Bet_Noire/iStock via Getty Images

A Seeking Alpha Top Quant rating goes to the steel pipe company Allegheny Technologies (ATI) with a Quant Rating of 4.94 out of a possible 5.00. To be reviewed the company must have a Quant Rating in the top 50 (or 1% of the 4,300 companies’ SA rates), be above its 20, 50, 100 and 200 day moving averages and trading within 5% of its 52-week high.

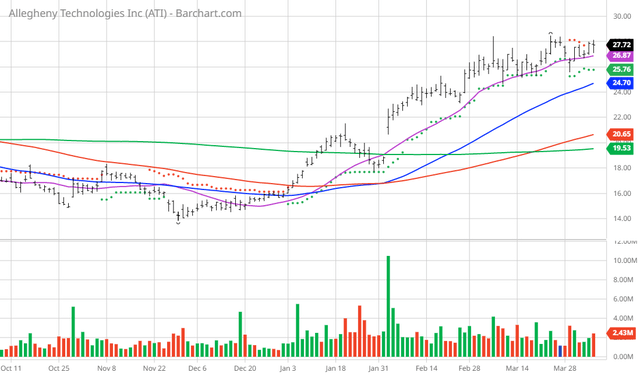

ATI Price vs Daily Moving Averages (Barchart.com)

Allegheny Technologies Incorporated manufactures and sells specialty materials and components worldwide. The company operates in two segments: High Performance Materials & Components (HPMC) and Advanced Alloys & Solutions (AA&S). The HPMC segment produces various materials, including titanium and titanium-based alloys, nickel- and cobalt-based alloys and superalloys, advanced powder alloys and other specialty materials, in long product forms, such as ingot, billet, bar, rod, wire, shapes and rectangles, and seamless tubes, as well as precision forgings, components, and machined parts. The segment serves aerospace and defense, medical, and energy markets. The AA&S segment produces zirconium and related alloys, including hafnium and niobium, nickel-based alloys, titanium and titanium-based alloys, and specialty alloys in a variety of forms, such as plate, sheet, and precision rolled strip products. It also provides hot-rolling conversion services, including carbon steel products, and titanium products. This segment offers its solutions to the energy, aerospace and defense, automotive, and electronics markets. Allegheny Technologies Incorporated was founded in 1960 and is based in Pittsburgh, Pennsylvania.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- Trading within 2.57% of its 52 week high

- 100% technical buy signals

- 41.00+ Weighted Alpha

- 23.36% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 ,100 and 200 day moving averages

- 2 new highs and up 6.41% in the last month

- Relative Strength Index 60.68%

- Technical support level at 27.71

- Recently traded at 27.72 with a 50 day moving average of 24.70

Fundamental Factors:

- Market Cap $3.53 billion

- P/E 232.08

- Revenue expected to grow 11.10% this year and another 9.30% next year

- Earnings estimated to increase 638.50% this year and an additional 56.30% next year

Analysts and Investor Sentiment — I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts issued 5 strong buy, 2 buy and 1 hold opinion on the stock

- Analysts have a consensus price target at 29.50

- The individual investors following the stock on Motley Fool voted 959 to 58 for the stock to beat the market with the more experienced investors voting 165 to 7 for the same result

- 7,930 investors are monitoring the stock on Seeking Alpha

Ratings Summary

Factor Grades

Conclusion:

Although using Seeking Alpha Quant Rating and Technical Analysis may not be suitable for all investors it appears that SA’s Quant Rating and numerous technical indicators are in agreement that this stock may be suitable for aggressive investors with a high risk tolerance.

Be the first to comment