’s prospects, given their price target of $147.57 and a 50.50% upside from current prices.

GOOG 5Y Stock Price

It is evident that the persistently robust US labor market in September has triggered another correction by now, given the rise in payrolls by 263K and the falling unemployment rate by 3.5% sequentially. Thereby, feeding Mr. Market’s growing pessimism about the Fed’s aggressive hikes through 2023. The September CPI released on 13 October will also provide critical insights into the Fed’s next rate hike in November, with 78% of analysts predicting an inline 75 basis points hike.

However, assuming that the Fed’s terminal rate of 4.6% remains, we may also assume that most of the pessimism is already baked in, pointing to the market’s near-bottom levels. Therefore, investors with higher risk tolerance and long-term trajectory may buy in at peak FUD levels, given GOOG’s excellent 5Y Total Price Return of 98.5% and 10Y Return of 252.1%. The stock’s continuous decline has also placed it far below its 50, 100, and 200-day moving averages. In the meantime, bottom fishing investors may potentially wait for the high $80s for a higher margin of safety. Good luck all, since the market seems overly downbeat now.

Be the first to comment