Kira-Yan/iStock Editorial via Getty Images

Introduction

We keep reading that Meta’s (NASDAQ:META) expenses are going up due to their Metaverse investments while their revenue is being hurt by Apple’s (AAPL) privacy changes. These considerations are important but there are other meaningful developments. Meta’s May 19th Conversations Messaging Conference revealed that the call center is being reinvented. My thesis is that headlines are missing things as they focus on privacy changes and Metaverse investments while not widely covering developments with messaging.

Customer Service Through Messaging

Pointing out that customer service with 1-800 numbers is broken, outgoing Meta COO Sheryl Sandberg said the following at the May 19th Conversations Messaging Conference:

You know, it relies on decades old technology. No one wants to wait on hold. No one wants to wait for back and forth email. So, we believe messaging is much more efficient.

At the same messaging conference, Business Messaging VP Matt Idema pointed out that 1-800 numbers were invented back in the 1960s when the world moved at a different pace. He also brought up an article about airlines having hold times of more than 2 hours. Meta has research showing that nearly 2/3rds of people say they prefer messaging over email and phone. Rather than using their own apps for messaging, studies say businesses will be turning to third-party apps like WhatsApp which are especially important for younger customers:

A recent Gartner study estimates that by 2025, in just three years, 80% of customer service organizations will abandon native mobile apps in favor of messaging on third party platforms. Messaging is changing how we buy. According to Forrester, 50% of U.S. online adults now use chat for commerce, meaning to buy something. And the level of use only increases among younger demographics, peaking with 25 to 34 year olds at 62%.

Business Messaging VP Idema went on to say that KLM is having tremendous success with WhatsApp:

Intuitive automated experiences can help customers get faster responses, and it frees up your agents to handle more complex questions, which drives better results at scale. For example, call volumes to KLM Royal Dutch Airlines spiked by 500% when COVID 19 restrictions first took effect. The airline introduced a new prioritization model and automation with machine learning on Messenger and WhatsApp to automatically resolve common incoming queries, while freeing up agent time, reducing wait times to nearly zero for the most urgent conversations.

Looking at customer relationship examples from WhatsApp, we have scenarios where customers are assisted via messaging. WhatsApp uses the term “conversation” loosely as there are times when the business communicates information in such a way that there is no response needed from the customer. The prices that the businesses pay WhatsApp are based on periods of 24 hours. The parts of each scenario are broken down with green circles on the right.

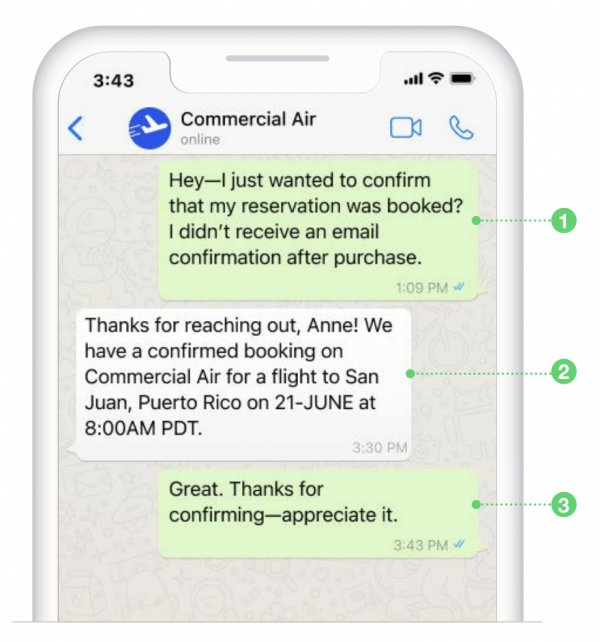

Here is a user-initiated exchange where a customer wants to confirm that a reservation went through. We’ve all been in this situation where a confirmation email isn’t received in our email Inbox due to issues like spam filters. In this scenario, Commercial Air pays for a user-initiated conversation:

WhatsApp user-initiated exchange (WhatsApp customer relationship examples)

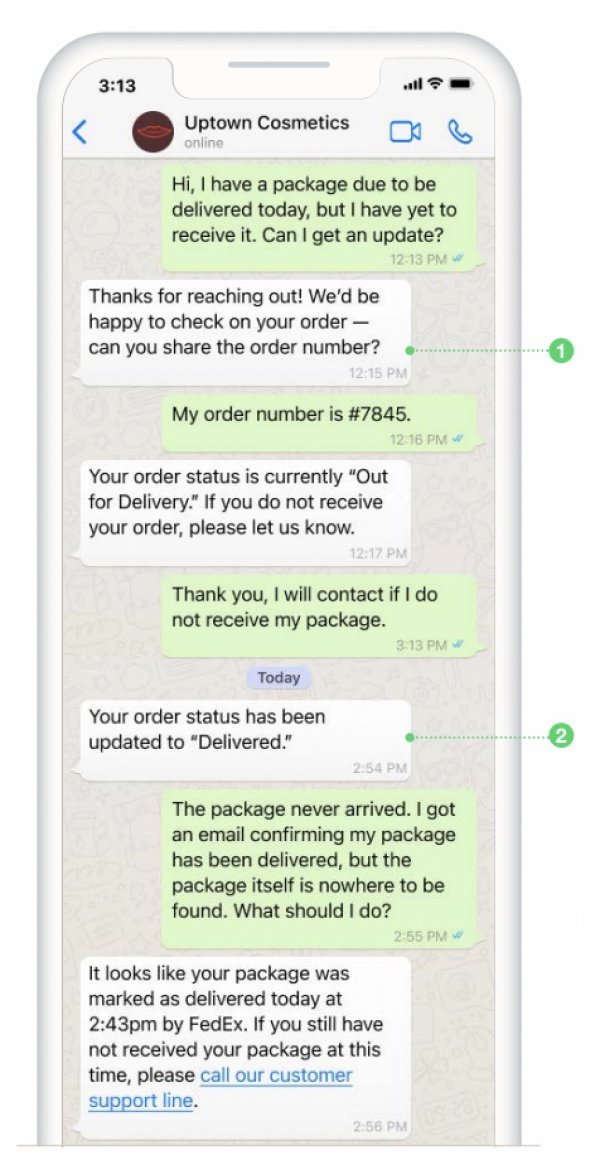

We have another user-initiated exchange but this time the business, Uptown Cosmetics, ends up paying for 2 user-initiated conversations. This is explained by the green part 2 circle on the right below. After the initial 24-hour conversation session expires, Anne’s inquiry isn’t yet resolved. As such, Uptown Cosmetics continues the dialogue by starting a 2nd conversation in which it is noted that the status of the order has changed to “Delivered.” Uptown Cosmetics pays for 2 user-initiated conversations in this scenario:

WhatsApp package delivery messaging (WhatsApp customer relationship examples)

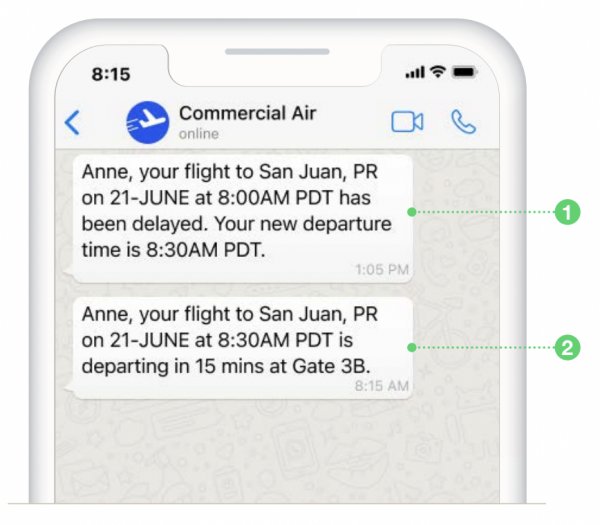

A business-initiated “conversation” example is shown despite the fact that it is a one-sided conversation with no response from the customer. Commercial Air is only charged for one business-initiated conversation because these message updates are within 24 hours of each other:

WhatsApp flight status (WhatsApp customer relationship examples)

There are more than just hypothetical examples of the above types of customer interactions. Salesforce (CRM) explains that airlines like KLM (OTCPK:KLMR) have turned to messaging for customer relationships:

The service team of 350+ handles cases from eight social media channels, proving 24/7 support to customers in 10 languages. “Agents have a central console in Service Cloud where they can speak to customers on their platform of choice – in China customers use WeChat, while Japanese customers use Line, and Koreans use Kakaotalk. Other regions reach out on WhatsApp, Messenger, Apple Messages, Facebook, or Twitter,” explained Renske Siersema, Head of Owned Channels and Partnerships.

A June 21st Skift article says WhatsApp is helping travel brands connect with customers in India and the Middle East. It notes that WhatsApp has increased the number of monthly active users from 1 billion to 2 billion since February 2016. WhatsApp enables travel brands to communicate key updates in a time efficient manner:

“WhatsApp allows us to instantly communicate flight status changes, alerts or boarding gate information to our customers,” said Ashish Pratap Singh, chief marketing officer of Rehlat.com, Middle East’s leading online travel agency.

Ride Hailing Via Messaging

The Verge explains in a June 16th article that Elon Musk wants Twitter (TWTR) to become more like WeChat (OTCPK:TCEHY):

He drew a comparison to WeChat, the super app in China that mixes social media with payments, games, and even ride-hailing. “There’s no WeChat equivalent outside of China,” Musk said after dialing in 10 minutes late to the virtual meeting via his phone camera. “You basically live on WeChat in China. If we can recreate that with Twitter, we’ll be a great success.”

The success seen by WeChat is indeed laudable and Meta has a tremendous opportunity to replicate much of it. Meta COO Sandberg spoke with Uber (UBER) CEO Dara Khosrowshahi at the May 19th Messaging Conference where they noted that folks in parts of India can now use a partnership called WhatsApp to Ride in order to call an Uber. Uber CEO Khosrowshahi explained that messaging is often necessary with Uber and Uber Eats because of complications such as delays with traffic and food preparation. He remarked that 1/3rd of the riders coming to Uber through WhatsApp are new riders and that this is unusual for an established brand like Uber where new ridership as a percentage of total rides is typically in the single digits. WhatsApp to Ride is bringing a young customer base to Uber. The plan is to launch in other parts of India like Delhi and then internationally in places like Brazil.

META Stock Valuation

I believe more businesses will be amenable to using messaging with WhatsApp as they see success stories from companies like KLM and Uber; this is sure to help boost Meta’s valuation.

Meta’s valuation has been hurt as interest rates keep rising and we have learned that COO Sandberg is leaving. Partially offsetting these considerations are potential opportunities from areas like payments. A June 22nd Kalinga TV article says WhatsApp pay has reported a significant surge in daily transaction numbers in India that has increased to 2-3 million payments per day up from a few hundred thousand till recently. WhatsApp has a long way to go in India in order to get meaningful market share with payments but this is an area to watch.

It isn’t great that year-over-year gross profit wasn’t up much for the March quarter from $21,040 million in 2021 to $21,903 million in 2022. More disturbing is that year-over-year operating income and net income for the quarter were down.

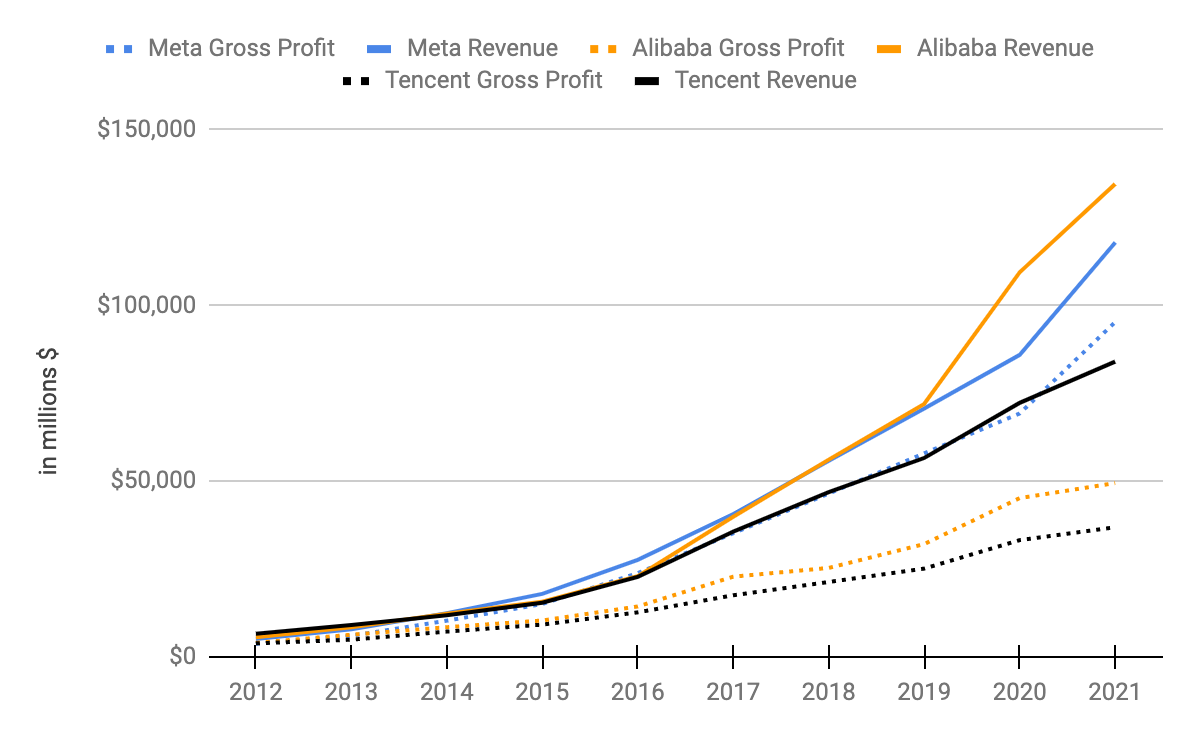

Meta, Alibaba (BABA) and Tencent should all be part of the Metaverse in the coming years. I like to compare the 3 companies given similarities with innovation and revenue size. All 3 companies are making innovations with digital advertising. All of these companies are helping businesses maintain customer relationships in the digital age. These digital companies have come a long way in the last decade with gross profit and revenue. Meta’s gross profit tracks pretty well with Tencent’s top line revenue. Looking at this graph below, it is nuts that Meta’s June 24th share price of $170.16 is lower than the May 2018 level of about $190. In May of 2018, we had just seen the 2017 annual report which showed a share count of 2,905 million, gross profit of $35.2 billion and revenue of $40.7 billion. Moving forward, the 2021 annual report showed 2,722 million shares, $95.3 billion and $117.9 billion, respectively:

Meta Gross Profit (Author’s spreadsheet)

*For Tencent, we used an exchange rate of 0.15 USD for 1 RMB. Alibaba’s fiscal years go through March but we put their numbers in the closest calendar year. In other words, we put their numbers through March 2022 in the 2021 calendar year. We used Alibaba’s USD figures except for calendar 2012 and 2013 where we calculated them as the same rate used for calendar 2014 which was 0.1613 RMD to 1 USD.

Meta has seen their revenue go up about 24x over the last decade while Alphabet’s (GOOG) (GOOGL) has “only” gone up about 8x. One of the reasons Alphabet’s percentage growth has been lower is that they were starting with a larger base. However, Meta has seen higher growth even at comparable revenue levels. In other words, Meta’s 3-year revenue CAGR was over 28% when they went from $55.8 billion in 2018 to $117.9 billion in 2021. Meanwhile, Alphabet’s 3-year revenue CAGR was a little under 18% when they went from $55.5 billion in 2013 to $90.3 billion in 2016.

Trailing-twelve-month (“TTM”) net income is $37.4 billion [$7.5 billion + $39.4 billion – $9.5 billion]. Capex exceeds amortization and depreciation due to growth investments so I think net income is a better representation of earning power. However, Meta is investing heavily in operating expense lines such that their earnings are suppressed and their P/E ratio is higher than it would otherwise be. Given the growth investments in operating expense lines, I think the valuation range is 18 to 22 times TTM net income or about $675 billion to $825 billion.

The June 24th share price of $170.16 gives us a market cap of $460.5 billion when we multiply it by the 2,706,323,387 shares outstanding in the 1Q22 10-Q. The enterprise value is lower than the market cap and both are lower than my valuation range such that I believe the stock is undervalued.

Be the first to comment